Alpaca Finance: A Resilient Leverage Protocol in the Expanding DeFi Landscape

Feasibility Experiment of Decentralized Lending

In the DeFi space, leveraged lending protocols are emerging one after another, but Alpaca Finance has successfully established itself in the competitive BNB Chain ecosystem. It is not just a platform that provides lending services; it is also a flexible, robust financial toolbox that allows users to manage assets freely on-chain, amplify leverage, participate in mining, and protect asset value through risk control.

High-efficiency financial system built on BNB Chain

Choosing to deploy on the BNB Chain is no coincidence. Compared to Ethereum, BNB offers lower fees, higher transaction throughput, and more mature development support, allowing Alpaca to provide leveraged trading and automated liquidation services more efficiently. In addition, EVM compatibility also means that the platform can integrate with a wider range of DeFi tools and protocols, creating a more open asset operation environment.

Practice of Open Finance

In the design logic of Alpaca, borrowing does not require traditional financial credit checks; users only need to collateralize assets to borrow funds and open leveraged positions. Through smart contracts, interest rate calculations and fund allocations are automated, and the system adjusts automatically based on real-time market liquidity. This not only lowers the threshold for capital operation but also provides a pathway for atypical users (such as those without bank accounts) to enter the financial market.

ILP protection mechanism

The Instant Loss Protection launched by Alpaca Finance is a highlight of the platform. When the market fluctuates sharply, this mechanism can automatically close positions under preset conditions, reducing the risk of substantial losses. This feature is equivalent to bringing institutional-level risk control tools on-chain, providing a highly valuable safety net for small and medium asset players.

ALPACA’s Dual Yield Strategy

The platform encourages users to participate in liquidity provision, with typical operations such as forming a liquidity pair with ALPACA and BNB, and staking for mining on platforms like PancakeSwap. These operations create dual revenue opportunities for users through transaction fee rewards and platform token incentives. However, participants must also face potential risks such as impermanent loss, making it crucial to understand asset allocation and capital management.

Multi-party technical cooperation strengthens the ecosystem

Alpaca Finance has not closed itself off from development, but has chosen to deeply integrate with other infrastructures, such as collaborating with Chainlink oracles to obtain real-time price data, and connecting liquidity protocols with platforms like ForTube. These collaborations have allowed ALPACA’s application scenarios to extend beyond a single interface and into other DeFi ecosystems.

Protocol Risks and Challenges

In the face of the existence of DeFi giants like Aave and Compound, Alpaca Finance cannot ignore the gap in ecological resources and brand trust. In addition, technical risks such as smart contract vulnerabilities and governance errors are always present, and the platform still needs to continuously strengthen its auditing mechanisms, open-source development transparency, and community education to reduce the impact of potential black swan events on platform trust.

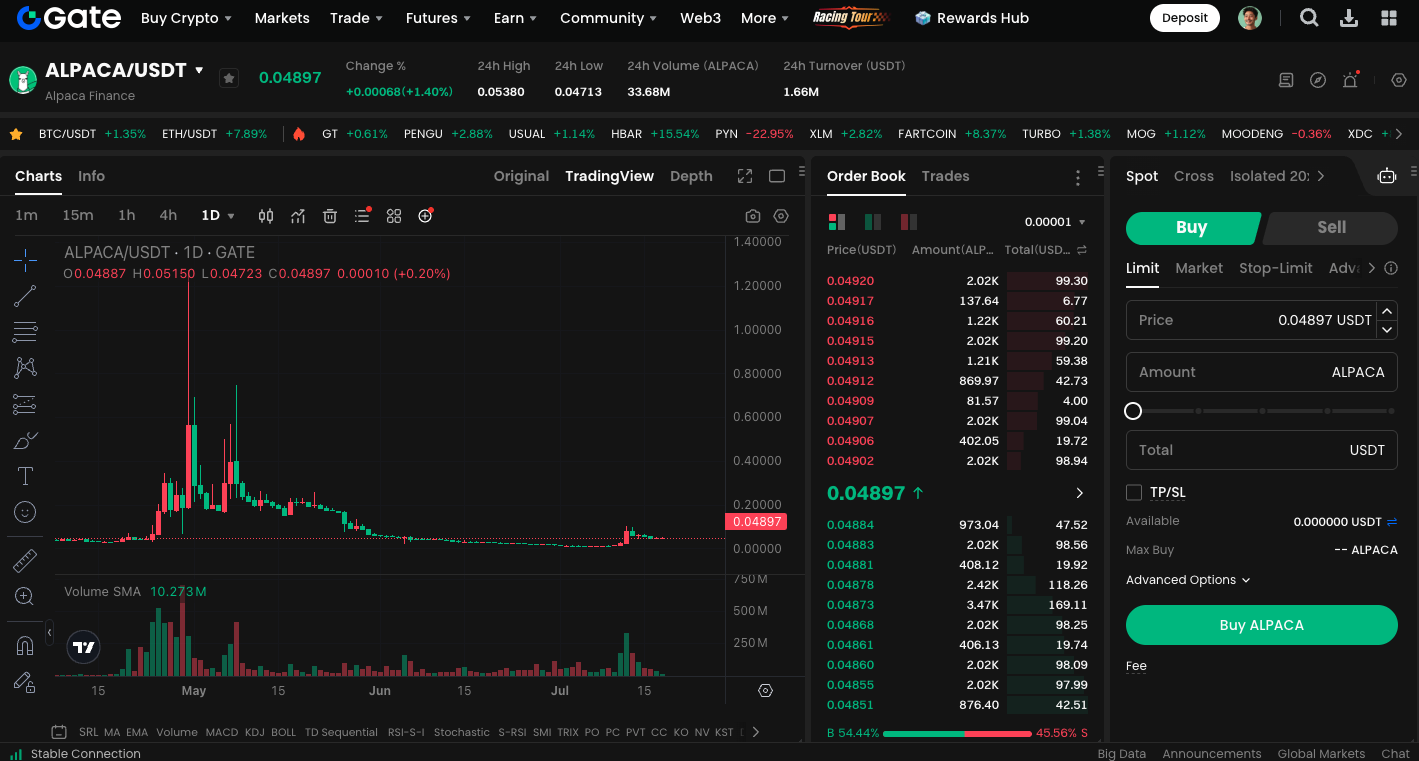

ALPACA_USDT is the entry point of the entire financial philosophy.

The spot trading of ALPACA_USDT is not just an entry point for entering and exiting the market, but also symbolizes a vote by DeFi users to participate in the decentralized finance system. It is both a tool and a ticket, leading to a new financial world where trust in third parties is not required and assets are self-managed.

Start trading ALPACA spot immediately:https://www.gate.com/trade/ALPACA_USDT

Summary

Alpaca Finance will move towards multi-chain integration, the combination of privacy protocols (such as ZK technology), expansion of NFT applications, and even consider extending to real-world application areas such as supply chain finance and cross-border payments. If it can continue to strengthen its core functions and maintain a highly transparent operating model, ALPACA has the opportunity to become an indispensable gear in the Decentralized Finance system.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution