2025 USDC Price Prediction: Expert Analysis and Market Forecast for the Leading Stablecoin

Introduction: USDC's Market Position and Investment Value

USD Coin (USDC) has established itself as a leading fully-collateralized stablecoin pegged to the US dollar since its inception in 2018. As of 2025, USDC's market capitalization has reached $78.4 billion, with a circulating supply of approximately 78.4 billion coins, maintaining a stable price of $1. This asset, known as the "trusted digital dollar," is playing an increasingly crucial role in facilitating transactions, cross-border payments, and decentralized finance (DeFi) applications.

This article will provide a comprehensive analysis of USDC's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

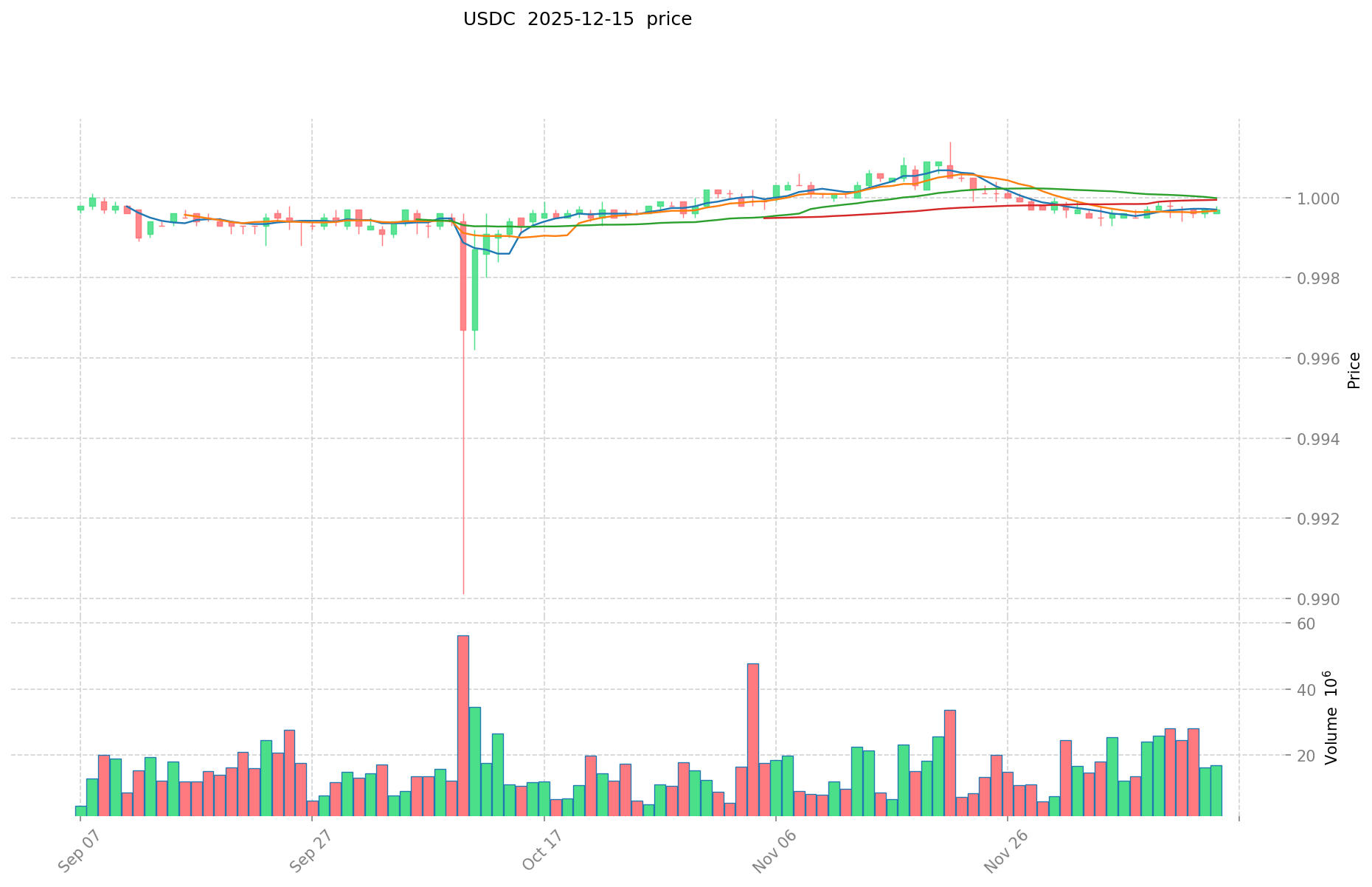

I. USDC Price History Review and Current Market Status

USDC Historical Price Evolution

- 2018: USDC launched, price remained stable around $1

- 2020: Rapid adoption during DeFi boom, maintaining $1 peg

- 2023: Brief de-peg to $0.87 due to banking crisis, quickly recovered to $1

USDC Current Market Situation

As of December 15, 2025, USDC is trading at exactly $1.00, maintaining its peg to the US dollar. The 24-hour trading volume stands at $23,434,200, indicating active market participation. USDC's market capitalization is $78,402,220,895, ranking it 6th among all cryptocurrencies with a 2.40% market share. The circulating supply of 78,402,220,895 USDC closely matches the total supply of 78,428,581,243 USDC, suggesting high liquidity and utilization. Price volatility remains minimal, with 24-hour highs and lows between $0.9996 and $0.9999, demonstrating USDC's stability as a stablecoin.

Click to view the current USDC market price

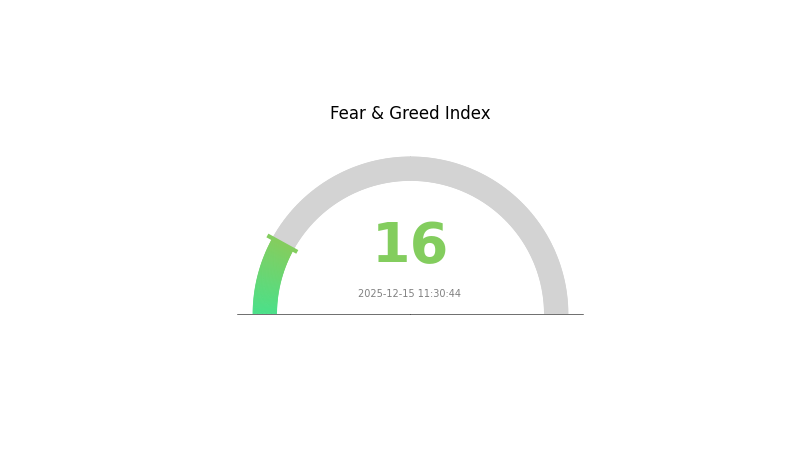

USDC Market Sentiment Indicator

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear today, with the sentiment indicator plummeting to 16. This suggests a high level of uncertainty and risk aversion among investors. During such periods, assets are often considered undervalued, potentially presenting buying opportunities for contrarian investors. However, caution is advised as market volatility may persist. It's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions in this challenging market environment.

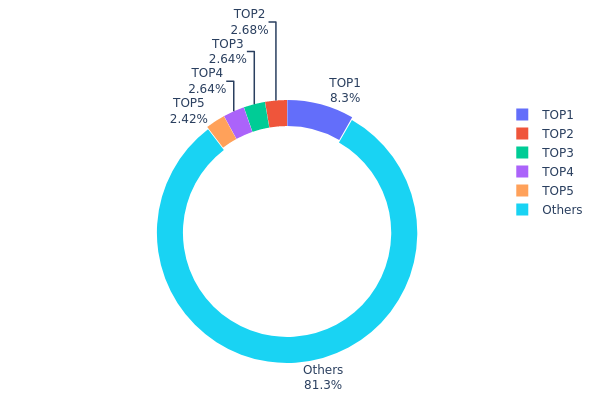

USDC Holdings Distribution

The address holdings distribution data for USDC reveals significant insights into its market structure. The top address holds 8.29% of the total supply, with the next four largest addresses each holding between 2.42% and 2.68%. Collectively, the top five addresses control 18.67% of all USDC, while the remaining 81.33% is distributed among other addresses.

This distribution pattern indicates a moderate level of concentration in USDC holdings. While the top address holds a notable portion, it does not suggest excessive centralization. The presence of several large holders in the 2-3% range demonstrates a balanced distribution among major players. However, the fact that over 80% of USDC is held by addresses outside the top five suggests a relatively wide distribution among smaller holders, contributing to overall market stability.

The current address distribution implies a market structure that balances between institutional involvement and broader adoption. While large holders may have some influence on short-term price movements, the significant portion held by smaller addresses acts as a buffer against potential market manipulation. This distribution reflects a maturing stablecoin ecosystem with a mix of major players and a diverse user base, indicating a reasonable level of decentralization and on-chain structural stability for USDC.

Click to view the current USDC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3730...fd7341 | 4399612.99K | 8.29% |

| 2 | 0x3b4d...cf5ca7 | 1421496.88K | 2.68% |

| 3 | 0xad35...329ef5 | 1400000.00K | 2.64% |

| 4 | 0xe194...6929b6 | 1400000.00K | 2.64% |

| 5 | 0xffa6...735a5e | 1283000.00K | 2.42% |

| - | Others | 43110664.55K | 81.33% |

II. Key Factors Affecting USDC's Future Price

Supply Mechanism

- Reserve Backing: USDC is fully backed by cash and short-term US Treasury bonds, ensuring a 1:1 peg to the US dollar.

- Historical Pattern: Transparent reserve management has helped maintain USDC's stability and investor confidence.

- Current Impact: The robust reserve system continues to support USDC's price stability and market trust.

Institutional and Whale Movements

- Institutional Holdings: Major institutions like BlackRock and Goldman Sachs have chosen USDC for cross-border settlements, with institutional holdings reaching 38% in 2024.

- Corporate Adoption: 150 international banks integrated with USDC's payment network in 2024, aiming to become the "blockchain version of SWIFT" for corporate cross-border settlements.

- Government Policies: The potential implementation of the GENIUS Act in the US could reshape the stablecoin landscape, potentially favoring USDC as a compliant option.

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve interest rate decisions directly affect USDC's reserve yield, impacting Circle's profitability and USDC's market competitiveness.

- Inflation Hedging Properties: As a dollar-pegged asset, USDC's value is directly tied to USD inflation rates.

- Geopolitical Factors: Global economic uncertainties and potential fragmentation of currency blocs could influence USDC's adoption and use in international trade.

Technological Development and Ecosystem Building

- EURC Expansion: Circle's launch of EURC, a euro-pegged stablecoin, aims to capture the European market and diversify its stablecoin offerings.

- USYC Innovation: The introduction of USYC, a tokenized version of US Treasury bond funds, represents Circle's move into the rapidly growing field of real-world asset (RWA) tokenization.

- Ecosystem Applications: Circle's Cross-Chain Transfer Protocol (CCTP) supports USDC's interoperability across multiple blockchain networks, enhancing its utility in various DeFi and Web3 applications.

III. USDC Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.99-$1.00

- Neutral forecast: $1.00

- Optimistic forecast: $1.00-$1.01 (requires increased adoption and regulatory clarity)

2026-2028 Outlook

- Market phase expectation: Stable growth and wider adoption

- Price range prediction:

- 2026: $0.99-$1.01

- 2027: $0.99-$1.01

- Key catalysts: Regulatory developments, institutional adoption, and integration with traditional finance

2029-2030 Long-term Outlook

- Base scenario: $0.99-$1.01 (assuming continued stability and adoption)

- Optimistic scenario: $1.00-$1.02 (assuming widespread global adoption and favorable regulations)

- Transformative scenario: $1.00-$1.03 (assuming USDC becomes a dominant global stablecoin)

- 2030-12-31: USDC $1.01 (potential slight premium due to high demand and trust)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. USDC Professional Investment Strategies and Risk Management

USDC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable value preservation

- Operation suggestions:

- Allocate a portion of portfolio to USDC as a hedge against volatility

- Use dollar-cost averaging to accumulate USDC over time

- Store USDC in secure, non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving averages: Monitor short-term price movements

- Trading volume: Identify potential trend reversals

- Key points for swing trading:

- Set strict stop-loss and take-profit levels

- Monitor market sentiment and regulatory news

USDC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of portfolio

- Moderate investors: 10-20% of portfolio

- Aggressive investors: 20-30% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple stablecoins

- Use of decentralized finance (DeFi) protocols for yield generation

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Multi-signature wallet solution: Implement for institutional-grade security

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for USDC

USDC Market Risks

- Depegging risk: Potential loss of 1:1 parity with USD

- Liquidity risk: Possibility of large-scale redemptions

- Competition risk: Emergence of new stablecoins or CBDCs

USDC Regulatory Risks

- Increased scrutiny: Potential for stricter regulations on stablecoins

- Legal uncertainty: Evolving regulatory landscape in different jurisdictions

- Compliance costs: Increasing expenses to meet regulatory requirements

USDC Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Centralization risks: Dependence on Circle's infrastructure

- Blockchain congestion: Transaction delays during high network activity

VI. Conclusion and Actionable Recommendations

USDC Investment Value Assessment

USDC offers stability in the volatile crypto market but faces regulatory and market risks. It provides a reliable store of value and potential for yield generation in DeFi ecosystems.

USDC Investment Recommendations

✅ Beginners: Consider USDC as a low-risk entry point into crypto ✅ Experienced investors: Use USDC for portfolio rebalancing and as a trading pair ✅ Institutional investors: Implement USDC for treasury management and cross-border transactions

USDC Participation Methods

- Direct purchase: Buy USDC on Gate.com

- Yield farming: Participate in DeFi protocols offering USDC liquidity pools

- Payment solution: Use USDC for international remittances and e-commerce transactions

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is USDC expected to rise?

USDC is expected to maintain its $1 peg, with minimal price fluctuations. As a stablecoin, significant rises are unlikely.

Is USDC a good investment?

USDC is a reliable investment, offering stability and widespread adoption in the crypto market. Its strong peg to the US dollar makes it a safe haven for investors seeking to preserve value.

Will USDC always be $1?

USDC aims to maintain a $1 value through 1:1 dollar backing, but minor fluctuations may occur due to market dynamics.

How much will $1 Bitcoin be worth in 2025?

Based on expert predictions, $1 Bitcoin could be worth around $100,000 to $150,000 by 2025, reflecting significant growth in the cryptocurrency market.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

2025 LUMINT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 ARRR Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

How to Transfer Assets to the Optimism Network: Step-by-Step Guide

Decoding Nostr: Exploring the Role of Decentralized Protocols in Web3

Detailed Trump Coin $TRUMP Unlocking Timeline Revealed