Post content & earn content mining yield

placeholder

LittleQueen

🧠 Your First Words Matter: Why Gate’s 2026 Opening Message Is Bigger Than a Campaign

As the crypto market enters 2026, one truth has become impossible to ignore:

noise is everywhere, but clarity is rare.

For years, platforms have competed on volume, leverage, and speed.

Gate chose a different opening for 2026 — not a trading challenge, not a hype contest, but a question:

“What are your first words of the year?”

This choice alone reveals intent.

📌 More Than Rewards — A Shift in Platform Philosophy

On the surface, My2026FirstPost looks like a New Year giveaway:

a $10,000 reward pool, position

As the crypto market enters 2026, one truth has become impossible to ignore:

noise is everywhere, but clarity is rare.

For years, platforms have competed on volume, leverage, and speed.

Gate chose a different opening for 2026 — not a trading challenge, not a hype contest, but a question:

“What are your first words of the year?”

This choice alone reveals intent.

📌 More Than Rewards — A Shift in Platform Philosophy

On the surface, My2026FirstPost looks like a New Year giveaway:

a $10,000 reward pool, position

- Reward

- 1

- 1

- Repost

- Share

AYATTAC :

:

Happy New Year! 🤑- Reward

- 2

- 2

- Repost

- Share

WeifangPiYou :

:

Bought 50U, doubled to 😂😂View More

- Reward

- 2

- 4

- Repost

- Share

WeifangPiYou :

:

Bought 50u, quickly doubledView More

#Gate 2025 年终社区盛典#

Peak Host & Content Expert Year-End Selection

Who will become the Peak Host of the year? Who will top the Content Expert list? Come and vote with me, support your favorite hosts and creators, and witness the birth of community stars together!

https://www.gate.com/activities/community-vote-2025?ref=VQJNA1SKAG&refType=1&refUid=46789346&ref_type=165&utm_cmp=xjdtmcgP

View OriginalPeak Host & Content Expert Year-End Selection

Who will become the Peak Host of the year? Who will top the Content Expert list? Come and vote with me, support your favorite hosts and creators, and witness the birth of community stars together!

https://www.gate.com/activities/community-vote-2025?ref=VQJNA1SKAG&refType=1&refUid=46789346&ref_type=165&utm_cmp=xjdtmcgP

- Reward

- like

- Comment

- Repost

- Share

#Gate 2025 年终社区盛典#

Peak Host & Content Expert Year-End Selection

Who will become the Peak Host of the year? Who will top the Content Expert list? Come and vote with me, support your favorite hosts and creators, and witness the birth of community stars together!

https://www.gate.com/activities/community-vote-2025?ref=VVFNB1HABG&refUid=34189654&ref_type=165&utm_cmp=xjdtmcgP

View OriginalPeak Host & Content Expert Year-End Selection

Who will become the Peak Host of the year? Who will top the Content Expert list? Come and vote with me, support your favorite hosts and creators, and witness the birth of community stars together!

https://www.gate.com/activities/community-vote-2025?ref=VVFNB1HABG&refUid=34189654&ref_type=165&utm_cmp=xjdtmcgP

- Reward

- like

- Comment

- Repost

- Share

kols when they're asked where they got that banger post idea from...

- Reward

- like

- Comment

- Repost

- Share

#Gate 2025 年终社区盛典#

Peak Host & Content Expert Year-End Selection

Who will become the Peak Host of the year? Who will top the Content Expert list? Come and vote with me, support your favorite hosts and creators, and witness the birth of community stars!

https://www.gate.com/activities/community-vote-2025?ref=VVUWAW1ECA&refType=1&refUid=38534424&ref_type=165&utm_cmp=xjdtmcgP

View OriginalPeak Host & Content Expert Year-End Selection

Who will become the Peak Host of the year? Who will top the Content Expert list? Come and vote with me, support your favorite hosts and creators, and witness the birth of community stars!

https://www.gate.com/activities/community-vote-2025?ref=VVUWAW1ECA&refType=1&refUid=38534424&ref_type=165&utm_cmp=xjdtmcgP

- Reward

- like

- Comment

- Repost

- Share

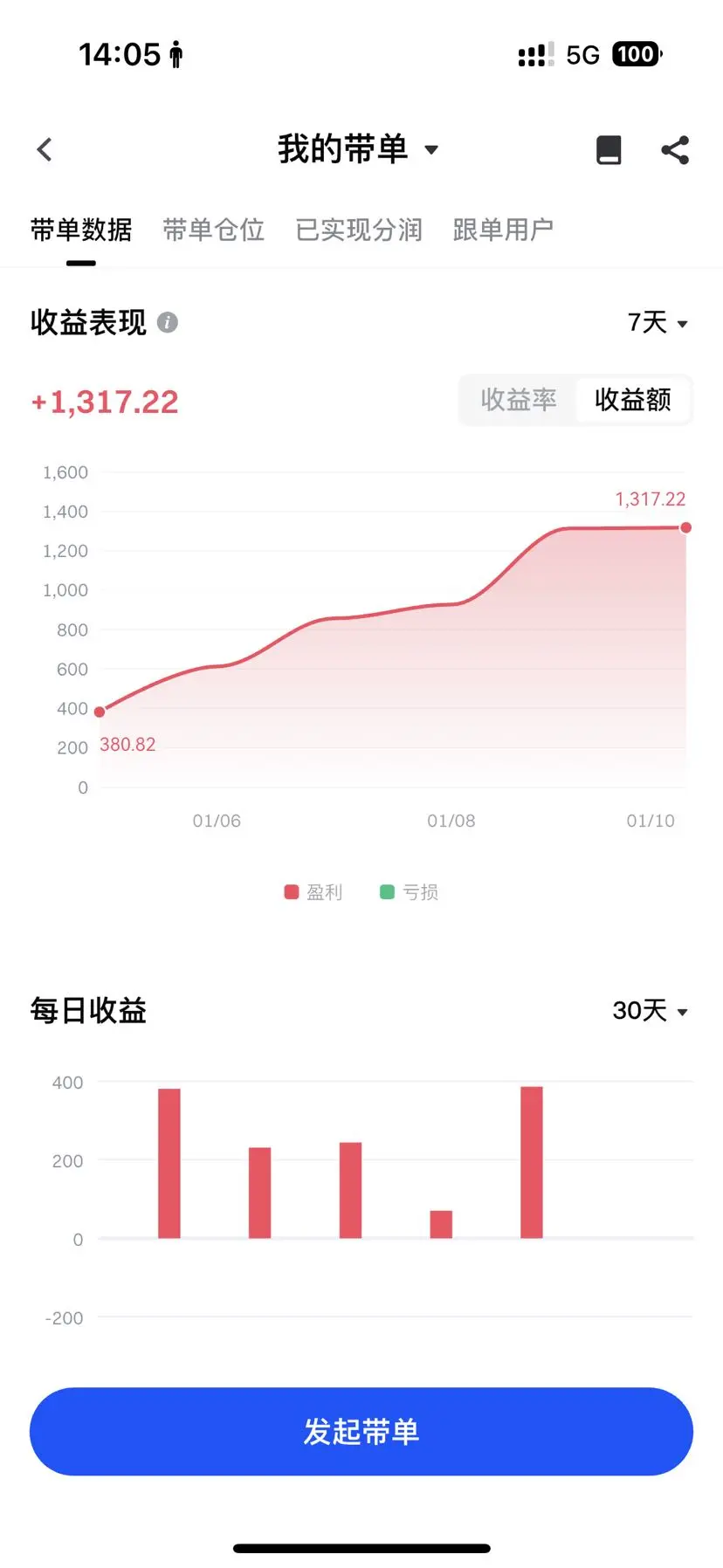

Invested $1,000 on January 6th, and by January 11th, the profit reached $1,315. I believe that in the future, it will become more and more stable, and the returns will continue to rise. Spend 80% of your time learning, 15% observing the market, and 5% trading. Constant trial and error are necessary to establish a stable trading system. Calm waters do not produce good sailors; to survive in this market, you must settle down and learn and explore. Observe more, act less.

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Gate Annual Report is out! Let's take a look at my yearly performance.

Click the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VQVEUV5XAA&ref_type=126&shareUid=U1ZGVV1dAgcO0O0O.

View OriginalClick the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VQVEUV5XAA&ref_type=126&shareUid=U1ZGVV1dAgcO0O0O.

- Reward

- like

- Comment

- Repost

- Share

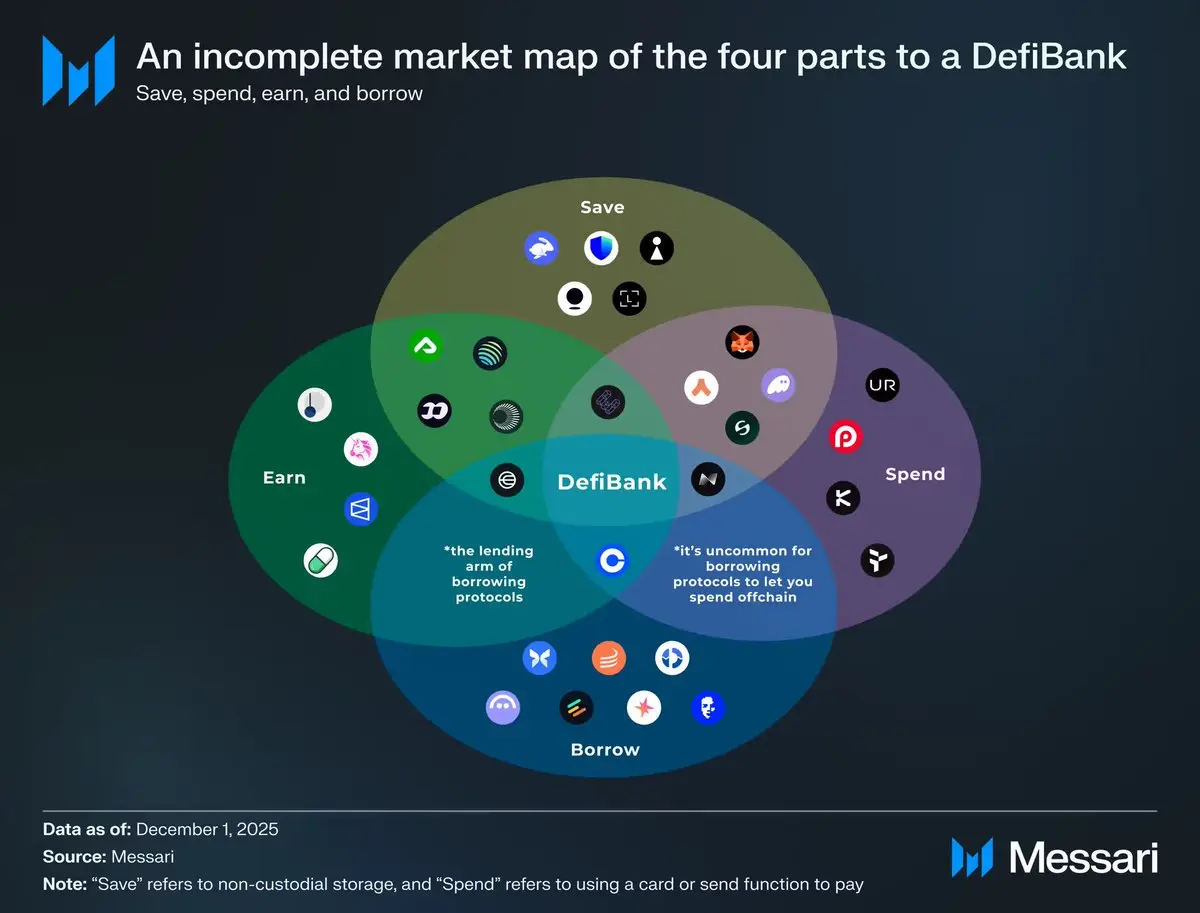

Who sits at the center intersection here?

Coinbase?

Coinbase?

- Reward

- like

- Comment

- Repost

- Share

The money is coming ...

Hit like if you want 2k26 to be your most successful year of all time .

Hit like if you want 2k26 to be your most successful year of all time .

- Reward

- like

- Comment

- Repost

- Share

#2026CryptoFlag Designing for the Next Phase of a Mature Digital Economy 🌐

As 2026 advances, the crypto market is no longer asking whether it will survive—it’s defining how it will scale responsibly. The focus has shifted from proving relevance to refining systems. Builders, investors, and institutions are now operating within a market that values resilience, governance, and measurable outcomes. This is a phase where thoughtful design outperforms rapid experimentation, and where long-term frameworks matter more than short-term wins.

A defining trend shaping the future is the normalization of

As 2026 advances, the crypto market is no longer asking whether it will survive—it’s defining how it will scale responsibly. The focus has shifted from proving relevance to refining systems. Builders, investors, and institutions are now operating within a market that values resilience, governance, and measurable outcomes. This is a phase where thoughtful design outperforms rapid experimentation, and where long-term frameworks matter more than short-term wins.

A defining trend shaping the future is the normalization of

- Reward

- 2

- 2

- Repost

- Share

AYATTAC :

:

Happy New Year! 🤑View More

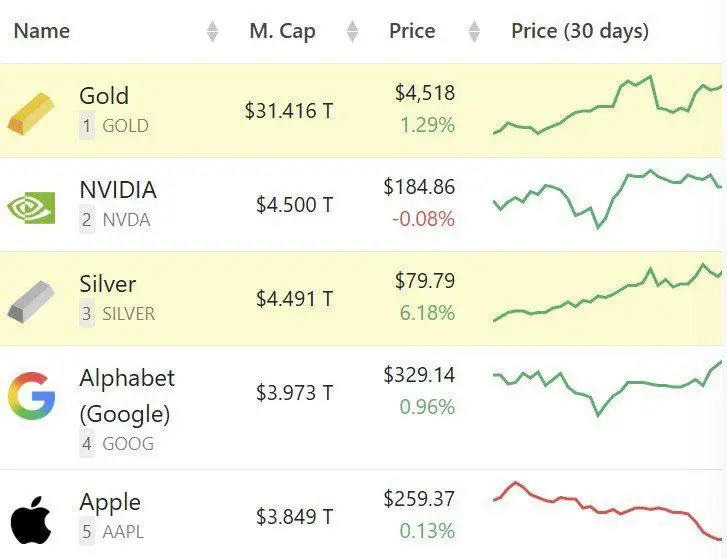

🚨 JUST IN: #Silver is about to flip #Nvidia in Market Cap.

do you think silver will flip Nvidia?👀

do you think silver will flip Nvidia?👀

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

January 11 BNB Market Outlook

The price initially surged to a high of 924.84 before pulling back, then stabilized at a low level. It has now rebounded and broken above the short-term moving averages, returning to the previous upward trend's correction phase. A strong support level has formed at this stage, and the downside is limited.

After testing the lower band of the Bollinger Bands and rebounding, the price is currently challenging the middle/upper band range. The Bollinger Bands are gradually opening from a converging shape, indicating that bullish rebound momentum is beginning to be re

The price initially surged to a high of 924.84 before pulling back, then stabilized at a low level. It has now rebounded and broken above the short-term moving averages, returning to the previous upward trend's correction phase. A strong support level has formed at this stage, and the downside is limited.

After testing the lower band of the Bollinger Bands and rebounding, the price is currently challenging the middle/upper band range. The Bollinger Bands are gradually opening from a converging shape, indicating that bullish rebound momentum is beginning to be re

BNB1.06%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More32.86K Popularity

62.65K Popularity

20.01K Popularity

14.44K Popularity

100.97K Popularity

News

View MoreThe probability of Trump being impeached again during his term rises to 57%

1 m

Vitalik: The crypto industry needs to address three major issues to develop better decentralized stablecoins

20 m

Vitalik: The industry needs better decentralized stablecoins, and there are still three issues to be addressed.

27 m

Data: Hyperliquid platform whales currently hold positions worth $6.408 billion, with a long-short position ratio of 0.93.

37 m

Da Huang increased by 295.83% after launching Alpha, current price is 0.0010586 USDT

49 m

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889Your First Words Matter!

Share your first post on and split $10,000 in New Year rewards.

Post with #My2026FirstPost to share your New Year wish

2026U Position Voucher, Gate New Year boxes, F1 Red Bull merch await you!

Ends on Jan 15, 2026, 16:00 UTC

2026 starts with this post!Gate 2025 Year-End Gala Square TOP50 List Announced!

The final ranking phase is now live.

Earn Votes by watching live streams and posting.

30 Votes = 1 chance — support your favorite creators now!

👉 https://www.gate.com/activities/community-vote-2025

iPhone 17 Pro Max, JD gift cards, Mi Band, Gate merch await you!

Creators are welcome to rally fans to climb the rankings and win rewards!

Voting ends: Jan 20, 02:00 UTC

Details: https://www.gate.com/announcements/article/48693