¿Qué es SwellChain?

SwellChain es un protocolo de staking no custodio que proporciona una experiencia de staking líquido y restaking en el mundo DeFi, haciendo que DeFi sea más accesible y garantizando el futuro de Ethereum y los servicios de restaking. Swell permite a los usuarios obtener ingresos pasivos al hacer staking o restaking de ETH para ganar recompensas tanto en blockchain como en AVS restaked, y a cambio, se les otorga un token líquido que genera rendimientos (LST o LRT) para almacenar o participar en el ecosistema DeFi más amplio y obtener más rendimientos.

¿Qué es SwellChain?

Swellchain es una red de Capa 2 (L2) basada en la pila OP. La red mejora la seguridad de Ethereum utilizando el mecanismo de restaking de EigenLayer y la infraestructura confiable de Optimism para un procesamiento rápido de transacciones y escalabilidad. Swellchain es una red de Capa 2 centrada en el restacking basada en la pila OP. La red tiene la intención de mejorar la seguridad de Ethereum con restaking de EigenLayer, aprovechando la arquitectura probada de la pila OP para el procesamiento de transacciones y la escalabilidad. Swell ofrece a los usuarios un método no custodial de staking líquido y restaking a través de un token ERC-20 transferible (swETH y rswETH). El protocolo tiene la intención de proporcionar mayores rendimientos a los consumidores. Swell permite a los clientes acceder a rendimientos de staking y oportunidades de DeFi a través de una sola interfaz. Los usuarios pueden apostar o retomar su Ethereum y ganar swETH o rswETH líquidos para utilizar en el ecosistema DeFi más amplio. El protocolo también ofrece a los usuarios tarifas más bajas. El APY promedio de staking de ETH es de alrededor del 4%, dejando poco margen para que los proveedores de staking cobren sus tarifas. Swell cobra una tarifa de staking del 10%, lo que lo convierte en una de las opciones de staking más asequibles del mercado.

Swellchain tiene como objetivo proporcionar un rollup escalable y descentralizado con una infraestructura salvaguardada a través del restakeo. Al aprovechar la seguridad y liquidación de Ethereum, Swellchain estará fuertemente vinculado con Ethereum y idealmente posicionado para abordar las dificultades fundamentales que enfrentan otros L2, como la liquidez escasa, la centralización y la falta de rendimiento nativo. Este objetivo se realizará a través de Proof of Restake, una técnica novedosa que utiliza los activos líquidos restakeados de Swell para proteger tanto a Eigenlayer AVS como a Symbiotic Networks, que proporcionan infraestructura crítica y servicios a la cadena de bloques, impulsando la creación de valor para los restakers a alturas sin precedentes. Swellchain es parte de Superchain, una red de blockchains impulsada por Optimism's OP Stack que colabora para escalar Ethereum. Además de Optimism, Swellchain se lanza con el respaldo de los participantes destacados en el ecosistema de restakeo: Etherfi, Renzo y Kelp, así como Ethena y las plataformas de restakeo EigenLayer y Symbiotic, todas respaldadas por los feeds de precios de RedStone.

Fuente: Swellchain.io

Antecedentes de SwellChain

Swellchain, la cadena de restake basada en Proof of Restake, fue lanzada formalmente en diciembre de 2024. Daniel Dizon fundó Swell Network, la entidad detrás de Swellchain. Aunque los hechos del equipo fundador de Swellchain no están bien documentados, se sabe que los cofundadores David Singleton y Hugo forman parte del equipo central. Swellchain se lanzó después de una exitosa campaña de prelanzamiento. Recibió más de $1 mil millones en depósitos de prominentes protocolos de restake como Swell, Etherfi y Renzo. Este sólido apoyo estableció a Swellchain como un conocido centro de activos restakeados en el ecosistema de Ethereum. Hasta el 26 de marzo de 2025, el Total Value Locked (TVL) de Swellchain fue de aproximadamente $292 millones, con una base de usuarios de más de 37,700. SWELL, el token nativo de la red, es vital para su ecosistema, brindando incentivos para los primeros adoptantes y proveedores de liquidez. Las alianzas estratégicas con actores esenciales en las industrias de restake y blockchain han ayudado al crecimiento de Swellchain. Las colaboraciones con plataformas como Ethena, EtherFi, EigenLayer, Symbiotic, Renzo y Kelp han contribuido a impulsar su crecimiento y popularidad.

Arquitectura Técnica

Swellchain implementa tres Servicios de Validación Activa de AltLayer (AVS) integrados verticalmente que colaboran para ofrecer seguridad y rendimiento. MACH AVS ofrece una finalización más rápida y compatibilidad con cross-rollup, con confirmación de transacciones en menos de 10 segundos en comparación con los ~13 minutos de finalización de Ethereum. Esto permite operaciones de puente más eficientes y mitigación de MEV. VITAL AVS realiza la verificación de estado a través de fraudes o pruebas ZK, mientras que los nodos de verificación sin permisos proporcionan garantías de seguridad a nivel de L1. El servicio ofrece alta disponibilidad al tiempo que permite la participación de la comunidad a través del staking. SQUAD AVS descentraliza la capa de secuenciación distribuyendo el orden de las transacciones entre varios nodos. Esto evita puntos únicos de fallo y permite la participación de la comunidad a través del staking de secuenciador, todo ello asegurando la resistencia a la censura. Estos servicios utilizan el método de restaking de EigenLayer para proporcionar seguridad compartida en toda la red al tiempo que preservan la descentralización y el rendimiento.

MACH

Para resolver la lentitud de la finalidad de los rollups, proporcionamos MACH, una capa de finalidad rápida para rollups de Ethereum, con los siguientes requisitos clave:

- Confirmación rápida para transacciones de rollup.

- La seguridad criptoeconómica se utiliza para abordar a cualquier miembro malintencionado de la red.

- Admite tanto ZK como rollups esperanzadores.

- Lo suficientemente genérico para alojar varios sistemas de prueba y tiempos de ejecución.

Para garantizar la finalidad, MACH, como red, debe validar la validez de un estado de rollup para asegurar que los operadores de rollup ejecuten correctamente la función de transición de estado. Con este objetivo, MACH proporciona tres modos de validez de estado.

Modo pesimista

En el modo pesimista, cada transacción se considera automáticamente inválida y debe repetirse. Como resultado, el operador de rollup envía los datos de la transacción directamente a la red MACH, la cual vuelve a ejecutar la transacción y acuerda sobre la validez del estado sugerido por el operador de rollup.

Si bien este modo de operación es el más simple, una de sus principales desventajas es su ineficiencia. MACH funciona efectivamente como una red de nodos completos durante el rollup. Esto conlleva a altos requisitos de nodos. Este modo se centrará en desarrollar clientes sin estado que requieran una huella de estado más pequeña para operar un nodo de rollup.

Modo optimista

En este modo, el operador de rollup realiza un reclamo de estado en MACH, afirmando ejecutar un bloque dado de transacciones, lo que resulta en un compromiso de estado especificado. Cualquier nodo en la red de MACH puede desafiar el reclamo y demostrar que el nuevo estado es inválido interactuando con el operador de rollup mediante un protocolo de bisección. Este es el modo optimista clásico, como se muestra en el diagrama a continuación.

Cabe destacar que el proceso de bisección solo se utiliza cuando un retador considera que el compromiso estatal no es válido. Alternativamente, el proceso de bisección podría ser reemplazado por pruebas ZK a pedido, en las que la prueba ZK se genera solo cuando hay un desafío. Esto se ve en el diagrama a continuación.

Esta configuración presupone la presencia de al menos un nodo honesto en la red MACH, con nodos de red principalmente en modo de observación.

Modo de Prueba de Validez

La red MACH es una red verificadora descentralizada para pruebas válidas en este modo. El operador de rollup, como un secuenciador, se comprometerá con un nuevo conjunto de transacciones, el estado resultante y la prueba de validación en MACH. La red MACH verificará y acordará la veracidad de la evidencia a continuación.

A pesar del uso explícito de pruebas de validez, este método también es efectivo con rollups optimistas. Con rollups optimistas, cualquier probador designado con la motivación correcta (fuera de MACH) puede construir una prueba de validez y enviarla a la red de MACH, que luego verifica y acepta la validez de la evidencia. Tenga en cuenta que para los rollups de ZK, el probador puede generar y enviar pruebas más a menudo en MACH que en Ethereum, lo cual es crucial para una finalidad más rápida. Además, esto no tiene por qué ser a expensas de un trabajo adicional de prueba: en lugar de esperar una sola prueba por lotes, el probador puede generar pruebas en tiempo real, enviarlas a MACH y luego utilizar la recursión para agregarlas en una prueba por lotes que se puede enviar a Ethereum. Las transacciones se finalizarán rápidamente si se proporcionan pruebas incrementales de inmediato a MACH.

VITAL

VITAL sirve como una capa de verificación establecida para rollups. Consta de una red de operadores registrados en AVS que verifican todos los nuevos estados presentados por los operadores de SQUAD. Los operadores de Vital identifican raíces de estado inválidas y pueden desafiar a los operadores de SQUAD en un proceso de bisección.

VITAL también puede utilizar pruebas ZK optimistas. Los operadores vitales requieren que los operadores de SQUAD generen una prueba ZK para una raíz de estado impugnada en lugar de participar en una técnica de bisección. Otro modo de operación es verificar pruebas intermedias que no requieren un L1. Vital es esencial porque el Mach AVS lo utiliza para ofrecer una capa de finalidad rápida.

VITAL es una red de operadores que verifican un nuevo estado. A diferencia de los secuenciadores rollup, el VITAL proporciona una confirmación mucho mayor debido al soporte económico subyacente. Esto permite que los activos se retiren al instante.

Finalidad de Nivel 1

Estas redes utilizan un secuenciador centralizado, que acepta la transacción de un usuario, la procesa y genera un recibo de transacción como prueba de la finalidad suave. Cabe señalar que esta transacción podría llegar directamente al secuenciador o desde la L1 (donde hay una solicitud de retiro de la Capa 2 a la Capa 1). Por otro lado, debido a que los rollups de AltLayer utilizan secuenciadores descentralizados a través de SQUAD y potencialmente pueden ejecutar un protocolo de consenso entre ellos, la garantía de finalidad suave aquí es un poco más "difícil" que la garantía correspondiente al mismo nivel de los rollups con secuenciadores centralizados.

Finalidad de Nivel 2

En la mayoría de los rollups, después de 1-3 minutos, el secuenciador agrupa las transacciones realizadas hasta ahora. Las empuja a la Capa 1 subyacente utilizando calldata, que básicamente permanece en el almacenamiento en cadena pero no forma parte del estado de cuenta global de la Capa 1 y no puede ser recuperado por otros contratos. La transacción de la Capa 2 ahora tiene la misma finalidad que el bloque de la Capa 1 que la contenía en un lote, lo que se conoce como 'finalidad definitiva'.

Además de los datos de transacción, el secuenciador envía raíces de estado antiguas (estado antes de las transacciones en lotes) y nuevas (estado después de que se ejecuten las operaciones en lotes) para demostrar la corrección de los cambios de estado. Cuando el secuenciador envía el lote, el contrato confirma que la raíz del estado previo coincide con la raíz del estado actual. Si coinciden, el contrato descarta la raíz del estado anterior y conserva la nueva raíz del estado ofrecida por el secuenciador.

Finalidad de Nivel 3

En este punto, los datos de la transacción y el nuevo estado se confirman en la Capa 1. El sistema de rollup está atravesando ahora un período desafiante. Si un compromiso de estado propuesto permanece sin impugnar durante el período de desafío, se considera definitivo, y los contratos inteligentes en la Capa 1 pueden aceptar de forma segura pruebas de retiro del estado del rollup basadas en ese compromiso. Si un compromiso de estado es impugnado con éxito, el lote inválido y los lotes posteriores se revertirán, devolviendo el rollup a su raíz de estado anterior. El protocolo de rollup debe entonces volver a ejecutar las transacciones y actualizar adecuadamente el estado del rollup.

SQUAD para Secuenciación Descentralizada

El secuenciador es un componente clave de cualquier rollup. Los secuenciadores son nodos en la red rollup que realizan las siguientes operaciones de rollup:

- Transacciones de AggreGate.io: Acepte transacciones de usuarios finales utilizando un mempool.

- Transacciones de pedidos: Elija transacciones de la mempool y ordénelas según algunas reglas.

- Ejecutar transacciones: En la mayoría de los rollups, el secuenciador también es responsable de ejecutar transacciones mediante la Máquina Virtual subyacente.

- Preconfirmación: Debido a que la finalidad de una transacción de rollup eventualmente proviene de la capa subyacente 1, los secuenciadores generan con frecuencia una preconfirmación para una transacción de usuario, lo que permite a los clientes y aplicaciones continuar mientras esperan la finalidad de la Capa 1.

- Enviar los datos de transacción ordenados a la capa DA: En la fase final, el secuenciador compromete los datos de transacción ordenados a una capa DA, como la Capa 1 subyacente. Una vez cargados en la Capa 1, las transacciones tienen una finalidad en la Capa 1.

Los secuenciadores sirven como el corazón de un rollup. Cuando un secuenciador falla, la red sigue operativa porque los usuarios pueden enviar sus transacciones de Capa 2 directamente a la Capa 1. Sin embargo, estas transacciones pueden tardar hasta 24 horas en considerarse finales. Incurrirán en las mismas tarifas que la Capa 1 subyacente, lo que resulta en una mala experiencia para el usuario. Además, un retraso de 24 horas puede no ser óptimo para actividades sensibles al tiempo como la liquidación de deudas.

¿Qué es SWELL Token?

El token SWELL es el token nativo de gobernanza para Swell Network, un protocolo descentralizado de staking líquido basado en Ethereum. SWELL permite a los titulares influir en las decisiones de gobernanza de Swell DAO, como el desarrollo del protocolo, los incentivos del ecosistema y la selección del operador de nodo.

Gobernanza

Los titulares de tokens SWELL son la base de la estructura de gobernanza descentralizada de Swell. Como parte de un protocolo impulsado por la comunidad, los titulares de SWELL pueden influir en decisiones cruciales, asegurando que el ecosistema de Swell evolucione según la visión compartida de sus usuarios. Esta arquitectura de gobernanza descentralizada otorga poder a la comunidad al mismo tiempo que garantiza que el protocolo de Swell se ajuste constantemente para el desarrollo y la seguridad. La votación sobre propuestas de gobernanza se realiza en la plataforma Snapshot fuera de la cadena, brindando un procedimiento de votación transparente y rápido. Cuantos más tokens SWELL posea un usuario, más votos tendrá. Sin embargo, Swell tiene la intención de fomentar una participación generalizada y conectarse con los objetivos de la comunidad. Más allá de la gobernanza, SWELL es fundamental para salvaguardar el protocolo de Swell al servir como token de gobernanza para protocolos como EigenLayer. En particular, SWELL se puede volver a apostar junto con otros activos como rswETH y swBTC para mejorar la seguridad criptoeconómica de los servicios de infraestructura de Capa 2 de SWELL (AVSs).

Tokenómica

El suministro circulante inicial será de hasta el 13% (1,300,000,000), redondeado al porcentaje entero más cercano, incluyendo el airdrop de Voyage (8.5%) y los creadores de mercado, el marketing de intercambio y la liquidez temprana de DEX. El suministro total máximo de SWELL es de 10,000,000,000. El suministro de SWELL se distribuye de la siguiente manera:

- Comunidad: (35%, 3,500,000,000 $SWELL)

- Equipo: (25%, 2,500,000,000 $SWELL)

- Recaudación de fondos: 25% (2,500,000,000 $SWELL)

- Fundación: 15% (1,500,000,000 $SWELL)

Otros tokens de SwellChain y participación

Token SwETH

SwETH es un token ERC-20 que refleja el ETH apostado de un usuario en la cadena de bloques de Ethereum, incluidas las recompensas y penalizaciones acumuladas de la capa de consenso y MEV y 'propinas' de la capa de ejecución. La cantidad de swETH mantenida permanecerá constante con el tiempo. Sin embargo, el valor subyacente del token aumentará a medida que se acumulen recompensas en la cadena. Los beneficios solo se realizarán cuando el token se intercambie en el mercado secundario (es decir, en un intercambio descentralizado) o se permitan retiros en el mercado primario tras la actualización de Ethereum Shanghai. Esto generalmente se conoce como un token que genera recompensas, y su valor subyacente se registra utilizando una tasa de cambio.

Cuando un usuario apuesta su ETH en el contrato Swell swETH, se emite el equivalente en ETH en el token de participación líquida de Swell, swETH, al usuario. El ETH del contrato swETH se transmite al contrato de gestión de depósitos y se agrupa hasta que haya suficiente para al menos un depósito de 32 ETH. El round robin determina el/los siguiente(s) validador(es) en el contrato de registro, y se realiza un depósito en el contrato de depósito de Ethereum utilizando la(s) clave(s) del validador. Luego, el validador se pone en cola para ser activado en la capa de consenso, lo que permite al operador del nodo comenzar a atestar transacciones y proponer bloques.

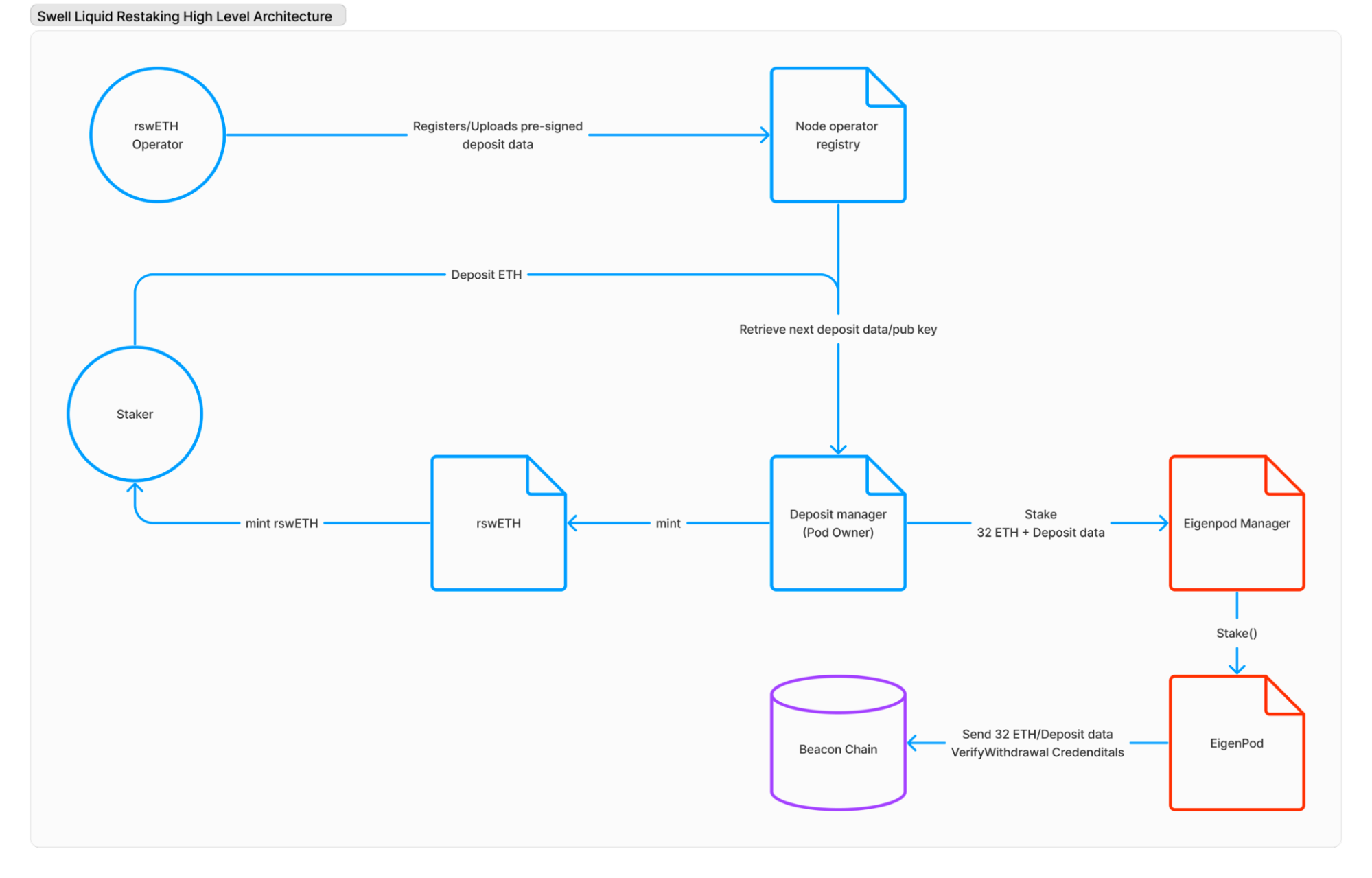

Token rswETH

rswETH es un Token de Restaking Líquido ERC-20 que proporciona liquidez a los usuarios que desean "restakear" su ETH en protocolos de restaking como EigenLayer sin bloquear su ETH restakeado. Es un token de repricing que refleja el ETH de rendimiento del usuario, y los validadores lo utilizan para verificar transacciones en la red de Ethereum. La primera versión de rswETH sigue la implementación existente del protocolo de restaking EigenLayer y es principalmente un fork directo de la colección de contratos inteligentes swETH. Esta implementación de la mainnet de EigenLayer solo permite depósitos y retiros; sin embargo, también recompensa a los 'restakers' con puntos off-chain de EigenLayer.

El gerente de depósitos restante actúa como propietario de EigenPod y se comunica con el gerente de EigenPod para:

- Crear el EigenPod y verificar las credenciales de retiro.

- Apueste 32 ETH con datos de depósito en la Beacon Chain.

- Devuelve premios desde el EigenPod al grupo de restaking.

Token swBTC

SwBTC es un token de reposición líquida ERC-20 que genera rendimientos y proporciona liquidez a los clientes que desean apostar su WBTC en protocolos como Symbiotic, EigenLayer o Karak sin bloquear su WBTC. SwBTC permite a los titulares recibir rendimientos nativos de plataformas de reposición mientras utilizan swBTC en todo el ecosistema DeFi. Puede utilizarse como garantía en protocolos de préstamos y préstamos, intercambios descentralizados, plataformas de opciones y otras aplicaciones. El rendimiento se obtiene utilizando el activo de garantía (WBTC) como seguridad económica para las redes que utilizan protocolos de reposición como Symbiotic, Karak y EigenLayer. Estas redes compensan la seguridad económica, lo que resulta en un rendimiento para los titulares de SWBTC.

Token rSWELL

rSWELL es un token ERC-20 con rendimiento que proporciona liquidez para los titulares de tokens SWELL que desean obtener rendimiento de restaking utilizando protocolos de restaking como Symbiotic y EigenLayer, al tiempo que conservan sus derechos de voto de gobernanza. Los titulares de RSWELL también pueden ganar Puntos del Ecosistema depositando sus tokens en el predepósito de Swell L2. La bóveda de rSWELL está construida en Yearn v3, que ha sido ampliamente probada en batalla desde su lanzamiento en 2022. Nethermind y ChainSecurity llevaron a cabo una auditoría de los cambios de la bóveda de Swell.

Conclusión

Swellchain, una cadena de bloques de Capa 2 basada en la pila Optimism (OP), fue lanzada en diciembre de 2024. Utiliza un novedoso mecanismo de prueba de reposición para mejorar la escalabilidad y seguridad de Ethereum. La red utiliza activos repuestos para proporcionar una alternativa descentralizada para la escalabilidad de Ethereum, abordando problemas como la escasez de liquidez y la centralización en los sistemas típicos de Capa 2. Swellchain ofrece soluciones escalables y descentralizadas de Ethereum, estableciéndose como un actor clave en el emergente ecosistema de reposición.

Artículos relacionados

¿Qué son las narrativas cripto? Principales narrativas para 2025 (ACTUALIZADO)

Solana Staking simplificado: una guía completa para el staking de SOL

Top 10 Token ETH LST

Comparación entre Staking de Cripto y Minería

Fragmetric: Pionero en Restaking Liquido en Solana