Dự báo giá REZ năm 2025: Đánh giá xu hướng thị trường và những yếu tố thúc đẩy tăng trưởng trong hệ sinh thái tài sản kỹ thuật số

Giới thiệu: Vị thế thị trường và giá trị đầu tư của REZ

Renzo (REZ) là Liquid Restaking Token (LRT) kiêm nhà quản lý chiến lược của EigenLayer, đóng vai trò thiết yếu thúc đẩy đổi mới phi tập trung trên Ethereum kể từ khi ra đời. Đến năm 2025, vốn hóa thị trường Renzo đạt 31.618.383 USD, nguồn cung lưu hành gần 2.631.575.802 token, giá quanh mức 0,012015 USD. Tài sản này, được mệnh danh là “giao diện hệ sinh thái EigenLayer”, ngày càng quan trọng trong bảo vệ các Dịch vụ xác thực chủ động (AVS) và tạo lợi suất cao hơn hình thức staking ETH truyền thống.

Bài viết sẽ phân tích toàn diện xu hướng giá Renzo giai đoạn 2025-2030, dựa trên dữ liệu lịch sử, diễn biến cung cầu, phát triển hệ sinh thái và yếu tố vĩ mô, cung cấp cho nhà đầu tư dự báo giá chuyên sâu cùng chiến lược đầu tư thực tiễn.

I. Tổng quan lịch sử giá REZ và tình hình thị trường hiện tại

Diễn biến lịch sử giá REZ

- 2024: REZ ra mắt ở mức 0,05 USD, lập đỉnh lịch sử tại 0,265 USD ngày 30 tháng 4

- 2025: Biến động mạnh, chạm đáy lịch sử 0,006997 USD ngày 22 tháng 6

- 2025 (Hiện tại): Giá phục hồi lên 0,012015 USD, xuất hiện tín hiệu hồi phục

Tình hình thị trường REZ hiện tại

Đến ngày 2 tháng 10 năm 2025, REZ đang giao dịch tại 0,012015 USD, khối lượng 24 giờ đạt 173.854,22 USD. Token này ghi nhận đà tăng ngắn hạn, tăng 7,25% trong 24 giờ, tăng 1,9% trong tuần. Tuy vậy, hiệu suất dài hạn vẫn yếu với mức giảm 68,88% trong năm vừa qua.

Vốn hóa thị trường REZ đạt 31.618.383 USD, xếp thứ 888 trên thị trường tiền mã hóa toàn cầu. Nguồn cung lưu hành 2.631.575.802 REZ, chiếm 26,32% tổng cung 10 tỷ token. Vốn hóa pha loãng tối đa là 120.150.000 USD.

Giá hiện tại thấp hơn 95,47% so với đỉnh lịch sử và cao hơn 71,71% so với đáy lịch sử, cho thấy tiềm năng phục hồi nhưng cũng phản ánh mức biến động lớn.

Bấm để xem giá REZ hiện tại

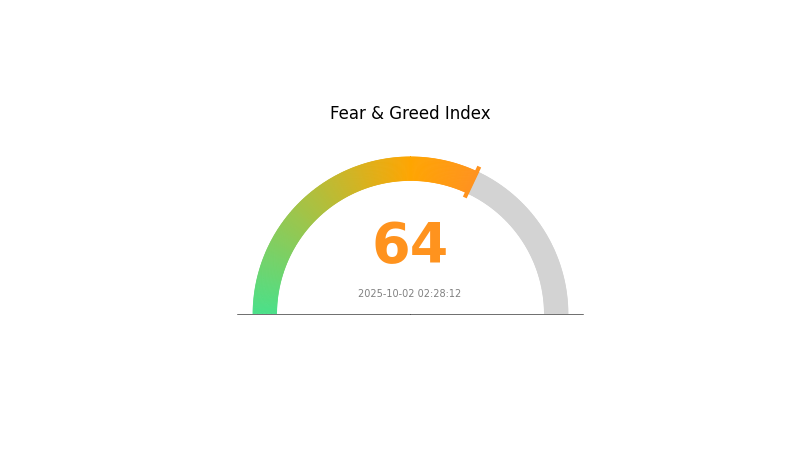

Chỉ báo tâm lý thị trường REZ

02 tháng 10 năm 2025, Chỉ số Sợ hãi & Tham lam: 64 (Tham lam)

Bấm để xem Chỉ số Sợ hãi & Tham lam

Thị trường crypto đang nghiêng về phía tham lam với chỉ số Sợ hãi & Tham lam ở mức 64, phản ánh sự tự tin và lạc quan của nhà đầu tư. Tuy nhiên, cần thận trọng vì tham lam quá mức có thể tạo áp lực tăng nóng. Nhà giao dịch nên cân nhắc chốt lời hoặc cân bằng lại danh mục. Luôn theo dõi các mức kháng cự quan trọng và chuẩn bị cho điều chỉnh có thể xảy ra. Đa dạng hóa và kiểm soát rủi ro vẫn là nguyên tắc cốt lõi trên thị trường biến động này.

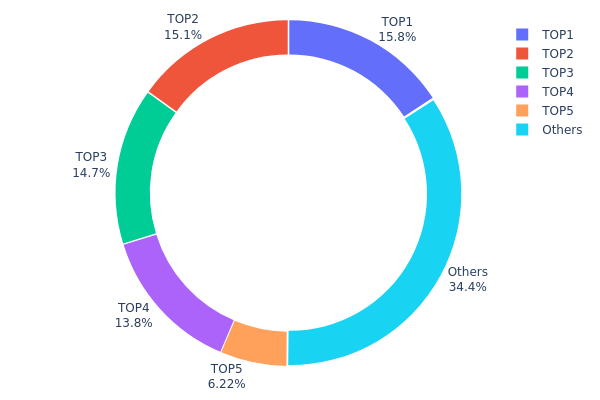

Phân bổ sở hữu REZ

Dữ liệu phân bổ địa chỉ REZ cho thấy phần lớn token tập trung vào một số địa chỉ lớn nhất. Top 5 địa chỉ nắm giữ 65,6% tổng cung REZ, phần còn lại 34,4% thuộc các địa chỉ khác. Mức tập trung này đặt ra nguy cơ tập trung hóa hệ sinh thái REZ.

Địa chỉ lớn nhất sở hữu 15,78% tổng cung, hai địa chỉ tiếp theo lần lượt nắm 15,06% và 14,71%. Sự tập trung này có thể khiến giá biến động mạnh, dễ bị thao túng bởi các “cá mập”. Những holder lớn có thể chi phối xu hướng thị trường thông qua hoạt động giao dịch.

Cấu trúc này cho thấy mức độ phi tập trung on-chain của REZ còn hạn chế so với tiêu chuẩn hệ sinh thái tiền mã hóa bền vững. Dù phân bổ tập trung là phổ biến trong nhiều dự án, phân bổ hiện tại của REZ làm dấy lên lo ngại về độ ổn định và nguy cơ phối hợp thao túng giá từ những holder lớn.

Bấm để xem phân bổ sở hữu REZ

| Top | Địa chỉ | Số lượng nắm giữ | Tỷ lệ (%) |

|---|---|---|---|

| 1 | 0x9706...2a1edb | 1.578.901,00K | 15,78% |

| 2 | 0xcd49...95ffee | 1.506.927,81K | 15,06% |

| 3 | 0xf977...41acec | 1.471.530,09K | 14,71% |

| 4 | 0x3363...7202e9 | 1.383.055,00K | 13,83% |

| 5 | 0x20f2...6f9087 | 622.000,00K | 6,22% |

| - | Khác | 3.437.586,10K | 34,4% |

II. Các yếu tố quyết định giá REZ trong tương lai

Cơ chế nguồn cung

- Tổng cung: 10 tỷ token REZ.

- Lưu hành ban đầu: 1,05 tỷ token.

- Phân bổ token: 30% cho cộng đồng, 31,56% cho nhà đầu tư.

Động lực tổ chức và cá mập

- Doanh nghiệp sở hữu lớn: Bitmine Immersion, Ether Machine, Sharplink Gaming nắm giữ nhiều REZ.

Yếu tố kinh tế vĩ mô

- Địa chính trị: Chính sách thương mại quốc tế, bất ổn kinh tế toàn cầu có thể ảnh hưởng giá REZ.

Phát triển kỹ thuật và hệ sinh thái

- Cạnh tranh thị trường: Cạnh tranh gia tăng trong mảng liquid restaking ảnh hưởng vị thế REZ.

- Ứng dụng hệ sinh thái: Phát triển DApp và dự án trong mạng REZ là động lực tăng trưởng.

III. Dự báo giá REZ từ 2025 đến 2030

Triển vọng 2025

- Dự báo thận trọng: 0,00927 - 0,01204 USD

- Dự báo trung lập: 0,01204 - 0,01258 USD

- Dự báo lạc quan: 0,01258 - 0,01312 USD (khi thị trường thuận lợi)

Triển vọng 2027-2028

- Giai đoạn dự kiến: Tăng trưởng tiềm năng

- Dự báo giá:

- 2027: 0,00916 - 0,01698 USD

- 2028: 0,00983 - 0,02103 USD

- Yếu tố thúc đẩy: Tăng tỷ lệ ứng dụng, đột phá công nghệ trong hệ sinh thái REZ

Triển vọng dài hạn 2029-2030

- Kịch bản cơ sở: 0,01808 - 0,01979 USD (tăng trưởng ổn định)

- Kịch bản lạc quan: 0,01979 - 0,02151 USD (thị trường mạnh mẽ)

- Kịch bản đột phá: từ 0,02151 USD trở lên (hệ sinh thái phát triển vượt trội)

- 31 tháng 12 năm 2030: REZ 0,02039 USD (mục tiêu giá cuối năm)

| Năm | Giá dự báo cao nhất | Giá dự báo trung bình | Giá dự báo thấp nhất | Biến động (%) |

|---|---|---|---|---|

| 2025 | 0,01312 | 0,01204 | 0,00927 | 0 |

| 2026 | 0,01396 | 0,01258 | 0,00956 | 4 |

| 2027 | 0,01698 | 0,01327 | 0,00916 | 10 |

| 2028 | 0,02103 | 0,01513 | 0,00983 | 25 |

| 2029 | 0,02151 | 0,01808 | 0,01012 | 50 |

| 2030 | 0,02039 | 0,01979 | 0,01801 | 64 |

IV. Chiến lược đầu tư chuyên nghiệp và quản trị rủi ro REZ

Phương pháp đầu tư REZ

(1) Chiến lược nắm giữ dài hạn

- Phù hợp: Nhà đầu tư dài hạn tập trung hệ sinh thái Ethereum

- Khuyến nghị hoạt động:

- Tích lũy REZ khi giá điều chỉnh

- Staking REZ để tối ưu lợi suất

- Lưu trữ bằng ví phần cứng an toàn

(2) Chiến lược giao dịch chủ động

- Công cụ kỹ thuật:

- Đường trung bình động: Nhận diện xu hướng và đảo chiều

- RSI: Theo dõi trạng thái quá mua/quá bán

- Lưu ý giao dịch xoay vòng:

- Giám sát phát triển hệ sinh thái EigenLayer

- Quan sát tâm lý thị trường Ethereum tổng thể

Khung quản trị rủi ro REZ

(1) Nguyên tắc phân bổ tài sản

- Nhà đầu tư thận trọng: 1-3% danh mục crypto

- Nhà đầu tư chủ động: 5-10% danh mục crypto

- Nhà đầu tư chuyên nghiệp: Tối đa 15% danh mục crypto

(2) Giải pháp phòng ngừa rủi ro

- Đa dạng hóa: Kết hợp REZ cùng các tài sản crypto khác

- Lệnh dừng lỗ: Hạn chế thua lỗ tiềm năng

(3) Giải pháp lưu trữ an toàn

- Ví nóng khuyến nghị: Gate web3 wallet

- Lưu trữ lạnh: Dùng ví phần cứng khi nắm giữ dài hạn

- Biện pháp bảo mật: Kích hoạt xác thực hai lớp, sử dụng mật khẩu mạnh

V. Rủi ro và thách thức tiềm ẩn với REZ

Rủi ro thị trường REZ

- Biến động giá mạnh: Đặc trưng của thị trường crypto

- Thanh khoản: Có thể gặp khó khi giao dịch khối lượng lớn

- Cạnh tranh: Các token liquid staking khác ảnh hưởng thị phần REZ

Rủi ro pháp lý REZ

- Chính sách chưa rõ ràng: Quy định tiền mã hóa thay đổi liên tục, tác động đến REZ

- Tuân thủ pháp lý: Có thể phát sinh vướng mắc với chuẩn toàn cầu

- Thuế: Chính sách thuế chưa rõ ràng ở nhiều quốc gia

Rủi ro kỹ thuật REZ

- Lỗ hổng hợp đồng thông minh: Nguy cơ bị khai thác giao thức

- Khả năng mở rộng: Tắc nghẽn mạng EigenLayer ảnh hưởng hiệu suất

- Rủi ro tích hợp: Vấn đề khi nâng cấp EigenLayer/Ethereum

VI. Kết luận và khuyến nghị hành động

Đánh giá giá trị đầu tư REZ

REZ giúp nhà đầu tư tiếp cận hệ sinh thái EigenLayer tăng trưởng và thị trường staking Ethereum. Tuy có tiềm năng dài hạn, biến động ngắn hạn và bất ổn pháp lý vẫn là rủi ro lớn.

Khuyến nghị đầu tư REZ

✅ Người mới: Mở vị thế nhỏ, chú trọng học hỏi ✅ Nhà đầu tư kinh nghiệm: Đưa vào danh mục crypto đa dạng ✅ Nhà đầu tư tổ chức: Thẩm định kỹ lưỡng, theo dõi diễn biến pháp lý

Cách tham gia REZ

- Giao dịch giao ngay: Mua, nắm giữ REZ trên Gate.com

- Staking: Tham gia staking REZ để tăng lợi suất

- Tích hợp DeFi: Khám phá REZ trong các giao thức tài chính phi tập trung

Đầu tư tiền mã hóa tiềm ẩn rủi ro rất cao, bài viết không phải là khuyến nghị đầu tư. Nhà đầu tư nên cân nhắc kỹ lưỡng theo mức độ chịu rủi ro và tham khảo ý kiến chuyên gia tài chính. Không đầu tư vượt quá khả năng chịu lỗ.

FAQ

Dự báo giá Rez năm 2030 là bao nhiêu?

Theo mô hình thống kê, Rez dự kiến đạt khoảng 0,0059 USD vào giữa năm 2030 và 0,00595 USD vào cuối năm 2030.

Dự báo giá Reserve Rights token năm 2025 là bao nhiêu?

Theo phân tích thị trường, dự báo giá Reserve Rights token năm 2025 dao động từ 0,0057 đến 0,0227 USD, có thể tăng 301% vào cuối năm.

Rez có phải là meme coin không?

Đúng, Rez là meme coin triển khai trên blockchain Solana, kết hợp văn hóa crypto với mục tiêu cộng đồng.

Giá trị hiện tại của Rez crypto là bao nhiêu?

Đến ngày 2 tháng 10 năm 2025, Rez (REZ) có giá 0,01122 USD, giảm 0,6% trong một giờ qua.

Mời người khác bỏ phiếu

Nội dung