2025 年 EGL1 價格預測:市場分析與投資人前景展望

深入解析 BSC 首款超級英雄梗幣 Eagles Landing (EGL1) 的投資潛力。現時市值達 3944 萬美元,結合價格走勢觀察,本分析將為 2025 年至 2030 年的市場預測與投資策略提供專業指引。瞭解 mar介紹:EGL1 的市場定位與投資價值

Eagles Landing(EGL1)為首款在 BSC 鏈推出的超級英雄類 Meme 幣,自 2025 年上市以來,已展現顯著成長。截至 2025 年,EGL1 市值達 39,440,000 美元,流通量約 10 億枚,價格穩定於 0.03944 美元上下。其作為「美國精神 Meme 幣」代表,在 Meme 加密貨幣領域扮演日益重要角色。

本文將系統性分析 EGL1 於 2025 至 2030 年的價格變化,結合歷史資料、供需動態、生態發展與宏觀經濟因素,為投資人提供專業價格預測及實用投資策略。

一、EGL1 價格歷程回顧與現行市場狀況

EGL1 歷史價格演變

- 2025 年 6 月:首次發行,價格創下歷史新低 0.02161 美元

- 2025 年 7 月:市場熱度攀升,價格攀抵歷史高點 0.1234 美元

- 2025 年 7 月至 10 月:價格逐步回落,維持於 0.03944 美元附近

EGL1 現行市場概況

EGL1 目前交易價為 0.03944 美元,較歷史高點 0.1234 美元下跌 68.06%,但較歷史低點 0.02161 美元上漲 82.51%。24 小時成交量達 463,975.10 美元,市場活躍度適中。市值 39,440,000 美元,全球加密貨幣市值排名第 793。近 24 小時價格小幅下跌 0.57%,但近一週上漲 13.71%,顯示投資人關注度回升。現階段市占率為 0.00095%,展現 EGL1 在加密生態的利基定位。

點選查看 EGL1 即時行情

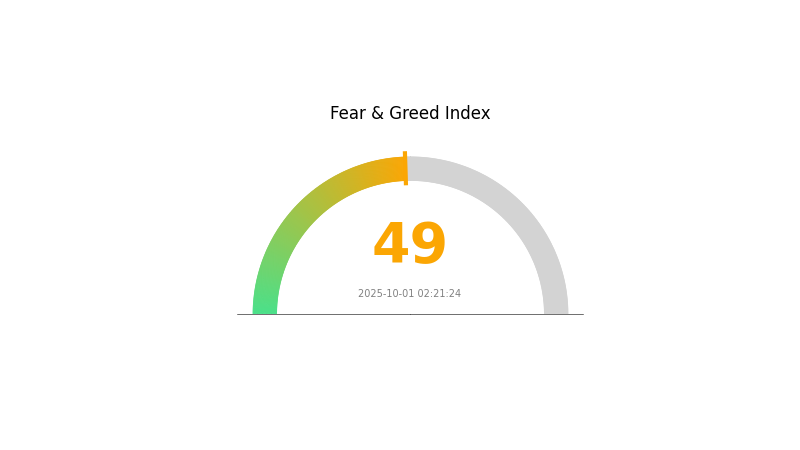

EGL1 市場情緒指標

2025 年 10 月 1 日恐懼與貪婪指數:49(中性)

點選查看 最新恐懼與貪婪指數

2025 年 10 月進場,整體情緒維持均衡,恐懼與貪婪指數穩定於 49。中性區間反映投資人心態理性,既不悲觀亦不過度樂觀。市場仍保守,但同時蘊含機會。建議交易者持續關注重要指標,分散投資,靈活應對市場均衡階段。

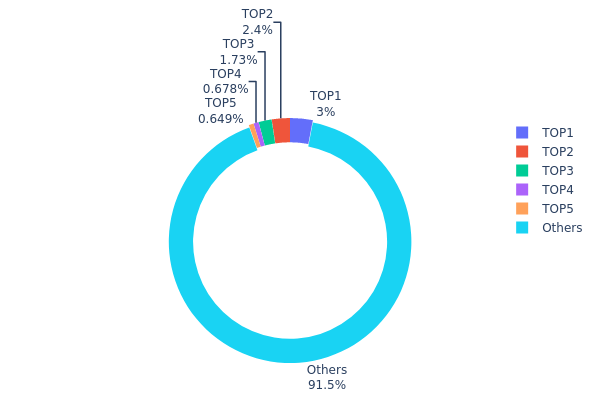

EGL1 持幣分布

持幣地址分布可有效反映 EGL1 代幣在各錢包間的集中程度。資料分析顯示,分布結構趨向去中心化。最大地址僅持有 3%,前五大地址合計 8.44%。絕大多數(91.56%)代幣分散於其他地址。

此分布模式有助強化市場穩定性,降低單一地址操控價格風險。無任何地址持有過高比例,拋售或壟斷風險顯著降低,投資人結構多元,有利於價格自然波動,長期有助於波動率下降。

目前 EGL1 持幣分布展現主力與散戶間良好平衡,去中心化程度高,呼應區塊鏈精神,助益生態穩定成長與廣泛應用。

點選查看 EGL1 持幣分布詳情

| 排名 | 地址 | 持幣數量 | 持幣比例 |

|---|---|---|---|

| 1 | 0x93f5...260e7b | 30000.10K | 3.00% |

| 2 | 0x73d8...4946db | 23997.21K | 2.40% |

| 3 | 0x6d76...2ee2be | 17321.06K | 1.73% |

| 4 | 0x9cab...3b0638 | 6771.42K | 0.67% |

| 5 | 0xd79c...76d236 | 6482.33K | 0.64% |

| - | 其他 | 914474.64K | 91.56% |

二、影響 EGL1 未來價格的關鍵因素

供應機制

- 生態分配:EGL1 生態內代幣分發直接牽動價格穩定。如代幣和 USD1 積分計劃高度綁定,短期流通量有限,有機會抑制賣壓。

- 現實影響:若生態基金提前變現或財務預期不符,EGL1 價格穩定性可能受衝擊。

機構與大戶動態

- 企業合作:如與 Ondo Finance 策略聯盟,將 RWA 產品納入儲備,有助提升 EGL1 資產背書與市值。

- 政策環境:監管政策變動,尤其加密資產納入合規金融體系,將深遠影響 EGL1 長期金融潛力。

宏觀經濟環境

- 抗通膨特性:作為穩定幣生態一環,EGL1 在通膨環境下的表現是其被廣泛採用及價值展現的關鍵。

技術進展與生態建設

- 跨鏈互操作性:EGL1 應用 Chainlink CCIP 技術實現 USD1 跨鏈操作,拓展多鏈應用場景。

- 生態應用:USD1 穩定幣生態在多鏈(BNB Chain、Ethereum、Tron、Solana 等)佈局,對 EGL1 生態成長至關重要。

三、2025-2030 年 EGL1 價格展望

2025 年預測

- 保守預測:0.03037 - 0.03944 美元

- 中性預測:0.03944 - 0.04496 美元

- 樂觀預測:0.04496 - 0.05048 美元(需市場氛圍正向)

2027 年中期預測

- 市場預期:可望進入成長區間

- 價格區間預測:

- 2026 年:0.03552 - 0.05171 美元

- 2027 年:0.03383 - 0.06187 美元

- 主要驅動因素:提升採用率與技術進步

2030 年長期預測

- 基礎情境:0.07122 - 0.07658 美元(假設市場穩健成長)

- 樂觀情境:0.07658 - 0.10415 美元(假設市場表現強勁)

- 突破情境:高於 0.10415 美元(極端有利條件下)

- 2030 年 12 月 31 日:EGL1 0.10415 美元(潛在高點)

| 年份 | 預測高點 | 預測均價 | 預測低點 | 漲跌幅 |

|---|---|---|---|---|

| 2025 | 0.05048 | 0.03944 | 0.03037 | 0 |

| 2026 | 0.05171 | 0.04496 | 0.03552 | 14 |

| 2027 | 0.06187 | 0.04833 | 0.03383 | 22 |

| 2028 | 0.08045 | 0.0551 | 0.04849 | 39 |

| 2029 | 0.08539 | 0.06777 | 0.06438 | 71 |

| 2030 | 0.10415 | 0.07658 | 0.07122 | 94 |

四、EGL1 投資策略與風險控管

EGL1 投資方式

(1) 長期持有策略

- 適用族群:高風險承受力投資人

- 操作建議:

- 市場回檔時分批布局 EGL1

- 訂定目標價,嚴格執行投資計畫

- 將代幣安全存放於 Gate Web3 錢包

(2) 主動交易策略

- 技術分析工具:

- 均線指標:輔助判斷趨勢反轉

- RSI:監控超買超賣訊號

- 波段交易重點:

- 關注社群輿論及活躍度變化

- 即時追蹤專案動態與公告

EGL1 風險管理架構

(1) 資產配置原則

- 保守型:配置 1-2% 加密資產

- 積極型:配置 5-10% 加密資產

- 專業型:最高可至 15% 加密資產

(2) 風險對沖方案

- 分散投資:涵蓋不同 Meme 幣及加密資產

- 停損設定:合理設置停損,控制損失

(3) 安全儲存方案

- 熱錢包推薦:Gate Web3 錢包

- 冷錢包方案:硬體錢包適合長期持有

- 安全措施:啟動雙重驗證,設置強密碼並定期更新安全設定

五、EGL1 潛在風險與挑戰

EGL1 市場風險

- 高波動性:Meme 幣價格波動劇烈

- 市場情緒:高度依賴社群媒體與名人影響

- 流動性風險:市場下行時大額賣出或難以成交

EGL1 合規風險

- 監管趨嚴:主管機關可能加強 Meme 幣管理

- 法律不確定性:若被歸類為證券將影響交易流通

- 跨境限制:各國法規差異影響全球採用

EGL1 技術風險

- 智能合約安全:存在遭受攻擊或漏洞風險

- BSC 網路壅塞:高交易量可能造成延遲及高手續費

- 依賴 BSC:Binance Smart Chain 若出現問題將影響 EGL1 功能

六、結論與行動建議

EGL1 投資價值判斷

EGL1 屬高風險高報酬 Meme 幣專案,儘管具備成長潛力,投資人應審慎評估其極端波動與高度投機屬性。

EGL1 投資建議

✅ 新手:僅以少量資金參與,重視學習與市場認知 ✅ 有經驗投資人:掌握短線機會,嚴格執行風險控管 ✅ 機構投資人:審慎布局,僅作加密資產組合的小比例配置

EGL1 參與管道

- 現貨交易:於 Gate.com 進行 EGL1 買賣

- 限價單:設定買賣區間自動執行策略

- 定期定額:定期小額布局以平滑市場波動

加密貨幣投資風險極高,本文不構成任何投資建議。投資人應根據自身風險承受能力審慎決策,並建議諮詢專業理財顧問。切勿投入超過自己可承受範圍的資金。

分享

目錄