What’s Skatechain?

Introduction

In the multi-chain Web3 landscape, application fragmentation is a growing challenge. Developers need to deploy and maintain apps across numerous blockchains. Traditional on-chain infrastructure often leads to inefficient duplication of resources. Skatechain addresses this issue by providing a universal application layer that reduces fragmentation and promotes modularity in Web3. It allows developers to run applications across thousands of chains simultaneously, with core apps developed and maintained in a shared pool accessible to all chains. This ensures efficient management of essential functions while enabling each chain to focus on its unique value proposition.

About Skatechain

Skatechain is a universal application layer that integrates all virtual machines (VMs) into a single shared state. It enables apps to run across thousands of chains within one cohesive framework. It monitors the state of each network; when users initiate cross-chain actions, they sign “intents” that are tracked and executed in real-time by executors. With Fast Finality, Skatechain ensures quick transaction completion and a seamless user experience. Embedding interoperability into application logic reduces fragmentation, simplifies development, and provides users with a consistent ecosystem for effortless cross-chain transactions and data flow.

Project Background

Team Members

Skate is led by a team of financial engineers and blockchain developers with extensive experience in digital asset trading:

Siddharth Lalwani, Co-founder & CEO

Graduated from Nanyang Technological University, Singapore.Tony Sun, Co-founder & COO

Former Head of Spot Trading at Blockchain.com and Head of Institutional Sales at Altonomy. Graduate of Cornell University.

Other core team members come from leading firms such as Altonomy, Point72, Bybit, Certik, and Citigroup, bringing deep expertise in blockchain and digital assets.

Funding

In September 2023, Skatechain raised $3.75 million in a seed funding round, led by HashKey Capital and Nomad Capital, with additional support from Spark Digital Capital, Mirana Ventures, Symbolic Capital, Asymm Ventures, and Comma3 Ventures.

The funds will be allocated towards further developing Skate’s unified on-chain asset management platform, as well as expanding its team and community.

Architecture

Skate’s infrastructure is built on three core layers:

- Kernel Layer: The central hub responsible for processing logic and managing application state.

- Preconfirmation AVS: A system deployed on Eigenlayer that securely delegates restaked ETH to Skate’s executor network. This is the main source of truth and ensures correct execution on target chains.

- Executor Network: Carries out application-defined actions. Each app has its own set of executors.

As a central chain, Skate maintains and updates the shared state. It sends commands to connected peripheral chains, which only respond to data provided by Skate. Each executor, registered as an AVS operator, performs these tasks. In case of dishonest behaviour, the Preconfirmation AVS can be used to penalize bad actors.

Kernel Layer

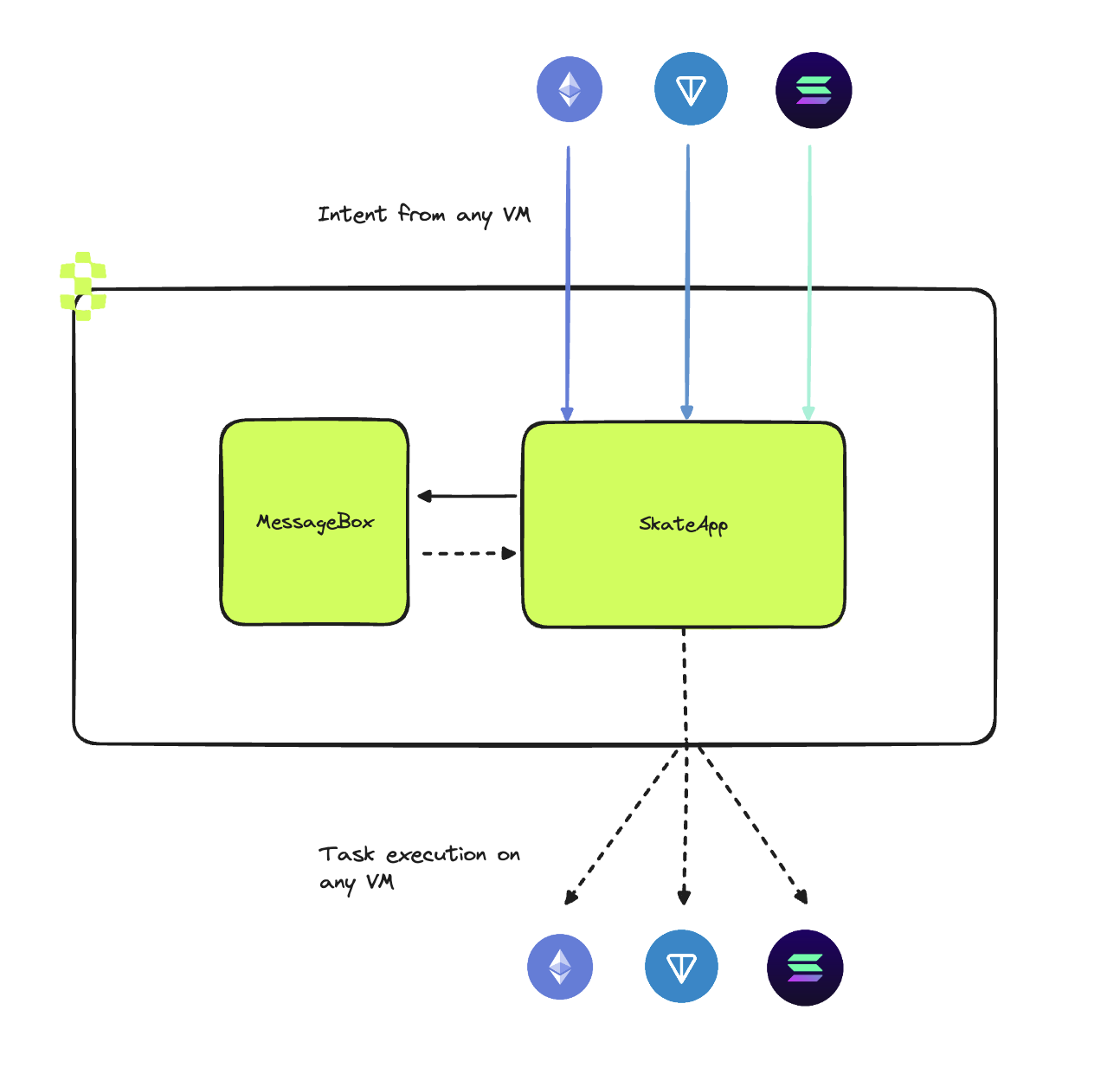

The kernel manages the unified state and essential logic. It is composed of:

- Message Box: A single contract registering all Skate app user intents and execution interfaces. It’s the entry point for creating intents and serves as a task queue for executors.

- Skate App: A base contract that all core implementations inherit. Functions include:

- Translating user intents into executable tasks.

- Pushing data to the Message Box.

- Connecting the core app to all peripheral apps on the target chains.

Preconfirmation AVS

This layer integrates Skate’s Preconfirmation AVS with Othentic’s stateless rollup stack

Othentic Stack uses the libp2p protocol for node communication. It ensures the robustness, efficiency, and decentralization of the proof process. The system consists of the following four types of nodes:

- Task Executors: Fetch tasks from the Message Box, sign them, and publish via JSON-RPC. In data-intensive apps (e.g., oracles), they serve as data sources or pre-validation entities within the AVS network, such as applications that require Oracle services.

- Task Aggregators: Monitors and aggregates proofs within the network. It receives updates from executors and publishes tasks to the p2p channel, thus effectively requesting provers to participate in the proof process.

- Provers: Subscribes to the p2p channel and participates in the proof process using BLS signatures. These nodes are responsible for validating the underlying task data (executor call data) and are rewarded or penalized based on their validation’s accuracy.

- Bootstrappers: These powerful nodes maintain the activity of the p2p network by managing and updating the distributed hash table used for peer discovery.

Periphery Layer

Periphery Contracts are deployed on connecting chains, such as TonVM, EVM, Solana VM, etc. These contracts serve as the interface for end-user interactions. They contain arbitrary logic and reference the core to share storage. Periphery contracts consist of the following two components:

Skate Gateway: Defines executor settlement interfaces, contingent on preconfirmed calldata signed by a relayer. Key features:

- Relayer Definition: Relayers from AVS verify and vouch for preconfirmed data.

- External Calls: Can invoke any peripheral contract.

- Task Tracking: Ensures state consistency with the kernel.

Skate Periphery Contract: A base contract for all peripheral implementations. It must pre-register the Gateway address and restrict state modification rights to the Gateway. It facilitates interactions on the local chain as instructed by the kernel.

Project Innovation

Cross-VM Interaction

Cross-virtual machine (VM) interaction refers to the seamless transfer of data, assets, and functionalities between different virtual machines. This breakthrough technology eliminates the isolation of traditional blockchain ecosystems. This innovation allows users and developers to interact across VMs without compatibility or technical barriers.

How cross-VM interaction addresses current blockchain limitations:

- Eliminating Blockchain Silos: Traditional blockchain ecosystems restrict asset and data movement across chains, forcing developers to replicate and maintain applications on each network. Cross-VM interaction overcomes this by offering unified interfaces and protocols that facilitate smooth collaboration between apps across different chains.

- Enhanced Efficiency and Seamless User Experience: Users can effortlessly interact with applications across various VMs without the hassle of switching networks or wallets. This significantly enhances the experience.

- Simplified Development Process: Developers can concentrate on building key features without repetitive redesigns and redeployments for each separate chain.

In Skatechain’s Skate Park, users can interact with random EVM-based applications via cross-VM transactions. For example, a user can initiate a payment on one VM, while execution and confirmation happen on another—all without any visible friction from the user’s perspective.

Stateless Apps

A Stateless App is an application that does not rely on maintaining local state. Skatechain introduced the first stateless app capable of running seamlessly across 20+ chains. It enables cross-chain coordination by utilizing a shared state pool. Key benefits include:

- Simplified Development: Developers don’t have to manage the state of each chain.

- Seamless User Experience: Users can interact with the same application across multiple chains without concerns over state discrepancies.

- Improved Efficiency: By utilizing a shared state pool, stateless applications minimize redundant computations and storage.

Skatechain is currently piloting stateless integrations with Polymarket on TON and Solana. This significantly enhances the user experience by enabling direct interactions with Polymarket through users’ native chains and wallets. Users don’t have to bridge or engage in cross-chain interactions.

Skate AMM

In traditional AMMs, liquidity is siloed by chain and constrained by the constant product formula x×y=k, which caps pool depth to what’s locally available. For new chains, establishing and scaling liquidity pools is a slow, resource-heavy process, which leads to fragmented liquidity, inconsistent pricing, and limited depth.

Skate AMM revolutionizes the model by implementing a centralized bitmap—an aggregated liquidity source accessible across all chains. This approach grants emerging chains instant access to liquidity on par with established networks, regardless of their native pool size. When a user initiates a trade on any supported chain, pricing is sourced from Skate AMM, guaranteeing consistent and accurate quotes throughout the ecosystem.

Here’s an example of exchanging ETH for USDC. In today’s multi-chain ecosystem, each blockchain typically manages its own liquidity pool. As a result, users across different chains experience variable pricing, which is influenced by the local liquidity. This often leads to higher slippage and inconsistent exchange rates, especially on new chains with shallow liquidity.

With Skate AMM, however, this dynamic is wholly transformed. Imagine a user initiating an ETH/USDC swap on a newly launched chain. Thanks to Skate’s aggregated liquidity model, which harmonizes and maintains pricing across all connected chains, users receive pricing that reflects deeper liquidity pools. This means that even on chains with limited liquidity, Skate can offer competitive, stable prices typically found only on well-established networks.

Tokenomics

Token Supply

Skatechain’s native asset, $SKATE, has yet to disclose its full supply. However, the following details have been made available:

12% of the token supply is dedicated to fostering community growth—rewarding early adopters and active participants.

An initial 1% has been distributed to Yappers via the Kaito AI leaderboard as part of early engagement efforts.

Token Utility

- Transaction Fees: $SKATE serves as the native gas token for transactions across the Skatechain network. It supports core infrastructure and execution.

- Governance: Holders can participate in protocol governance—voting on upgrades, proposals, and ecosystem direction. This ensures decentralized and community-driven development.

- Staking & Rewards: Users can stake $SKATE to earn rewards, contributing to network security and liquidity. Staking promotes long-term alignment and helps stabilize token dynamics.

- In-App Utility: In apps like Skate Park, users earn Ollies through cross-VM interactions. Ollies are redeemable for $SKATE, incentivizing engagement and reinforcing on-chain activity.

Project Development

Key Milestones

- 2024

April 3: Skate is introduced as the first universal application layer for all chains. This marks a key breakthrough in blockchain interoperability. \

August 9: The first stateless app is launched. It operates seamlessly across 20+ chains, setting a new standard for multi-chain dApps. \

October 28: Skate unveils the Shadow Mainnet, a major step in its technical maturity and infrastructure development.

- 2025

January 24: Introduction of the Execution Network, designed to support cross-VM settlements at trillion-dollar scale—highlighting Skate’s ambition to become the backbone for high-throughput, interoperable blockchains.

March 2: Strategic partnership with EigenLayer to power robust dApps via stateless infrastructure, enabling them to run across diverse blockchain ecosystems, marking a pivotal moment in multi-chain dApp architecture.

Looking Ahead

- Expanding Stateless Applications: Skate plans to extend stateless app access to more chains—including Solana and other EVM-compatible chains—to achieve seamless multi-chain deployment for apps like Polymarket.

- Enhancing Cross-Chain Interactions: Skate will continue optimizing its cross-chain capabilities to ensure smooth user and developer experiences across networks, thus further unifying the blockchain ecosystem.

- Pushing DeFi and RWA Use Cases: The team is focused on applying its tech stack to decentralized finance and real-world asset use cases—optimizing liquidity flows and exploring cross-chain management of stablecoins and off-chain assets.

- Community & Developer Incentives: Through Testnet Campaigns and other initiatives, Skate will incentivize developers and users to actively contribute to ecosystem growth.

Risk Analysis

Following a review of Skatechain’s developmental progress and recent milestones, it is clear that the project has made significant advancements in both technological innovation and ecosystem expansion. However, as the platform scales and the underlying cross-chain architecture becomes more complex, Skatechain must also confront a growing set of potential risks and challenges. These risks arise not only from the technical intricacies of implementation and increasing market competition but also from the evolving global regulatory landscape. In the following sections, we will examine these risks in greater detail and explore how Skatechain is positioning itself to address them to ensure sustainable long-term growth and preserve its competitive edge within the broader blockchain ecosystem.

Technical Risks

- Smart Contract Vulnerabilities: Skatechain’s core operations are built on smart contracts—self-executing code that underpins its cross-chain interactions and stateless applications. However, once deployed, smart contracts are often resistant to modifications. This means that any flaws or vulnerabilities could serve as potential attack vectors. A stark reminder of this risk is the infamous DAO hack, which demonstrated how a single vulnerability in a smart contract could result in catastrophic financial losses and systemic failure. To mitigate such risks, Skatechain must ensure rigorous security audits and implement robust contract logic before the mainnet launch.

- Complexity of Cross-Chain Interactions: Cross-chain interoperability is one of Skatechain’s core strengths. It enables users to interact with applications across different virtual machines. However, the process involves highly complex asset transfers between chains and carries inherent risks such as transaction latency and replay attacks, which could undermine user experience and system stability.

For instance, on August 2, 2022, the cross-chain bridge Nomad fell victim to a severe exploit, which led to a loss of approximately $190 million in cryptocurrency assets. The underlying cause was a vulnerability during the contract initialization phase, which enabled attackers to circumvent the message validation logic and withdraw funds at will. By manipulating the committedRoot parameter, attackers bypassed the authorization checks to execute unauthorized asset transfers.

Skatechain must take valuable lessons from the Nomad incident when designing its cross-chain infrastructure. By implementing thorough auditing processes, robust verification systems, and real-time monitoring tools, Skatechain can significantly reduce cross-chain vulnerabilities and build greater trust within its ecosystem.

- Degree of Decentralization: Decentralization is a core principle of blockchain, but certain cross-chain protocols still exhibit centralized characteristics. This makes them vulnerable to internal breaches or external threats. Skatechain must prioritize decentralization by utilizing distributed nodes and implementing resilient consensus mechanisms to strengthen the security and dependability of its network.

Market Risks

Regarding technological competition, LayerZero has emerged as a formidable contender with its lightweight messaging protocol. It leverages oracles and relayers to facilitate cross-chain data transmission with minimal friction. Its streamlined approach to interoperability poses a direct challenge to Skatechain’s model. Similarly, Wormhole, initially developed to link Ethereum and Solana, has grown its cross-chain volume significantly. It benefits from Solana’s thriving ecosystem. With its large-scale transactional capabilities and deep integrations, Wormhole poses a direct competitive threat to Skatechain’s market share.

NEAR has leveraged its sharding architecture and Rainbow Bridge to establish interoperability with Ethereum and secured a strong position in the DeFi and NFT sectors. The rapid growth of NEAR’s ecosystem, particularly in developer support and funding incentives, makes it an attractive option for developers. This poses a direct challenge to Skatechain’s ecosystem expansion efforts. Meanwhile, Solana continues to stand out in cross-chain technology. Particularly, it offers exceptional transaction speed and cost-efficiency, which has helped it attract a significant developer and user base. With its strong brand presence and market momentum, Solana puts additional pressure on Skatechain in the race to gain adoption among developers and users.

As the cross-chain infrastructure space matures, institutional interest continues to rise. However, institutional players generally favour projects that have demonstrated sustained technical robustness and long-term viability. To earn their trust, Skatechain must prove its ability to innovate continuously and show consistent market success—two factors that will be vital in ensuring long-term growth and support.

In summary, Skatechain faces a competitive landscape that is shaped by technical innovation, ecosystem expansion, financial backing, and institutional credibility. To stay ahead, Skatechain must invest heavily in R&D, focus on ecosystem growth, enhance user experience, and strengthen its brand positioning.

Regulatory Risks

Given blockchain technology’s global reach, Skatechain must navigate a fragmented and ever-evolving regulatory landscape across multiple jurisdictions.

MiCA Compliance (EU):

- GDPR Compliance: Under the Markets in Crypto-Assets (MiCA) regulation, crypto asset service providers (CASPs) are required to adhere to the General Data Protection Regulation (GDPR). This entails obtaining clear user consent, minimizing data collection, and ensuring transparency in data usage.

- KYC/AML Compliance: MiCA mandates rigorous anti-money laundering (AML) and know-your-customer (KYC) procedures. CASPs must verify user identities, evaluate risk profiles, and securely maintain records. High-risk activities, such as significant cross-border transactions, are subject to enhanced due diligence (EDD).

- Data Storage and Protection: Under MiCA, CASPs must establish comprehensive cybersecurity protocols to protect user data from cyber threats and breaches. This involves employing encryption, access controls, and other safeguards to maintain data integrity and confidentiality.

SEC Data Compliance (U.S.):

- Record Retention: According to SEC Rule 17a-4, firms are required to retain customer account records for a minimum of six years, trade confirmations or order tickets for at least three years, and all written and electronic business communications for at least three years.

- Data Storage and Retrieval: The SEC mandates that companies organize and index all records to ensure they can be quickly retrieved. Records must generally be accessible within 24 hours of a regulatory request. This requires the use of advanced indexing systems for efficient searching and retrieval.

- Data Integrity and Security: The SEC requires comprehensive safeguards to prevent unauthorized data access, tampering, or destruction. This includes encrypted storage, controlled access, and other robust cybersecurity practices to protect sensitive financial information.

Conclusion

As a pioneer in cross-chain technology, Skatechain is positioned at the forefront of blockchain innovation. While it faces technical, regulatory, and market challenges, its ongoing innovation and strategic risk mitigation efforts position it well to navigate these hurdles. If successful, Skatechain stands to play a pivotal role in advancing blockchain interoperability and shaping the future of decentralized technology. Each step forward will carry meaningful implications—not just for Skatechain, but for the broader Web3 ecosystem.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape