2025 DAO Price Prediction: Expert Analysis and Market Forecast for the Decentralized Autonomous Organization Token

Introduction: Market Position and Investment Value of DAO

DAO Maker (DAO) serves as a pioneering platform providing startups with growth technology infrastructure and risk-mitigated financing frameworks for investors. Since its inception in 2021, DAO Maker has established itself through innovative fundraising mechanisms including DYCO and SHO models, demonstrating strong market demand and sustainable success. As of 2025, DAO's market capitalization has reached approximately $15.31 million USD, with a circulating supply of around 250.93 million tokens, currently trading at $0.05516 per token. This asset, recognized for its robust tokenomics featuring non-inflationary equity rewards, loyalty utilities, and monetary functions, plays an increasingly vital role in democratizing venture capital opportunities for retail enterprises and advancing decentralized autonomous organization infrastructure.

This article provides a comprehensive analysis of DAO's price trajectory and market dynamics, integrating historical performance patterns, supply-demand mechanisms, ecosystem development, and macroeconomic factors to deliver professional price forecasting and actionable investment strategies for stakeholders through 2030.

DAO Maker (DAO) Market Analysis Report

I. DAO Price History Review and Current Market Status

DAO Historical Price Evolution

DAO Maker token has experienced significant volatility since its launch in February 2021. The token reached its all-time high of $8.71 on April 22, 2021, during the peak of the cryptocurrency bull market. Since this peak, the token has experienced a prolonged downtrend, particularly over the past year with a decline of -83.93%. The token recently tested new lows, touching $0.053475 on December 19, 2025, reflecting sustained selling pressure in the market.

DAO Current Market Status

As of December 21, 2025, DAO is trading at $0.05516, representing a marginal decline of -0.5% over the past 24 hours. The token's short-term performance shows stability with a minimal 1-hour gain of 0.02%, though the 7-day and 30-day periods continue to show weakness at -7.51% and -14.64% respectively.

Market Capitalization and Trading Metrics:

- Market Cap: $13,841,078.16

- Fully Diluted Valuation: $15,308,223.84

- 24-Hour Trading Volume: $1,119,246.88

- Circulating Supply: 250,926,000 DAO

- Total Supply: 277,524,000 DAO

- Current Market Ranking: #1,019

The circulating supply represents approximately 90.42% of the total supply, indicating a relatively low inflation profile. The token maintains a market dominance of 0.00047%, reflecting its niche position within the broader cryptocurrency ecosystem.

DAO is currently listed on 12 exchanges with 17,550 token holders, demonstrating a modestly distributed holder base. The token is available on multiple blockchain networks including Ethereum (ETH) and Binance Smart Chain (BSC), providing users with cross-chain accessibility and liquidity options.

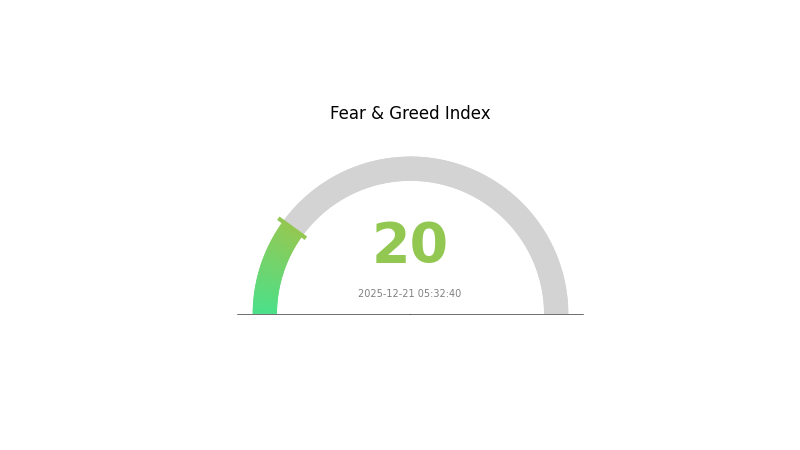

Market sentiment currently reflects "Extreme Fear" with a VIX reading of 20, indicating heightened risk aversion in the broader market environment.

View current DAO market price

DAO Market Sentiment Index

2025-12-21 Fear & Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The DAO market is experiencing extreme fear, with the index dropping to 20. This sentiment reading indicates investors are highly cautious, with widespread market anxiety driving reduced trading activity and defensive positioning. Such extreme fear often presents contrarian opportunities for long-term investors, as panic-driven sell-offs may create buying opportunities at depressed valuations. Monitor key support levels closely and consider accumulating positions strategically during these heightened fear periods on Gate.com's trading platforms.

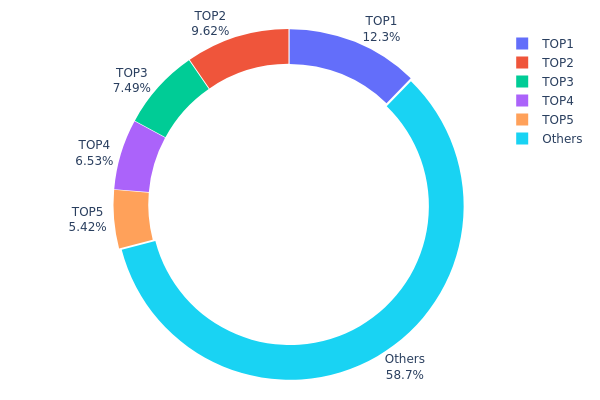

DAO Token Holdings Distribution

The address holdings distribution chart provides a granular view of how DAO tokens are allocated across individual wallet addresses, serving as a critical indicator for assessing decentralization levels and potential governance risks. By analyzing the concentration of tokens among the largest holders versus the broader holder base, market participants can evaluate whether voting power and protocol influence are distributed in a manner consistent with decentralized governance principles.

The current distribution data reveals a moderate concentration profile. The top five addresses collectively control 41.29% of total token supply, with the largest holder commanding 12.26%. While this concentration is non-trivial, the substantial remaining 58.71% held by other addresses indicates that no single entity has achieved overwhelming control. The distribution shows a gradual decline in holdings across the top addresses—ranging from 12.26% to 5.41%—rather than an extreme cliff-drop pattern, suggesting a more distributed power structure among major stakeholders.

This distribution pattern presents a balanced risk-reward profile for market dynamics. The dispersion across numerous smaller holders mitigates extreme centralization risks and governance capture concerns, while the meaningful stakes held by top addresses provide necessary liquidity and active participation in protocol management. The current structure supports relatively stable market fundamentals with reduced single-point-of-failure vulnerabilities, though continued monitoring of top holder activities remains essential for assessing potential coordinated actions that could impact price stability or governance outcomes.

Click to view the current DAO Token Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd07e...d6a847 | 27100.91K | 12.26% |

| 2 | 0x1a94...4b0eb3 | 21248.92K | 9.61% |

| 3 | 0x7bb4...b89e00 | 16536.00K | 7.48% |

| 4 | 0x87e8...fc6b31 | 14430.00K | 6.53% |

| 5 | 0x5857...1e188c | 11964.00K | 5.41% |

| - | Others | 129631.69K | 58.71% |

II. Core Factors Affecting DAO Future Price

Supply Mechanism

-

Token Supply and Inflation Control: CORE implements a reasonable inflation control mechanism to maintain currency scarcity and value. The total issuance volume directly influences price trajectory, with prudent monetary policy expected to support long-term price appreciation trends.

-

Current Impact: As Core DAO ecosystem expands and user adoption increases, demand for CORE tokens is projected to rise steadily, creating positive price pressure. The controlled supply mechanism helps sustain value preservation in the long term.

Technology Development and Ecosystem Construction

-

Satoshi Plus Consensus: Core utilizes an innovative hybrid consensus mechanism combining Delegated Proof of Work (DPoW), Delegated Proof of Stake (DPoS), and non-custodial Bitcoin staking. This enables Core to maintain decentralization without sacrificing performance, creating a liquid validator market accessible to all participants.

-

Cross-chain Technology and Interoperability: Core DAO enhances ecosystem extensibility through cross-chain development and interoperability solutions. CORE tokens can circulate not only within the Core DAO network but also potentially achieve interconnectivity with other blockchain platforms, elevating market value.

-

Ecosystem Applications: Multiple use cases drive demand across decentralized governance, staking, network security, and DeFi services. The ecosystem supports decentralized finance applications including lending, trading, and stablecoins. As more decentralized applications (dApps) deploy on the Core DAO network, demand for CORE tokens is expected to increase continuously.

Market Sentiment and Investor Confidence

-

Market Volatility and Speculation: Cryptocurrency markets exhibit inherent high volatility, with short-term price fluctuations closely tied to investor sentiment. Speculation plays a core role in price movements. Positive market conditions, particularly with growing demand in DeFi and DAO sectors, could drive price appreciation. Conversely, depressed market sentiment and increased volatility may trigger short-term price declines.

-

Community Governance Impact: The utility of DAO tokens in community building and governance mechanisms significantly influences token value. Community participation and governance functionality directly affect investor confidence and long-term utility perception.

Three、2025-2030 DAO Price Forecast

2025 Outlook

- Conservative Forecast: $0.0481 - $0.0553

- Neutral Forecast: $0.0553

- Optimistic Forecast: $0.0824 (requires sustained ecosystem development and increased institutional adoption)

2026-2028 Mid-term Outlook

- Market Stage Expectations: Gradual recovery phase with increasing market confidence and infrastructure maturation

- Price Range Forecast:

- 2026: $0.0640 - $0.0833 (24% upside potential)

- 2027: $0.0646 - $0.0943 (37% upside potential)

- 2028: $0.0758 - $0.1116 (54% upside potential)

- Key Catalysts: Enhanced governance mechanisms, expanded protocol functionality, growing community participation, and positive regulatory developments

2029-2030 Long-term Outlook

- Base Case: $0.0836 - $0.1112 (assuming stable market conditions and moderate adoption growth)

- Optimistic Scenario: $0.0984 - $0.1362 (assuming accelerated enterprise adoption and strengthened market fundamentals)

- Transformative Scenario: $0.1362+ (assuming breakthrough technological advancements, mainstream institutional investment, and significant ecosystem expansion)

- 2030-12-21: DAO reaches $0.1362 (78-89% cumulative appreciation from 2025 levels, reflecting substantial long-term value creation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.08237 | 0.05528 | 0.04809 | 0 |

| 2026 | 0.08328 | 0.06882 | 0.06401 | 24 |

| 2027 | 0.0943 | 0.07605 | 0.06464 | 37 |

| 2028 | 0.11158 | 0.08518 | 0.07581 | 54 |

| 2029 | 0.11117 | 0.09838 | 0.08362 | 78 |

| 2030 | 0.1362 | 0.10477 | 0.07753 | 89 |

DAO Maker (DAO) Investment Strategy and Risk Management Report

IV. DAO Professional Investment Strategy and Risk Management

DAO Investment Methodology

(1) Long-Term Holding Strategy

-

Target Investors: Retail investors seeking exposure to venture capital infrastructure and DAO governance models with extended time horizons (2+ years)

-

Operational Recommendations:

- Accumulate DAO tokens during market downturns, particularly when prices approach historical lows ($0.053475), to establish a core position at favorable valuations

- Dollar-cost averaging (DCA) strategy by investing fixed amounts monthly to mitigate short-term volatility and reduce timing risk

- Participate in staking mechanisms to earn non-inflationary equity rewards and generate passive income while maintaining long-term exposure

-

Storage Solution:

- Utilize Gate Web3 Wallet for secure self-custody of DAO tokens while maintaining flexibility to participate in governance and staking rewards

- Enable two-factor authentication and backup recovery phrases offline for enhanced security

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour range ($0.05422 to $0.05624) as immediate technical boundaries; historical low at $0.053475 represents strong support

- Moving Average Analysis: Apply 7-day and 30-day moving averages to identify trend reversals; the -7.51% 7-day decline suggests bearish momentum requiring confirmation

-

Range Trading Key Points:

- Execute buy orders near historical lows during panic selling phases when market sentiment deteriorates

- Set profit-taking targets at 15-25% gains above entry points, given current market volatility and liquidity conditions

- Monitor 24-hour volume ($1,119,246.88) as a liquidity indicator; increased volume on price movements confirms trend strength

V. DAO Risk Management Framework

(1) Asset Allocation Principles

-

Conservative Investors: 2-5% portfolio allocation maximum

- Focus on the long-term fundamentals of DAO Maker's platform ecosystem rather than short-term price fluctuations

- Limit position size given the -83.93% annual decline and relatively small market capitalization

-

Active Investors: 5-10% portfolio allocation

- Combine core holdings with tactical trading around identified support/resistance levels

- Diversify DAO position across multiple blockchain networks (Ethereum and BSC) to mitigate network-specific risks

-

Professional Investors: 10-15% portfolio allocation with hedging

- Structure positions with options or futures on Gate.com for downside protection

- Implement systematic rebalancing quarterly to maintain target exposure

(2) Risk Hedging Solutions

-

Stablecoin Reserve Strategy: Maintain 30-50% of venture capital allocation in stablecoins to capitalize on sudden price dislocation opportunities and reduce forced liquidation scenarios

-

Diversification Across DAO Ecosystem: Balance DAO Maker exposure with complementary governance tokens and infrastructure plays within the blockchain sector to reduce single-project concentration risk

(3) Security Storage Solutions

-

Web3 Wallet Solution: Gate Web3 Wallet offers integrated security features for DAO token management, enabling direct participation in governance voting and reward claims without custody risk

-

Self-Custody Best Practice: Transfer tokens from exchange wallets to personal custody immediately after purchase to mitigate exchange counterparty risk and hacking vulnerabilities

-

Critical Security Precautions:

- Never share private keys or seed phrases; store recovery phrases in geographically distributed secure locations

- Verify smart contract addresses on Etherscan (0x0f51bb10119727a7e5ea3538074fb341f56b09ad for ETH) and BSCscan before transactions

- Enable hardware wallet integration where possible for high-value holdings

- Regularly audit connected dApps and revoke unnecessary token approvals

VI. DAO Potential Risks and Challenges

DAO Market Risks

-

Severe Price Volatility: The token has declined 83.93% over the past year, falling from $8.71 (April 2021) to current levels of $0.055. This extreme drawdown demonstrates susceptibility to market cycles and reduced institutional confidence in the project thesis.

-

Limited Trading Liquidity: With 24-hour volume of only $1.12 million and listing on just 12 exchanges, the token exhibits thin order books. Large position exits could face significant slippage, and market manipulation risks exist given the low trading activity.

-

Competitive Pressure: The venture capital tokenization and DAO creation space faces increasing competition from established platforms and traditional finance integration, potentially pressuring DAO Maker's market share and token utility.

DAO Regulatory Risks

-

Securities Compliance Uncertainty: DAO Maker's DYCO and SHO fundraising models exist in a regulatory gray zone. Future enforcement actions by securities regulators could restrict platform operations or token utility, particularly as regulators clarify rules for token offerings.

-

Cross-Border Regulatory Fragmentation: Operating across multiple jurisdictions creates compliance complexity. Changes in regulations in key markets (EU, US, Asia) could necessitate platform modifications and reduce addressable market opportunities.

-

Venture Capital Licensing Requirements: The company's stated goal of expanding into equity crowdfunding and venture capital bonds may trigger strict regulatory licensing requirements, creating barriers to business expansion and increasing operational costs.

DAO Technology Risks

-

Smart Contract Vulnerability: While DAO Maker operates on established networks (Ethereum and BSC), any critical vulnerabilities in platform smart contracts could lead to fund loss or platform downtime, significantly impacting token value and user confidence.

-

Network Dependency: Concentration on Ethereum and BSC creates exposure to these networks' technical failures, congestion, or security breaches. Inadequate cross-chain redundancy limits resilience.

-

Ecosystem Adoption Risk: The success of DAO Maker's governance and creation platforms depends on developer adoption and end-user engagement. Slow adoption or migration to competing platforms would reduce token utility and demand.

VII. Conclusion and Action Recommendations

DAO Investment Value Assessment

DAO Maker presents a mixed investment profile characterized by compelling long-term platform fundamentals undermined by severe short-term bearish pressures. The platform's B2B2C infrastructure for compliant fundraising and DAO creation addresses a genuine market need in the venture capital tokenization space. However, the 83.93% annual price decline, thin liquidity, and regulatory uncertainties reflect investor skepticism about near-term execution and monetization pathways. The token's non-inflationary reward structure and governance participation mechanisms provide utility beyond pure speculation, supporting a contrarian thesis for patient, risk-tolerant investors. Nevertheless, significant technical, regulatory, and competitive headwinds must be resolved before meaningful price recovery materializes.

DAO Investment Recommendations

✅ Newcomers:

- Allocate only 1-2% of experimental cryptocurrency holdings as a long-term venture capital infrastructure play

- Purchase small positions exclusively through established exchanges like Gate.com with demonstrated security track records

- Prioritize self-education on DAO governance mechanisms and platform use cases before increasing exposure

- Avoid leveraged trading or margin purchases given volatility and limited liquidity

✅ Experienced Investors:

- Consider 5-8% portfolio allocation combined with staking participation to generate passive yield

- Implement systematic DCA over 6-12 months to accumulate at varied price points and reduce timing risk

- Monitor quarterly technical indicators and manage positions based on identified support/resistance levels

- Hedge core holdings with complementary governance tokens to reduce single-project concentration

- Stay informed on regulatory developments affecting venture capital tokenization and DAO frameworks

✅ Institutional Investors:

- Evaluate 10-15% strategic allocation as part of infrastructure and governance token exposure

- Structure positions using exchange options on Gate.com for downside protection and risk-adjusted returns

- Conduct ongoing regulatory compliance assessments across key operating jurisdictions

- Engage directly with DAO Maker management regarding platform roadmap, adoption metrics, and monetization timelines

- Establish exit strategies and rebalancing triggers tied to specific technical, regulatory, or fundamental milestones

DAO Trading Participation Methods

-

Direct Exchange Trading: Purchase DAO tokens on Gate.com through spot trading with fiat on-ramps or crypto pairings; utilize market orders for immediate execution or limit orders for price-target precision

-

Staking and Governance Participation: Lock DAO tokens through the platform's staking mechanism to earn non-inflationary equity rewards and participate in protocol governance voting; compound returns over extended holding periods

-

Portfolio Rebalancing: Use dollar-cost averaging on Gate.com to systematically build positions during extended downtrends; harvest tax losses during market weakness and redeploy capital during recovery phases

Disclaimer: Cryptocurrency investment carries extreme risk. This report does not constitute investment advice, financial recommendation, or inducement to purchase. All investors must conduct independent research and consult qualified financial advisors before making investment decisions. Never invest capital exceeding your ability to sustain complete loss. Past performance does not guarantee future results. Market conditions, regulatory frameworks, and project fundamentals change rapidly and unpredictably.

FAQ

Is DAO crypto a good investment?

DAO crypto presents strong investment potential through decentralized governance and community-driven returns. With growing adoption and innovative tokenomics, DAOs offer compelling opportunities for high-yield gains in the evolving crypto ecosystem.

Is Core DAO a good project?

Core DAO shows strong potential with innovative technology and active community engagement. The project demonstrates solid fundamentals and growing adoption, making it an attractive opportunity for crypto investors seeking exposure to decentralized infrastructure and blockchain innovation.

Will Curve DAO recover?

Curve DAO shows potential for recovery through ecosystem upgrades and increased DeFi adoption. Strong community support and protocol improvements position CRV for long-term growth despite current market headwinds.

Is HTX DAO (HTX) a good investment?: Analyzing the Potential and Risks of this Decentralized Exchange Token

Is DAO Maker (DAO) a Good Investment?: Analyzing the Potential and Risks in the Current Crypto Market

Is Stella (ALPHA) a Good Investment?: Analyzing Potential Returns and Risks in the Current Crypto Market

2025 DEXE Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Dorayaki (DORA) a Good Investment?: Analyzing Its Potential in the Cryptocurrency Market

Is AladdinDAO (ALD) a Good Investment?: Analyzing the Potential and Risks of This DeFi Protocol Token in Today's Market

Evaluating the Trustworthiness of BitTorrent Token for Web3 Investors

Rizzmas Coin Overview: Essential Guide to Updates and Opportunities

2025 NETX Price Prediction: Expert Analysis and Market Forecast for the Next Generation Technology Token

Best Bitcoin Debit Cards for 2025: Your Complete Guide

2025 LUNAI Price Prediction: Expert Analysis and Market Forecast for the Next Generation AI Token