TonyTheBull

لا يوجد محتوى حتى الآن

TonyTheBull

لقد أصبحت الذهب بالتأكيد سائدة في التيار الرئيسي

شاهد النسخة الأصلية

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

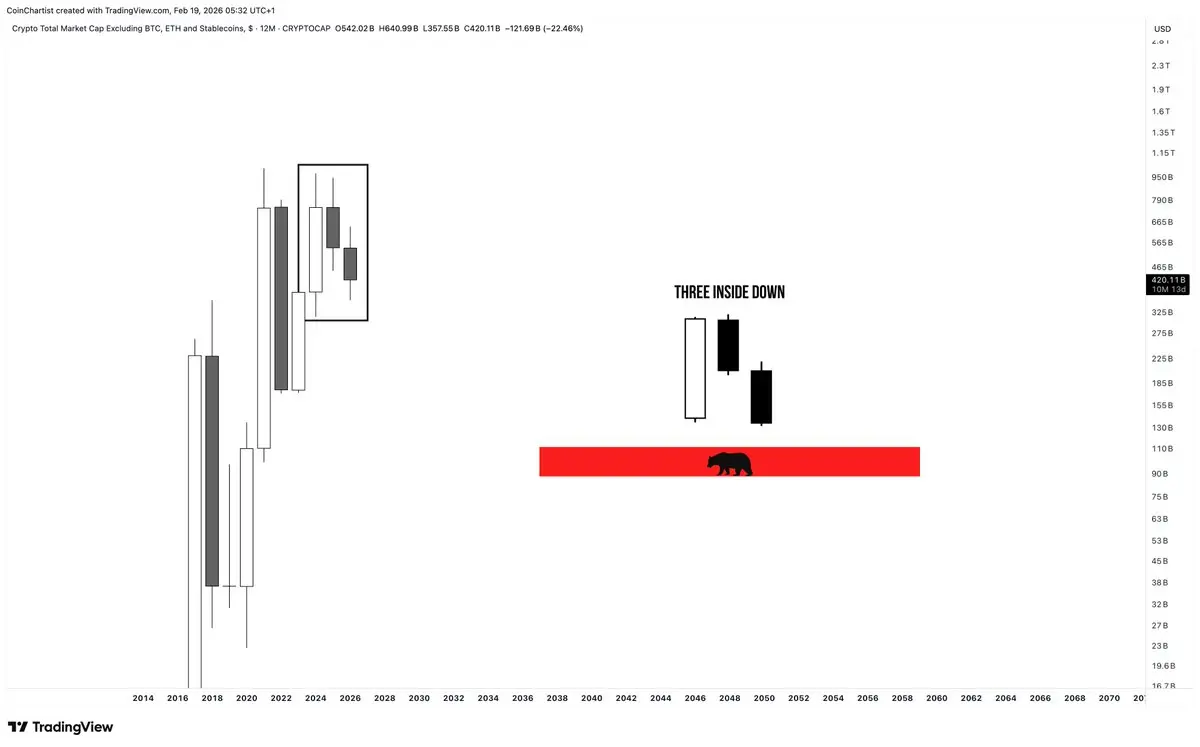

الابتلاع الهابط، الثلاثة داخل أسفل، ونجمة المساء

تحليل الشموع اليابانية هو أداة قيمة أخرى تخبرك بسيكولوجية الجماهير التي تتكشف

شاهد النسخة الأصليةتحليل الشموع اليابانية هو أداة قيمة أخرى تخبرك بسيكولوجية الجماهير التي تتكشف

- أعجبني

- 2

- تعليق

- إعادة النشر

- مشاركة

في بعض الأحيان، على الرغم من أن الأمور سيئة، إلا أنها تزداد سوءًا قبل أن تصل إلى القاع

هذا له معنى أكثر مما تتخيل

شاهد النسخة الأصليةهذا له معنى أكثر مما تتخيل

- أعجبني

- 1

- تعليق

- إعادة النشر

- مشاركة

تكرار سوق الدببة في البيتكوين

هل من المحتمل أن تمتد موجة الدفع هذه؟ إذا كان الأمر كذلك، فالهدف تقريبًا تحت $45K

هل من المحتمل أن تمتد موجة الدفع هذه؟ إذا كان الأمر كذلك، فالهدف تقريبًا تحت $45K

BTC-3.35%

- أعجبني

- 3

- تعليق

- إعادة النشر

- مشاركة

الشرطة بولينجر الأسبوعية لمؤشر S&P 500 هي الأضيق منذ ما قبل COVID

العاطفة تتضيق، والصبر وإدارة المخاطر ضروريان

شاهد النسخة الأصليةالعاطفة تتضيق، والصبر وإدارة المخاطر ضروريان

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

نظرة سريعة على إعدادات التداول وعملية التفكير التي أوجهها للمشتركين

تحصل على الرسم البياني، والإعدادات، والتحليل الفني، والأهم من ذلك، رأيي في نفسية السوق

شاهد النسخة الأصليةتحصل على الرسم البياني، والإعدادات، والتحليل الفني، والأهم من ذلك، رأيي في نفسية السوق

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

- أعجبني

- 2

- تعليق

- إعادة النشر

- مشاركة

“…لذا كان علي قياس الجرامات”

-بيجي سمولز ( هو الأذكى)

شاهد النسخة الأصلية-بيجي سمولز ( هو الأذكى)

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

أنا أُحجب الأشخاص الغبيين والكذابين والمحتالين والأشخاص الذين لا يتحملون المسؤولية

ليس فقط على X بل في كل مجالات حياتي

شاهد النسخة الأصليةليس فقط على X بل في كل مجالات حياتي

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

مؤشر الدولار الأمريكي DXY قد شكل تقاطع ذهبي على إطار زمني ربعي (3M)

تشير البيانات إلى أن التقاطعات الذهبية/القاتلة تكون أكثر فاعلية عندما يكون السعر قريبًا من المتوسطات المتحركة

السعر يقف مباشرة فوقها، ويعيد اختبارها كدعم للعام الماضي وقد صمد

قبل عامين، لفتت الانتباه إلى هذا التقاطع القاتل المتوقع وقلت إنه قادم – ماذا يخبرنا بالضبط الآن؟

لا أعتقد أن هناك شيئًا جيدًا

شاهد النسخة الأصليةتشير البيانات إلى أن التقاطعات الذهبية/القاتلة تكون أكثر فاعلية عندما يكون السعر قريبًا من المتوسطات المتحركة

السعر يقف مباشرة فوقها، ويعيد اختبارها كدعم للعام الماضي وقد صمد

قبل عامين، لفتت الانتباه إلى هذا التقاطع القاتل المتوقع وقلت إنه قادم – ماذا يخبرنا بالضبط الآن؟

لا أعتقد أن هناك شيئًا جيدًا

- أعجبني

- 3

- تعليق

- إعادة النشر

- مشاركة

العملات الرقمية البديلة (TOTAL3ES) شهدت تقاطع الموت على الإطار الأسبوعي

بيانات الانخفاض تأتي إلى Slice في أي لحظة

قد تزداد الأمور سوءًا قبل أن تتحسن

شاهد النسخة الأصليةبيانات الانخفاض تأتي إلى Slice في أي لحظة

قد تزداد الأمور سوءًا قبل أن تتحسن

- أعجبني

- 2

- تعليق

- إعادة النشر

- مشاركة

مخطط العملات البديلة السنوي (TOTAL3ES 12M) يشكل حاليًا نمط Inside Down ثلاثي

هذا نمط انعكاس هبوطي محتمل في تحليل الشموع اليابانية

مثل هذا النمط القمة على مخطط سنوي قد يشير إلى سوق هابطة تستمر من 3 إلى 5 سنوات (على الأقل) للعملات البديلة

اطلع على باقي تحليلي للعملات البديلة ذات الإطارات الزمنية العالية الذي سيأتي طوال بقية هذا الأسبوع على Slice (الرابط في السيرة الذاتية)

شاهد النسخة الأصليةهذا نمط انعكاس هبوطي محتمل في تحليل الشموع اليابانية

مثل هذا النمط القمة على مخطط سنوي قد يشير إلى سوق هابطة تستمر من 3 إلى 5 سنوات (على الأقل) للعملات البديلة

اطلع على باقي تحليلي للعملات البديلة ذات الإطارات الزمنية العالية الذي سيأتي طوال بقية هذا الأسبوع على Slice (الرابط في السيرة الذاتية)

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

مؤشر القوة النسبية الشهري لللايتكوين هو الأكثر بيعًا على الإطلاق في تاريخه

LTC-2.99%

- أعجبني

- 2

- تعليق

- إعادة النشر

- مشاركة

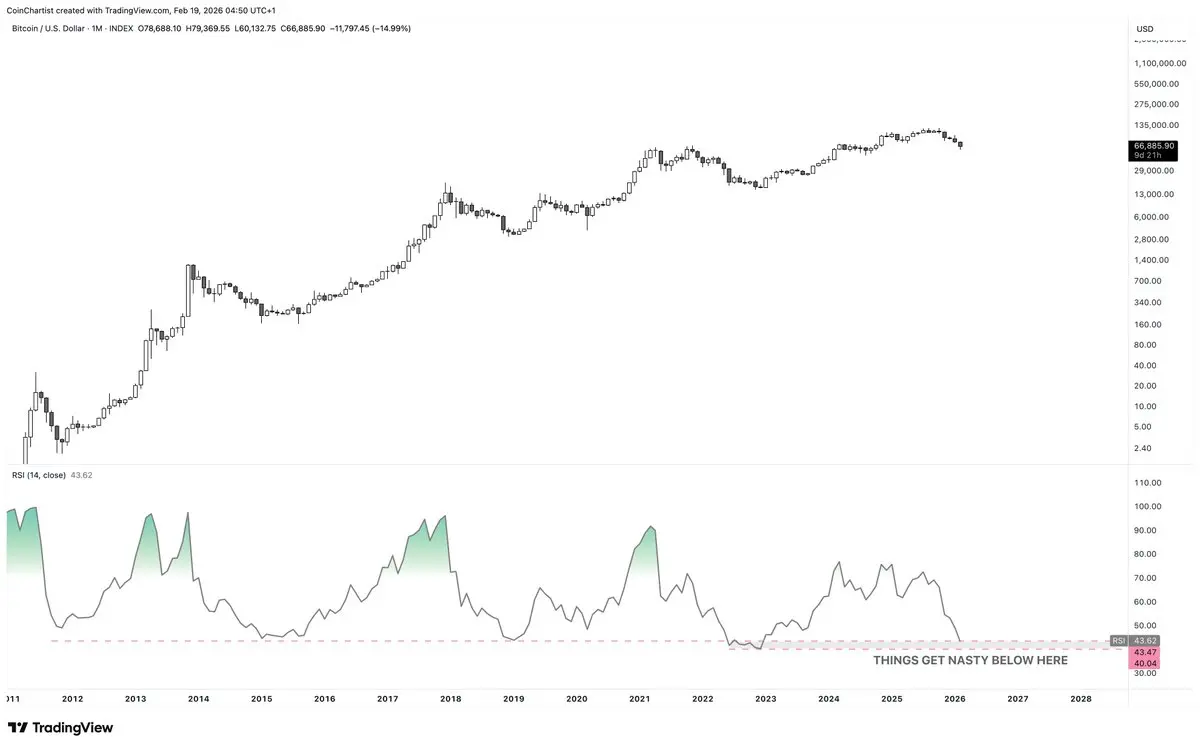

مؤشر القوة النسبية الشهري لبيتكوين هو ثاني أكثر المؤشرات تشبعًا بالبيع على مدى دورة – أكثر من قيعان السوق الهابطة في عامي 2014 و2018

مؤشر القوة النسبية في اتجاه هبوطي، حيث يحقق ارتفاعات أدنى وقيعان أدنى في كل قمة وقاع دورة منذ عام 2017 – وهو الذروة الحالية للزخم

أعتقد أنه سيحقق قاعًا أدنى مرة أخرى ويصل إلى منطقة التشبع بالبيع الحقيقية على مؤشر القوة النسبية الشهري للمرة الأولى على الإطلاق

مؤشر القوة النسبية في اتجاه هبوطي، حيث يحقق ارتفاعات أدنى وقيعان أدنى في كل قمة وقاع دورة منذ عام 2017 – وهو الذروة الحالية للزخم

أعتقد أنه سيحقق قاعًا أدنى مرة أخرى ويصل إلى منطقة التشبع بالبيع الحقيقية على مؤشر القوة النسبية الشهري للمرة الأولى على الإطلاق

BTC-3.35%

- أعجبني

- 1

- تعليق

- إعادة النشر

- مشاركة

المواضيع الرائجة

عرض المزيد392.67K درجة الشعبية

132.22K درجة الشعبية

442.1K درجة الشعبية

22.09K درجة الشعبية

140.31K درجة الشعبية

Gate Fun الساخن

عرض المزيد- القيمة السوقية:$2.4Kعدد الحائزين:20.11%

- القيمة السوقية:$2.39Kعدد الحائزين:20.14%

- القيمة السوقية:$2.37Kعدد الحائزين:10.00%

- القيمة السوقية:$0.1عدد الحائزين:10.00%

- القيمة السوقية:$0.1عدد الحائزين:10.00%

تثبيت