# 現貨黃金再創新高

5.81萬

現貨黃金突破 10 月 20 日高點 4381.4 美元/盎司,再度刷新曆史新高。黃金走強是否意味着全球風險偏好下降?你認爲對 BTC 的影響是對衝還是壓製?

小财神Plutus

# 现货黄金再创新高

昨天刚分析完黄金与比特币的关联关系,今天黄金就又双叒叕冲上热搜了,现货黄金(伦敦金现)史上首次站上4500美元/盎司关口,今年累计涨逾70%,现货白银首次突破70美元/盎司,COMEX白银期货收涨4.44%,报71.61美元/盎司,创历史新高。而比特币却不涨反跌,资金的跷跷板效应再次显现。今天小财神带大家再来分析一下黄金上涨的因素和比特币能否复制这个逻辑

?回顾本次黄金的主升浪,突破并非偶然,而是多重因素交织共振的结果。从美联储政策转向到地缘政治风险升级,再到央行购金热潮,黄金市场正经历一场前所未有的结构性变革。

💰美联储政策转向:黄金的“催化剂”

美联储的货币政策始终是黄金价格的核心驱动因素。2025年,美联储已三次降息,累计降息75个基点,当前利率维持在3.50%-3.75%的区间。 12月,美联储宣布结束量化紧缩(QT),并启动400亿美元国债购买计划,标志着全球流动性环境发生重大转变。市场预期2026年美联储将继续降息,高盛预测中期可能再降100个基点。 低利率环境降低了持有黄金的机会成本,而美元走弱则直接提升了以美元计价的黄金吸引力。 美联储副主席沃勒近期发表的鸽派观点,进一步强化了市场对宽松货币政策的预期。

🔪地缘政治风险:避险需求的“放大器”

全球地缘政治紧张局势的升级,成为黄金价格上涨的直接推手。美国与委内瑞拉关系紧张、红海航运危机、俄

昨天刚分析完黄金与比特币的关联关系,今天黄金就又双叒叕冲上热搜了,现货黄金(伦敦金现)史上首次站上4500美元/盎司关口,今年累计涨逾70%,现货白银首次突破70美元/盎司,COMEX白银期货收涨4.44%,报71.61美元/盎司,创历史新高。而比特币却不涨反跌,资金的跷跷板效应再次显现。今天小财神带大家再来分析一下黄金上涨的因素和比特币能否复制这个逻辑

?回顾本次黄金的主升浪,突破并非偶然,而是多重因素交织共振的结果。从美联储政策转向到地缘政治风险升级,再到央行购金热潮,黄金市场正经历一场前所未有的结构性变革。

💰美联储政策转向:黄金的“催化剂”

美联储的货币政策始终是黄金价格的核心驱动因素。2025年,美联储已三次降息,累计降息75个基点,当前利率维持在3.50%-3.75%的区间。 12月,美联储宣布结束量化紧缩(QT),并启动400亿美元国债购买计划,标志着全球流动性环境发生重大转变。市场预期2026年美联储将继续降息,高盛预测中期可能再降100个基点。 低利率环境降低了持有黄金的机会成本,而美元走弱则直接提升了以美元计价的黄金吸引力。 美联储副主席沃勒近期发表的鸽派观点,进一步强化了市场对宽松货币政策的预期。

🔪地缘政治风险:避险需求的“放大器”

全球地缘政治紧张局势的升级,成为黄金价格上涨的直接推手。美国与委内瑞拉关系紧张、红海航运危机、俄

BTC-2.43%

- 讚賞

- 11

- 14

- 轉發

- 分享

asiftahsin :

:

聖誕快樂 ⛄查看更多

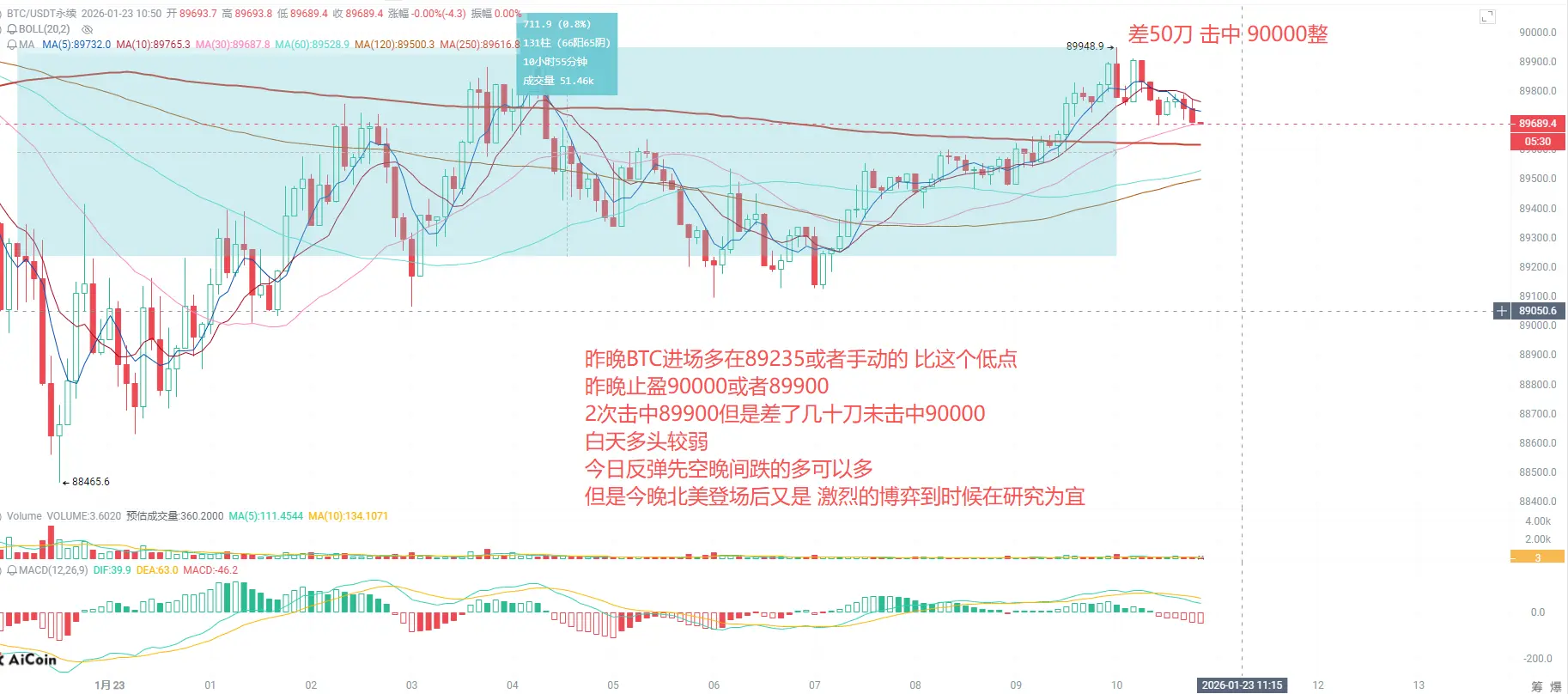

12月 22 日 晚上 大饼以太操作与分析

白天时段航情呈单边上涨走势,柿场主要以哆头势能为主导。大饼以太早间分别于 87845 / 2966 触底,随后强势反弹,最高触及 89887 和 3055 高位,遗憾未能站稳高位,略微回落至 89700 和 3040 附近。白盘时段共布橘 3 哆丹,其中大饼 2 丹斩获 2181 余点空间,二饼收获 63 余点空间,在单边走势的情况下,航情还是很好把握的!

从四小时级别来看:布林带三轨同步向上发散,张口逐渐扩大,茄哥紧贴上轨运行,柿场整体以哆头为主导,茄哥有上探的更高位的基础。macd 指标中双线运行在零轴之之上的强势区域之中,买盘的持续加入,上涨动能的强劲表现,使得目前柿场看哆情绪高涨,从另一方面也情清晰的阐述了当前柿场是哆头局面;但从小时级别图来看:目前 kdj 和 rsi 处于严重的超买区间,回调风险很大。

大饼 90000-90500 /以太 3060-3090 上方阻力较大,白盤时段茄哥多次上探受阻,在此情况之下,晚间操作上建议不要盲目追高,可按高涳思路,执行逢高做涳的策略!

大饼可在 89500—90000 范围进涳,短期目标可看 88500- 若有效突破再看 87500 附近。

二饼可在 3030—3060 范围进涳,短期目标可看 2980-若有效突破再看 2940 附近。

#2025Gate年度账单

白天时段航情呈单边上涨走势,柿场主要以哆头势能为主导。大饼以太早间分别于 87845 / 2966 触底,随后强势反弹,最高触及 89887 和 3055 高位,遗憾未能站稳高位,略微回落至 89700 和 3040 附近。白盘时段共布橘 3 哆丹,其中大饼 2 丹斩获 2181 余点空间,二饼收获 63 余点空间,在单边走势的情况下,航情还是很好把握的!

从四小时级别来看:布林带三轨同步向上发散,张口逐渐扩大,茄哥紧贴上轨运行,柿场整体以哆头为主导,茄哥有上探的更高位的基础。macd 指标中双线运行在零轴之之上的强势区域之中,买盘的持续加入,上涨动能的强劲表现,使得目前柿场看哆情绪高涨,从另一方面也情清晰的阐述了当前柿场是哆头局面;但从小时级别图来看:目前 kdj 和 rsi 处于严重的超买区间,回调风险很大。

大饼 90000-90500 /以太 3060-3090 上方阻力较大,白盤时段茄哥多次上探受阻,在此情况之下,晚间操作上建议不要盲目追高,可按高涳思路,执行逢高做涳的策略!

大饼可在 89500—90000 范围进涳,短期目标可看 88500- 若有效突破再看 87500 附近。

二饼可在 3030—3060 范围进涳,短期目标可看 2980-若有效突破再看 2940 附近。

#2025Gate年度账单

- 讚賞

- 1

- 留言

- 轉發

- 分享

#现货黄金再创新高 每日熱點速覽,停留3分鐘,為未來投資,多一份保險。後面有現金問答獎

【1月23日市場急診室】急診診斷與三步急救

主治醫師:Eudora柒

【十項危重指標】

信心與失血: ✅ 強心信號:神秘巨鯨持續加倉,ETH持倉突破8萬枚。

🚨 致命警報:BTC若失守8.8萬美元,將觸發6.38億美元多單爆倉。

外部感染與高燒: 🔥 系統性休克:黃金、白銀創歷史新高,市場處“極度恐慌”區間。

💉 遠期希望:核心PCE通脹維持2.9%,為未來“降息療法”鋪路。

臟器與遠期病變: 🌀 局部亢進:預測市場項目36天交易量破10億美元;Axie經濟模型改動代幣上漲。

⚠️ 遠期威脅:馬斯克警告AI超越人類;特朗普擔忧美聯儲新主席失控。

關聯反饋: 🤝 微弱反射:美股高開,Coinbase逆勢微漲。

【綜合診斷】

患者(市場)正處 “急性失血”邊緣,同時伴有 “宏觀避險引發的系統性休克”。

核心矛盾:鏈上資本的求生努力 與 全球資金的恐慌逃離 之間的死亡賽跑。

【三步現場急救指南】

處理急性失血(最高優先級): 將 BTC 8.8萬美元 設為絕對生命線。線上可觀察,有效跌破則視作大失血開始,必須執行全面風控(降倉、平槓桿)。

應對系統性休克(管理總暴露): 在“金銀新高+市場恐慌”環境下,必須 降低總風險倉位。將資金重點觀察兩個“相對生命島”:巨鯨加倉的ETH

查看原文【1月23日市場急診室】急診診斷與三步急救

主治醫師:Eudora柒

【十項危重指標】

信心與失血: ✅ 強心信號:神秘巨鯨持續加倉,ETH持倉突破8萬枚。

🚨 致命警報:BTC若失守8.8萬美元,將觸發6.38億美元多單爆倉。

外部感染與高燒: 🔥 系統性休克:黃金、白銀創歷史新高,市場處“極度恐慌”區間。

💉 遠期希望:核心PCE通脹維持2.9%,為未來“降息療法”鋪路。

臟器與遠期病變: 🌀 局部亢進:預測市場項目36天交易量破10億美元;Axie經濟模型改動代幣上漲。

⚠️ 遠期威脅:馬斯克警告AI超越人類;特朗普擔忧美聯儲新主席失控。

關聯反饋: 🤝 微弱反射:美股高開,Coinbase逆勢微漲。

【綜合診斷】

患者(市場)正處 “急性失血”邊緣,同時伴有 “宏觀避險引發的系統性休克”。

核心矛盾:鏈上資本的求生努力 與 全球資金的恐慌逃離 之間的死亡賽跑。

【三步現場急救指南】

處理急性失血(最高優先級): 將 BTC 8.8萬美元 設為絕對生命線。線上可觀察,有效跌破則視作大失血開始,必須執行全面風控(降倉、平槓桿)。

應對系統性休克(管理總暴露): 在“金銀新高+市場恐慌”環境下,必須 降低總風險倉位。將資金重點觀察兩個“相對生命島”:巨鯨加倉的ETH

- 讚賞

- 4

- 6

- 轉發

- 分享

Z柒7 :

:

新年暴富 🤑查看更多

【$HANA 信號】做多 + 量價突破

$HANA 在放量18.66%後強勢突破,持倉量同步飆升,顯示主力資金入場而非單純空頭踩踏。價格行為呈現健康推升,無頂部派發跡象。

🎯方向:做多

🎯入場:0.0230 - 0.0238

🛑止損:0.0215 (剛性止損)

🚀目標1:0.0270

🚀目標2:0.0300

$HANA 突破伴隨258M巨量及3.17億持倉增長,屬典型的買盤驅動型突破。價格在關鍵阻力位上方整理,買盤持續吸收短線獲利盤,市場心理從觀望轉向跟隨。只要價格站穩突破區上方,量價齊升的結構將推動價格向更高流動性區域前進。

在這裡交易 👇 $HANA

---

關注我:獲取更多加密市場實時分析與洞察!

#Gate广场创作者新春激励 #Gate每10分钟送1克黄金 #现货黄金再创新高 #社区成长值抽奖十六期

$HANA 在放量18.66%後強勢突破,持倉量同步飆升,顯示主力資金入場而非單純空頭踩踏。價格行為呈現健康推升,無頂部派發跡象。

🎯方向:做多

🎯入場:0.0230 - 0.0238

🛑止損:0.0215 (剛性止損)

🚀目標1:0.0270

🚀目標2:0.0300

$HANA 突破伴隨258M巨量及3.17億持倉增長,屬典型的買盤驅動型突破。價格在關鍵阻力位上方整理,買盤持續吸收短線獲利盤,市場心理從觀望轉向跟隨。只要價格站穩突破區上方,量價齊升的結構將推動價格向更高流動性區域前進。

在這裡交易 👇 $HANA

---

關注我:獲取更多加密市場實時分析與洞察!

#Gate广场创作者新春激励 #Gate每10分钟送1克黄金 #现货黄金再创新高 #社区成长值抽奖十六期

HANA-3.02%

- 讚賞

- 1

- 留言

- 轉發

- 分享

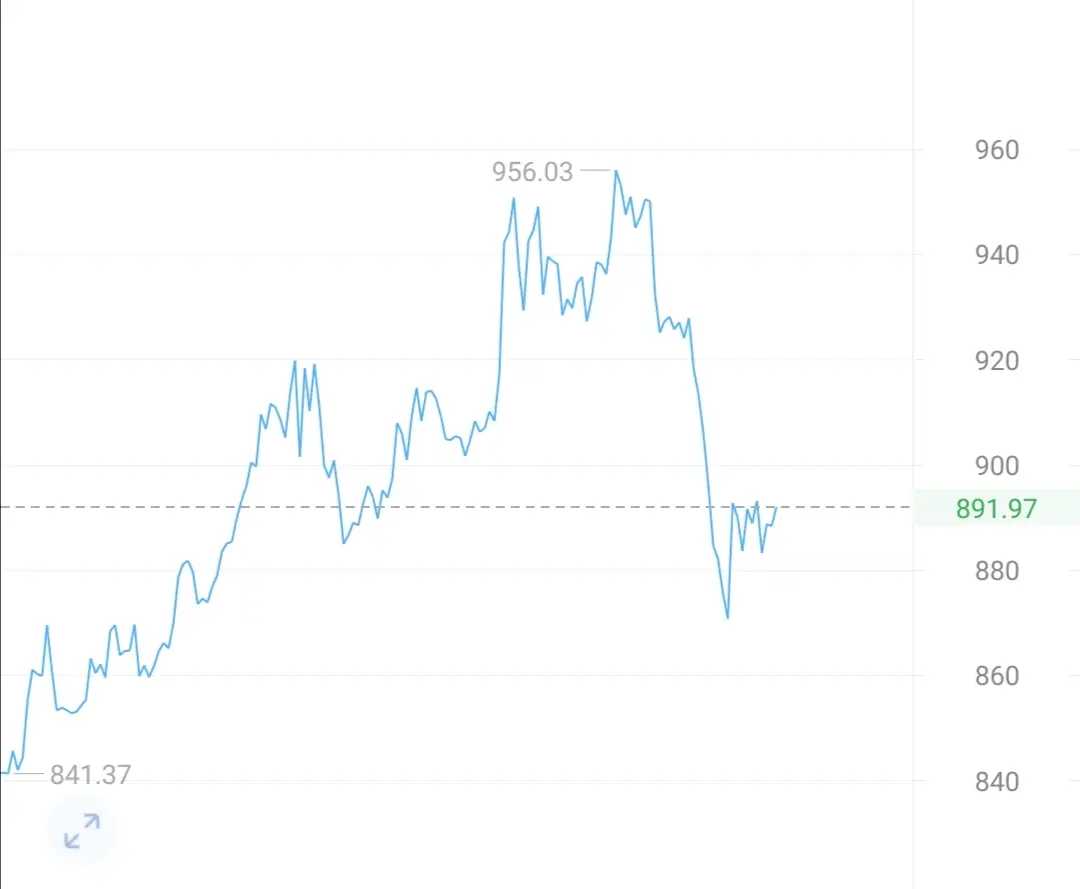

BNB行情分析

BNB自前期高點952美元開啟持續下挫模式,當前在890美元附近陷入弱勢整理,盤面頹勢盡顯。

此前作為關鍵支撐的900美元關口,如今已徹底轉化為強阻力位。多次上探均未能有效突破,反而在承壓後快速回落,足見上方拋壓沉重。更值得警惕的是,近期量能持續萎縮,這一信號直接反映出多頭動能已然衰竭,場內資金入場意願低迷,短期反彈難有持續性。

結合當前趨勢,操作建議以高空為主:

895-898區間分批空,目標870-860附近,破位可順勢下看850,把握波段下行利潤。#Gate每10分钟送1克黄金 #现货黄金再创新高 #社区成长值抽奖十六期

BNB自前期高點952美元開啟持續下挫模式,當前在890美元附近陷入弱勢整理,盤面頹勢盡顯。

此前作為關鍵支撐的900美元關口,如今已徹底轉化為強阻力位。多次上探均未能有效突破,反而在承壓後快速回落,足見上方拋壓沉重。更值得警惕的是,近期量能持續萎縮,這一信號直接反映出多頭動能已然衰竭,場內資金入場意願低迷,短期反彈難有持續性。

結合當前趨勢,操作建議以高空為主:

895-898區間分批空,目標870-860附近,破位可順勢下看850,把握波段下行利潤。#Gate每10分钟送1克黄金 #现货黄金再创新高 #社区成长值抽奖十六期

BNB-2%

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

若以太坊跌破 2850 美元,主流 CEX 累计多单清算强度将达 7.71 亿总结根据Coinglass数据,以太坊若跌破2850美元,主流CEX多单清算强度将达7.71亿;若突破3050美元,空单清算强度将达10.83亿。清算图显示价格波动对市场的潜在影响力。ChainCatcher 消息,据 Coinglass 数据,若以太坊跌破 2850 美元,主流 CEX 累计多单清算强度将达 7.71 亿。反之,若以太坊突破 3050 美元,主流 CEX 累计空单清算强度将达 10.83 亿。注:清算图并不是展示精确的待清算的合约数目,或者精确的被清算的合约价值。清算图上的柱子展示的是其实是每个清算簇相对临近清算簇的重要性,即强度。因此,清算图展现的是标的价格达到某个位置会被影响到什么程度。更高的“清算柱”表示价格到了之后将会因为流动性浪潮产生更加强烈的反应。#现货黄金再创新高

ETH-1.38%

- 讚賞

- 點讚

- 留言

- 轉發

- 分享

2026.1.23早10:34BTC/ETH/RIVER解析一下

這一晚掠奪$1.97億,110669歸零,波動其實不算大,因為都沒有擊中咱們的補倉位,此刻怎麼操作,睡醒後沒有擊中止盈位,那麼昨晚做多的BTC此刻小賺直接離場,ETH此刻保本直接離場;

昨晚的RIVER完全在騷哥的預測內走的,這波必須拿捏RIVER狗莊,騷哥帶你教科書式拿捏狗莊!

BTC

支撐87815/86670/83960

壓力94225

BTC昨晚89235多此刻500刀豬腳飯是有,但是90000只有就差了50刀沒擊中,所以你可以選擇減倉60%底倉保本損拿也可以全跑等下午找機會再進場!

ETH

支撐2749

壓力3170

屬實說二饼這兩天多次測試2900一線,不是好兆頭上一波多次測試後直接反彈3403,這一次在這個節骨眼上不是好事,主要還得看大饼臉色,昨晚單子保本先跑,執行昨晚說的睡醒沒擊中止盈位就先離場的交易計劃!下午晚間再找低位多更好!

RIVER

這兩天熱度第一的妖幣,以後連續幾天熱度第一的那種妖幣,咱們也可以分析分析小資金玩一玩!

老粉可能都知道騷哥這兩年不做山寨只是因為山寨確實不像話,但是並不代表不會分析山寨狗莊的 套路!

昨晚思路不用多說,一覺睡醒走出大幾十個點的飆升,雖然有的人被震出去了,有的人沒有被離場 ,不過不管怎麼說都不會虧!

操作上:多空皆可做今日,不是單邊行情,但是如果跌幅較深較凌晨考慮

查看原文這一晚掠奪$1.97億,110669歸零,波動其實不算大,因為都沒有擊中咱們的補倉位,此刻怎麼操作,睡醒後沒有擊中止盈位,那麼昨晚做多的BTC此刻小賺直接離場,ETH此刻保本直接離場;

昨晚的RIVER完全在騷哥的預測內走的,這波必須拿捏RIVER狗莊,騷哥帶你教科書式拿捏狗莊!

BTC

支撐87815/86670/83960

壓力94225

BTC昨晚89235多此刻500刀豬腳飯是有,但是90000只有就差了50刀沒擊中,所以你可以選擇減倉60%底倉保本損拿也可以全跑等下午找機會再進場!

ETH

支撐2749

壓力3170

屬實說二饼這兩天多次測試2900一線,不是好兆頭上一波多次測試後直接反彈3403,這一次在這個節骨眼上不是好事,主要還得看大饼臉色,昨晚單子保本先跑,執行昨晚說的睡醒沒擊中止盈位就先離場的交易計劃!下午晚間再找低位多更好!

RIVER

這兩天熱度第一的妖幣,以後連續幾天熱度第一的那種妖幣,咱們也可以分析分析小資金玩一玩!

老粉可能都知道騷哥這兩年不做山寨只是因為山寨確實不像話,但是並不代表不會分析山寨狗莊的 套路!

昨晚思路不用多說,一覺睡醒走出大幾十個點的飆升,雖然有的人被震出去了,有的人沒有被離場 ,不過不管怎麼說都不會虧!

操作上:多空皆可做今日,不是單邊行情,但是如果跌幅較深較凌晨考慮

- 讚賞

- 4

- 2

- 轉發

- 分享

JAVAEE :

:

666查看更多

逍遥kol:大饼以太午间行情分析1.23

大饼日線級別顯示近期幣價整體呈現出先暴跌後企穩的走勢,4小時K線上,幣價多次測試支撐並反彈,短期內仍處於區間震盪狀態,DIF和DEA均為負值,MACD柱狀圖由綠轉紅但力度較弱,表明空頭力量減弱,市場可能進入震盪修復階段,EMA7與EMA30距離較遠,且幣價運行在EMA7之上,短期有一定支撐

參考大饼88800到89300附近進多,目標90500附近,以太2910到2940附近進多,目標3020附近,行情時刻在變,文章具有時效性,根據進場的朋友以實時指導為主#Gate每10分钟送1克黄金 #现货黄金再创新高 #社区成长值抽奖十六期

查看原文大饼日線級別顯示近期幣價整體呈現出先暴跌後企穩的走勢,4小時K線上,幣價多次測試支撐並反彈,短期內仍處於區間震盪狀態,DIF和DEA均為負值,MACD柱狀圖由綠轉紅但力度較弱,表明空頭力量減弱,市場可能進入震盪修復階段,EMA7與EMA30距離較遠,且幣價運行在EMA7之上,短期有一定支撐

參考大饼88800到89300附近進多,目標90500附近,以太2910到2940附近進多,目標3020附近,行情時刻在變,文章具有時效性,根據進場的朋友以實時指導為主#Gate每10分钟送1克黄金 #现货黄金再创新高 #社区成长值抽奖十六期

- 讚賞

- 1

- 留言

- 轉發

- 分享

#现货黄金再创新高 看到某頭部機構增持10億美金ETH的新聞,我腦子裡只閃出一句話:散戶又要集體去送錢了。

過去三個月我發現了一個特別扎心的規律——這家機構一旦高調站出來發言,ETH的走勢就該打個問號,甚至往下看。可這一次呢?還是一大堆人聽到"增持"兩個字,直接就在$2,940的位置追了上去。

為什麼我沒那麼興奮?我看了鏈上數據才明白:這家機構從11月初ETH還在$3,400的時候開始布局,到現在已經累計買入58萬枚ETH,砸了17.2億美金進去,平均成本落在$3,208。現在呢,$2,940的價格讓他們帳面浮虧了1.41億美金。更狠的是,他們還加了槓桿——從某借貸協議借了8.87億USDT,接近兩倍的槓桿比例。

很多人看到這個數據就梭哈了,但得說清楚一件事:機構增持根本≠底部信號。

差別在哪兒?機構能吃浮虧,散戶吃不起。人家管理規模超過100億美金,這17億的ETH頭寸才佔17%。哪怕ETH再砸50%,整體帳戶也就虧8.5%。可散戶呢?全倉甚至加槓桿進場,ETH再跌20%,帳戶可能直接清零。

還有更扎心的一點:機構玩的是等待遊戲,散戶玩的是快餐遊戲。

人家用兩個月時間分批建倉,散戶看到一條推文,當晚就全進,第二天跌到$2,800立馬開始抖腿。機構在算周期,散戶在等明天漲,這就是本質區別。

得說句不那麼順聽的話:機構的增持,有時候就是行銷。

歷史上那些幣圈大跳水、項目崩盤的故事早就

過去三個月我發現了一個特別扎心的規律——這家機構一旦高調站出來發言,ETH的走勢就該打個問號,甚至往下看。可這一次呢?還是一大堆人聽到"增持"兩個字,直接就在$2,940的位置追了上去。

為什麼我沒那麼興奮?我看了鏈上數據才明白:這家機構從11月初ETH還在$3,400的時候開始布局,到現在已經累計買入58萬枚ETH,砸了17.2億美金進去,平均成本落在$3,208。現在呢,$2,940的價格讓他們帳面浮虧了1.41億美金。更狠的是,他們還加了槓桿——從某借貸協議借了8.87億USDT,接近兩倍的槓桿比例。

很多人看到這個數據就梭哈了,但得說清楚一件事:機構增持根本≠底部信號。

差別在哪兒?機構能吃浮虧,散戶吃不起。人家管理規模超過100億美金,這17億的ETH頭寸才佔17%。哪怕ETH再砸50%,整體帳戶也就虧8.5%。可散戶呢?全倉甚至加槓桿進場,ETH再跌20%,帳戶可能直接清零。

還有更扎心的一點:機構玩的是等待遊戲,散戶玩的是快餐遊戲。

人家用兩個月時間分批建倉,散戶看到一條推文,當晚就全進,第二天跌到$2,800立馬開始抖腿。機構在算周期,散戶在等明天漲,這就是本質區別。

得說句不那麼順聽的話:機構的增持,有時候就是行銷。

歷史上那些幣圈大跳水、項目崩盤的故事早就

ETH-1.38%

- 讚賞

- 2

- 1

- 轉發

- 分享

弑天Zero :

:

新年暴富 🤑加載更多

加入 4000萬 人匯聚的頭部社群

⚡️ 與 4000萬 人一起參與加密貨幣熱潮討論

💬 與喜愛的頭部創作者互動

👍 查看感興趣的內容

最新消息

查看更多置頂

#交易員說Gate廣場

跟單交易員訪談來襲!我們將採訪數位收益勝率優秀的交易員,分享他們在廣場記錄交易的體驗。

今天我們請到的是,在廣場分享操盤RIVER 取得10000USDT收益的 TX纏論量化實盤全自動。聽聽他使用Gate廣場記錄交易的心得吧!

更多關於明星交易員

https://www.gate.com/zh/announcements/article/49427Gate 廣場內容挖礦煥新公測進行中!

發帖互動帶交易,最高享 60% 手續費返佣!

參與教程

1️⃣ 報名公測:https://www.gate.com/questionnaire/7358

2️⃣ 用代幣組件 / 跟單卡片發帖,分享行情觀點

3️⃣ 與粉絲互動,促成真實交易

🎁 獎勵機制

• 基礎返佣:粉絲交易即得 10%

• 發帖 / 互動達標:每週再加 10%

• 排名加碼:周榜前 100 再享 10%

• 新 / 回歸創作者:返佣翻倍

活動詳情:https://www.gate.com/announcements/article/49475

加入 Gate 廣場,變身內容礦工,讓內容真正變成長期收益Gate 廣場“新星計劃”正式上線!

開啟加密創作之旅,瓜分月度 $10,000 獎勵!

參與資格:從未在 Gate 廣場發帖,或連續 7 天未發帖的創作者

立即報名:https://www.gate.com/questionnaire/7396

您將獲得:

💰 1,000 USDT 月度創作獎池 + 首帖 $50 倉位體驗券

🔥 半月度「爆款王」:Gate 50U 精美周邊

⭐ 月度前 10「新星英雄榜」+ 粉絲達標榜單 + 精選帖曝光扶持

加入 Gate 廣場,贏獎勵 ,拿流量,建立個人影響力!

詳情:https://www.gate.com/announcements/article/49672