2025 STIK Price Prediction: Expert Analysis and Future Outlook for the Upcoming Year

Introduction: Market Position and Investment Value of STIK

Staika (STIK) is a blockchain project designed to establish itself as a trustworthy platform through continuous technological development centered on user and customer experience. Since its launch in 2023, the project has developed a comprehensive ecosystem featuring a multi-list cryptocurrency wallet, Move To Earn and Play To Earn services, and a trusted NFT marketplace. As of December 2025, STIK has achieved a market capitalization of $130.6 million, with approximately 134.28 million tokens in circulation, and the price currently stabilizes around $0.5224. This innovative asset is increasingly playing a crucial role in the Web3 ecosystem through its integrated services and ESG-focused commercialization model.

This article will conduct a comprehensive analysis of STIK's price trends from 2025 through 2030, incorporating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

Staika (STIK) Market Analysis Report

I. STIK Price History Review and Current Market Status

STIK Historical Price Evolution

Based on available data, Staika (STIK) has experienced significant volatility since its market inception:

- February 28, 2025: All-time high reached at $5.58, representing peak market valuation

- December 17, 2025: All-time low recorded at $0.508192, marking a substantial decline from peak levels

- Current Period (December 18, 2025): Price recovery to $0.5224, indicating a slight rebound from recent lows

The token has experienced a 63.44% decline over the past year, reflecting broader market headwinds and project-specific challenges.

STIK Current Market Status

Price Performance:

- Current Price: $0.5224

- 24-hour Change: +1.29% ($0.006653 appreciation)

- 1-hour Change: +0.19%

- 7-day Change: -12.21%

- 30-day Change: -17.26%

- 52-week Change: -63.44%

Market Capitalization Metrics:

- Market Cap: $70,148,014.49

- Fully Diluted Valuation (FDV): $130,600,000.00

- Market Cap/FDV Ratio: 53.71%

- Market Dominance: 0.0042%

- 24-hour Trading Volume: $64,844.26

Token Distribution:

- Circulating Supply: 134,280,272.75 STIK (53.71% of total supply)

- Total Supply: 250,000,000 STIK

- Maximum Supply: 250,000,000 STIK

- Active Holders: 27,937

Market Range (24-hour):

- 24-hour High: $0.5488

- 24-hour Low: $0.51

STIK is currently trading on 3 exchanges with modest liquidity levels. The token experienced a 90.63% decline from its all-time high, currently trading near recent support levels established on December 17, 2025.

Click to view current STIK market price

STIK Market Sentiment Index

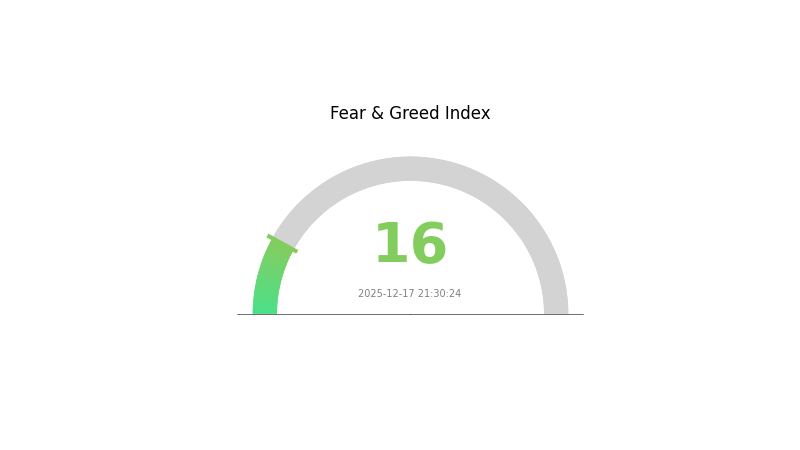

2025-12-17 Fear & Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear with an index reading of 16, signaling significant bearish sentiment among investors. This level typically indicates panic selling and heightened market anxiety. When fear reaches such extremes, it often presents contrarian opportunities for long-term investors, as markets tend to overreact to negative news. However, caution is warranted as downward momentum may continue. Monitor key support levels and consider dollar-cost averaging strategies. Stay informed through Gate.com's comprehensive market data tools to navigate this volatile period effectively.

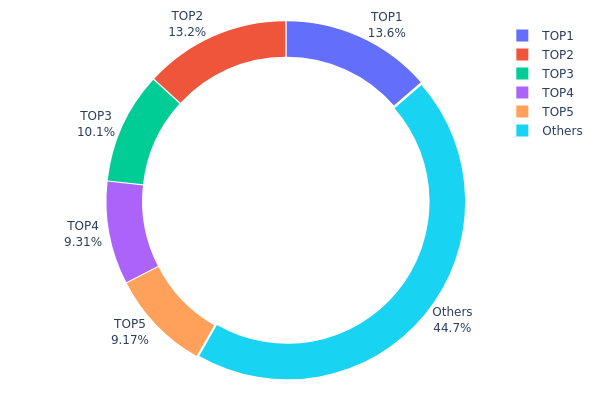

STIK Holdings Distribution

Address holdings distribution refers to the concentration analysis of token ownership across blockchain addresses, revealing how STIK tokens are allocated among different holders. This metric is critical for understanding the decentralization degree, market structure stability, and potential risks of large-scale token concentration that could affect price volatility and market manipulation susceptibility.

The current holdings distribution of STIK demonstrates a moderate concentration pattern with notable structural characteristics. The top five addresses collectively control 55.32% of total token supply, with the largest holder commanding 13.60% and the second-largest holding 13.19%. This concentration level indicates that while significant holdings are distributed among multiple major participants, the token still exhibits moderate centralization. The remaining 44.68% dispersed across other addresses suggests a reasonably diversified holder base, though the top five addresses maintaining over half the circulating supply represents a concentration threshold worth monitoring for potential market influence.

From a market structure perspective, this distribution pattern suggests moderate decentralization with contained systemic risks. The relatively balanced holdings among the top five addresses, each ranging between 9-14%, reduces the likelihood of unilateral market manipulation by a single entity. However, the combined influence of these major holders could potentially impact price discovery and liquidity dynamics during periods of high volatility. The substantial "Others" category comprising 44.68% indicates organic distribution among retail and smaller institutional participants, which generally supports market resilience and reduces extreme concentration risks typical of early-stage tokens.

Click to view current STIK Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 6dcsjc...3SvBon | 34000.00K | 13.60% |

| 2 | GKBPeJ...CWEZxg | 32999.60K | 13.19% |

| 3 | u6PJ8D...ynXq2w | 25169.27K | 10.06% |

| 4 | 72fmM5...4PQiRn | 23281.25K | 9.31% |

| 5 | HErKip...WgXbkF | 22913.00K | 9.16% |

| - | Others | 111636.76K | 44.68% |

II. Core Factors Influencing STIK's Future Price

Supply Mechanism

-

Token Supply and Scarcity: STIK's value proposition is significantly influenced by its scarcity characteristics. Limited token supply creates a foundation for potential price appreciation, as increased demand combined with constrained supply dynamics can drive value growth.

-

Staking Demand: Continued user growth in health and gaming integration mechanisms is expected to increase token circulation and staking demand, which can positively influence token utility and price dynamics.

Technology Development and Ecosystem Building

-

Move-to-Earn and Play-to-Earn Integration: The integration of health and gaming features with move-to-earn and play-to-earn mechanics represents a core technological development. Continuous user growth in these integrated ecosystems can increase both token circulation demand and staking requirements, thereby supporting price appreciation potential.

-

NFT Applications: NFT integration within the STIK ecosystem provides additional utility and engagement mechanisms for users, expanding the token's practical applications and ecosystem value.

Macroeconomic Environment

-

Macroeconomic Trends: STIK's price trajectory is affected by broader macroeconomic trends, policy regulation, and technological innovation. These external factors interact to shape market conditions and investor sentiment toward emerging cryptocurrencies.

-

Regulatory Environment: Policy monitoring and regulatory developments represent critical variables influencing STIK's investment outlook and market stability.

III. STIK Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.418 - $0.5225

- Base Case Forecast: $0.5225

- Optimistic Forecast: $0.56953

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation and recovery phase with incremental growth trajectory

- Price Range Forecast:

- 2026: $0.32215 - $0.6716

- 2027: $0.54792 - $0.78536

- 2028: $0.39037 - $0.88529

- Key Catalysts: Enhanced protocol adoption, improved market liquidity on platforms like Gate.com, and positive sentiment reversal in the broader crypto market

2029-2030 Long-term Outlook

- Base Case Scenario: $0.69624 - $0.95734 (Sustained ecosystem development and moderate institutional adoption)

- Optimistic Scenario: $0.69941 - $1.13654 (Strong network effects and increased utility recognition)

- Bullish Scenario: $1.13654+ (Mainstream adoption breakthrough and significant market capitalization expansion)

- Performance Trajectory: STIK demonstrates cumulative appreciation of approximately 67% from 2025 baseline through 2030, reflecting consistent upward momentum across the forecast period

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.56953 | 0.5225 | 0.418 | 0 |

| 2026 | 0.6716 | 0.54601 | 0.32215 | 4 |

| 2027 | 0.78536 | 0.6088 | 0.54792 | 16 |

| 2028 | 0.88529 | 0.69708 | 0.39037 | 33 |

| 2029 | 0.95734 | 0.79119 | 0.69624 | 51 |

| 2030 | 1.13654 | 0.87426 | 0.69941 | 67 |

STIK Professional Investment Strategy and Risk Management Report

IV. STIK Professional Investment Strategy and Risk Management

STIK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-averse investors seeking exposure to blockchain-based earning platforms with ESG focus

- Operation suggestions:

- Accumulate STIK during market downturns, leveraging the current 63.44% annual decline as a potential entry point for long-term believers

- Hold through platform development cycles, as Staika's Move To Earn and Play To Earn features mature

- Reinvest any staking rewards to compound returns over 12-24 month periods

(2) Active Trading Strategy

- Market volatility observation:

- 24-hour volatility: Monitor the 1.29% daily change and 12.21% weekly decline patterns

- Support level: $0.51 (recent 24h low) represents a key technical floor

- Resistance level: $0.5488 (current 24h high) should be watched for breakout potential

- Wave operation considerations:

- Enter positions during downtrend phases when market sentiment weakens

- Exit positions upon 5-10% gains during temporary recovery rallies

- Maintain tight stop-losses at 3-5% below entry points given the asset's volatility profile

STIK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of portfolio

- Active investors: 3-5% of portfolio

- Professional investors: 5-8% of portfolio

(2) Risk Hedging Solutions

- Diversification strategy: Balance STIK holdings with established blockchain assets and traditional securities

- Position sizing: Never exceed individual risk tolerance; consider STIK's market cap of $130.6M and liquidity constraints (3 exchange listings)

(3) Secure Storage Solutions

- Hot wallet solution: Gate Web3 Wallet for active trading and platform interactions with Staika's Move To Earn and Play To Earn services

- Cold storage approach: Transfer long-term holdings to secure self-custody solutions for offline storage

- Security considerations: Protect private keys and seed phrases; enable multi-signature authentication where available; verify official Staika contract addresses on Solana blockchain before transactions

V. STIK Potential Risks and Challenges

STIK Market Risk

- Liquidity concentration: With only 3 exchange listings and 27,937 holders, STIK faces significant liquidity constraints that could result in slippage during large trades

- Price volatility: 63.44% annual decline and recent all-time low of $0.508192 (December 17, 2025) demonstrate extreme price instability

- Market dominance: 0.0042% market share indicates minimal market recognition and adoption compared to established platforms

STIK Regulatory Risk

- Evolving regulatory framework: Play To Earn and Move To Earn services face uncertain regulatory treatment across different jurisdictions

- Virtual asset taxation: Proposed tax mechanisms for virtual asset-based income require ongoing regulatory compliance monitoring

- Geographic compliance: Different countries may impose restrictions on gaming-based cryptocurrency projects

STIK Technology Risk

- Platform maturity: The reliance on multiple services (wallet, Move To Earn, Play To Earn, NFT marketplace) suggests a complex development roadmap with execution uncertainties

- Smart contract vulnerability: Solana-based implementation requires rigorous auditing to prevent security exploits

- User experience adoption: Success depends on seamless integration of all platform features and mass-market adoption

VI. Conclusion and Action Recommendations

STIK Investment Value Assessment

Staika presents a speculative opportunity within the blockchain ecosystem, offering differentiated features through its Move To Earn, Play To Earn services, and NFT marketplace integrated with social responsibility (ESG donations). However, the project exhibits significant challenges: extreme price volatility (63.44% annual decline), minimal market capitalization ($130.6M), limited exchange presence (3 listings), and uncertain platform maturation. The current all-time low price reflects substantial market skepticism. While the project's vision of scalable, affordable blockchain services with tax compliance features demonstrates ambition, execution risk remains considerable. The token's fully diluted valuation at $130.6M suggests market participants question current adoption levels and future growth prospects.

STIK Investment Recommendations

✅ Beginners: Allocate only 1-2% of portfolio if interested; purchase exclusively through Gate.com with verified account security; prioritize understanding Staika's platform features before committing capital

✅ Experienced Investors: Consider 3-5% allocation as speculative high-risk position; employ technical analysis on Solana blockchain price action; use dollar-cost averaging during extended downtrends; maintain strict stop-losses

✅ Institutional Investors: Conduct thorough due diligence on tokenomics (53.71% circulating ratio), regulatory exposure in gaming and Move To Earn categories, and technology audit of Solana smart contracts before consideration

STIK Trading Participation Methods

- Gate.com Direct Trading: Access STIK spot markets with real-time price discovery and liquidity aggregation; monitor the market cap progression as adoption indicators

- Accumulation Strategy: Dollar-cost average entries during downtrend phases to reduce timing risk

- Platform Participation: Direct engagement with Staika's Move To Earn and Play To Earn services provides firsthand assessment of platform quality and user experience before financial commitment

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial circumstances. Consult with professional financial advisors before committing capital. Never invest amounts exceeding your capacity to sustain loss.

FAQ

Does Stacks Crypto have a future?

Yes, Stacks has a promising future. Its innovative layer-2 solutions for Bitcoin drive increasing adoption and network growth, positioning it for significant long-term potential and expansion.

How high will stx go?

STX's future price depends on DeFi adoption and market dynamics. It could potentially reach $100 or remain under $3, driven by ecosystem development and investor sentiment rather than BTC price alone.

What is the price of STX in 2025?

As of December 2025, the maximum expected price for STX is around $0.338. This forecast is based on technical analysis by cryptocurrency experts.

How much will Chainlink be worth in 2025?

Chainlink is projected to reach approximately $12.75 by the end of 2025, based on current growth trends and market analysis. This forecast reflects the platform's continued development and adoption in the blockchain ecosystem.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

What is ICX: A Comprehensive Guide to ICON's Native Cryptocurrency and Its Role in the Blockchain Ecosystem

World Liberty Financial Proposes Using Unlocked WLFI Tokens to Boost USD1 Adoption

What is MELANIA: A Comprehensive Guide to Understanding the Emerging Technology Platform

What is LUMINT: A Comprehensive Guide to Imagery Intelligence in Modern Surveillance and Defense Systems

How New SEC and CFTC Guidelines Are Transforming Crypto Market Infrastructure