Dự báo giá CELR năm 2025: Đánh giá triển vọng tăng trưởng và các yếu tố tác động của thị trường đối với token Celer Network

Giới thiệu: Vị thế thị trường và giá trị đầu tư của CELR

Celer (CELR) là nền tảng Layer 2 mở rộng hiệu năng cao, đã đạt nhiều dấu mốc kể từ khi xuất hiện năm 2019. Đến năm 2025, vốn hóa thị trường CELR đạt 40.810.993 USD, tổng nguồn cung lưu hành khoảng 5.645.454.935 token, giá giữ ở mức xấp xỉ 0,007229 USD. Được xem là “giải pháp mở rộng blockchain”, CELR ngày càng đóng vai trò thiết yếu trong nâng cao hiệu suất blockchain và thúc đẩy ứng dụng thương mại.

Bài viết này phân tích toàn diện xu hướng giá CELR giai đoạn 2025-2030, dựa trên dữ liệu lịch sử, cung cầu thị trường, phát triển hệ sinh thái và yếu tố vĩ mô, cung cấp dự báo giá chuyên sâu cùng chiến lược đầu tư thực tiễn cho nhà đầu tư.

I. Lịch sử giá và hiện trạng thị trường CELR

Lịch sử biến động giá CELR

- 2019: CELR ra mắt, giá ban đầu khoảng 0,473 USD

- 2020: Thị trường lao dốc, giá giảm sâu kỷ lục xuống 0,00095575 USD ngày 13 tháng 3

- 2021: Đỉnh tăng giá, CELR đạt mức cao nhất lịch sử 0,194843 USD vào ngày 26 tháng 9

Tình hình thị trường hiện tại của CELR

Đến ngày 01 tháng 10 năm 2025, CELR giao dịch ở mức 0,007229 USD. Giá tăng 0,79% trong 1 giờ gần nhất, tăng 1,18% trong tuần qua, nhưng giảm 3,23% trong 30 ngày và giảm mạnh 42,80% so với cùng kỳ năm trước. Giá hiện thấp hơn 96,29% so với đỉnh lịch sử và cao hơn 656,80% so với đáy lịch sử. Vốn hóa thị trường đạt 40.810.993,73 USD, định giá pha loãng hoàn toàn 72.290.000 USD, CELR hiện xếp thứ 777 trên thị trường crypto. Khối lượng giao dịch 24 giờ là 19.892,36 USD, phản ánh mức hoạt động trung bình.

Nhấn để xem giá CELR hiện tại

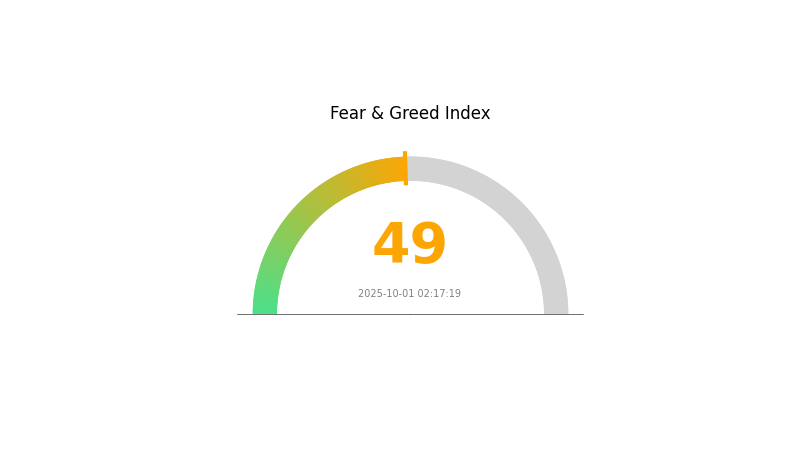

Chỉ báo tâm lý thị trường CELR

01 tháng 10 năm 2025, Chỉ số Sợ hãi & Tham lam: 49 (Trung lập)

Nhấn để xem Chỉ số Sợ hãi & Tham lam hiện tại

Tâm lý thị trường CELR giữ trạng thái trung lập, chỉ số Sợ hãi & Tham lam ở mức 49. Điều này phản ánh nhà đầu tư chưa nghiêng về bi quan hay lạc quan. Thị trường không có xu hướng rõ ràng tạo ra cơ hội cho giao dịch chiến lược. Nhà đầu tư cần theo dõi sát vì tâm lý trung lập có thể nhanh chóng dịch chuyển do tin tức hoặc biến động thị trường. Như thường lệ, nghiên cứu kỹ lưỡng và quản trị rủi ro là yếu tố sống còn khi tham gia thị trường crypto.

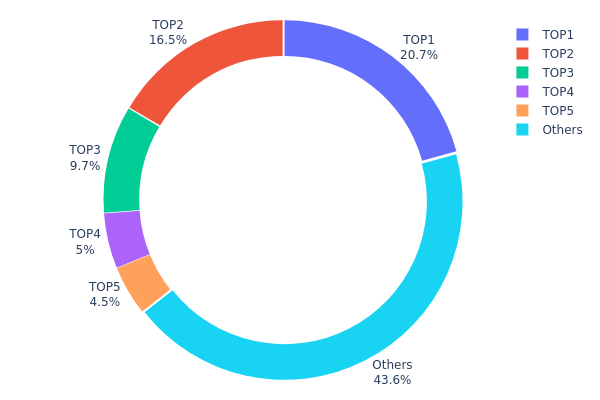

Phân bổ sở hữu CELR

Dữ liệu phân bổ địa chỉ cho thấy quyền sở hữu CELR tập trung cao ở các holder lớn. Địa chỉ lớn nhất giữ 20,73% tổng cung, năm địa chỉ lớn nhất nắm giữ tổng cộng 56,39% token. Mức độ tập trung này cho thấy các holder lớn có thể tác động mạnh đến xu hướng thị trường.

Phân bổ tập trung có thể ảnh hưởng đến ổn định giá. Nếu các holder lớn giao dịch quy mô lớn, thị trường sẽ biến động mạnh. Tuy nhiên, vẫn có 43,61% token phân bổ cho các địa chỉ nhỏ, phản ánh tính phân phối rộng hơn.

Mô hình này cho thấy mức độ tập trung vừa phải trong cấu trúc on-chain của CELR. Dù chưa phải tập quyền tuyệt đối, các holder lớn vẫn có thể tạo ra biến động lớn. Việc giám sát hoạt động của các địa chỉ này là rất quan trọng để nắm bắt rủi ro thị trường.

Nhấn để xem Phân bổ sở hữu CELR hiện tại

| Top | Địa chỉ | Số lượng nắm giữ | Tỷ lệ nắm giữ (%) |

|---|---|---|---|

| 1 | 0x8a4b...a015ce | 2.073.134,55K | 20,73% |

| 2 | 0xa604...d951b2 | 1.646.575,89K | 16,46% |

| 3 | 0xf977...41acec | 970.000,00K | 9,70% |

| 4 | 0x5a52...70efcb | 500.000,00K | 5,00% |

| 5 | 0x0fcb...5bab0c | 450.000,00K | 4,50% |

| - | Khác | 4.360.289,56K | 43,61% |

II. Yếu tố quyết định giá trị tương lai của CELR

Cơ chế cung ứng

- Mở khóa token: Việc mở khóa định kỳ có thể ảnh hưởng tới nguồn cung và giá trị CELR

- Tác động hiện tại: Các lần mở khóa tiếp theo có thể tạo áp lực bán lớn hơn

Ảnh hưởng từ tổ chức và cá mập

- Doanh nghiệp ứng dụng: Nếu doanh nghiệp tăng cường sử dụng CELR sẽ hỗ trợ giá tích cực

Yếu tố vĩ mô

- Tính năng chống lạm phát: Hiệu quả của CELR trong môi trường lạm phát quyết định mức độ hấp dẫn của token này như một tài sản phòng vệ

Phát triển công nghệ và hệ sinh thái

- Layer 2 Scaling Solutions: Công nghệ mở rộng Layer 2 của Celer Network càng phát triển càng nâng cao giá trị và nhu cầu CELR

- Ứng dụng hệ sinh thái: Sự phát triển các DApp và dự án trong hệ sinh thái Celer Network thúc đẩy sử dụng và giá trị CELR

III. Dự báo giá CELR giai đoạn 2025-2030

Dự báo năm 2025

- Kịch bản thận trọng: 0,00512 - 0,00600 USD

- Kịch bản trung lập: 0,00600 - 0,00721 USD

- Kịch bản lạc quan: 0,00721 - 0,00837 USD (cần thị trường thuận lợi và tiến triển dự án tốt)

Dự báo năm 2027-2028

- Giai đoạn thị trường: Có thể bước vào pha tăng trưởng với tỷ lệ ứng dụng tăng

- Phạm vi giá dự báo:

- 2027: 0,00506 - 0,00947 USD

- 2028: 0,00728 - 0,01362 USD

- Yếu tố thúc đẩy: Đột phá công nghệ, tích hợp hệ sinh thái rộng, tâm lý thị trường cải thiện

Dự báo dài hạn 2029-2030

- Kịch bản cơ bản: 0,01147 - 0,01406 USD (tăng trưởng và ứng dụng ổn định)

- Kịch bản lạc quan: 0,01406 - 0,01757 USD (thị trường tăng mạnh, dự án thành công)

- Kịch bản đột phá: 0,01757 - 0,02000 USD (đột phá công nghệ và ứng dụng đại trà)

- 31 tháng 12 năm 2030: CELR 0,01757 USD (đỉnh tiềm năng theo dự báo lạc quan)

| Năm | Giá cao nhất dự báo | Giá trung bình dự báo | Giá thấp nhất dự báo | % biến động |

|---|---|---|---|---|

| 2025 | 0,00837 | 0,00721 | 0,00512 | 0 |

| 2026 | 0,01059 | 0,00779 | 0,00553 | 7 |

| 2027 | 0,00947 | 0,00919 | 0,00506 | 27 |

| 2028 | 0,01362 | 0,00933 | 0,00728 | 29 |

| 2029 | 0,01664 | 0,01147 | 0,00906 | 58 |

| 2030 | 0,01757 | 0,01406 | 0,00956 | 94 |

IV. Chiến lược đầu tư chuyên nghiệp và quản trị rủi ro CELR

Phương pháp đầu tư CELR

(1) Chiến lược nắm giữ dài hạn

- Phù hợp: Nhà đầu tư dài hạn, chấp nhận rủi ro cao

- Khuyến nghị vận hành:

- Tích lũy CELR khi giá giảm

- Đặt mục tiêu giá, chốt lời từng phần

- Lưu trữ token bằng ví phần cứng an toàn

(2) Chiến lược giao dịch chủ động

- Công cụ phân tích kỹ thuật:

- Đường trung bình động: Xác định xu hướng, điểm đảo chiều

- Chỉ báo RSI: Theo dõi trạng thái quá mua/quá bán

- Lưu ý giao dịch theo nhịp sóng:

- Theo dõi chỉ số ứng dụng Layer 2

- Bám sát tiến độ dự án, hợp tác chiến lược

Khung quản trị rủi ro CELR

(1) Nguyên tắc phân bổ tài sản

- Nhà đầu tư thận trọng: 1-3% danh mục crypto

- Nhà đầu tư chủ động: 5-10% danh mục crypto

- Nhà đầu tư chuyên nghiệp: Tối đa 15% danh mục crypto

(2) Giải pháp phòng ngừa rủi ro

- Đa dạng hóa: Kết hợp CELR với token Layer 2 và DeFi khác

- Lệnh cắt lỗ: Thiết lập hạn chế thua lỗ

(3) Giải pháp lưu trữ an toàn

- Ví nóng đề xuất: Gate Web3 wallet

- Ví lạnh: Ví phần cứng cho khoản nắm giữ lâu dài

- An ninh: Kích hoạt xác thực 2 lớp, dùng mật khẩu riêng biệt

V. Rủi ro và thách thức tiềm tàng với CELR

Rủi ro thị trường CELR

- Biến động mạnh: Giá có thể lên xuống đột ngột

- Cạnh tranh: Các giải pháp Layer 2 khác có thể vượt trội hơn

- Rủi ro thanh khoản: Khối lượng giao dịch thấp dễ gây trượt giá

Rủi ro pháp lý CELR

- Quy định chưa ổn định: Chính sách tiền mã hóa vẫn đang thay đổi

- Thách thức tuân thủ: Có thể khó khăn với giao dịch xuyên biên giới

- Ảnh hưởng thuế: Luật thuế thay đổi có thể tác động đến nhà đầu tư CELR

Rủi ro kỹ thuật CELR

- Lỗ hổng hợp đồng thông minh: Có nguy cơ bị khai thác hoặc lỗi kỹ thuật

- Thách thức mở rộng: Có thể gặp vấn đề khi mạng tăng trưởng mạnh

- Khả năng kết nối: Việc tích hợp với blockchain khác có thể phức tạp

VI. Kết luận và khuyến nghị

Đánh giá giá trị đầu tư CELR

CELR có tiềm năng là giải pháp Layer 2, nhưng đối mặt cạnh tranh khốc liệt và biến động lớn. Tiềm năng dài hạn sẽ rõ ràng hơn nếu mức độ ứng dụng tăng, tuy nhiên rủi ro ngắn hạn vẫn rất cao.

Khuyến nghị đầu tư CELR

✅ Người mới: Bắt đầu với vị thế nhỏ, chú trọng học hỏi ✅ Nhà đầu tư kinh nghiệm: Đưa vào danh mục crypto đa dạng ✅ Nhà đầu tư tổ chức: Theo dõi số liệu ứng dụng, phân tích tiềm năng dài hạn

Phương thức giao dịch CELR

- Giao dịch giao ngay: Mua, giữ CELR trên Gate.com

- Staking: Tham gia staking để nhận lợi nhuận bổ sung

- Tích hợp DeFi: Khám phá ứng dụng DeFi dựa trên CELR để tối ưu hóa lợi suất

Đầu tư tiền mã hóa tiềm ẩn rủi ro rất cao, bài viết này không phải khuyến nghị đầu tư. Nhà đầu tư cần cân nhắc kỹ và nên tham khảo chuyên gia tài chính. Không đầu tư quá khả năng chịu đựng rủi ro của bản thân.

FAQ

CELR có thể đạt 1 USD không?

CELR có khả năng đạt mốc 1 USD nhưng sẽ mất nhiều năm. Các dự báo hiện tại cho rằng mục tiêu này chỉ khả thi trong dài hạn, có thể sau năm 2025.

CELR có tương lai không?

CELR có tiềm năng phát triển. Nếu được các ngân hàng ứng dụng và trở nên phổ biến, CELR có thể ghi nhận những bước tiến lớn về hiệu quả và giá trị thị trường.

CELR có thể đạt mức giá nào?

Celer (CELR) có thể lên đến 0,009439 USD vào tháng 12 năm 2025, dựa trên xu hướng và dự báo thị trường hiện tại.

CELR có phải là khoản đầu tư tốt?

CELR tiềm năng tăng trưởng ngắn hạn nhưng biến động mạnh. Dài hạn chưa chắc chắn do lịch sử dao động giá lớn. Nhà đầu tư cần cân nhắc kỹ rủi ro trước khi quyết định.

Mời người khác bỏ phiếu

Nội dung