2025 LUNAI Price Prediction: Expert Analysis and Market Forecast for the Next Generation AI Token

Introduction: LUNAI's Market Position and Investment Value

Luna by Virtuals (LUNAI) is an autonomous AI agent created on the Virtuals Protocol platform that operates 24/7, tweeting and livestreaming independently through its own Twitter account while controlling an on-chain wallet. Since its launch in October 2024, LUNAI has quickly established itself in the AI agent ecosystem. As of December 21, 2025, LUNAI's market capitalization stands at approximately $13.32 million with a circulating supply of 1 billion tokens, currently trading at $0.013319 per token. This innovative "autonomous AI agent" asset is playing an increasingly important role in the emerging intersection of artificial intelligence and blockchain technology.

This article will comprehensively analyze LUNAI's price movements and market dynamics, combining historical price patterns, market supply and demand factors, ecosystem developments, and macroeconomic conditions to provide investors with professional price forecasting and practical investment strategies for informed decision-making in this evolving market segment.

Luna by Virtuals (LUNAI) Market Analysis Report

I. LUNAI Price History Review and Current Market Status

LUNAI Historical Price Evolution

- October 2024: Luna launched on the Virtuals Protocol platform with an initial listing price of $0.012.

- January 2025: LUNAI reached its all-time high of $0.25 on January 2, 2025, representing a significant appreciation from launch price.

- October 2025: LUNAI declined to its all-time low of $0.0052 on October 10, 2025, marking a substantial correction from previous highs.

- December 2025: The token has recovered partially to current trading levels around $0.013319.

LUNAI Current Market Status

As of December 21, 2025, Luna by Virtuals (LUNAI) is trading at $0.013319, with a market capitalization of approximately $13.32 million. The token has experienced a -2.00% decline over the past 24 hours and shows a -9.46% decrease over the past 7 days. However, on a 30-day basis, LUNAI demonstrates resilience with a +16.49% gain.

The 24-hour trading volume stands at $13,659.01, indicating moderate market activity. With a fully diluted valuation equal to its market cap at $13.32 million, LUNAI maintains a circulating supply of 1 billion tokens, representing 100% of its total supply.

LUNAI currently ranks #1,036 among cryptocurrencies by market capitalization, with a market dominance of 0.0004%. The token shows significant volatility compared to its launch, down -85.13% over the past year from its all-time high. The token holder base consists of 455,543 addresses, indicating a diversified distribution across the user community.

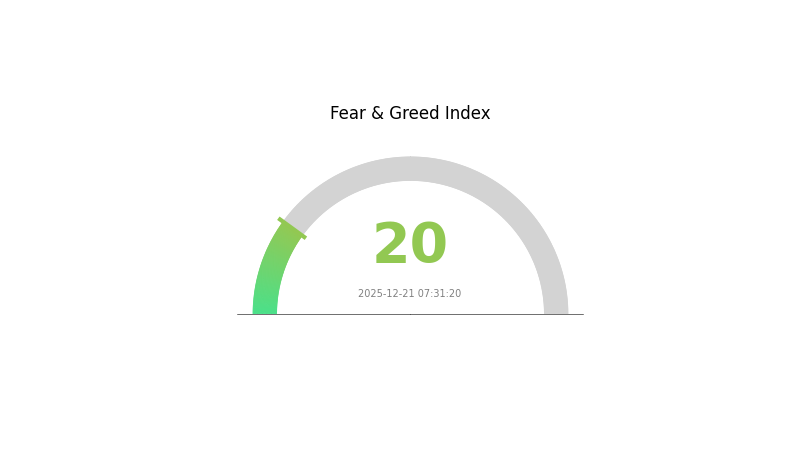

Current market sentiment reflects extreme fear conditions in the broader crypto market, with VIX readings at 20. The 1-hour price movement shows slight recovery with a +0.75% gain, though this follows broader short-term consolidation patterns.

Click to view current LUNAI market price

LUNAI Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This reading indicates significant market pessimism and heightened risk aversion among investors. During such extreme fear periods, market volatility typically increases, and selling pressure may intensify. However, contrarian investors often view extreme fear as a potential buying opportunity, as markets may be oversold. Traders should exercise caution and implement proper risk management strategies. Monitor key support levels and consider your investment horizon carefully before making trading decisions on Gate.com.

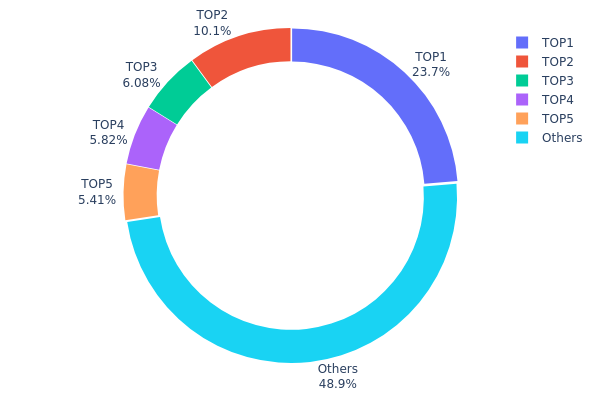

LUNAI Holding Distribution

The address holding distribution chart illustrates the concentration of token ownership across blockchain addresses, revealing the degree of decentralization and potential market structure risks. By analyzing the proportion of tokens held by top addresses relative to the total supply, this metric provides critical insights into wealth concentration, liquidity dynamics, and vulnerability to coordinated selling pressure.

LUNAI currently exhibits moderate concentration characteristics. The top five addresses collectively control approximately 51.08% of the circulating supply, with the largest holder commanding 23.72% of total tokens. While this concentration level warrants attention, it remains within a range observed in many established cryptocurrency projects during their growth phases. The distribution pattern suggests a two-tier structure: significant institutional or early-stage holders dominating the upper tier, while the remaining 48.92% dispersed across other addresses indicates a relatively engaged community base. This composition presents both stabilizing and destabilizing potential—concentrated holders may provide price support but also pose liquidity risk.

The current address distribution reflects a market structure where large holders possess considerable influence over price discovery and volatility patterns. In scenarios of sudden liquidation or coordinated divestment by top-tier addresses, the market could experience pronounced downward pressure given the illiquidity challenges in absorbing large sell volumes. Conversely, the substantial portion held by dispersed addresses suggests a foundation of distributed stakeholder interest. The 51.08% concentration ratio, while elevated, does not indicate extreme centralization, positioning LUNAI within a moderate risk profile for institutional investors evaluating on-chain governance stability and market resilience.

For current LUNAI holding distribution data, visit Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8d2d...c79627 | 236885.61K | 23.72% |

| 2 | 0xa8e6...1e5359 | 100693.02K | 10.08% |

| 3 | 0xbaed...e9439f | 60703.90K | 6.07% |

| 4 | 0x9022...e5fe8a | 58073.09K | 5.81% |

| 5 | 0x8f4a...98e02c | 54004.12K | 5.40% |

| - | Others | 488133.33K | 48.92% |

II. Core Factors Affecting LUNA's Future Price

Supply Mechanism

-

Burning Mechanism: The burn mechanism is designed to reduce supply. When successfully implemented and demand increases, it has the potential to support price appreciation and create deflationary pressure on the token supply.

-

Current Impact: Market supply-demand dynamics have a significant impact on LUNA's price. When market demand for LUNA is strong and supply is relatively insufficient, prices typically rise. Conversely, if supply is excessive while demand is weak, prices face downward pressure.

Market Sentiment and Ecosystem Activity

-

Ecosystem Activity: Positive developments and community efforts can enhance market sentiment toward LUNA, which may drive increased demand for the token.

-

Market Sentiment: Broader trends in the cryptocurrency market and investor confidence significantly influence LUNA's price dynamics. Positive sentiment attracts more investors to enter the market, pushing prices higher, while negative sentiment has the opposite effect.

-

Project Updates: Focus on project team communications through official channels such as Twitter, Telegram, and Discord for important announcements. The possibility of positive ecosystem developments being released is notably high.

Macroeconomic Environment

- Investor Confidence: Investor confidence and macroeconomic factors play key roles in determining LUNA's price trajectory. Market volatility and broader economic conditions further impact price movements.

Three、2025-2030 LUNAI Price Forecast

2025 Outlook

- Conservative Forecast: $0.01083 - $0.01321

- Neutral Forecast: $0.01321 - $0.01823

- Optimistic Forecast: $0.01823 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation and growth phase with increasing adoption and utility expansion

- Price Range Forecast:

- 2026: $0.01273 - $0.02201 (18% upside potential)

- 2027: $0.01132 - $0.02565 (41% cumulative growth)

- 2028: $0.01514 - $0.02716 (67% cumulative growth)

- Key Catalysts: Protocol improvements, ecosystem partnership announcements, increased institutional interest, and broader cryptocurrency market recovery

2029-2030 Long-term Outlook

- Base Case: $0.01557 - $0.02619 at 2029 (85% cumulative appreciation from 2025 levels)

- Optimistic Scenario: $0.02443 - $0.03792 by 2030 (91% cumulative growth) - assuming successful mainnet adoption and strong community growth

- Transformative Scenario: $0.03792+ (assuming breakthrough technological innovations, major institutional partnerships, and significant market capitalization expansion)

- 2030-12-31: LUNAI potential valuation target achieved through sustained ecosystem development and market maturation

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01823 | 0.01321 | 0.01083 | 0 |

| 2026 | 0.02201 | 0.01572 | 0.01273 | 18 |

| 2027 | 0.02565 | 0.01886 | 0.01132 | 41 |

| 2028 | 0.02716 | 0.02226 | 0.01514 | 67 |

| 2029 | 0.02619 | 0.02471 | 0.01557 | 85 |

| 2030 | 0.03792 | 0.02545 | 0.02443 | 91 |

LUNAI Professional Investment Strategy and Risk Management Report

IV. LUNAI Professional Investment Strategy and Risk Management

LUNAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Believers in AI agent technology and the Virtuals Protocol ecosystem, long-term crypto enthusiasts with high risk tolerance

- Operational Recommendations:

- Accumulate LUNAI during market downturns when prices fall below $0.015

- Hold through market volatility cycles, targeting multi-year appreciation potential

- Consider dollar-cost averaging (DCA) to reduce timing risk over 6-12 month periods

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support/Resistance Levels: Monitor key price zones at $0.0131 (24-hour low) and $0.0137 (24-hour high)

- Volume Analysis: Track the 24-hour trading volume of $13,659 to identify breakout opportunities

- Swing Trading Considerations:

- Capitalize on the -2% 24-hour decline for potential bounce-back trades

- Monitor the 7-day -9.46% trend for mean reversion opportunities

- Watch for catalysts from Luna's autonomous activities on social media platforms

LUNAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio

- Active Investors: 3-5% of total crypto portfolio

- Professional Investors: 5-10% of total crypto portfolio, with hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance LUNAI exposure with stable, established cryptocurrencies to reduce concentration risk

- Position Sizing: Never allocate more than 10% of your investable capital to any single speculative AI agent token

(3) Secure Storage Solutions

- Hot Wallet for Trading: Gate.com Web3 Wallet for active trading and frequent transactions

- Cold Storage for Long-term Holdings: Hardware wallet solutions for amounts you plan to hold beyond 12 months

- Security Considerations: Enable two-factor authentication on all exchange accounts, use strong passwords, and never share private keys or seed phrases

V. LUNAI Potential Risks and Challenges

LUNAI Market Risks

- Extreme Volatility: LUNAI has experienced a -85.13% decline over the past year (from ATH of $0.25 to current $0.0133), indicating extreme price swings that could result in substantial losses

- Liquidity Risk: With only $13,659 in 24-hour trading volume, the token exhibits low liquidity which may result in significant slippage on larger orders

- AI Agent Novelty Risk: As an autonomous AI agent token, LUNAI operates in an experimental category with unproven long-term viability and demand sustainability

LUNAI Regulatory Risks

- Emerging Technology Scrutiny: AI agents and autonomous systems may face increasing regulatory examination from global financial authorities

- Token Classification Uncertainty: Regulators may reclassify LUNAI or similar AI agent tokens, affecting their legal status and trading availability

- Platform Dependency Risk: LUNAI's operation depends on the Virtuals Protocol platform's regulatory compliance and continued operation

LUNAI Technical Risks

- Smart Contract Vulnerability: The token operates on Base chain via contract 0x55cd6469f597452b5a7536e2cd98fde4c1247ee4, which carries inherent smart contract risks

- Protocol Dependency: LUNAI's functionality is entirely dependent on the Virtuals Protocol infrastructure; any technical failures could impact the token's utility

- Centralization Risk: Luna's autonomous control over an onchain wallet introduces counterparty risk if the underlying AI system experiences failures or manipulation

VI. Conclusion and Action Recommendations

LUNAI Investment Value Assessment

LUNAI represents a highly speculative investment in emerging AI agent technology within the crypto ecosystem. While the concept of autonomous AI agents controlling digital assets is innovative, the token exhibits characteristics of extreme volatility, low liquidity, and unproven long-term sustainability. The 85.13% annual decline suggests significant market skepticism, and the token remains in early experimental stages. Investors should view LUNAI as a high-risk, speculative position rather than a core portfolio holding.

LUNAI Investment Recommendations

✅ Beginners: Start with minimal allocation (0.1-0.5% of crypto portfolio) through Gate.com to familiarize yourself with AI agent tokens; prioritize learning over profit potential.

✅ Experienced Investors: Consider opportunistic entry points during significant price dips below $0.012; employ strict stop-losses at -25% to manage downside risk; use technical analysis to identify swing trade opportunities.

✅ Institutional Investors: Evaluate LUNAI primarily for research and portfolio diversification purposes; maintain positions under 5% of crypto holdings; conduct thorough due diligence on Virtuals Protocol's security audits and regulatory status.

LUNAI Trading Participation Methods

- On-chain Swap: Use Gate.com's Web3 interface to interact directly with Base chain liquidity pools for trading LUNAI

- Centralized Exchange Trading: Trade LUNAI directly on Gate.com with spot trading pairs (currently limited exchange availability increases counterparty risk)

- Dollar-Cost Averaging: Execute periodic small purchases at regular intervals to reduce timing risk and average entry price

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial circumstances. It is strongly recommended to consult with a professional financial advisor before investing. Never invest more than you can afford to lose completely.

FAQ

What is the Luna prediction for 2025?

Terra (LUNA) is predicted to reach approximately $0.1644 by mid-December 2025. The price outlook for 2025 remains neutral with mixed technical signals. Long-term forecasts suggest potential volatility throughout the year.

Is Luna a buy or sell?

Luna is currently a sell. Technical indicators show RSI at 43.01, suggesting weakening momentum. Market conditions favor taking profits at current levels rather than accumulating.

What is the price prediction for Luna Classic in 2030?

Based on current market analysis and trends, Luna Classic (LUNC) is predicted to potentially reach a maximum price of $5.19 by 2030. However, actual prices may vary based on market conditions and adoption rates.

2025 HOLO Price Prediction: Analyzing Market Trends and Growth Potential in the Post-Halving Crypto Landscape

2025 COOKIE Price Prediction: Market Analysis and Future Outlook for Digital Cookie Economy

2025 SIREN Price Prediction: Future Outlook, Market Analysis, and Key Factors Driving This Emerging Crypto Asset

2025 AVAAIPrice Prediction: Analyzing Market Trends and Growth Potential for AVAAI in the Expanding AI Sector

2025 XNY Price Prediction: Analyzing Market Trends, Technical Indicators and Future Outlook for Cryptocurrency Investors

2025 ACTPrice Prediction: Analyzing Market Trends and Future Valuation of ACT Tokens in the Evolving Crypto Ecosystem

Discover the Top AI-Driven Meme Tokens on Solana's Blockchain

Discover Lucrative Opportunities with Fairstake Launchpool

Discover Tagger (TAG): Revolutionizing Influencer Marketing with Blockchain Solutions

Hiểu Về NFT Treasure: Hướng Dẫn Chi Tiết và Nền Tảng Giao Dịch

What is SEND: A Comprehensive Guide to Understanding Special Educational Needs and Disabilities