MasterOfChaosTheory

‼️ Guan He Ping Wheel Brothers, give U‼️ The contract/spot order for the night of the 7th has been updated 👇 In the crypto world, only follow the right people. Thank you all for your support. The New Year 4GT half-price promotion has exceeded 280 people, and tonight it will resume at 8GT‼️ Tap on Apple 👇

https://www.gate.com/zh/profile/ Chanlun Master

🔥 Recently ate over 2 million U‼️ Last week 3045/90400 short + 84400 short, 1740/59900 ate big meat over 1 million W 📉 Counterattack 1770/60300 more, now 2095/71700 floating profit 🀄️

#当前行情抄底还是观望?

View Originalhttps://www.gate.com/zh/profile/ Chanlun Master

🔥 Recently ate over 2 million U‼️ Last week 3045/90400 short + 84400 short, 1740/59900 ate big meat over 1 million W 📉 Counterattack 1770/60300 more, now 2095/71700 floating profit 🀄️

#当前行情抄底还是观望?

- Reward

- 10

- 10

- Repost

- Share

InvincibilityIsMyNickname. :

:

Hold on tight, we're about to take off 🛫View More

‼️ Guan He and the old friends of the wheel, give U‼️ The contract/spot order for the night of the 7th has been updated 👇 In the crypto world, we only follow the right people. Thank you all for your support. The New Year 4GT half-price promotion has already exceeded 280 people. Tonight, it will resume at 8GT‼️ Click 👇 on Apple

https://www.gate.com/zh/profile/ King of Bitcoin returns

🔥 Recently, eating over 2 million U in a row‼️ Last week, 3045/90400 short + 84400 short, eating big meat over 1 million W 📉 Counterattack 1770/60300, now floating profit of 2095/71700🀄️

#当前行情抄底还是观望?

View Originalhttps://www.gate.com/zh/profile/ King of Bitcoin returns

🔥 Recently, eating over 2 million U in a row‼️ Last week, 3045/90400 short + 84400 short, eating big meat over 1 million W 📉 Counterattack 1770/60300, now floating profit of 2095/71700🀄️

#当前行情抄底还是观望?

- Reward

- 10

- 10

- Repost

- Share

InvincibilityIsMyNickname. :

:

Hold on tight, we're about to take off 🛫View More

‼️ Guan Peace Wheel, friends, give U‼️ The contract/spot order for the 7th night has been updated 👇 In the crypto world, we only follow the right people. Thank you all for your support. The New Year 4GT half-price promotion has already exceeded 280 people. Tonight, it will resume at 8GT‼️ Apple click 👇 https://www.gate.com/zh/profile/ Little Ghost Daily Contract

🔥 Recently, over 2 million U have been eaten consecutively‼️ Last week, 3045/90400 short + 84400 short, 1740/59900 ate big meat over 1 million W 📉 Counterattack 1770/60300, currently floating profit at 2095/71700 🀄️

#当前行情抄底还是观望?

View Original🔥 Recently, over 2 million U have been eaten consecutively‼️ Last week, 3045/90400 short + 84400 short, 1740/59900 ate big meat over 1 million W 📉 Counterattack 1770/60300, currently floating profit at 2095/71700 🀄️

#当前行情抄底还是观望?

- Reward

- 10

- 10

- Repost

- Share

InvincibilityIsMyNickname. :

:

Experienced driver, guide me 📈View More

‼️ Guan Peace Wheel Brothers, give me a thumbs up‼️ The contract/spot order for the night of the 7th has been updated 👇 In the crypto world, only follow the right people. Thank you all for your support. The New Year 4GT half-price promotion has already exceeded 280 people. Tonight, it returns to 8GT‼️ Click 👇 on Apple

https://www.gate.com/zh/profile/ Trend Analysis

🔥 Recently, over 2 million USDT have been eaten in a row‼️ Last week, 3045/90400 short + 84400 short, 1740/59900 ate big meat over 1 million W 📉 Counterattack 1770/60300, currently holding 2095/71700 floating profit 🀄️

#当前行情抄底还

View Originalhttps://www.gate.com/zh/profile/ Trend Analysis

🔥 Recently, over 2 million USDT have been eaten in a row‼️ Last week, 3045/90400 short + 84400 short, 1740/59900 ate big meat over 1 million W 📉 Counterattack 1770/60300, currently holding 2095/71700 floating profit 🀄️

#当前行情抄底还

- Reward

- 10

- 10

- Repost

- Share

InvincibilityIsMyNickname. :

:

Hold on tight, we're about to take off 🛫View More

- Reward

- like

- 7

- Repost

- Share

MakeMoneyAndDoubleYo :

:

Are you still alive? MasterView More

- Reward

- like

- 4

- Repost

- Share

Arshak01 :

:

Jump in 🚀View More

- Reward

- 1

- 4

- Repost

- Share

Rotschild :

:

Some people are without power, so they didn't trade and lose money. 🤪View More

$PERCOLATOR It’s currently sitting at 1.5M marketcap, I bought some. Looking to sell at 6-7 M

- Reward

- 3

- 3

- Repost

- Share

Buyer99 :

:

$PERCOLATOR It’s currently sitting at 1.5M marketcap, I bought some. Looking to sell at 6-7 MView More

A new ticket for the Al Agent era: Pushing ERC-8004 What exactly is Ethereum betting on?

- Reward

- 3

- 5

- Repost

- Share

Lock_433 :

:

2026 GOGOGO 👊View More

Small shareholder: I like this coin. With a market cap of 270,000 and contracts included, that's the only way it can be issued.😃

小股东-14,01%

- Reward

- like

- 4

- Repost

- Share

WeSpecializeInShorting :

:

Everyone, don't hold any hope. Just sell everything. Exchanges where retail investors hold most of the tokens usually end up being delisted because no one is willing to support the price. I've seen it happen many times. Take advantage of the fact that it's still worth something now and don't be fooled.View More

A few months ago, I transferred some USDT from the exchange to the Zhima Web Wallet. Later, I tried to transfer back to the exchange but kept failing. Does anyone know how to do it? Please teach me.

PI-3,57%

- Reward

- like

- 3

- Repost

- Share

GateUser-add3a53a :

:

Thanks for the help! [抱拳] Repeatedly doing this doesn't work anymore. Now even the balance display is just spinning and not showing up. Strange.

View More

Life should have a sense of relaxation, returning to the way it was before!

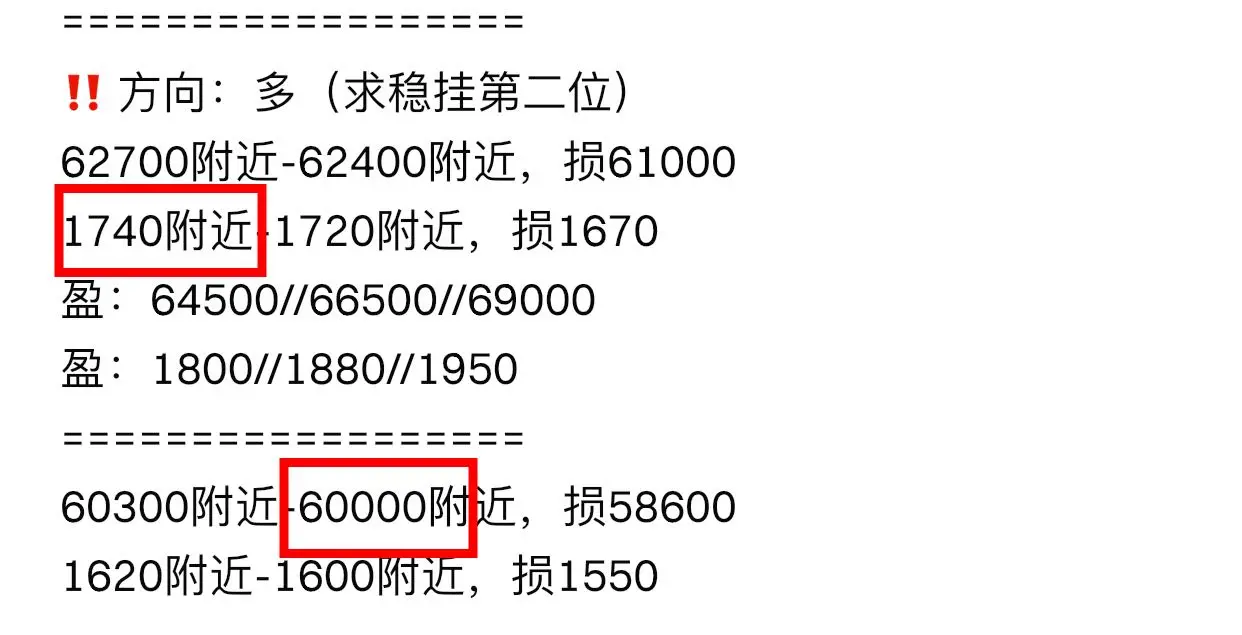

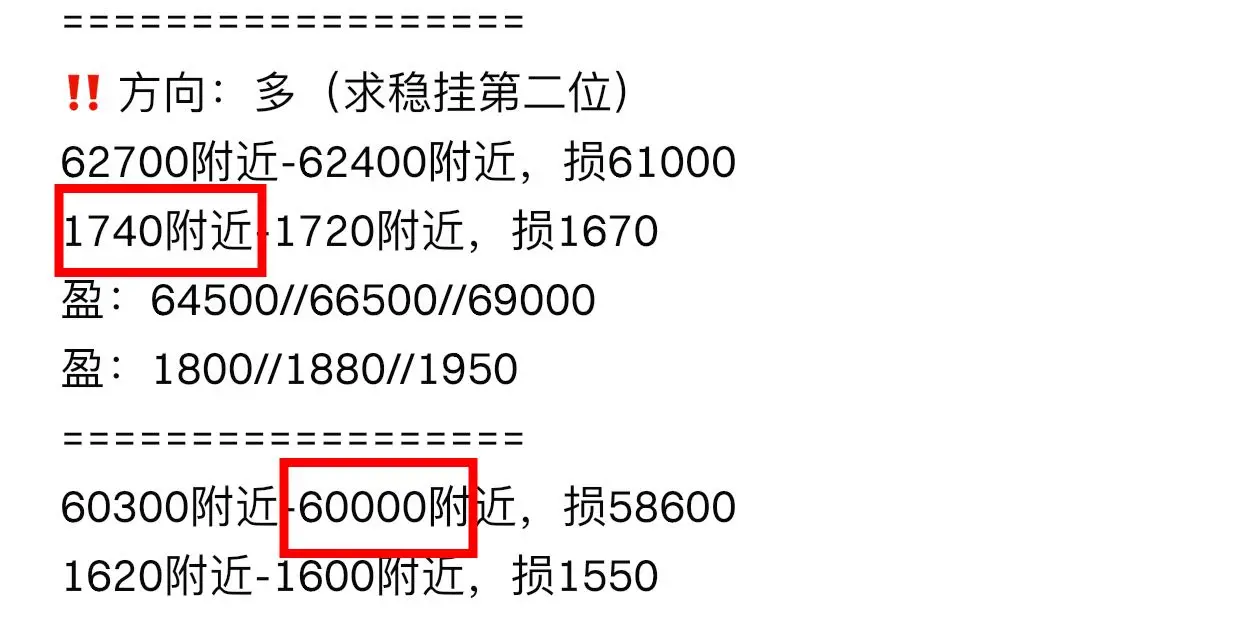

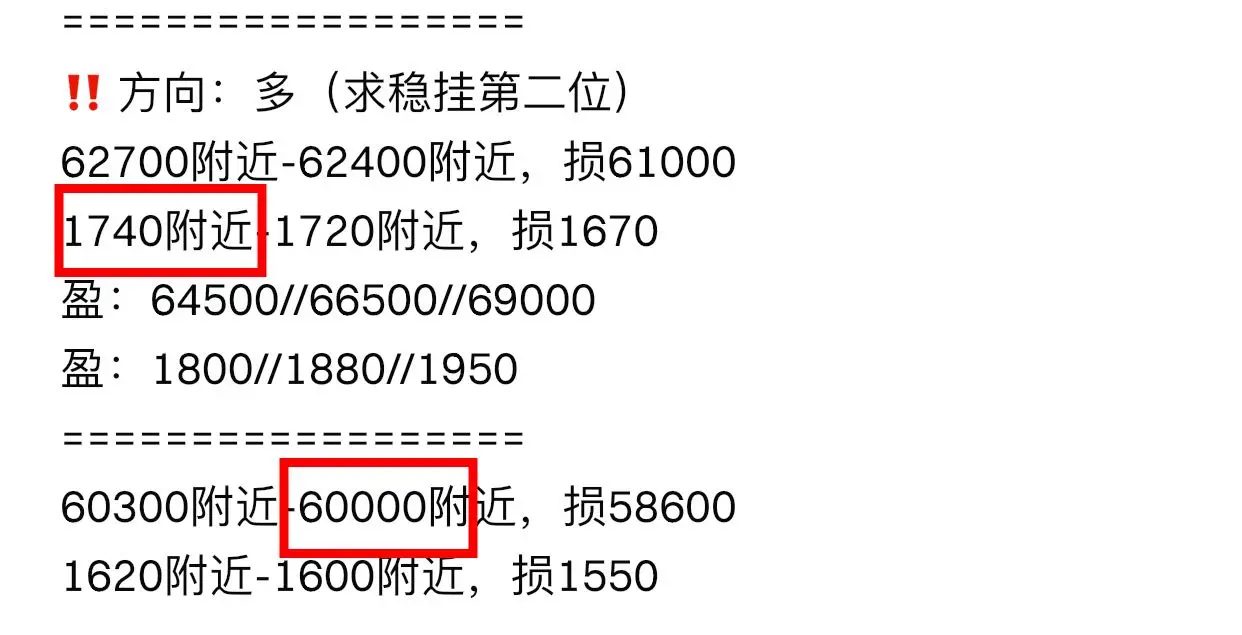

Leverage over 20x, holding more than 50 positions—that's the target for sniping. When the short positions are not balanced enough, they will continue to shake out!

Keep adding positions and stepping on the gas. Maji's liquidation was because of insufficient understanding!

After the shakeout, there will be a violent surge. Hold your spot holdings well!

Once the consensus of big players fully turns to short, and the chips are swept away, it will push the price up.

View OriginalLeverage over 20x, holding more than 50 positions—that's the target for sniping. When the short positions are not balanced enough, they will continue to shake out!

Keep adding positions and stepping on the gas. Maji's liquidation was because of insufficient understanding!

After the shakeout, there will be a violent surge. Hold your spot holdings well!

Once the consensus of big players fully turns to short, and the chips are swept away, it will push the price up.

- Reward

- 5

- 4

- Repost

- Share

ShanzhaiSeasonIsComingSoon!Get :

:

Boss, when do you think the clone season will arrive?View More

- Ethereum Price Expectations: Ethereum tests the $2100 level after bouncing from $1740:

Ethereum network experienced liquidations of $136 million in futures contracts over the past 24 hours, led by $87 million in short positions liquidations, according to Coinglass data.

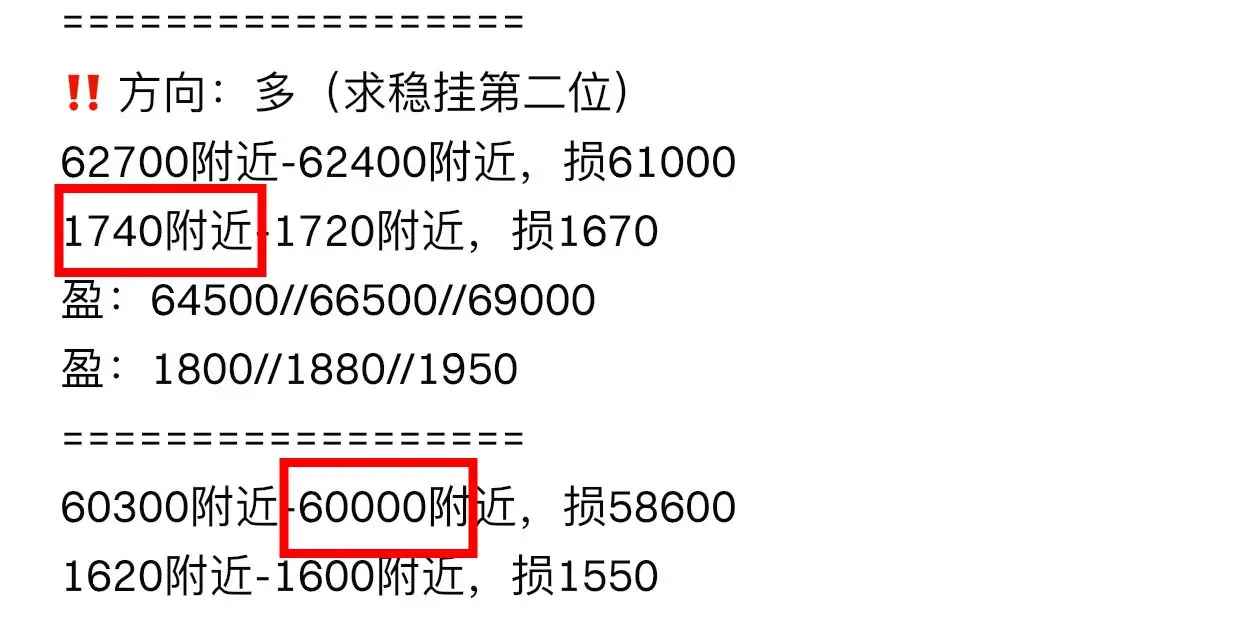

Ethereum (ETH) price rose from the $1740 support level on Friday after its largest drop since the liquidation event on October 10. The leading altcoin is testing the $2100 level on Saturday and could rise to $2380 if it breaks above. However, any rejection could push it back to the $1740 level.

Daily chart of ETH/USDT

The (RS

Ethereum network experienced liquidations of $136 million in futures contracts over the past 24 hours, led by $87 million in short positions liquidations, according to Coinglass data.

Ethereum (ETH) price rose from the $1740 support level on Friday after its largest drop since the liquidation event on October 10. The leading altcoin is testing the $2100 level on Saturday and could rise to $2380 if it breaks above. However, any rejection could push it back to the $1740 level.

Daily chart of ETH/USDT

The (RS

ETH1,04%

- Reward

- 1

- 5

- Repost

- Share

GateUser-d6e2b459 :

:

Can't see clearly anymore. It's obvious that the price is being manipulated at the 1385 level. It can only go up if it stops there. I don't know how you've been playing until now; it feels like a constant dream every day.View More

Brothers, it's time to buy the dip. If you don't buy now, you won't be able to buy later.

PI-3,57%

- Reward

- like

- 2

- Repost

- Share

小龙7757 :

:

These days, I need to do quite a few mappings. I'm not sure how many more there will be.View More

🚀 $ZIL Ready to Bounce! 🚀

The sellers have finally hit a brick wall 🧱 — smart money is stepping in!

🔥 $ZIL LONG 🔥

Entry: 0.0041 – 0.0043

SL: 0.0040

TP1: 0.00454

TP2: 0.00475

💎 High-interest bullish order block forming after a sustained downtrend. Accumulation is crystal clear as smart money defends this structural base. With buy-side liquidity stacked above recent consolidation and a massive imbalance left from the last drop, all signs point upwards 📈.

💥 This setup is ripe for a reversal — get ready for the bounce!

Trade $ZIL here 👇

#Crypto #Altcoins #ZIL #BullishSetup

The sellers have finally hit a brick wall 🧱 — smart money is stepping in!

🔥 $ZIL LONG 🔥

Entry: 0.0041 – 0.0043

SL: 0.0040

TP1: 0.00454

TP2: 0.00475

💎 High-interest bullish order block forming after a sustained downtrend. Accumulation is crystal clear as smart money defends this structural base. With buy-side liquidity stacked above recent consolidation and a massive imbalance left from the last drop, all signs point upwards 📈.

💥 This setup is ripe for a reversal — get ready for the bounce!

Trade $ZIL here 👇

#Crypto #Altcoins #ZIL #BullishSetup

ZIL-6,42%

- Reward

- 1

- 4

- Repost

- Share

AYATTAC :

:

2026 GOGOGO 👊View More

- Reward

- like

- 2

- Repost

- Share

StromBreaker :

:

we also deleted this shitView More

- Reward

- like

- 2

- Repost

- Share

小龙7757 :

:

You need to share your screenshot; don’t be foolish. There are even more low prices coming up later.View More

- Reward

- like

- 3

- Repost

- Share

Hayeli :

:

I have a purchase of $1300.View More

Load More

Trending Topics

View More139.5K Popularity

31.17K Popularity

391.96K Popularity

13.01K Popularity

12.07K Popularity

Pin