توقع سعر ARRR لعام 2025: تحليل الاتجاه المستقبلي لـ Pirate Chain في منظومة عملات الخصوصية الرقمية

المقدمة: مكانة ARRR في السوق وقيمتها الاستثمارية

تُعد Pirate Chain (ARRR) عملة مشفرة تركز على الخصوصية، وحققت تقدمًا ملحوظًا في مجال الخصوصية المالية منذ تأسيسها. حتى عام 2025، بلغ رأس مال Pirate Chain السوقي 41,008,683 دولارًا، مع معروض متداول يقارب 196,213,797 ARRR، وسعر مستقر حول 0.209 دولار. وتُعرف هذه العملة غالبًا باسم "عملة الخصوصية الحقيقية"، وتلعب دورًا متزايد الأهمية في مجال المعاملات الرقمية الآمنة والمجهولة الهوية.

يستعرض هذا المقال تحليلًا شاملًا لاتجاهات أسعار Pirate Chain من 2025 إلى 2030، مع مراعاة الأنماط التاريخية، والعرض والطلب في السوق، وتطور النظام البيئي، والعوامل الاقتصادية الكلية، لتقديم توقعات سعرية احترافية واستراتيجيات استثمار عملية للمستثمرين.

I. مراجعة تاريخ سعر ARRR والوضع الحالي للسوق

تطور سعر ARRR التاريخي

- 2020: سجّل ARRR أدنى سعر له على الإطلاق عند 0.00797788 دولار في 26 نوفمبر 2020

- 2021: بلغ ARRR أعلى سعر له على الإطلاق عند 16.76 دولار في 24 أبريل 2021

- 2025: يتداول ARRR حاليًا عند 0.209 دولار، مع تقلبات كبيرة منذ أعلى مستوياته

الوضع الحالي لسوق ARRR

حتى 1 أكتوبر 2025، يتداول ARRR عند 0.209 دولار، برأس مال سوقي يبلغ 41,008,683.78 دولار. ويبلغ حجم التداول خلال 24 ساعة 35,298.97 دولار. شهد ARRR تغيرًا في السعر بنسبة -2.65% خلال آخر 24 ساعة، ما يشير إلى تراجع طفيف على المدى القصير. إلا أن العملة أظهرت زخمًا إيجابيًا على مدى أطول، مع ارتفاع بنسبة 8.29% خلال 7 أيام و14.33% خلال 30 يومًا.

السعر الحالي أقل بكثير من أعلى سعر تاريخي له عند 16.76 دولار، ما يمثل انخفاضًا بنسبة 98.75% من الذروة. ويشير ذلك إلى تصحيح قوي منذ ارتفاع 2021. ومع ذلك، فإن الاتجاهات الإيجابية الأخيرة خلال 7 أيام و30 يومًا تعكس تزايد الاهتمام وإمكانية التعافي.

وبوجود معروض متداول يبلغ 196,213,797.97 ARRR من إجمالي معروض قدره 200,000,000، تبلغ نسبة التداول 98.11%. هذا المعدل المرتفع يشير إلى أن معظم المعروض الكلي متداول بالفعل، ما قد يقلل من الضغوط التضخمية المستقبلية.

انقر للاطلاع على سعر ARRR الحالي سعر السوق

مؤشر معنويات سوق ARRR

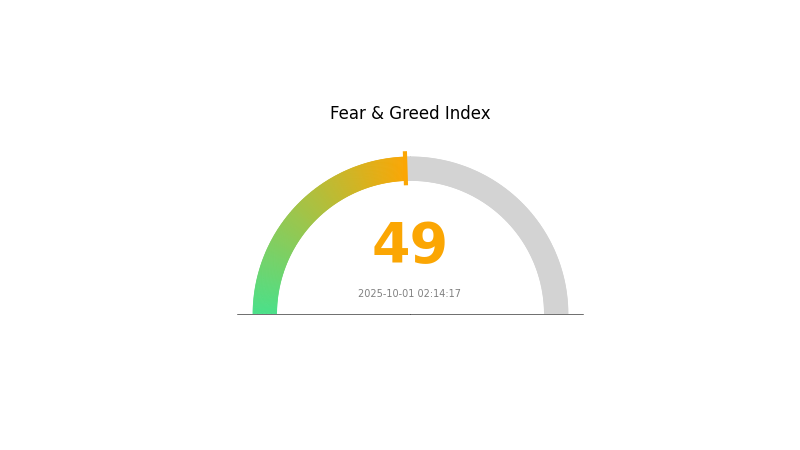

مؤشر الخوف والطمع 2025-10-01: 49 (محايد)

انقر للاطلاع على مؤشر الخوف والطمع الحالي

يسود سوق العملات المشفرة حاليًا حالة توازن، إذ بلغ مؤشر الخوف والطمع 49، ما يعكس موقفًا محايدًا. هذا التوازن يدل على أن المستثمرين ليسوا في حالة خوف مفرط أو تفاؤل زائد حيال اتجاه السوق. وغالبًا ما تمثل هذه الحالة فرصة مناسبة للمتداولين لإعادة تقييم استراتيجياتهم وتوزيع محافظهم. وكالعادة، يجب إجراء بحث دقيق ومراعاة درجة تحمل المخاطر قبل اتخاذ أي قرارات استثمارية في سوق العملات الرقمية المتقلب.

توزيع حيازات ARRR

تشير بيانات توزيع العناوين الحائزة لـ ARRR إلى نمط مثير للاهتمام في هيكل ملكية الرمز، لكن الجدول المقدم فارغ، ما يحد من إمكانية التحليل التفصيلي لتركيز الحيازات.

في غياب بيانات دقيقة، يمكن فقط مناقشة أهمية توزيع العناوين في سوق العملات المشفرة. عادةً ما يعكس توزيع الملكية بشكل جيد شبكة أكثر صحة ولا مركزية، ويؤثر ذلك على ديناميكيات السوق مثل ثبات الأسعار ومقاومة التلاعب. لكن دون أرقام واضحة، يصعب تقييم مستوى المركزية أو اللامركزية الحالي لـ ARRR.

للحصول على تقييم شامل لبنية سوق ARRR والمخاطر المحتملة، يجب الحصول على بيانات توزيع الحيازات الفعلية وتحليلها. هذه البيانات تقدم رؤى مهمة حول استقرار الرمز على السلسلة وخصائص السوق العامة.

انقر للاطلاع على توزيع حيازات ARRR الحالي

| Top | Address | Holding Qty | Holding (%) |

|---|

II. العوامل الرئيسية المؤثرة على سعر ARRR المستقبلي

آلية العرض

- الإيرادات السنوية المتكررة (ARR): تمثل ARR النسخة السنوية من الإيرادات الشهرية المتكررة (MRR)، ويتم حسابها بضرب MRR في 12. تعكس مجموع الإيرادات السنوية المتكررة من جميع عقود العملاء النشطة.

- الأثر الحالي: تؤثر تغييرات ARR بشكل مباشر على التدفق المالي المتوقع للشركة وصحتها المالية، وقد تؤثر على معنويات المستثمرين والسعر.

البيئة الاقتصادية الكلية

- أثر السياسة النقدية: سياسات البنوك المركزية وتغييرات أسعار الفائدة وإجراءات التحفيز المالي تؤثر في سيولة السوق، وقد تنعكس على سعر ARRR.

- العوامل الجيوسياسية: التوترات الدولية مثل النزاع الروسي الأوكراني تؤثر على الأسواق العالمية وأسعار السلع، وتنعكس بشكل غير مباشر على تقييم ARRR.

التطوير التقني وبناء النظام البيئي

- التسعير الاستراتيجي: التخطيط الدقيق لاستراتيجيات التسعير يؤدي إلى نمو ARR طويل الأمد، ما ينعكس إيجابيًا على قيمة ARRR.

- تطبيقات النظام البيئي: التركيز على الاحتفاظ بالعملاء وتوسيع قاعدة المستخدمين يعزز نمو ARR بشكل مستدام ويؤثر في سعر ARRR.

III. توقع سعر ARRR للفترة 2025-2030

توقعات 2025

- توقع متحفظ: 0.12761 - 0.18 دولار

- توقع محايد: 0.18 - 0.24 دولار

- توقع متفائل: 0.24 - 0.27824 دولار (يتطلب ظروف سوق مواتية وزيادة التبني)

توقعات 2027-2028

- المرحلة المتوقعة: نمو محتمل مع زيادة التبني

- توقعات نطاق السعر:

- 2027: 0.15778 - 0.41266 دولار

- 2028: 0.23273 - 0.42249 دولار

- العوامل الرئيسية: التطورات التقنية، توسع قبول عملات الخصوصية، وتطورات تنظيمية إيجابية

توقعات طويلة الأمد 2029-2030

- السيناريو الأساسي: 0.39027 - 0.45271 دولار (مع نمو مستقر في قطاع عملات الخصوصية)

- السيناريو المتفائل: 0.45271 - 0.51516 دولار (مع تبني أوسع وبيئة تنظيمية داعمة)

- السيناريو التحويلي: 0.51516 - 0.57947 دولار (مع حالات استخدام مبتكرة واهتمام مؤسسي قوي)

- 2030-12-31: ARRR 0.57947 دولار (السعر الأعلى المتوقع للفترة)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.27824 | 0.2092 | 0.12761 | 0 |

| 2026 | 0.36314 | 0.24372 | 0.13648 | 16 |

| 2027 | 0.41266 | 0.30343 | 0.15778 | 45 |

| 2028 | 0.42249 | 0.35805 | 0.23273 | 71 |

| 2029 | 0.51516 | 0.39027 | 0.20294 | 86 |

| 2030 | 0.57947 | 0.45271 | 0.42102 | 116 |

IV. استراتيجيات الاستثمار الاحترافية وإدارة المخاطر لـ ARRR

منهجية الاستثمار في ARRR

(1) استراتيجية الاحتفاظ طويل الأمد

- مناسبة للمستثمرين المهتمين بالخصوصية ومحبي تقنية البلوكشين

- اقتراحات التشغيل:

- تراكم ARRR خلال فترات الهبوط

- الاحتفاظ لمدة لا تقل عن 2-3 سنوات لتجاوز التقلبات

- التخزين في محفظة آمنة تركز على الخصوصية

(2) استراتيجية التداول النشط

- أدوات التحليل الفني:

- مؤشر القوة النسبية (RSI) لتحديد مناطق التشبع الشرائي/البيعي

- المتوسطات المتحركة: مراقبة متوسط 50 يوم و200 يوم لتحديد الاتجاهات

- نقاط التداول المتأرجح:

- مراقبة حجم التداول لاكتشاف الاختراقات

- تحديد أوامر وقف الخسارة لإدارة المخاطر

إطار إدارة المخاطر لـ ARRR

(1) مبادئ تخصيص الأصول

- للمستثمرين المحافظين: 1-3% من محفظة العملات المشفرة

- للمستثمرين الجريئين: 5-10% من محفظة العملات المشفرة

- للمحترفين: حتى 15% من المحفظة

(2) حلول التحوط من المخاطر

- تنويع المحفظة: موازنة ARRR مع عملات الخصوصية والعملات الرئيسية

- استراتيجيات الخيارات: استخدام الخيارات للتحوط عند توفرها

(3) حلول التخزين الآمن

- توصية المحفظة الساخنة Gate Web3 Wallet

- التخزين البارد: استخدام محافظ الأجهزة الداعمة لـ ARRR

- احتياطات الأمن: تفعيل المصادقة الثنائية، كلمات مرور قوية، نسخ احتياطية للمفاتيح الخاصة

V. المخاطر والتحديات المحتملة لـ ARRR

مخاطر سوق ARRR

- تقلبات مرتفعة: قد يشهد سعر ARRR تغيرات كبيرة

- سيولة محدودة: صعوبة تنفيذ الصفقات الكبيرة دون تأثير سعري

- الارتباط بالسوق العام: تأثر ARRR باتجاهات سوق العملات المشفرة

المخاطر التنظيمية لـ ARRR

- تدقيق تنظيمي متزايد على عملات الخصوصية

- خطر الشطب من منصات التداول

- تحديات الامتثال لمتطلبات مكافحة غسل الأموال ومعرفة العميل (AML/KYC)

المخاطر التقنية لـ ARRR

- ثغرات أمنية في بروتوكول الخصوصية

- مشكلات قابلية التوسع مع ارتفاع حجم التداولات

- منافسة تقنيات الخصوصية الأكثر تطورًا

VI. الخلاصة وتوصيات العمل

تقييم قيمة الاستثمار في ARRR

يوفر ARRR ميزات خصوصية قوية وقيمة طويلة الأمد للمستثمرين المهتمين بالخصوصية، لكنه يواجه مخاطر كبيرة على المدى القصير بسبب عدم اليقين التنظيمي وتقلبات السوق.

توصيات الاستثمار في ARRR

✅ للمبتدئين: خصص نسبة صغيرة (1-2%) من المحفظة وتعرّف على تقنيات الخصوصية ✅ للمستثمرين ذوي الخبرة: تخصيص 5-10% مع إدارة نشطة للمراكز وفق السوق ✅ للمؤسسات: تقييم المخاطر التنظيمية بدقة قبل إدراج ARRR ضمن المحفظة المتنوعة

طرق المشاركة في ARRR

- التداول الفوري: شراء واحتفاظ بـ ARRR على Gate.com

- الشراء الدوري: عمليات شراء صغيرة منتظمة لتقليل مخاطر التقلب

- التعدين: دعم الشبكة وكسب مكافآت ARRR (إذا كان ممكنًا تقنيًا)

الاستثمار في العملات المشفرة ينطوي على مخاطر عالية للغاية، ولا يُعد هذا المقال نصيحة استثمارية. يجب اتخاذ القرارات بحذر وفقًا لتحمل المخاطر، وينصح باستشارة مستشارين ماليين محترفين. لا تستثمر أكثر مما يمكنك تحمل خسارته.

الأسئلة الشائعة

أي عملة رقمية قد تحقق مضاعفة 1000x؟

من المتوقع أن تحقق Tapzi (TAPZI) وEchelon Prime (PRIME) مضاعفة 1000x. تركّز هاتان العملتان على الألعاب القائمة على المهارات وقابلية التشغيل البيني، وتقدمان حلولًا مبتكرة في مجال Web3.

ما هو توقع سعر XRP في 2025؟

وفق الاتجاهات الحالية، من المتوقع أن يصل سعر XRP إلى حوالي 1.50 إلى 2.00 دولار بنهاية 2025، مع احتمال بلوغ قمم أعلى في الفترات الصاعدة.

ما هو توقع سعر ARC coin في 2030؟

استنادًا إلى الاتجاهات الحالية وتحليل السوق، يُتوقع أن يبلغ سعر ARC coin الأقصى 0.023661 دولار في فبراير 2030.

ما هو مستقبل ARK crypto؟

مستقبل ARK واعد مع الحوكمة المدعومة بالذكاء الاصطناعي، وترقيات بنية Mainsail، وتوسيع النظام البيئي. يركز المشروع على DeFAI، وتحسين SDKs، وأنظمة الائتمان اللامركزية، بهدف زيادة التبني والوظائف.

مشاركة

المحتوى