Riset Gate: Dompet Gate Sekarang Mendukung Berachain; Nilai Pasar Tokenisasi Pasar U.S. Treasury Melebihi $5 Miliar

Abstrak

- Bitcoin naik 0,71% menjadi $87.393, sementara Ethereum turun 0,06% menjadi $2.055.

- Market cap obligasi Treasury AS yang ter-tokenisasi melampaui $5 miliar untuk pertama kalinya.

- Volume perdagangan harian PumpSwap melebihi $580 juta.

- Market cap USDC mencapai rekor tertinggi, melampaui $60 miliar.

- Dompet Gate telah menambahkan dukungan untuk Berachain.

- BlackRock meluncurkan iShares Bitcoin ETP di Eropa.

- Asia Web3 Alliance Jepang telah mengusulkan kemitraan AS-Jepang untuk memajukan ekonomi ter-tokenisasi dan mendorong inovasi di Web3.

Analisis Pasar

- BTCSelama 24 jam terakhir, Bitcoin telah naik 0,71%, mencapai $87.393 pada pukul 12:00 siang (UTC+8) pada 26 Maret. Harganya saat ini mengalami tren naik, menghadapi resistensi di sekitar level $88.600. Rata-rata pergerakan terkumpul rapat, dan volume perdagangan menunjukkan sedikit perubahan, menandakan tidak ada arah yang jelas saat ini.

- ETH— Ethereum turun 0,06% dalam 24 jam terakhir, saat ini diperdagangkan di $2.055. ETH tetap dalam lintasan naik yang bergejolak, dengan garis tren menunjukkan pola bullish yang lebih luas. Namun, mengalami resistensi di dekat $2.100. Data volume menunjukkan sentimen hati-hati di kalangan peserta pasar, tanpa tanda-tanda pergerakan yang kuat ke satu arah. Indikator MACD sedikit cenderung bearish, mengisyaratkan tekanan koreksi jangka pendek yang mungkin. [2]

- ETFMenurut SoSoValue, ETF Bitcoin spot AS mengalami aliran masuk bersih sebesar $26,83 juta pada 25 Maret, sementara ETF Ethereum spot AS mengalami aliran keluar bersih sebesar $3,21 juta. Data tersebut pada pukul 11:00 AM (UTC+8) pada 26 Maret.

- AltcoinSektor Zero Knowledge (ZK), Modular Blockchain, dan yang terinspirasi oleh Elon Musk mencatat keuntungan masing-masing +9,1%, +6,4%, dan +6,0%.[5]

- Pasar Saham ASPada 25 Maret, S&P 500 naik 0,16%, Dow Jones naik 0,01%, dan Nasdaq mengalami kenaikan 0,46%.[6]

- Emas Spot— Emas spot dihargai sebesar $3,019.76 per ons, naik 0.01% pada hari itu. Data pada pukul 11:00 AM (UTC+8) pada tanggal 26 Maret.[7]

- Indeks Ketakutan & KeserakahanIndeks berada di angka 47, menunjukkan sentimen pasar netral.[8]

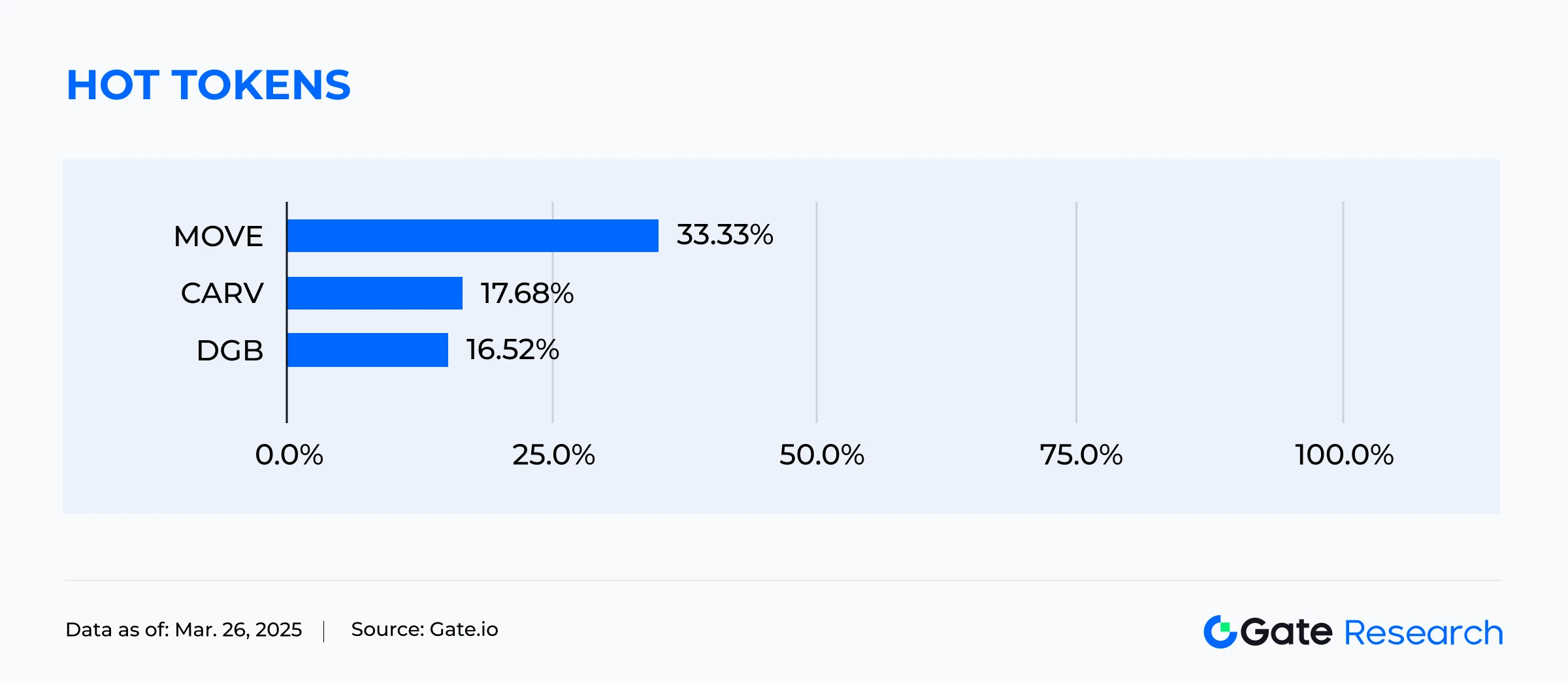

Pendatang Teratas

Menurut data pasar Gate.io[9], berdasarkan volume perdagangan dan kinerja harga selama 24 jam terakhir, altcoin dengan kinerja terbaik adalah sebagai berikut:

MOVE (Movement Network) - Peningkatan Harian Kira-kira 33.33%, Kapitalisasi Pasar yang Beredar sebesar $1.4 Miliar

Movement Network adalah blockchain Layer 2 pertama yang dibangun di Ethereum menggunakan bahasa pemrograman Move. Tujuannya adalah memberikan throughput tinggi (TPS), keamanan yang ditingkatkan, dan finalitas yang hampir instan. Dengan mengintegrasikan Move dengan Mesin Virtual Ethereum (EVM), Movement Network membawa fitur keamanan superior dan beragam kemungkinan aplikasi ke platform kontrak pintar terkemuka, meningkatkan ekosistem Ethereum.

Lonjakan tajam baru-baru ini dalam harga token MOVE secara utama dikaitkan dengan pengumuman pembelian kembali token senilai $38 juta oleh Yayasan Jaringan Gerakan pada 25 Maret 2025. Dana untuk pembelian kembali berasal dari keuntungan market maker yang tidak sesuai aturan yang asetnya dibekukan di Binance. Yayasan berencana menggunakan dana ini untuk secara bertahap membeli kembali token MOVE di Binance dan mendepositokannya ke dompet “Cadangan Strategis Gerakan”. Ini bertujuan untuk mengurangi pasokan beredar, meningkatkan stabilitas token, dan meningkatkan likuiditas ekosistem. Program pembelian kembali akan berlangsung selama tiga bulan dan resmi dimulai pada awal Maret 26. Meskipun ada kekhawatiran komunitas tentang sumber dana, sentimen pasar secara keseluruhan tetap optimis. MOVE melonjak lebih dari 30% dalam waktu 24 jam, mencerminkan reaksi pasar yang kuat dan kepercayaan investor.

DGB (DigiByte) - Kenaikan Harian Sekitar 16.52%, Kapitalisasi Pasar Beredar sebesar $187 Juta

DigiByte (DGB) adalah platform blockchain terdesentralisasi dan sangat aman. Token aslinya, DGB, dirancang untuk memberikan pembayaran digital yang cepat dan murah serta solusi keamanan data kepada pengguna di seluruh dunia. Sejak diluncurkan pada tahun 2014, DigiByte terus meningkatkan kinerja blockchain melalui inovasi teknologi. Dengan lima algoritma penambangan, arsitektur multi-layer, dan TPS (transaksi per detik) yang tinggi, DigiByte menawarkan infrastruktur yang stabil dan dapat diandalkan baik untuk individu maupun perusahaan. Model pengembangan yang didorong oleh komunitas telah memungkinkannya untuk menjaga ekosistem yang aktif dan berkembang, meskipun tanpa adanya ICO atau pre-mining. DGB banyak digunakan untuk keamanan jaringan, pemrosesan pembayaran, dan implementasi kontrak pintar di masa depan, menjadikannya utilitas inti dalam ekosistem.

Kenaikan harga DGB baru-baru ini sebagian besar didorong oleh persetujuan komunitas dan aktivasi upgrade Taproot yang akan datang, menyuntikkan vitalitas teknis baru ke dalam platform. Awalnya merupakan peningkatan protokol yang diperkenalkan oleh Bitcoin, Taproot telah diadopsi oleh DigiByte untuk mengurangi biaya transaksi, meningkatkan privasi, dan mendukung logika kontrak pintar yang lebih kompleks. Teknologi seperti MAST (Merkelized Alternative Script Trees) dan P2TR (Pay-to-Taproot) meningkatkan efisiensi transaksi jaringan dan skalabilitas. Dengan lebih dari 95% blok menunjukkan dukungan untuk upgrade tersebut, ada konsensus komunitas yang kuat, yang telah meningkatkan kepercayaan pasar terhadap potensi masa depan DGB. Kenaikan minat media sosial, volume perdagangan, dan diskusi seputar upgrade semuanya telah berkontribusi pada kenaikan DGB lebih dari 17% dalam waktu singkat.

CARV (Carv) – Kenaikan Harian Sekitar 17,68%, Kapitalisasi Pasar Beredar $89,27 Juta

CARV adalah proyek Web3 yang berfokus pada ekosistem gaming dan AI, dengan token aslinya CARV memainkan peran penting di platform tersebut. CARV bertujuan untuk membangun lapisan data yang didorong oleh pengguna yang memberdayakan konektivitas antara gamer dan aplikasi AI, memungkinkan pengguna untuk mendapatkan nilai nyata melalui pemberdayaan data dan partisipasi dalam tata kelola. Platform ini mencakup beberapa modul seperti identitas terdesentralisasi (DID), sistem reward, mekanisme tata kelola, dan integrasi data game, berusaha menciptakan ekonomi data yang transparan, efisien, dan berorientasi pada pengguna untuk pengembang, gamer, dan konsumen data. Sebagai token utilitas inti, CARV digunakan untuk staking, voting, partisipasi dalam tata kelola, mendapatkan reward, membuka fitur, dan mendukung layanan platform di masa depan.

Lonjakan harga terbaru dari token CARV sebagian besar didorong oleh peluncuran program insentif “Infinite Play” pada 25 Maret 2025. Program ini mendistribusikan 300.000 token $CARV untuk mendorong keterlibatan pengguna dalam permainan, pemungutan suara tata kelola, dan pembangunan komunitas, secara signifikan meningkatkan aktivitas platform dan retensi pengguna. Sementara itu, antusiasme pasar yang tumbuh untuk proyek data dan kecerdasan buatan telah lebih lanjut memperkuat minat. CARV, dengan posisinya yang unik sebagai platform data yang mencakup lebih dari 900 permainan dan proyek kecerdasan buatan, telah menarik perhatian investor. CARV naik hampir 19% dalam 24 jam terakhir, dengan peningkatan yang signifikan dalam volume perdagangan, mencerminkan pengakuan pasar yang kuat dan kepercayaan pada potensi pertumbuhannya.[12]

Sorotan Data

Tokenisasi Cap Pasar Surat Utang AS Melampaui $5 Miliar untuk Pertama Kalinya

Pada 25 Maret 2025, kapitalisasi pasar Treasury AS tokenized melampaui $5 miliar untuk pertama kalinya, mencapai $5,02 miliar—menandai fase baru untuk sektor yang sedang berkembang ini. Pasar telah berkembang pesat dalam waktu singkat — naik dari $ 4,2 miliar pada 13 Maret menjadi $ 5,02 miliar dalam waktu kurang dari dua minggu, meningkat $ 820 juta. Tokenized Treasury AS mewakili inovasi keuangan di mana obligasi yang diterbitkan pemerintah AS diubah menjadi token digital dan diperdagangkan di blockchain. Dibandingkan dengan metode perdagangan obligasi tradisional, tokenisasi meningkatkan efisiensi transaksi, likuiditas, dan komposabilitas aset, mengumpulkan minat yang kuat dari lembaga keuangan tradisional dan investor crypto.

Ekspansi pasar ini yang cepat didorong secara besar-besaran oleh dana BUIDL BlackRock, yang memiliki kapitalisasi pasar sekitar $1.7 miliar dan menduduki posisi teratas di ruang tersebut, bertindak sebagai katalis utama untuk pertumbuhan terbaru. Selain itu, permintaan investor yang meningkat untuk aset yang aman, transparan, dan sangat likuid telah lebih mempercepat perkembangan pasar obligasi ter-tokenisasi.

Volume Perdagangan Harian PumpSwap Melampaui $580 Juta, Menangkap 19.2% Ekosistem Solana

PumpSwap, pertukaran terdesentralisasi (DEX) baru yang diluncurkan oleh Pump.fun, telah mengalami pertumbuhan yang sangat pesat sejak debutnya di Solana pada 19 Maret. Pada hari pertamanya, platform ini mencatat volume perdagangan sebesar $50 juta, yang kemudian naik dengan cepat, mencapai puncak $580 juta pada 25 Maret. Hingga saat ini, total volume perdagangan telah melebihi $1.5 miliar, dan pangsa pasar PumpSwap dalam ekosistem Solana telah meningkat menjadi 22,4%. Platform ini telah memproses lebih dari 11 juta transaksi dan menarik 388.000 pengguna aktif.

Dikembangkan oleh Pump.fun, PumpSwap dirancang untuk menjadi lingkungan perdagangan terdesentralisasi yang bebas gesekan yang difokuskan khusus pada perdagangan memecoin, mengoptimalkan likuiditas dan pengalaman pengguna untuk proyek-proyek tersebut. Kenaikan cepatnya sebagian besar disebabkan oleh kemampuannya untuk mengurangi gesekan dalam perdagangan memecoin. Sebelumnya, memecoin yang diterbitkan di Pump.fun harus bermigrasi ke Raydium untuk perdagangan—proses yang merepotkan yang menghambat perdagangan yang lancar. PumpSwap memecahkan hal ini dengan mekanisme migrasi instan dan gratis, sangat menyederhanakan proses perdagangan dan meningkatkan pengalaman pengguna.

Selain itu, aktivitas perdagangan tinggi telah menyebabkan pertumbuhan pendapatan yang signifikan bagi platform. PumpSwap telah menghasilkan lebih dari $2,1 juta dalam total biaya, dengan lebih dari $1,5 juta dialokasikan untuk protokol dan $540.000 dibayarkan kepada penyedia likuiditas, lebih meningkatkan daya tarik ekosistem platform.[14]

USDC Market Cap Melampaui $60 Miliar, Mencatat Rekor Tertinggi Baru

Pada 25 Maret 2025, kapitalisasi pasar USDC—stablecoin yang terikat dengan dolar AS yang diterbitkan oleh Circle—telah berhasil melampaui $60 miliar, mencapai $60,1 miliar, menetapkan rekor tertinggi baru. Tonggak sejarah ini lebih memperkuat posisi USDC sebagai salah satu stablecoin terkemuka di dunia. Kenaikan terus-menerus kapitalisasi pasar USDC mencerminkan pengakuan pasar yang semakin meningkat terhadap peran pentingnya dalam ekosistem aset digital.

Didorong oleh ekspansi berkelanjutan dari ekosistem DeFi, pembayaran lintas batas, dan perdagangan aset kripto, permintaan untuk USDC terus meningkat, mendorong nilai pasarnya ke level tertinggi baru. Circle telah secara konsisten memajukan pengembangan ekonomi digital dengan bermitra dengan berbagai platform kripto dan lembaga keuangan, memperluas kasus penggunaan USDC dan jangkauan pasar. Dalam konteks volatilitas tinggi di pasar kripto, stablecoin seperti USDC menawarkan kepada pengguna media harga yang stabil untuk transfer nilai. Peningkatan penggunaan dan penerimaan globalnya semakin berkontribusi pada pertumbuhan pasarnya. [15]

Analisis Sorotan

Dompet Gate Sekarang Mendukung Berachain, Meningkatkan Keamanan dan Likuiditas

Pada 25 Maret 2025, Gate Wallet sekarang mengumumkan dukungan untuk Berachain—blockchain Layer 1 yang dikenal dengan mekanisme konsensus Proof of Liquidity (PoL). Integrasi ini meningkatkan keamanan aset dan likuiditas transaksi bagi pengguna, menawarkan akses yang lebih luas ke ekosistem Berachain. Secara khusus, Gate Wallet sekarang memungkinkan pengguna untuk menyimpan, mengirim, dan menerima token asli Berachain, memanfaatkan teknologi penyimpanan dingin dan enkripsi Gate.io.

Dukungan terhadap Berachain memungkinkan Gate Wallet menawarkan berbagai aset blockchain yang lebih luas, menarik pengguna yang tertarik pada jaringan blockchain yang sedang berkembang. Langkah ini juga dapat menarik lebih banyak perhatian terhadap fitur unik Berachain, yang potensial meningkatkan volume perdagangan dan aktivitas pengguna. Dengan langkah-langkah keamanan yang kuat dari Gate.io, termasuk penyimpanan dingin dan teknologi multi-tanda tangan, pengguna Berachain dapat mendapatkan perlindungan aset yang lebih tinggi dan kepercayaan yang lebih besar dalam platform.

BlackRock Meluncurkan iShares Bitcoin ETP di Eropa

Pada 25 Maret 2025, BlackRock meluncurkan iShares Bitcoin ETP di Eropa, yang lebih memperluas jejaknya di ruang produk investasi Bitcoin. Sebelumnya, ETF spot Bitcoin BlackRock yang diluncurkan di Amerika Serikat menarik lebih dari $50 miliar aliran modal. Peluncuran ETP ini di Eropa bertujuan untuk memenuhi permintaan yang berkembang di kalangan investor Eropa terhadap paparan cryptocurrency.

iShares Bitcoin ETP adalah produk investasi Bitcoin yang didukung secara fisik, memungkinkan investor untuk melakukan perdagangan Bitcoin di bursa tradisional tanpa perlu langsung memegang aset kripto. Penyimpan untuk produk ini adalah Coinbase, dan pengecualian biaya sementara ditawarkan, mengurangi biaya pengelolaan menjadi 0.15% hingga akhir 2025.

Setelah peluncuran sukses ETF Bitcoin-nya di pasar AS, masuknya BlackRock ke pasar Eropa lebih memperkuat posisinya sebagai pemimpin dalam manajemen aset kripto global, sambil menarik lebih banyak modal institusi. Ekspansi terus-menerus BlackRock menunjukkan bahwa Bitcoin telah menjadi kelas aset kunci yang menarik minat di kalangan perusahaan manajemen aset global. Peningkatan penerimaan ETP Bitcoin di Eropa juga dapat mendorong lembaga keuangan tradisional untuk mempercepat peluncuran produk investasi cryptocurrency. Baru-baru ini, BlackRock juga mengumumkan dukungan untuk perdagangan BUIDL di blockchain Solana, memajukan lebih lanjut ekspansi ke teknologi blockchain dan aset kripto.

Asia Web3 Alliance Jepang Mengusulkan Kerjasama AS-Jepang untuk Mendorong Ekonomi yang Di-tokenisasi dan Inovasi Web3

Pada 25 Maret 2025, Asia Web3 Alliance Jepang mengajukan proposal kepada tim kripto Securities and Exchange Commission (SEC) AS, merekomendasikan pembentukan kerangka kerja kerja sama regulasi AS-Jepang untuk tokenisasi dan Web3. Tujuan utama dari proposal tersebut adalah untuk memfasilitasi upaya bersama oleh kedua negara dalam menciptakan kerangka klasifikasi token yang terpadu, dengan jelas mendefinisikan sekuritas ter-tokenisasi, token utilitas, dan aset digital non-sekuritas, sambil memajukan penerbitan token lintas batas yang patuh dan koordinasi regulasi. Proposal tersebut menyarankan upaya kolaboratif di antara SEC, Financial Services Agency (JFSA) Jepang, Kementerian Ekonomi, Perdagangan, dan Industri (METI), dan Bank of Japan (BOJ) untuk secara bersama-sama mempromosikan pengembangan ekosistem Web3. Ini juga menekankan desain mekanisme tempat aman untuk proyek token tahap awal dan pembentukan standar yang aman dan patuh untuk perdagangan dan penyimpanan token lintas batas.

Selain itu, proposal tersebut menyerukan pertemuan regulasi Web3 AS-Jepang secara berkala untuk mempromosikan kebijakan dan berbagi penelitian. Inisiatif ini memperkuat kerjasama AS-Jepang dalam regulasi Web3, membantu menyelaraskan standar regulasi token, mengurangi hambatan hukum dan kepatuhan untuk operasi lintas batas, dan mendorong perkembangan yang sehat dari industri kripto. Lingkungan uji coba pasir dan ketentuan perlindungan hukum dari proposal tersebut menawarkan kepada startup Web3 Jepang tempat uji coba yang lebih fleksibel dan jalur yang mematuhi peraturan, mengurangi biaya kepatuhan yang tinggi dan hambatan masuk pasar. Rencana kerjasama AS-Jepang juga bisa menjadi contoh untuk negara lain dalam regulasi Web3 dan kripto, mendorong globalisasi dan standarisasi ekonomi yang ter-tokenisasi serta meningkatkan stabilitas dan transparansi di pasar global.

Berita Pendanaan

Menurut RootData, dua proyek secara publik mengumumkan berhasil mengumpulkan dana dalam 24 jam terakhir, dengan total pendanaan melebihi $15 juta. Investasi tunggal terbesar mencapai $12 juta, melibatkan sektor-sektor seperti infrastruktur dan gaming. Rincian putaran pendanaan adalah sebagai berikut:[19]

Protokol KronisChronicle Protocol mengumpulkan $12 juta dalam putaran pendanaan awal, dengan partisipasi dari Strobe Ventures, 6th Man Ventures, dan yang lainnya. Chronicle adalah oracle pertama di Ethereum, didirikan oleh anggota tim asli MakerDAO. Fungsinya intinya adalah memungkinkan blockchain mengirim dan menerima data off-chain—mirip dengan bagaimana smartphone terhubung ke data eksternal—sehingga meningkatkan kemampuan aplikasi blockchain.

Chronicle juga berfungsi sebagai penyedia infrastruktur data untuk aset ter-tokenisasi, mencakup sektor DeFi dan Aset Dunia Nyata (RWA). Ini menawarkan sebuah oracle RWA yang dikenal sebagai "aset terverifikasi." Dana yang terkumpul akan digunakan untuk pengembangan produk dan penelitian.[20]

Immortal Rising 2— Immortal Rising 2 berhasil mengamankan pendanaan sebesar $3 juta, didukung oleh Spartan Group, Immutable, dan pihak lainnya. Immortal Rising 2 adalah game seluler berbasis blockchain yang inovatif yang sepenuhnya mengintegrasikan mekanisme Web3, memberikan pemain kepemilikan aset digital yang sebenarnya dan insentif dalam game. Tujuan utama dari putaran pendanaan ini adalah untuk lebih memperluas ekosistem game, meningkatkan mekanika gameplay, dan memperdalam keterlibatan komunitas.

Kesempatan Airdrop

InfiniFi

InfiniFi adalah sistem keuangan terdesentralisasi yang dirancang untuk mengatasi masalah ketidakcocokan kedewasaan yang ditemukan dalam sistem perbankan tradisional. Sistem ini mengadopsi model yang didorong oleh deposito, memungkinkan pengguna untuk mengendalikan alokasi aset berdasarkan preferensi likuiditas mereka sendiri. Melalui sistem cadangan fraksional on-chain-nya, InfiniFi menawarkan alternatif yang lebih aman dan terdesentralisasi dibandingkan dengan perbankan tradisional, yang mengklaim dapat memberikan stabilitas yang lebih besar dan tingkat pengembalian yang lebih tinggi.[22]

Saat ini, InfiniFi sedang menjalankan kampanye berbasis poin untuk mendorong partisipasi dan berbagi pengguna. Pengguna dapat mulai mendapatkan hadiah dengan mengklik tombol — semakin banyak yang mereka bagikan, semakin banyak hadiah yang mereka dapatkan.

Bagaimana Cara Berpartisipasi:

- Kunjungi situs web InfiniFi dan hubungkan dompet Anda.

- Klik tombol untuk memulai permainan dan mendapatkan hadiah.

- Undang teman-teman untuk bergabung dalam kampanye agar memiliki lebih banyak kesempatan untuk bermain.

Catatan:

Rencana airdrop dan metode partisipasi dapat diperbarui kapan saja. Pengguna disarankan untuk mengikuti saluran resmi InfiniFi untuk informasi terbaru. Pada saat yang sama, pengguna sebaiknya berpartisipasi dengan hati-hati, menyadari risiko potensial, dan melakukan penelitian menyeluruh sebelum terlibat. Gate.io tidak menjamin penerbitan hadiah airdrop di masa depan.

Referensi:

- Gate.io,https://www.gate.io/trade/BTC_USDT

- Gate.io,https://www.gate.io/trade/ETH_USDT

- Nilai SoSo,https://sosovalue.xyz/assets/etf/us-btc-spot

- SoSoValue,https://sosovalue.xyz/assets/etf/us-eth-spot

- CoinGecko,https://www.coingecko.com/id/categories

- Investasi,https://investing.com/indices/usa-indices

- Investasi,https://investing.com/currencies/xau-usd

- Gate.io,https://www.gate.io/bigdata

- Gate.io,https://www.gate.io/price

- X,https://x.com/Ashcryptoreal/status/1904576123515641919

- X,https://x.com/DigiByteCoin/status/1904240979068301343

- X,https://x.com/carv_official/status/1904418548048642231

- Rwa,https://app.rwa.xyz/treasuries

- Dune,https://dune.com/adam_tehc/pumpswap

- Coingrecko,https://www.coingecko.com/en/coins/usdc

- X,https://x.com/GateDompet/status/1904443183163170873

- Blackrock,https://www.blackrock.com/au/solutions/ishares

- SEC,https://www.sec.gov/about/crypto-task-force/written-submission/ctf-input-asia-web3-alliance-japan-3-25-25

- Rootdata,https://www.rootdata.com/PenggalanganDana

- Blockworks,https://blockworks.co/news/chronicle raises-12m

- Globenewswire,https://www.globenewswire.com/news-release/2025/03/26/3049295/0/id/Immortal-Rising-2-Memastikan-3-Juta-Dolar-Pendanaan-dan-Menyelesaikan-Penjualan-NFT-yang-Sukses-Menjelang-TGE.html

- Infinifi,https://infinifi.xyz/

Penelitian Gate

Penelitian Gate adalah platform penelitian blockchain dan kripto yang komprehensif yang menyediakan pembaca dengan konten yang mendalam, termasuk analisis teknis, wawasan terkini, ulasan pasar, penelitian industri, ramalan tren, dan analisis kebijakan makroekonomi.

Klik Tautanuntuk belajar lebih lanjut

Penafian

Investasi di pasar cryptocurrency melibatkan risiko tinggi, dan disarankan pengguna melakukan penelitian independen dan memahami sepenuhnya sifat aset dan produk yang mereka beli sebelum membuat keputusan investasi apa pun.Gate.iotidak bertanggung jawab atas kerugian atau kerusakan yang disebabkan oleh keputusan investasi tersebut.

Artikel Terkait

Bagaimana Melakukan Penelitian Anda Sendiri (DYOR)?

Bagaimana Mempertaruhkan ETH?

Analisis Teknis adalah apa?

Apa yang Dimaksud dengan Analisis Fundamental?

Top 10 Platform Perdagangan Koin Meme