2025年FLIP価格予測:今後の市場動向と価値上昇の可能性を分析

Chainflip(FLIP)の2025年から2030年にかけての市場動向や価格予測について解説します。過去の推移、需給バランス、エコシステムの進展を分析し、投資戦略立案に役立ててください。クロスチェーンDeFi分野におけるFLIPの役割についても理解を深めましょう。序章:FLIPの市場ポジションと投資価値

Chainflip(FLIP)はクロスチェーン分散型取引所(DEX)として、設立以来、ネイティブなクロスチェーンスワップの提供を行っています。2025年時点のChainflipの時価総額は40,882,133ドル、流通供給量は約67,229,293 FLIPトークン、価格は0.6081ドル前後で推移しています。資本効率と低スリッページが特徴の本資産は、クロスチェーンDeFi分野でますます重要な役割を担っています。

本記事では、Chainflipの2025年から2030年までの価格動向を、過去の推移、市場の需給、エコシステムの発展、マクロ経済要因を総合的に分析し、投資家に専門的な価格予測と実践的な投資戦略を提供します。

I. FLIP価格履歴のレビューと現状

FLIPの過去価格推移

- 2024年:FLIPは2024年3月7日に過去最高値9.501ドルを記録し、プロジェクトの大きな節目となりました。

- 2025年:市場は大きく調整し、2025年7月7日にFLIPは過去最安値0.3077ドルまで下落しました。

- 2025年:底打ち後、FLIPは回復傾向を示し、2025年10月1日時点で0.6081ドルで取引されています。

FLIPの現在市場状況

2025年10月1日時点でFLIPは0.6081ドルで取引され、直近24時間で1.72%上昇しています。トークンは期間ごとに大きな値動きがあり、過去7日間では7.93%下落、過去30日間では43.56%上昇しています。年間パフォーマンスは前年同期比で51.84%減となっています。

FLIPの現在の時価総額は40,882,133ドルで、暗号資産市場で775位です。流通供給量は67,229,293 FLIPで、総供給量90,000,000 FLIPの74.7%に相当します。完全希薄化後評価額(FDV)は54,729,000ドルです。

FLIPの24時間取引量は159,367ドルで、適度な市場活動が見られます。過去24時間の価格は0.596ドルから0.6188ドルの範囲で推移し、日中のボラティリティも確認できます。

現在のFLIP市場価格を見る

FLIP市場センチメント指標

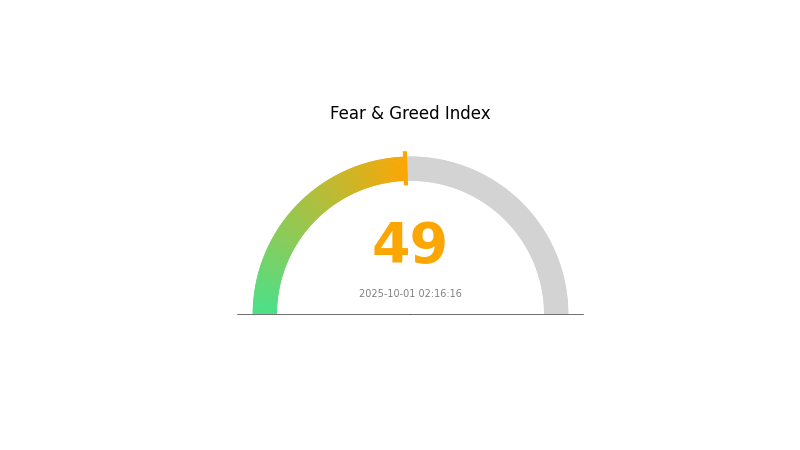

2025年10月01日 Fear and Greed Index:49(中立)

現在のFear & Greed Indexを見る

2025年10月に入った暗号資産市場のセンチメントは均衡状態で、Fear and Greed Indexは49付近を維持しています。この中立的な状況は、投資家が過度な恐怖も過剰な強気も持っていないことを示しています。慎重な姿勢とともに、楽観的なムードも感じられます。Gate.comのトレーダーは市場動向を注視し、チャンスを狙っています。常に十分な調査とリスク管理が求められます。

FLIP保有分布

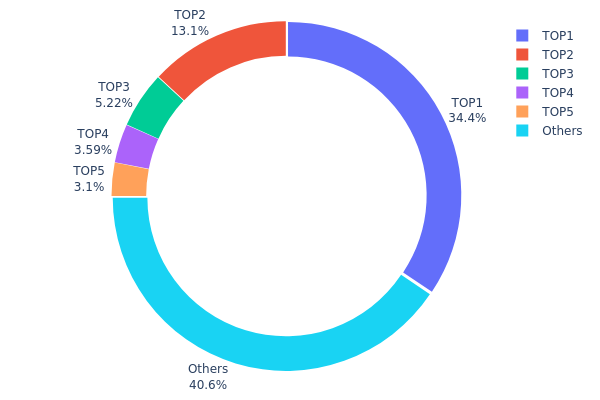

アドレス保有分布は、FLIPトークンの集中状況を示す重要な指標です。データ分析より、少数アドレスへの高い集中が明らかです。最大保有者は総供給量の34.40%を持ち、上位5アドレスで合計59.40%を支配しています。

この高い集中度は、市場操作や価格変動への懸念を招きます。少数の主体が供給の大部分をコントロールすることで、大規模な売却や買い集めのリスクが高まり、価格に大きな影響が出る可能性があります。また、この集中は分散化の主張を損ない、大口保有者の影響を懸念する新規投資家を遠ざける要因ともなります。

一方で、トークンの40.6%はその他アドレスへ分散されており、一定の広がりも見られます。広範な保有基盤はエコシステムの安定性を一部担保し、集中リスクを緩和する効果も期待できます。とはいえ、より一層の分散化が、長期的な持続性と健全な市場のために必要です。

現在のFLIP保有分布を見る

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6995...621dbd | 32,616.15K | 34.40% |

| 2 | 0x9a44...f562d3 | 12,426.16K | 13.10% |

| 3 | 0xf42a...36f173 | 4,951.60K | 5.22% |

| 4 | 0x49d1...d2a314 | 3,404.54K | 3.59% |

| 5 | 0xd163...13452b | 2,935.00K | 3.09% |

| - | Others | 38,471.81K | 40.6% |

II. FLIPの将来価格に影響する主因

供給メカニズム

- Just-In-Time(JIT)Automated Market Maker(AMM):Uniswap V3を基盤とするChainflipの中核機能で、相互接続チェーンやパートナーアグリゲーターの流動性を活用し、競争力のある価格と低手数料を実現します。

技術開発とエコシステム構築

-

クロスチェーン流動性:Chainflipの技術は複数のブロックチェーン流動性を活用し、取引効率や価格安定性を向上させます。

-

エコシステムアプリケーション:Chainflip上でのDAppsやプロジェクト開発が進むことで、FLIPトークンの需要が高まり、価格に影響を及ぼします。

III. 2025年~2030年 FLIP価格予測

2025年展望

- 保守的予測:0.56553~0.60810ドル

- 中立的予測:0.60810~0.73276ドル

- 楽観的予測:0.73276~0.85742ドル(市場センチメント改善・採用拡大が条件)

2027~2028年展望

- 市場フェーズ見通し:ボラティリティが高まる成長局面の可能性

- 価格レンジ予測:

- 2027年:0.41152~0.99831ドル

- 2028年:0.58973~1.07383ドル

- 主なカタリスト:技術進化、市場受容拡大、戦略的提携

2029~2030年長期展望

- ベースシナリオ:0.97701~1.06494ドル(安定した市場成長と採用拡大)

- 楽観シナリオ:1.06494~1.15288ドル(市場パフォーマンスとユーティリティ向上)

- 変革シナリオ:1.15014~1.15288ドル(機関投資家の大規模採用など有利な条件下)

- 2030年12月31日:FLIP 1.15014ドル(現時点予測のピーク価格)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.85742 | 0.6081 | 0.56553 | 0 |

| 2026 | 0.79138 | 0.73276 | 0.5056 | 20 |

| 2027 | 0.99831 | 0.76207 | 0.41152 | 25 |

| 2028 | 1.07383 | 0.88019 | 0.58973 | 44 |

| 2029 | 1.15288 | 0.97701 | 0.71322 | 60 |

| 2030 | 1.15014 | 1.06494 | 0.63897 | 75 |

IV. FLIP専門投資戦略とリスク管理

FLIP投資手法

(1) 長期保有戦略

- 対象:高リスク許容度でクロスチェーン技術を信じる投資家

- 運用アドバイス:

- 市場下落時にFLIPトークンを積み立てる

- 利益確定のための価格目標を設定

- ハードウェアウォレットで安全に保管

(2) アクティブ取引戦略

- テクニカル分析ツール:

- 移動平均線:トレンドや反転ポイントを判別

- 相対力指数(RSI):買われ過ぎや売られ過ぎを監視

- スイングトレードの注目点:

- クロスチェーンDEXの採用率を監視

- 暗号資産市場全体のセンチメントを追跡

FLIPリスク管理フレームワーク

(1) 資産配分の原則

- 保守的投資家:暗号資産ポートフォリオの1~3%

- 積極的投資家:5~10%

- プロ投資家:最大15%

(2) リスクヘッジ策

- 分散投資:異なるブロックチェーンエコシステムに分散

- ストップロス注文:損失の限定に活用

(3) セキュアな保管ソリューション

- ホットウォレット:Gate web3ウォレット推奨

- コールドストレージ:長期保有にはハードウェアウォレット

- セキュリティ対策:二段階認証の有効化と強力なパスワード設定

V. FLIPの潜在的リスクと課題

FLIP市場リスク

- ボラティリティ:暗号資産市場特有の大幅な価格変動

- 流動性:大口取引時の流動性課題

- 競合:新興クロスチェーンDEXによる市場シェア争い

FLIP規制リスク

- 規制の不確実性:グローバルな暗号資産規制の変化が運営に影響

- コンプライアンスコスト:規制対応コスト増加の可能性

- 地域制限:特定法域での取引制限の可能性

FLIP技術リスク

- スマートコントラクトの脆弱性:プロトコルのセキュリティ侵害リスク

- スケーラビリティ課題:需要急増時のネットワーク混雑

- 相互運用性問題:クロスチェーン間連携リスク

VI. 結論とアクション推奨

FLIP投資価値評価

FLIPはクロスチェーンDEX分野で独自の価値を持ち、長期的な成長余地があります。一方、短期的なボラティリティや規制不透明性は大きなリスク要因です。

FLIP投資推奨

✅ 初心者:技術理解を目的とした少額の試験的ポジション推奨 ✅ 経験者:リスク管理を徹底したドルコスト平均法による積立 ✅ 機関投資家:戦略的パートナーシップの検討と厳格なデューデリジェンス

FLIP取引参加方法

- 現物取引:Gate.comなど対応取引所で利用可能

- ステーキング:流動性提供が可能な場合に参加

- DeFi連携:クロスチェーンスワップやイールドファーミングの活用

暗号資産投資は極めて高リスクであり、本記事は投資助言ではありません。投資判断はご自身のリスク許容度に基づき慎重に行い、専門の金融アドバイザーへの相談を推奨します。余剰資金以上の投資は絶対に行わないでください。

FAQ

2025年のFLIP価格予測は?

現在の市場動向に基づき、2025年のFLIPは大きな成長が期待されます。アナリストは0.05~0.10ドルの価格レンジを予測しており、強気の見通しです。

2030年のTrump価格予測は?

現状の傾向から、2030年のTrumpの価格予測は平均11.84ドルです。価値上昇が期待されますが、市場環境によって変動します。

最も高い価格予測の暗号資産は?

2025年時点ではBitcoinが最も高い価格予測となり、次いでEthereumが続きます。両者は引き続き市場価値トップの地位を維持すると見込まれます。

Chainflipとは何ですか?

Chainflipは、ラップトークンや専用ウォレット不要でネイティブ資産スワップを可能にするクロスチェーンAMMです。Solana上で稼働し、異なるブロックチェーン間のシームレスな取引を実現します。FLIPはそのネイティブ暗号資産です。

共有

内容