2025 年 MGO 價格預測:深入剖析市場趨勢及 Mobile Go Token 未來成長潛力

全面掌握 Mobile Go Token (MGO) 的未來發展,歡迎參考我們 2025 年 MGO 價格預測報告。深入分析市場動向、歷史資料,以及左右 MGO 成長潛力的宏觀經濟因素。詳盡解析 MGO 現階段的市場情勢與投資人情緒指標,並簡介:MGO 市場定位與投資價值

Mango Network(MGO)作為 Layer 1 多虛擬機全鏈基礎建設,自計畫啟動以來,持續聚焦於解決 Web3 應用及 DeFi 協議的核心難題。截至 2025 年,MGO 市值達 42,802,800 美元,流通量約 15.9 億枚,價格穩定在 0.02692 美元左右。身為「Web3 基礎建設創新者」,MGO 在安全性、模組化、高效能區塊鏈解決方案領域扮演愈加關鍵的角色。

本文將全面剖析 MGO 於 2025 至 2030 年間的價格走勢,結合歷史脈絡、市場供需、生態發展與宏觀經濟因素,為投資人提供專業價格預測與實用投資策略。

一、MGO 價格歷史回顧與現今市場狀況

MGO 歷史價格演變軌跡

- 2025 年 6 月:6 月 24 日,MGO 創下歷史最低價 0.005 美元

- 2025 年 7 月:7 月 19 日,MGO 攀上歷史最高價 0.08158 美元,價格急速上漲

- 2025 年 10 月:價格穩定於 0.02692 美元,市場進入整合期

MGO 現今市場狀況

截至 2025 年 10 月 1 日,MGO 交易價格為 0.02692 美元,24 小時成交量達 900,960 美元。過去 24 小時價格下跌 2%,但近 30 天漲幅達 11.58%。目前市值 42,802,800 美元,MGO 在加密貨幣市場排名第 755 位。流通量 15.9 億枚,總發行量 100 億枚,市值與完全稀釋估值比例 15.9%。現價較歷史高點低 67%,若市場回暖仍有上漲空間。

點擊查看最新 MGO 市場價格

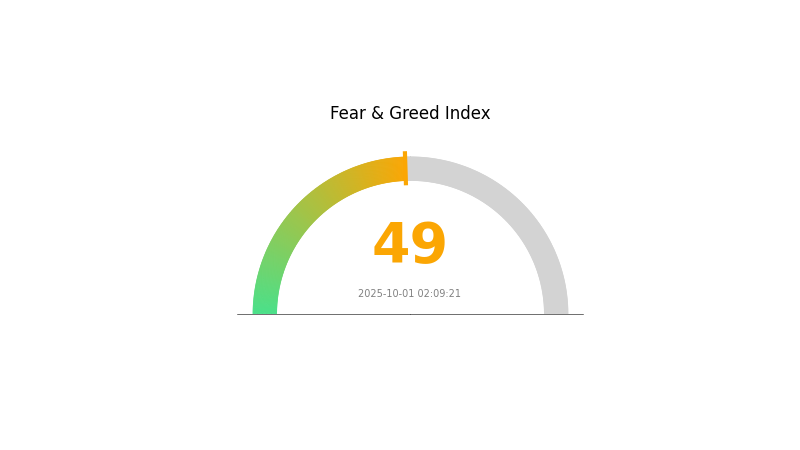

MGO 市場情緒指標

2025-10-01 恐懼與貪婪指數:49(中性)

點擊查看現行 恐懼與貪婪指數

目前加密市場情緒維持平衡,恐懼與貪婪指數為 49,屬中性態勢。投資人既不悲觀亦不樂觀,市場逐步趨於穩定。交易者需謹慎留意,因後續動態或消息可能帶來方向性變化。投資決策宜充分調查並妥善管理風險。

MGO 持幣分布

MGO 地址持幣數據顯示,代幣分布高度分散,未見集中大額地址,顯示 MGO 持有者數量龐大,去中心化特性鮮明。

缺乏「大戶」集中持幣,有助降低市場操縱風險,強化價格穩定性。然而,由於缺乏細部的小額地址資料,整體分析尚有限。

現有地址分布支持去中心化原則,有助於鏈上穩定及抗中心化,但完整評估仍需補充小額地址數據。

點擊查閱最新 MGO 持幣分布

| Top | Address | Holding Qty | Holding (%) |

|---|

二、影響 MGO 未來價格的關鍵因素

供應機制

- 總供應量:MGO 總發行量 100 億枚,分配策略兼顧生態長期發展與短期激勵。

- 現行影響:供應與分配架構將深度影響 MGO 長期價格趨勢。

技術發展與生態建構

- Narwhal-Bullshark 共識機制:平台採用該機制,實現高吞吐量與高效能,為 MGO 提供技術支撐。

- 生態應用:MGO 網路內 DApp 及生態項目發展有望推升需求,進而帶動代幣價格。

三、2025-2030 年 MGO 價格預測

2025 年展望

- 保守預測:0.01695 - 0.02691 美元

- 中性預測:0.02691 - 0.03000 美元

- 樂觀預測:0.03000 - 0.03175 美元(須市場情緒正向及採用率提升)

2027-2028 年展望

- 市場階段預期:有望進入成長階段,波動性將提升

- 價格區間預測:

- 2027:0.01806 - 0.04681 美元

- 2028:0.03290 - 0.05337 美元

- 主要推升因素:技術進步、產業合作擴展及市場拓展

2029-2030 年長期展望

- 基礎情境:0.04675 - 0.05072 美元(假設市場持續成長及採用擴大)

- 樂觀情境:0.05469 - 0.06188 美元(採用加速、市場環境有利)

- 突破情境:0.06500 - 0.07000 美元(發生重大創新與主流整合)

- 2030-12-31:MGO 年度潛在高點 0.06188 美元

| 年份 | 預測最高價 | 預測平均價 | 預測最低價 | 漲跌幅 |

|---|---|---|---|---|

| 2025 | 0.03175 | 0.02691 | 0.01695 | 0 |

| 2026 | 0.03754 | 0.02933 | 0.02845 | 8 |

| 2027 | 0.04681 | 0.03344 | 0.01806 | 24 |

| 2028 | 0.05337 | 0.04013 | 0.0329 | 49 |

| 2029 | 0.05469 | 0.04675 | 0.03693 | 73 |

| 2030 | 0.06188 | 0.05072 | 0.04514 | 88 |

四、MGO 專業投資策略與風險管理

MGO 投資方法論

(1) 長期持有策略

- 適用對象:高風險承受度的長期投資人

- 操作建議:

- 於市場下跌時分批布局 MGO

- 設定分階段停利目標

- 採用硬體錢包或專業託管服務安全保存

(2) 主動交易策略

- 技術分析工具:

- 均線:判斷趨勢與反轉點

- RSI:辨識超買或超賣狀態

- 波段操作重點:

- 密切追蹤計畫進度及合作消息

- 嚴格設定停損,有效控管風險

MGO 風險管理架構

(1) 資產配置原則

- 保守型:加密資產比例 1-3%

- 積極型:加密資產比例 5-10%

- 專業型:加密資產最高可達 15%

(2) 風險對沖措施

- 分散投資:布局多個 Layer 1 計畫

- 停損策略:設停損,控管潛在損失

(3) 安全保存措施

- 熱錢包推薦:Gate Web3 錢包

- 冷存放:長期持有建議選用硬體錢包

- 安全管理:啟用雙重驗證,採獨立密碼

五、MGO 潛在風險與挑戰

MGO 市場風險

- 高度波動:加密市場價格劇烈起伏

- 競爭壓力:Layer 1 計畫眾多,市場競爭激烈

- 流動性風險:大額交易可能影響成交價格

MGO 合規風險

- 監管環境不明朗:Layer 1 計畫可能遭遇新法規

- 跨境合規挑戰:須因應多國監管標準

- 代幣定性風險:部分司法區可能將 MGO 視為證券

MGO 技術風險

- 智能合約漏洞:網路程式碼存有攻擊風險

- 擴充性挑戰:高交易量時處理能力有限

- 跨鏈互操作性困難:鏈間溝通仍存技術瓶頸

六、結論與行動建議

MGO 投資價值評估

MGO 作為 Layer 1 解決方案,在 Web3 與 DeFi 領域具備成長潛力,但面臨激烈競爭及技術挑戰,短期波動與監管不確定性需特別注意。

MGO 投資建議

✅ 新手:充分調查後可嘗試小額分散布局 ✅ 有經驗投資人:定期加碼並嚴控風險 ✅ 機構投資人:全面盡職調查並納入多元加密資產組合

MGO 交易參與方式

- 現貨交易:可於 Gate.com 及各大主流交易所參與

- 質押:參與網路驗證以獲得獎勵

- DeFi 整合:探索基於 MGO 的 DeFi 協議以增值收益

加密貨幣投資風險甚高,本文不構成投資建議。投資人應依自身風險承受度審慎決策,建議諮詢專業理財顧問。切勿投入超過可承受損失之資金。

常見問題 FAQ

MGO Global 今日適合買進嗎?

是的,MGO Global 今日具備一定買進價值。根據現行市場分析與正向獲利預期,該股票成長潛力明顯。

Harvest Minerals 2025 年股價預測為何?

依目前趨勢,Harvest Minerals 2025 年股價預測為 0.950 美元。此數據以 2025 年 10 月長期市場分析為基礎。

MGO Global 股價為何上漲?

MGO Global 股價上漲主因於預期策略發展,目前漲幅達 27.81%。截至 2025 年 10 月 1 日,上漲趨勢持續。

MGO 代幣目前價格為何?

截至 2025 年 10 月 1 日,MGO 代幣價格為 0.02883 美元,1 枚 MGO 可依此價買入。

分享

目錄