Velódromo explicado: Predicción de precios y tendencias del mercado de Cripto

Antecedentes del equipo Velodrome

Velodrome Finance es un intercambio descentralizado nativo construido en la solución de escalado de la capa 2 de Ethereum, Optimism. Se lanzó oficialmente el 1 de junio de 2022. La plataforma tiene como objetivo promover el desarrollo del ecosistema de Optimism proporcionando un entorno comercial con una liquidez profunda, bajos costos de negociación y baja deslizamiento. La plataforma se inspira en el modelo ve(3,3) de Solidly y lo mejora, y adopta un sistema de doble token para gestionar su funcionalidad.

Velodrome se compromete a incentivar a los proveedores de liquidez y participantes en la gobernanza, consolidando así su posición central en el ecosistema de Optimism. Con su innovador modelo de creador de mercado automatizado (AMM), Velodrome integra de manera efectiva la gobernanza descentralizada, mecanismos de captura de rendimiento y liquidez eficiente. Esto no solo mejora la escalabilidad y sostenibilidad del protocolo, sino que también crea oportunidades de participación y rendimiento más estables y a largo plazo para los usuarios de DeFi.

Logotipo del Proyecto Velodrome (Fuente de la imagen:https://github.com/velodrome-finance)

Enlaces del Proyecto:

Sitio web oficial:https://www.velodrome.finance/

X (Twitter):https://www.velodrome.finance/

Discord:http://discord.gg/velodrome

Medio:https://medium.com/VelodromeFi

Etherscan:https://optimistic.etherscan.io/token/0x9560e827aF36c94D2Ac33a39bCE1Fe78631088Db

Entrada de Trading:https://www.gate.io/zh/trade/VELODROME_USDT

Antecedentes del equipo Velodrome

El fundador de Velodrome Finance es el ingeniero y empresario alemán Lasse Clausen, quien tiene una experiencia a largo plazo y una profunda participación en la infraestructura blockchain y las finanzas descentralizadas. Además, el equipo de desarrollo y operaciones de Velodrome está compuesto por miembros de empresas de tecnología blockchain conocidas como Optimism y ConsenSys, con experiencia práctica en arquitectura L2 y protocolos DeFi.

Antes de lanzar Velodrome, el equipo lideró el proyecto veDAO, con el objetivo de comprometerse profundamente con el ecosistema Solidly y explorar la implementación del modelo ve(3,3) en el mundo real. El equipo tiene un entendimiento sistemático del protocolo Solidly, la arquitectura veNFT y el mecanismo de gobernanza ve(3,3), y ha realizado optimizaciones basadas en esta base, convirtiendo a Velodrome en una de las implementaciones más representativas en este campo.

Fundador de Velodrome Finance Lasse Clausen (Fuente de la imagen:https://1kx.network/team/lasse-clausen)

Información del token $VELODROME

Nombre del token: Velodrome (VELODROME)

Suministro total: 204,700,000,000 tokens

Tipo de token: ERC-20

Dirección del Contrato: 0x9560e827aF36c94D2Ac33a39bCE1Fe78631088Db

$VELODROME Datos en cadena (Fuente de la imagen:https://optimistic.etherscan.io/token/0x9560e827aF36c94D2Ac33a3)

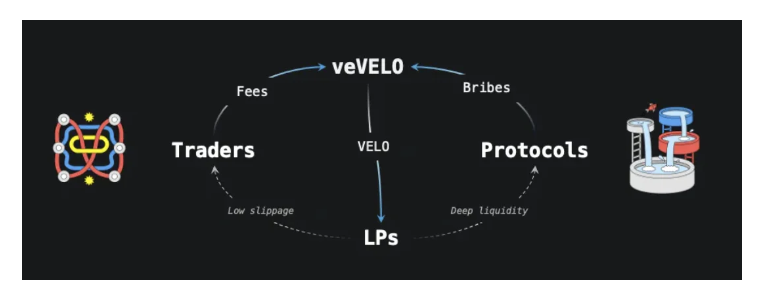

Desde la perspectiva de la tokenomía, el token nativo VELO de Velodrome se utiliza para incentivar a los proveedores de liquidez, mientras que el token de gobernanza veVELO otorga derechos de gobernanza a los titulares. El primero se distribuye como recompensas por proporcionar liquidez, y los titulares pueden optar por bloquear VELO a cambio de veVELO y participar en la gobernanza del protocolo, incluyendo, entre otras cosas, decidir qué pares de tokens pueden recibir recompensas VELO.

Modelo económico de doble token de VELODROME (Fuente de la imagen:https://github.com/velodrome-finance)

Desempeño del mercado $VELODROME

En el último mes, $VELODROME experimentó un mercado volátil con rebotes y retrocesos alternos. Específicamente, el precio de $VELODROME cayó a un punto bajo a principios de marzo (alrededor de $0.045), luego se recuperó y aumentó gradualmente a finales de marzo, alcanzando cerca de $0.060, pero no logró romper el máximo anterior, formando un pico a corto plazo. En abril, el precio volvió a caer a alrededor de $0.0463, cerca del mínimo del mes pasado.

A partir del 6 de abril, cuando se escribió este artículo, el último precio de $VELODROME es de $0.04675, cerca de una zona de soporte clave. Si $0.045 no logra sostenerse de manera efectiva, podría abrirse un mayor descenso. Por otro lado, si se forma un patrón de doble fondo aquí con un volumen aumentado, una tendencia al alza podría reanudarse. En ausencia de nuevos desarrollos positivos o actualizaciones de protocolo, el mercado tiende a permanecer cauteloso, con un sentimiento inclinado hacia una actitud de esperar y ver.

Tendencia de precios de $PEPU del 02/27 al 03/27 (Fuente de la imagen:https://dexscreener.com/ethereum/0x3ebec0a1b4055c8)

Predicción de precio de $VELODROME

Desde el máximo de principios de año, el precio de $VELODROME ha formado una clara estructura superior y ha roto por debajo de la zona de soporte anterior entre 0,07 y 0,08 dólares. Se espera que después de abril, el precio continúe su ligera tendencia bajista, mostrando un patrón "en zigzag" de caídas volátiles. No hay señales significativas de un repunte en los próximos meses, y la falta de impulso ecológico puede dificultar el apoyo a una nueva ronda de movimiento alcista.

La tendencia bajista actual aún no ha terminado y el precio puede seguir cayendo. A corto plazo, puede buscar soporte entre $0.03 y $0.05. Si el precio vuelve al nivel clave de soporte a largo plazo (alrededor de $0.03) y va acompañado de una recuperación en el entorno del mercado macro, puede proporcionar un punto de entrada relativamente atractivo para inversores a medio y largo plazo. Se recomienda que los inversores se mantengan al margen y esperen señales de fondo confirmadas o aspectos positivos fundamentales antes de ingresar.

Predicción de precios de $VELODROME (Fuente de la imagen:https://coincodex.com/cripto/pepe-unchained/price-prediction/)

Conclusión

En general, con sus innovaciones tecnológicas y su posición temprana, Velodrome ocupa un lugar importante en el ecosistema DeFi. Actualmente, el precio de $VELODROME está bajo presión, pero su rendimiento a medio y largo plazo todavía tiene potencial. Se recomienda a los inversores que monitoreen de cerca los cambios en el sentimiento del mercado y los desarrollos del protocolo, y esperen pacientemente las señales de entrada cerca de los niveles clave de soporte. Al juzgar razonablemente el momento de rebote y las zonas de riesgo, uno puede aprovechar la oportunidad antes de una futura recuperación del mercado DeFi.

Artículos relacionados

Valor de los Blox Fruits: Cómo evaluar y maximizar el valor comercial de los Blox Fruits

Valor de Cripto PI: Lanzamiento en Mainnet el 20 de febrero de 2025 & Predicciones de precios futuros

¿Es XRP una Buena Inversión? Una Guía Integral sobre su Potencial

Cómo vender Pi Coin: una guía para principiantes

¿Cómo rastrear la transacción USDT BEP20?