CavilZevran

Decoding the Markets. Delivering the Alpha

CavilZevran

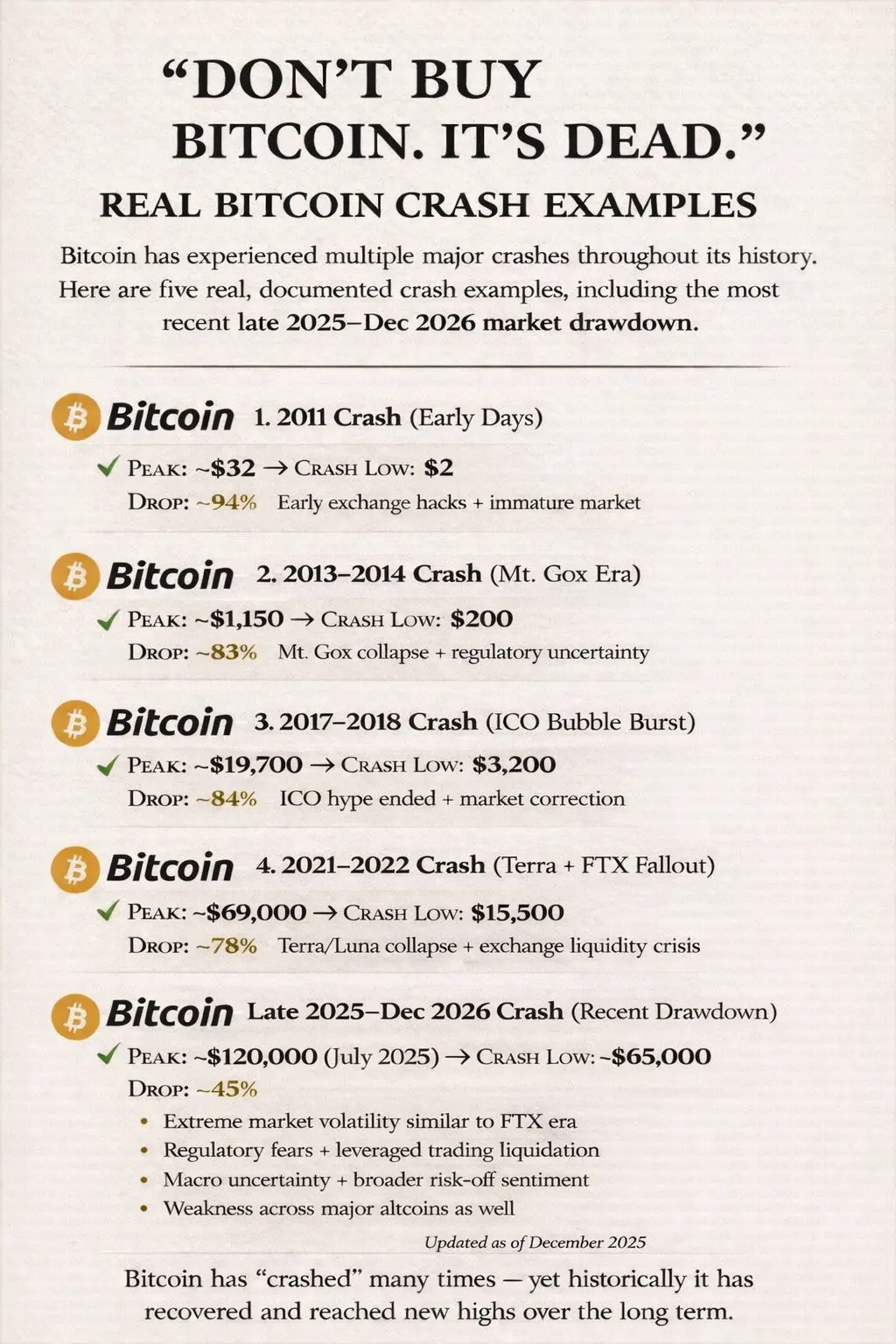

Bitcoin $BTC has crashed.

Not once.

Not twice.

But every cycle.

And each time, the same story repeats:

“It's over.”

“This time is different.”

“Crypto is dead.”

Yet history keeps leaving receipts.

📉 2011: $32 → $2

📉 2013–14: $1,150 → $200

📉 2017–18: $19,700 → $3,200

📉 2021–22: $69,000 → $15,500

📉 2025: ~$120,000 → ~$65,000

Here’s what I’ve learned:

Bitcoin doesn’t reward certainty. It rewards resilience.

Crashes aren’t anomalies, they are part of the design of an emerging asset class.

The real divide in crypto is simple:

* Some people react to volatility

* Others recogn

Not once.

Not twice.

But every cycle.

And each time, the same story repeats:

“It's over.”

“This time is different.”

“Crypto is dead.”

Yet history keeps leaving receipts.

📉 2011: $32 → $2

📉 2013–14: $1,150 → $200

📉 2017–18: $19,700 → $3,200

📉 2021–22: $69,000 → $15,500

📉 2025: ~$120,000 → ~$65,000

Here’s what I’ve learned:

Bitcoin doesn’t reward certainty. It rewards resilience.

Crashes aren’t anomalies, they are part of the design of an emerging asset class.

The real divide in crypto is simple:

* Some people react to volatility

* Others recogn

BTC-2.94%

- Reward

- like

- Comment

- Repost

- Share

$TNSR /USDT (1H) — Bull Flag Continuation

Bias: Long

Entry (Zone): 0.0532 – 0.0542

Targets:

TP1: 0.0600

TP2: 0.0659

TP3: 0.0700

Stop Loss: 0.0518

Why this Setup:

After the sharp impulse move, $TNSR is now consolidating above the breakout base and holding a tight range around current price (~0.0538). That’s classic bull-flag behavior: volatility cools off, sellers fail to push it back into the prior range, and dips keep getting bought quickly. As long as this 0.0532–0.0542 zone holds, a squeeze/continuation back toward 0.0600 is the most likely next leg, with extension targets above if momentum

Bias: Long

Entry (Zone): 0.0532 – 0.0542

Targets:

TP1: 0.0600

TP2: 0.0659

TP3: 0.0700

Stop Loss: 0.0518

Why this Setup:

After the sharp impulse move, $TNSR is now consolidating above the breakout base and holding a tight range around current price (~0.0538). That’s classic bull-flag behavior: volatility cools off, sellers fail to push it back into the prior range, and dips keep getting bought quickly. As long as this 0.0532–0.0542 zone holds, a squeeze/continuation back toward 0.0600 is the most likely next leg, with extension targets above if momentum

TNSR38.95%

- Reward

- like

- Comment

- Repost

- Share

$TAKE /USDT (1H) — Base After Spike (Continuation Setup)

Bias: Long

Entry (Zone): 0.0345 – 0.0360

Targets:

TP1: 0.0400

TP2: 0.0450

TP3: 0.0500

Stop Loss: 0.0328

Why this Setup:

After the explosive move up, $TAKE flushed and is now stabilizing around 0.0354 with tight consolidation, signaling sellers are losing control and buyers are defending the post-dump base. This kind of “cool-off” usually sets up the next leg if price holds the current support and starts stepping higher. As long as 0.0345–0.0360 remains defended, the higher-probability path is a rotation back into prior supply at 0.0400 f

Bias: Long

Entry (Zone): 0.0345 – 0.0360

Targets:

TP1: 0.0400

TP2: 0.0450

TP3: 0.0500

Stop Loss: 0.0328

Why this Setup:

After the explosive move up, $TAKE flushed and is now stabilizing around 0.0354 with tight consolidation, signaling sellers are losing control and buyers are defending the post-dump base. This kind of “cool-off” usually sets up the next leg if price holds the current support and starts stepping higher. As long as 0.0345–0.0360 remains defended, the higher-probability path is a rotation back into prior supply at 0.0400 f

TAKE49.39%

- Reward

- 2

- Comment

- Repost

- Share

$CAD /USDT (1H) — Breakout Retest

Bias: Long

Entry (Zone): 0.0008200 – 0.0008800

Targets:

TP1: 0.0009000

TP2: 0.0009500

TP3: 0.0010000

Stop Loss: 0.0007700

Why this Setup:

$CAD just posted a strong BOS impulse and is now sitting right around the breakout area (current price ~0.0008767). This zone often gets retested as buyers defend and late sellers get squeezed out. If price holds the 0.00082–0.00088 region, continuation toward the 0.00090 level becomes the first logical push, with extension into 0.00095–0.00100 if momentum stays active. Invalidating below 0.00077 protects the setup in case

Bias: Long

Entry (Zone): 0.0008200 – 0.0008800

Targets:

TP1: 0.0009000

TP2: 0.0009500

TP3: 0.0010000

Stop Loss: 0.0007700

Why this Setup:

$CAD just posted a strong BOS impulse and is now sitting right around the breakout area (current price ~0.0008767). This zone often gets retested as buyers defend and late sellers get squeezed out. If price holds the 0.00082–0.00088 region, continuation toward the 0.00090 level becomes the first logical push, with extension into 0.00095–0.00100 if momentum stays active. Invalidating below 0.00077 protects the setup in case

CAD22.9%

- Reward

- like

- Comment

- Repost

- Share

$TOSHI3L /USDT (1H) — Breakout Continuation

Bias: Long

Entry (Zone): 0.3300 – 0.3600

Targets:

TP1: 0.4000

TP2: 0.4500

TP3: 0.5000

Stop Loss: 0.2950

Why this Setup:

Price just delivered a strong continuation breakout and is holding above prior structure after a clean shift in momentum (CHoCH/BOS on the chart). With the current price around 0.361, the best play is to look for a controlled pullback into the 0.33–0.36 area to confirm buyers are still defending. If that zone holds, continuation higher is likely as momentum remains clearly in the bulls’ favor, while the stop stays tucked below the b

Bias: Long

Entry (Zone): 0.3300 – 0.3600

Targets:

TP1: 0.4000

TP2: 0.4500

TP3: 0.5000

Stop Loss: 0.2950

Why this Setup:

Price just delivered a strong continuation breakout and is holding above prior structure after a clean shift in momentum (CHoCH/BOS on the chart). With the current price around 0.361, the best play is to look for a controlled pullback into the 0.33–0.36 area to confirm buyers are still defending. If that zone holds, continuation higher is likely as momentum remains clearly in the bulls’ favor, while the stop stays tucked below the b

TOSHI3L38.13%

- Reward

- like

- Comment

- Repost

- Share

$GT / USDT (1H) — Supply Rejection

Bias: Short

Entry (Zone): 7.08 – 7.13

Targets:

TP1: 7.00

TP2: 6.90

TP3: 6.80

Stop Loss: 7.18

Why this Setup:

Price is trading right into a clear supply zone near the recent highs, after a strong push up. This area has a higher chance of profit-taking and rejection, especially if buyers struggle to break and hold above the top of the range. A pullback from here would be a natural move back into the prior structure, with room to rotate toward 7.00 first, then deeper into the mid-range and the highlighted demand zone around 6.8 if selling pressure picks up.

#Ce

Bias: Short

Entry (Zone): 7.08 – 7.13

Targets:

TP1: 7.00

TP2: 6.90

TP3: 6.80

Stop Loss: 7.18

Why this Setup:

Price is trading right into a clear supply zone near the recent highs, after a strong push up. This area has a higher chance of profit-taking and rejection, especially if buyers struggle to break and hold above the top of the range. A pullback from here would be a natural move back into the prior structure, with room to rotate toward 7.00 first, then deeper into the mid-range and the highlighted demand zone around 6.8 if selling pressure picks up.

#Ce

GT1.16%

- Reward

- 1

- Comment

- Repost

- Share

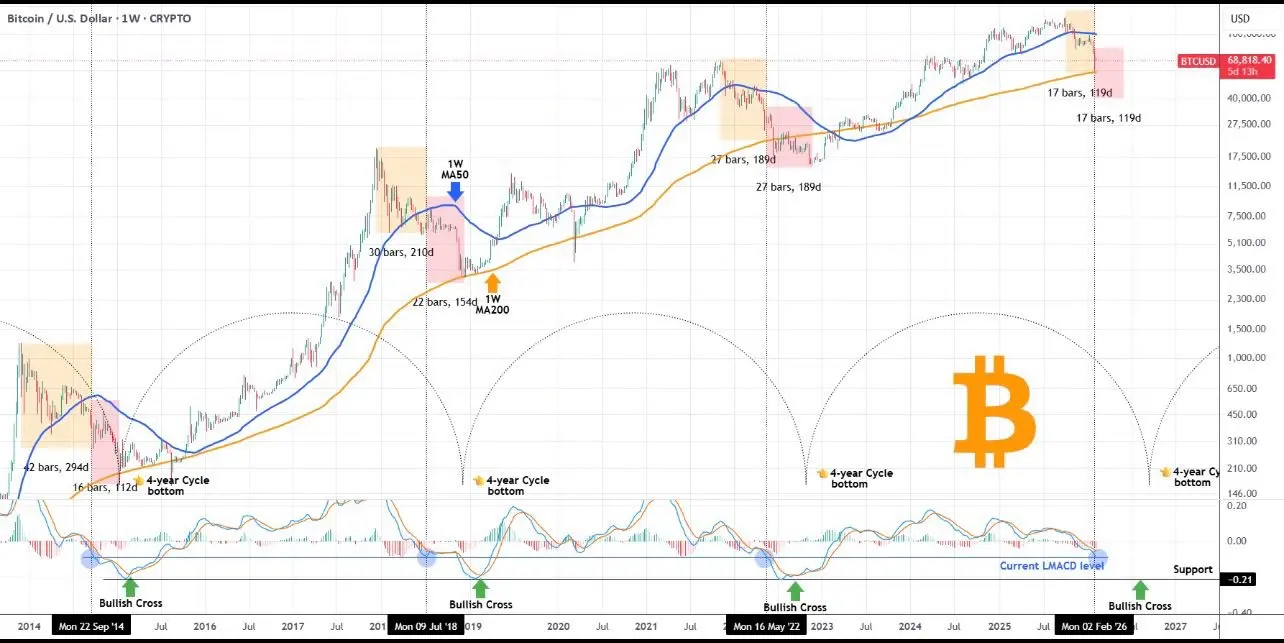

BITCOIN IS DOING THE “RESET MOVE” AGAIN… AND MOST PEOPLE PANIC AT THE WRONG TIME ⚡

Every cycle looks different.

But the rhythm?

Almost always the same.

🔁 The Bitcoin cycle pattern (you’ve seen this movie)

✅ Big run up

✅ Deep pullback toward weekly moving averages (MAs)

✅ MACD reset

✅ Then the next leg higher

📉 What’s happening right now with $BTC

After a strong move, Bitcoin is pulling back — and it looks a lot like those mid-cycle drops we’ve seen before.

Here’s why the setup matters:

✅ Price is back near the weekly averages

✅ MACD is nearing zones where prior bottoms have formed

✅ This lo

Every cycle looks different.

But the rhythm?

Almost always the same.

🔁 The Bitcoin cycle pattern (you’ve seen this movie)

✅ Big run up

✅ Deep pullback toward weekly moving averages (MAs)

✅ MACD reset

✅ Then the next leg higher

📉 What’s happening right now with $BTC

After a strong move, Bitcoin is pulling back — and it looks a lot like those mid-cycle drops we’ve seen before.

Here’s why the setup matters:

✅ Price is back near the weekly averages

✅ MACD is nearing zones where prior bottoms have formed

✅ This lo

BTC-2.94%

- Reward

- like

- Comment

- Repost

- Share

This Is the Bitcoin Situation for the Next 3 Years

Bitcoin’s next 3 years may follow historical halving cycles: peaks tend to align, lows often arrive about a year later, and each cycle’s upside shrinks as Bitcoin grows (logarithmic). Using past drawdowns (85/80/75%), this article maps a plausible 2026 “max pain” period, potential lower zones, and a phased accumulation plan, while stressing uncertainty and high risk.

BTC-2.94%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin ($BTC )has almost 66,000 on Wednesday after a pullback. The traders are anticipating three of the headline risks, which are US jobs data, US CPI, and a potential US government shutdown.

The jobs report of January followed briefly due to a brief shutdown. The Nonfarm Payrolls, unemployment, and wage growth are all monitored in markets to give clues on the demand of 2026. December contributed an addition of 50,000 jobs and the unemployment stood at 4.4%. It is projected to have created 55,000 jobs and the unemployment will remain 4.4%. Recruiting is confronted by counter winds of tar

The jobs report of January followed briefly due to a brief shutdown. The Nonfarm Payrolls, unemployment, and wage growth are all monitored in markets to give clues on the demand of 2026. December contributed an addition of 50,000 jobs and the unemployment stood at 4.4%. It is projected to have created 55,000 jobs and the unemployment will remain 4.4%. Recruiting is confronted by counter winds of tar

BTC-2.94%

- Reward

- 8

- 9

- 5

- Share

MyLove1998 :

:

Macro jitters rising; Bitcoin rangebound as traders await jobs, CPI, shutdown risks.View More

The Alpenglow enhancement may revive Solana ( $SOL ).

Solana prices have risen 25% from recent lows to their highest level since mid-November. The move goes beyond technology. As focus turns to the Alpenglow upgrade and sustained ETF inflows, Solana's medium-term prognosis improves.

The Alpenglow patch may be Solana's biggest protocol modification since launch. It replaces Proof-of-History and TowerBFT with a new design that boosts speed and efficiency. Solana promises to lower finality from 12.8 seconds to 100 to 150 milliseconds, making it one of the quickest blockchains.

This jump comes fro

Solana prices have risen 25% from recent lows to their highest level since mid-November. The move goes beyond technology. As focus turns to the Alpenglow upgrade and sustained ETF inflows, Solana's medium-term prognosis improves.

The Alpenglow patch may be Solana's biggest protocol modification since launch. It replaces Proof-of-History and TowerBFT with a new design that boosts speed and efficiency. Solana promises to lower finality from 12.8 seconds to 100 to 150 milliseconds, making it one of the quickest blockchains.

This jump comes fro

SOL-3.4%

- Reward

- 1

- Comment

- Repost

- Share

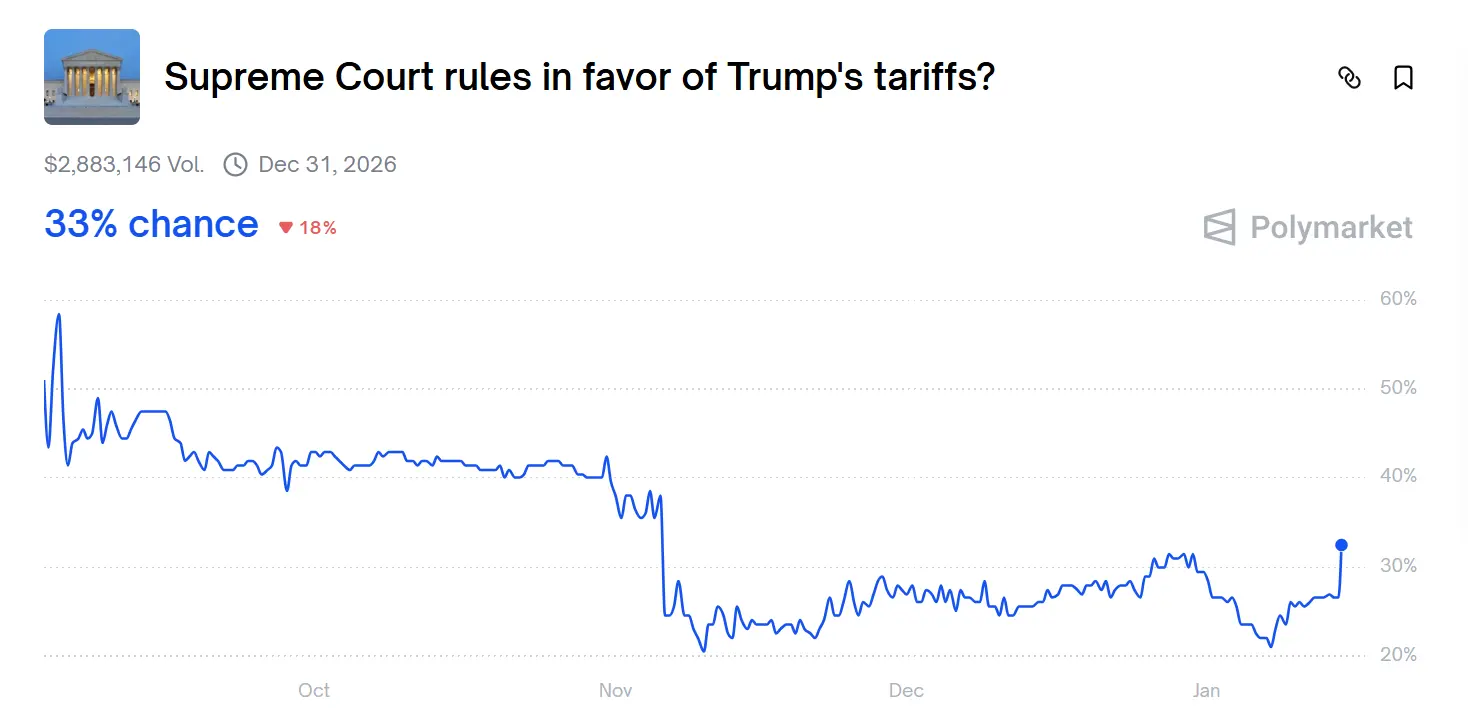

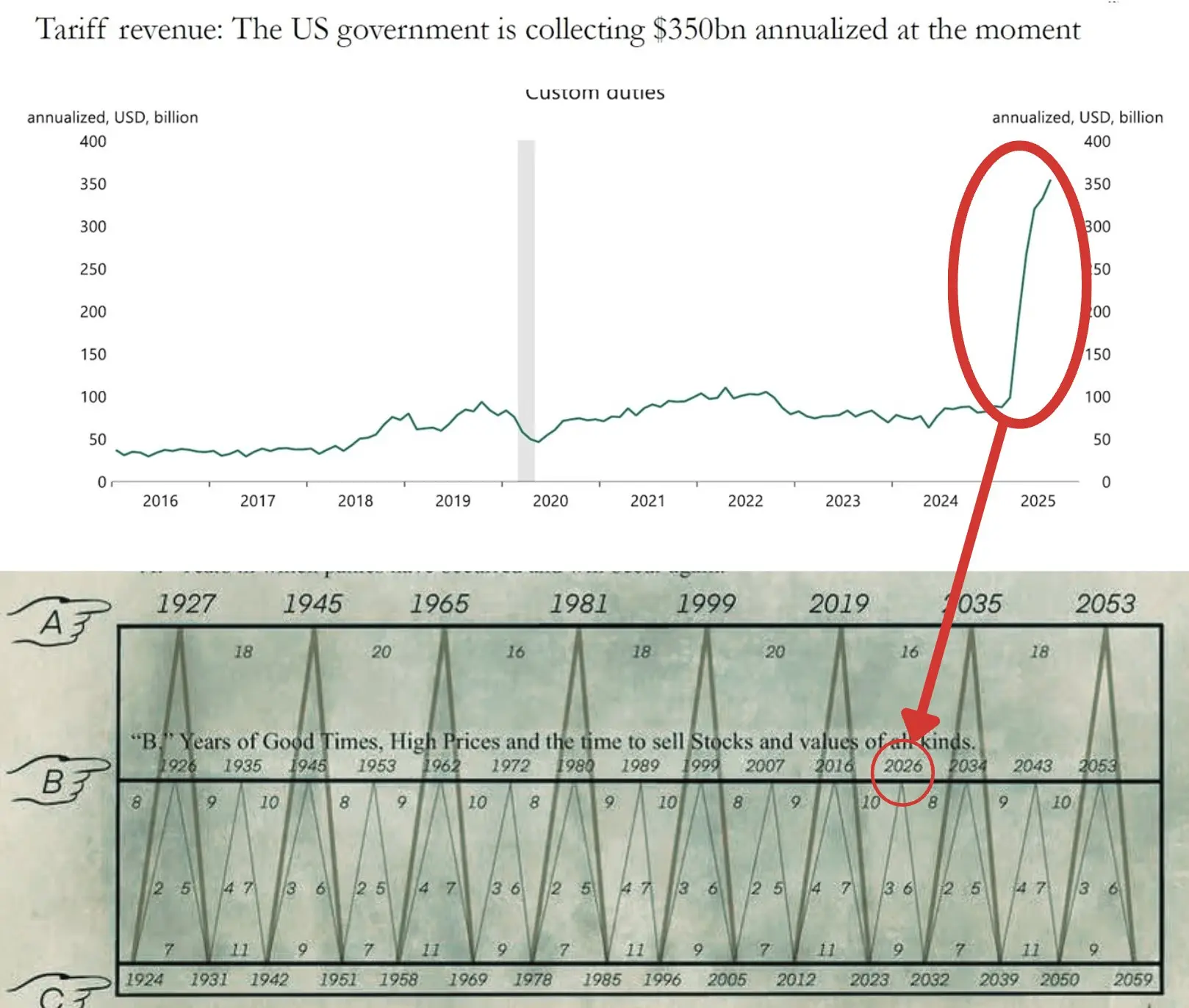

$BTC price enters a decisive phase as macro risk meets a bullish structure

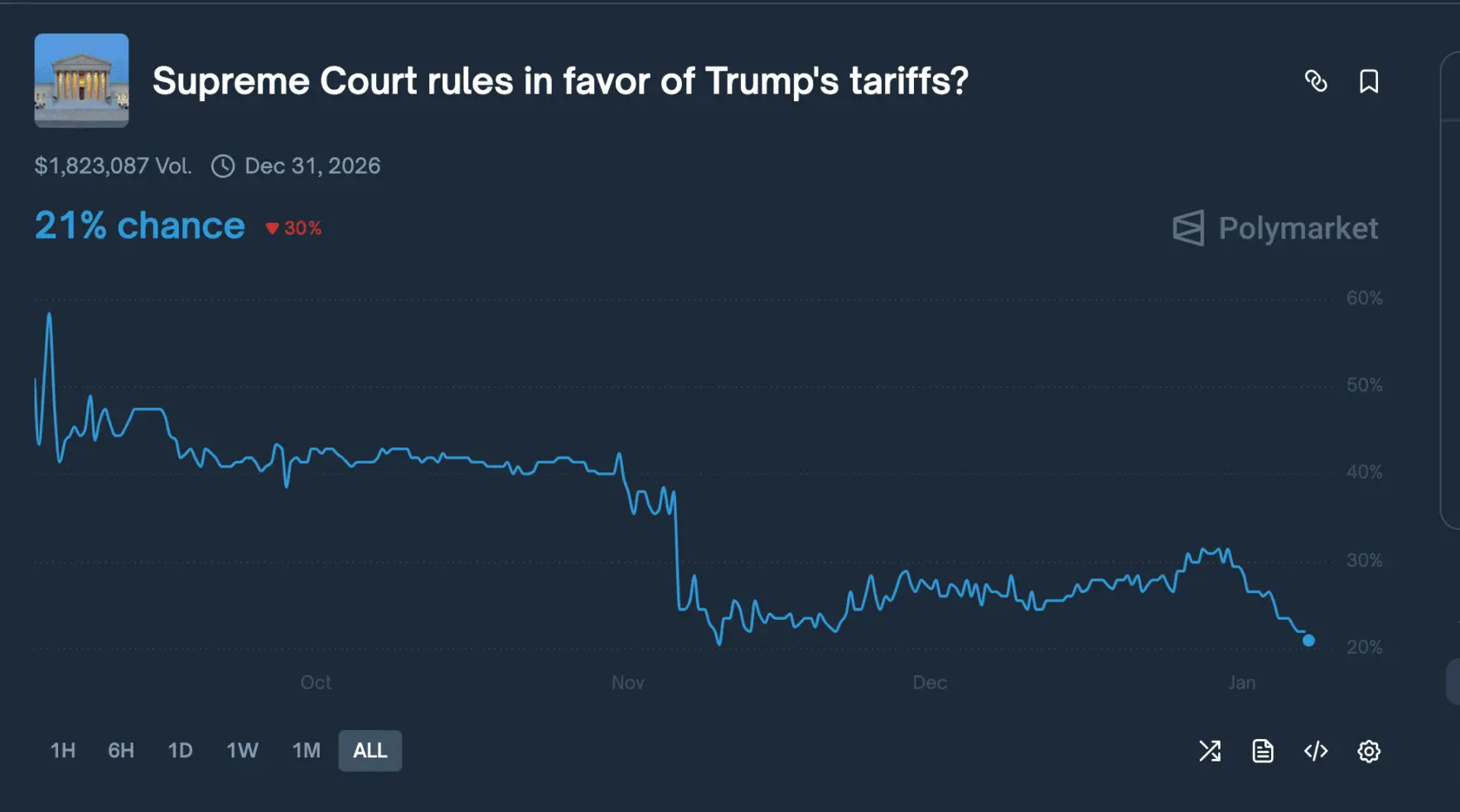

$BTC has moved into a new phase after breaking above a consolidation ceiling that capped upside since late November. BTC is now trading above former resistance, showing sustained participation rather than hesitant range behavior. This shift is happening as markets remain highly sensitive to the pending U.S. Supreme Court tariff decision.

Even without a final ruling, Bitcoin is already reacting to probabilities, not headlines. According to Polymarket, there is roughly a 67% chance that the court strikes down the tariff

$BTC has moved into a new phase after breaking above a consolidation ceiling that capped upside since late November. BTC is now trading above former resistance, showing sustained participation rather than hesitant range behavior. This shift is happening as markets remain highly sensitive to the pending U.S. Supreme Court tariff decision.

Even without a final ruling, Bitcoin is already reacting to probabilities, not headlines. According to Polymarket, there is roughly a 67% chance that the court strikes down the tariff

BTC-2.94%

- Reward

- 2

- Comment

- Repost

- Share

$BTC just reclaimed $96K and ETF demand is tightening supply fast

$BTC pushed above $96,000, marking its highest level this year and its strongest showing since November. The move capped a near 5% rally in 24 hours, with BTC briefly touching the $96,600 area before cooling near $95K. Momentum has clearly flipped back toward buyers.

The driver is institutional flow. U.S. spot Bitcoin ETFs pulled in over $750M in net inflows in a single day. Fidelity’s FBTC and Bitwise’s BITB led the charge, showing that demand is not slowing as price rises. This is steady absorption, not speculative chasing.

$BTC pushed above $96,000, marking its highest level this year and its strongest showing since November. The move capped a near 5% rally in 24 hours, with BTC briefly touching the $96,600 area before cooling near $95K. Momentum has clearly flipped back toward buyers.

The driver is institutional flow. U.S. spot Bitcoin ETFs pulled in over $750M in net inflows in a single day. Fidelity’s FBTC and Bitwise’s BITB led the charge, showing that demand is not slowing as price rises. This is steady absorption, not speculative chasing.

BTC-2.94%

- Reward

- 2

- Comment

- Repost

- Share

Ethereum aiming for $40,000 by 2030 sounds bold, but the structure matters more than the headline

Standard Chartered has projected that $ETH could reach $40,000 by 2030, a valuation that would imply a network size approaching $5 trillion. That forecast stands in sharp contrast to current price behavior, where ETH is still working through nearby supply rather than trending freely. The gap between the long-term thesis and present structure is where the real discussion sits.

For $ETH to reach that level, demand cannot be episodic. With a circulating supply of roughly 120 million ETH, moving fro

Standard Chartered has projected that $ETH could reach $40,000 by 2030, a valuation that would imply a network size approaching $5 trillion. That forecast stands in sharp contrast to current price behavior, where ETH is still working through nearby supply rather than trending freely. The gap between the long-term thesis and present structure is where the real discussion sits.

For $ETH to reach that level, demand cannot be episodic. With a circulating supply of roughly 120 million ETH, moving fro

ETH-1.83%

- Reward

- like

- Comment

- Repost

- Share

Cardano is starting to attract attention again as Europe unlocks regulated access for institutions

$ADA is trading in a recovery phase as the broader crypto market turns risk on. Bitcoin reclaiming $95,000 and Ethereum holding above $3,300 has improved sentiment, but the more important development for Cardano is structural. Germany’s DZ Bank has received MiCAR approval to offer Cardano trading, opening the door for institutional participation through regulated banking channels.

This approval changes the quality of capital entering $ADA . Institutional access under MiCAR reduces friction for c

$ADA is trading in a recovery phase as the broader crypto market turns risk on. Bitcoin reclaiming $95,000 and Ethereum holding above $3,300 has improved sentiment, but the more important development for Cardano is structural. Germany’s DZ Bank has received MiCAR approval to offer Cardano trading, opening the door for institutional participation through regulated banking channels.

This approval changes the quality of capital entering $ADA . Institutional access under MiCAR reduces friction for c

ADA0.66%

- Reward

- like

- Comment

- Repost

- Share

$BTC facing a real test as the next FOMC meeting gets closer, and honestly, the odds of a rate cut look pretty much dead in the water.

Lately, $BTC just been stuck—trading sideways while macro pressures keep building and momentum fizzles out. Sure, BTC tried to climb back up to $90,000, but sellers jumped in fast and shut that down. Meanwhile, markets are practically convinced the Fed won’t cut rates this time. Polymarket even puts the chance of rates staying the same at about 90%. That’s a lot of agreement.

It matters because Bitcoin’s recent moves higher were all about hoping the Fed would

Lately, $BTC just been stuck—trading sideways while macro pressures keep building and momentum fizzles out. Sure, BTC tried to climb back up to $90,000, but sellers jumped in fast and shut that down. Meanwhile, markets are practically convinced the Fed won’t cut rates this time. Polymarket even puts the chance of rates staying the same at about 90%. That’s a lot of agreement.

It matters because Bitcoin’s recent moves higher were all about hoping the Fed would

BTC-2.94%

- Reward

- like

- Comment

- Repost

- Share

Crypto traders are on edge, waiting for a potential jolt in the markets—and it could hit as soon as this Friday.

A well-known crypto analyst, Wimar, says a big selloff might be on the horizon, all hinging on a Supreme Court decision about Trump-era tariffs. The ruling could drop as early as January 9. If it goes against the tariffs, this won’t just be about politics—it’s about the numbers. Investors would immediately start wondering how much money the government has to pay back and how fast that happens. That kind of uncertainty never calms markets.

You can already see the nerves showing up in

A well-known crypto analyst, Wimar, says a big selloff might be on the horizon, all hinging on a Supreme Court decision about Trump-era tariffs. The ruling could drop as early as January 9. If it goes against the tariffs, this won’t just be about politics—it’s about the numbers. Investors would immediately start wondering how much money the government has to pay back and how fast that happens. That kind of uncertainty never calms markets.

You can already see the nerves showing up in

BTC-2.94%

- Reward

- like

- Comment

- Repost

- Share

Chainlink’s price is sneaking its way toward a $20 breakout, and honestly, the big reason is all about institutional money finally getting a way in.

$LINK is hanging out above $13 after jumping about 12% over the last week. It’s one of the top performers in altcoins lately. Bitcoin’s hovering close to $92,000 and Ethereum’s comfortably above $3,200, so the overall mood is still pretty bullish. With the big coins steady, more investors are looking for solid altcoin plays—and Chainlink’s comeback is grabbing attention.

The U.S. SEC has just approved Bitwise’s spot Chainlink ETF for the New York

$LINK is hanging out above $13 after jumping about 12% over the last week. It’s one of the top performers in altcoins lately. Bitcoin’s hovering close to $92,000 and Ethereum’s comfortably above $3,200, so the overall mood is still pretty bullish. With the big coins steady, more investors are looking for solid altcoin plays—and Chainlink’s comeback is grabbing attention.

The U.S. SEC has just approved Bitwise’s spot Chainlink ETF for the New York

LINK-0.94%

- Reward

- 2

- 1

- Repost

- Share

DexterBrown :

:

Send it higherChainlink just got a serious boost, and this time, big institutions are behind it.

$LINK jumped about 4.5% over the last day, trading around $14.16, right as institutional interest took off. The main spark? News just broke that Bitwise can launch the first U.S. spot Chainlink ETF—ticker CLNK—on NYSE Arca, with Coinbase as custodian. That’s another sign that regulated ways to invest in altcoins keep growing.

But honestly, confidence in LINK isn’t just hanging on one new product. Grayscale’s LINK fund pulled in about $62 million lately. That’s a pretty clear signal—investors want more than just

$LINK jumped about 4.5% over the last day, trading around $14.16, right as institutional interest took off. The main spark? News just broke that Bitwise can launch the first U.S. spot Chainlink ETF—ticker CLNK—on NYSE Arca, with Coinbase as custodian. That’s another sign that regulated ways to invest in altcoins keep growing.

But honestly, confidence in LINK isn’t just hanging on one new product. Grayscale’s LINK fund pulled in about $62 million lately. That’s a pretty clear signal—investors want more than just

LINK-0.94%

- Reward

- 2

- Comment

- Repost

- Share

Morgan Stanley just took its biggest leap into crypto yet.

Wall Street just delivered another big message to the crypto world. Morgan Stanley—yeah, the one with nearly $9 trillion under management—filed S-1 registrations with the SEC for both Bitcoin and Solana ETFs. This isn’t a test run. They’re going straight after regulated, institutional exposure to both $BTC and $SOL

Here’s what they’re planning: two separate trusts, one for Bitcoin and one for Solana. The Bitcoin trust gives investors direct price exposure, nothing fancy. The Solana trust adds a twist—it’ll include staking, so the fun

Wall Street just delivered another big message to the crypto world. Morgan Stanley—yeah, the one with nearly $9 trillion under management—filed S-1 registrations with the SEC for both Bitcoin and Solana ETFs. This isn’t a test run. They’re going straight after regulated, institutional exposure to both $BTC and $SOL

Here’s what they’re planning: two separate trusts, one for Bitcoin and one for Solana. The Bitcoin trust gives investors direct price exposure, nothing fancy. The Solana trust adds a twist—it’ll include staking, so the fun

- Reward

- 1

- Comment

- Repost

- Share

CPI next week could decide $BTC ’s next big move

Everyone’s watching next week’s U.S. CPI numbers, and honestly, this one feels bigger than usual for crypto. December’s inflation data lands January 13, right before the next Fed meeting. It’s the first major economic signal of the year, and it could shake up Bitcoin and the rest of the crypto market.

Last time, CPI surprised everyone by coming in lower than expected. Headline inflation dropped to 2.7%, core CPI hit 2.6%—the lowest since early 2021. People started hoping inflation was cooling off and maybe the Fed could stay more flexible. But t

Everyone’s watching next week’s U.S. CPI numbers, and honestly, this one feels bigger than usual for crypto. December’s inflation data lands January 13, right before the next Fed meeting. It’s the first major economic signal of the year, and it could shake up Bitcoin and the rest of the crypto market.

Last time, CPI surprised everyone by coming in lower than expected. Headline inflation dropped to 2.7%, core CPI hit 2.6%—the lowest since early 2021. People started hoping inflation was cooling off and maybe the Fed could stay more flexible. But t

BTC-2.94%

- Reward

- 1

- Comment

- Repost

- Share

Trending Topics

View More22.52K Popularity

9.8K Popularity

4.58K Popularity

36.36K Popularity

247.29K Popularity

Pin