ADA暗号資産価格の駆動要因は何ですか?

価格変動におけるADAトークノミクスの役割

トークノミクスは、ADAの価格動向において重要な役割を果たしています。その供給構造とステーキングメカニズムは、その市場行動に直接影響します。

固定供給と流通

総供給量: 45十億 ADA

流通供給量:約35十億ADA

デフレーションの側面:固定供給は、フィアット通貨や無制限供給の暗号資産とは異なり、インフレリスクを防ぎます。

ADA供給モデルは予測可能性を確保し、投資家や開発者がネットワークとの長期的な関与を計画するのに役立ちます。

戦略的なトークン割り当て

CardanoのADAの配布は生態系の成長を支援するために注意深く構築されました:

パブリックセールとプライベートセール:初期配布により、さまざまな参加者がADAを取得することができました。

Cardano Foundation: トークンの一部は、ブロックチェーンの採用と規制の遵守を促進するために予約されています。

IOHK&Emurgo:これらの組織は、開発、研究、商業化を支援するために資金が割り当てられました。

このバランスの取れた配分戦略は、主要なステークホルダーがADAの長期的な成功に投資し続ける一方、分散化を維持します。

ADA 暗号資産価格の市場ドライバー

ADAの価格は、さまざまな外部および内部市場の要因に影響を受けています。これには次のような要因が含まれます:

1. ネットワークのアップグレードと開発の進捗

Cardanoには、Byron、Shelley、Goguen、Basho、Voltaireなどのフェーズに従う構造化された開発ロードマップがあります。主要なアップグレードはしばしばADAの価格に影響を与えます。

アロンゾ・ハードフォーク(2021年):スマートコントラクト機能を導入し、ADAの価格を史上最高の約$3.10に押し上げました。

Vasil Upgrade (2022): トランザクション速度と効率が向上し、再び投資家の関心を集めています。

今後のガバナンスのアップグレード:分散型ガバナンスと相互運用性の将来の向上は、ADAの価値にさらなる影響を与える可能性があります。

2. 機関の採用とパートナーシップ

ADAに対する機関投資家の関心が高まっています:

Cardano上のDeFiやNFTの活性化が大手企業の注目を集めるかもしれません。

政府や企業とのパートナーシップ(例:カルダノとエチオピア教育省の協力)は実世界でのユースケースを追加します。

採用が拡大すれば、ADAの暗号資産価格は持続的な上昇勢力を見る可能性があります。

3. 市場センチメントと暗号資産トレンド

ほとんどの仮想通貨と同様に、ADAはBitcoinの価格動向、全体的な市場トレンド、投資家の感情に影響を受けています。

上昇サイクルでは、ADAはしばしばBTCの上昇トレンドに追随します。

ベアリッシュな状況は、需要の低下と売りオフの増加によって価格が下落する結果となります。

4. 規制の進展

暗号資産の規制はADA価格に影響を与える可能性があります。

SECや政府がステーキングやブロックチェーンのプロジェクトを明確にすれば、信頼感が高まる可能性があります。

より厳しい規制は、CardanoのDeFiエコシステムの成長を制限し、価格に否定的な影響を与える可能性があります。

他の暗号資産とADAトークン経済モデルの比較

ADAは、Solana(SOL)やBinance Coin(BNB)などの他のブロックチェーンプロジェクトと競合しています。ここでは、それらのトークン経済モデルの簡単な比較をご紹介します。

ADAのポジションに関する要点

SolanaとBNBよりも分散化されており、ガバナンス志向の投資家にとって魅力的です。

Solanaよりも取引速度が遅く、DeFiの拡張が遅れています。

固定供給はスカーシティを確保し、Solanaのインフレモデルとは異なります。

Cardanoが取引速度とDeFiの採用を向上させることができれば、ADA暗号資産価格は市場でさらに競争力を持つようになるかもしれません。

ADA暗号資産価格予測

現在の市場動向を考慮すると、ADAの価格は将来どのようになると予想されますか?

短期価格予測(6-12ヶ月)

期待されるレンジ:$0.40 - $1.00

ポテンシャルな触媒:市場の回復、今後のガバナンスのアップグレード、またはDeFiの採用の増加。

リスク:規制上の懸念、Solanaのようなより速いブロックチェーンからの競争。

中期(1-3年)

期待される範囲:$1.50 - $3.00

潜在的なカタリスト: 機関投資家の採用、Cardano上のNFTおよびDeFiの成長、およびエコシステムの拡大。

リスク:イーサリアムやソラナと比較して採用率が低い、ネットワークの混雑問題。

長期(3年以上)

予想範囲:$5.00以上(Cardanoが金融、ガバナンス、およびDeFiで主流採用を達成した場合)。

潜在的な触媒:政府がADAを実世界アプリケーションに使用し、Cardanoが主要なスマートコントラクトプラットフォームになること。

リスク:テクノロジー競合他社がCardanoを追い越す、規制変更がPoSブロックチェーンを制限する。

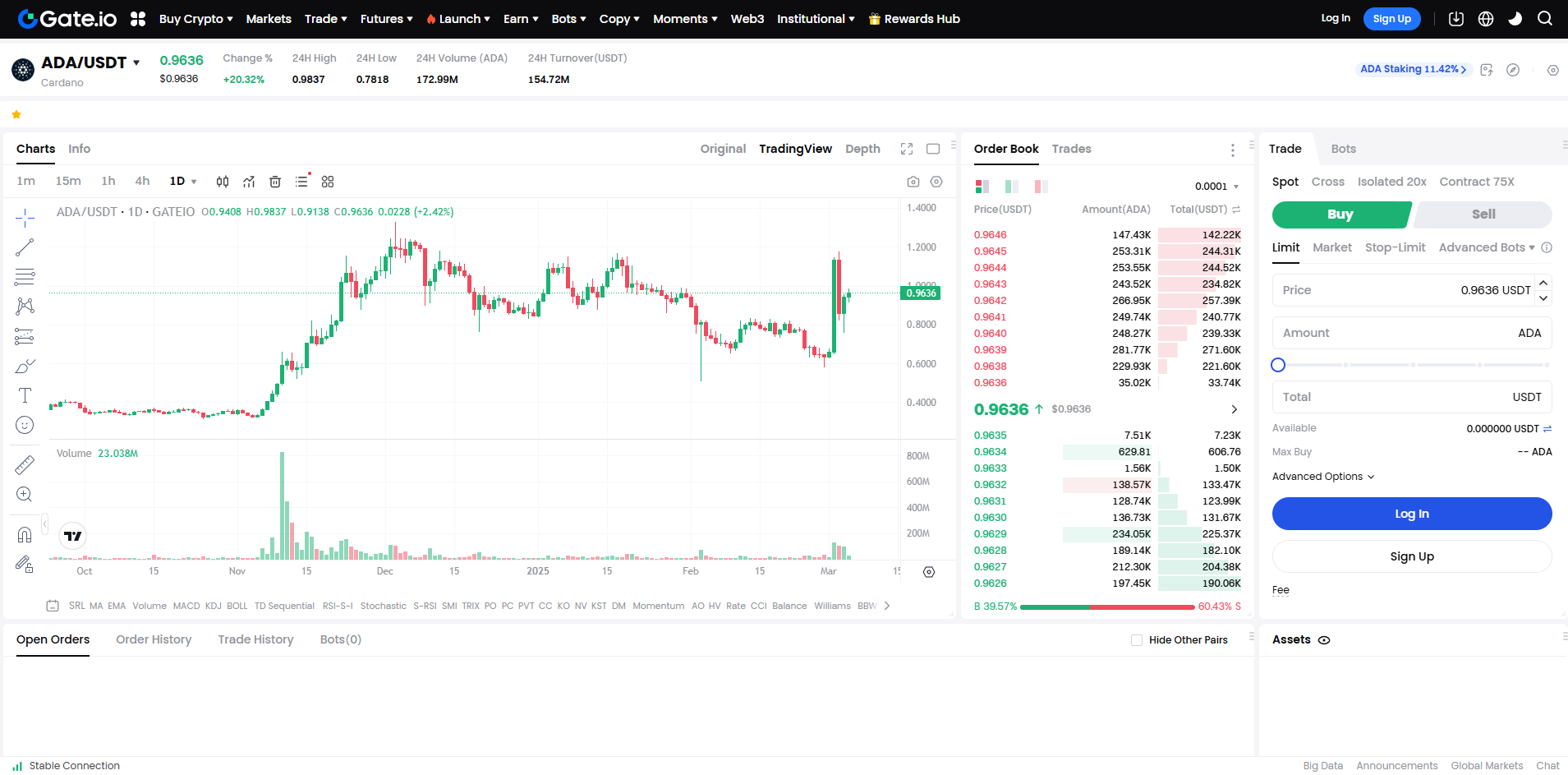

スクリーンショットの時間:2025年3月5日

免責事項:暗号資産取引には、資本の潜在的な損失、市場の変動、規制上の不確実性を含む重大なリスクが伴います。責任を持って取引し、投資する前に十分な調査を行ってください。

結論:ADA暗号資産価格に何を期待するか?

ADAの価格は、強力なトークンエコノミクス、ステーキングインセンティブ、および継続的なネットワークのアップグレードによって形作られています。

市場のボラティリティや採用のスピードなどの課題は残っていますが、カルダノのスケーラビリティ、分散化、セキュリティへの取り組みは、強力なブロックチェーンの競争相手として位置付けられています。

機関の採用が増加し、CardanoがDeFiおよびNFTエコシステムを拡大する場合、ADA暗号の価格は長期的に大幅に上昇する可能性があります。

ADAの価格トレンドを追跡したいですか、それともステーキングの機会についてもっと知りたいですか?お知らせください!🚀

暗号通貨取引には、資本の損失の可能性、市場のボラティリティ、規制の不確実性など、重大なリスクが伴いますが、責任を持って取引し、投資する前に徹底的な調査を行ってください。

関連記事

Piコインを売却する方法:初心者向けガイド

Forkast (CGX): ゲームやインターネット文化向けに構築された予測市場プラットフォーム

Radiant Multi-Signature Attackを使用したBybitハックの分析を例に

$MAD: MemesAfterDark – The Ultimate Degen Token

Piノード:誰もが参加できるブロックチェーンノード