#SocialFiSectorShowsResilience

The Story of Heroes Who Survived the Crypto Storm

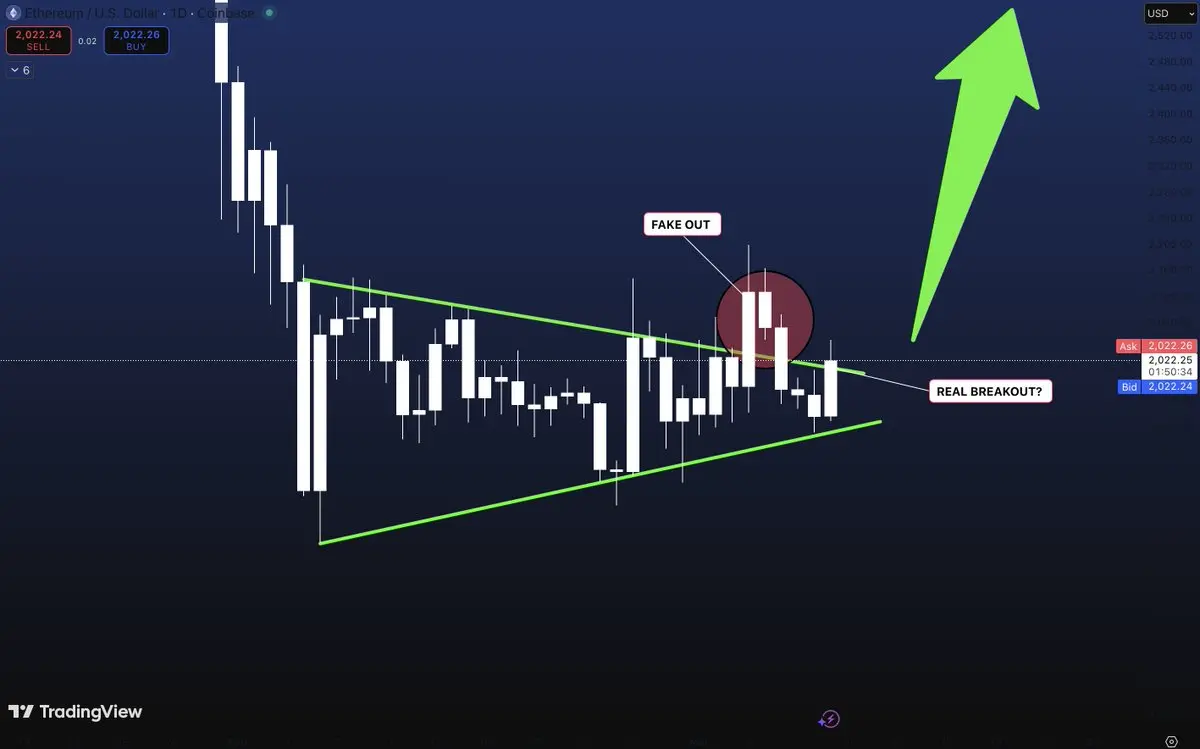

Imagine… A giant storm has broken out in the crypto ocean. Bitcoin is struggling with the waves, falling below $66,000 and trying to catch its breath. Ethereum is barely holding onto $2,000. Layer-2 cryptocurrencies, DeFi, meme coins – they're all submerged. Fear and uncertainty reign… But there's one ship that's cutting through the waves, even riding the wind: SocialFi.

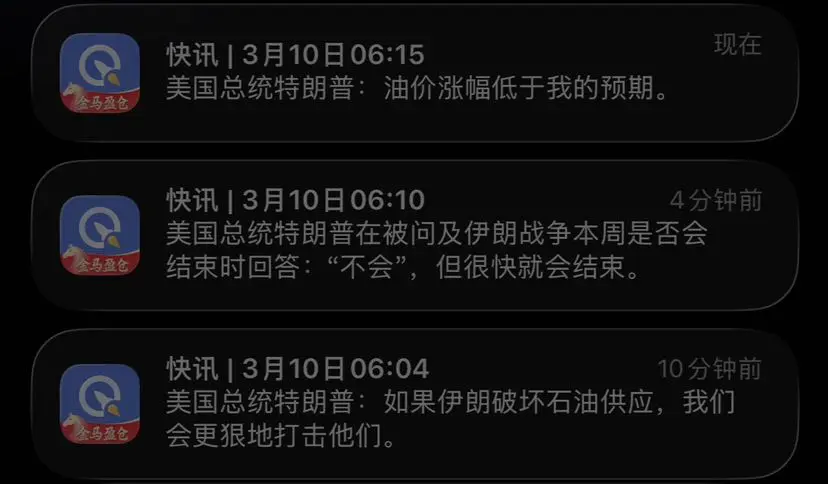

As of March 9, 2026, SoSoValue data tells exactly this story. While the overall crypto market is falling, Bitcoin is losing 1.63%, Ethereum is declining 1.15%. But the SocialFi sector is rising 0.53%! Its leader, Chiliz (CHZ), is shining with a spectacular jump of 6.3%. Moreover, even the sector index ssiSocialFi is showing a 1.35% increase. This isn't the first time; we've seen the same pattern repeatedly throughout February and March: SocialFi resists, even stands out, while the market falls. That's why the #SocialFiSectorShowsResilience hashtag is shining so brightly right now.

So where does this resilience come from? That's where the story gets deeper.

The first generation of "creator coin" platforms rose with hype in 2025, and experienced a major consolidation in 2026. Their tokens fell by over 90% from their all-time highs, some projects were abandoned or acquired by larger infrastructures. But this wasn't the end, it was rather a story of maturation. The speculative bubble burst, leaving behind "Social Essence": Real content sharing, deep connection building, users truly taking ownership of their own social graphs.

These are the ones that survived and thrived today:

Social graph infrastructures like Lens Protocol and CyberConnect (CyberConnect has surpassed 1.6 million+ users).

Farcaster (approximately 1.2 million active users) and Friendtech (800,000+ users) are still keeping daily interaction alive.

ZORA (priced at $0.01909 as of March 2026, with a market capitalization of $85.37 million and 1.07 million holders) evolved from an NFT marketplace to a SocialFi infrastructure; it stands out with its high-frequency, low-cost media mints, “Creator Coins,” and Attention Markets built on Base.

Leading tokens like Chiliz (CHZ) and Toncoin (TON) represent real-world use cases focused on sports and communities.

Social media is no longer just “like, share, forget.” Every interaction turns into a token, every share into ownership, and every community into DAOs. Users don't lose their data to platforms; they carry their own social identities on the blockchain. That's why SocialFi survives even when the market crashes; because it's no longer speculation, but a true “Ownership Economy.”

Since 2023, the sector's daily active wallets have increased by 518%. In 2026, with consolidation, we entered a healthier, more sustainable growth phase. Analysts predict that the SocialFi market could exceed $100 billion by 2033. And this growth will happen in communities like Gate Square, with real users like you.

My Gate Square friends, this story doesn't end here… This story is just beginning!

Tokenize your social interaction, own your own community, and take your place on this resilient ship, from Chiliz to TON, from ZORA to Lens. When the storm subsides, it's not the ones who survive but those who turn the storm into an opportunity who will win.

Like, Share, comment, write your own social story! 🔥

The Story of Heroes Who Survived the Crypto Storm

Imagine… A giant storm has broken out in the crypto ocean. Bitcoin is struggling with the waves, falling below $66,000 and trying to catch its breath. Ethereum is barely holding onto $2,000. Layer-2 cryptocurrencies, DeFi, meme coins – they're all submerged. Fear and uncertainty reign… But there's one ship that's cutting through the waves, even riding the wind: SocialFi.

As of March 9, 2026, SoSoValue data tells exactly this story. While the overall crypto market is falling, Bitcoin is losing 1.63%, Ethereum is declining 1.15%. But the SocialFi sector is rising 0.53%! Its leader, Chiliz (CHZ), is shining with a spectacular jump of 6.3%. Moreover, even the sector index ssiSocialFi is showing a 1.35% increase. This isn't the first time; we've seen the same pattern repeatedly throughout February and March: SocialFi resists, even stands out, while the market falls. That's why the #SocialFiSectorShowsResilience hashtag is shining so brightly right now.

So where does this resilience come from? That's where the story gets deeper.

The first generation of "creator coin" platforms rose with hype in 2025, and experienced a major consolidation in 2026. Their tokens fell by over 90% from their all-time highs, some projects were abandoned or acquired by larger infrastructures. But this wasn't the end, it was rather a story of maturation. The speculative bubble burst, leaving behind "Social Essence": Real content sharing, deep connection building, users truly taking ownership of their own social graphs.

These are the ones that survived and thrived today:

Social graph infrastructures like Lens Protocol and CyberConnect (CyberConnect has surpassed 1.6 million+ users).

Farcaster (approximately 1.2 million active users) and Friendtech (800,000+ users) are still keeping daily interaction alive.

ZORA (priced at $0.01909 as of March 2026, with a market capitalization of $85.37 million and 1.07 million holders) evolved from an NFT marketplace to a SocialFi infrastructure; it stands out with its high-frequency, low-cost media mints, “Creator Coins,” and Attention Markets built on Base.

Leading tokens like Chiliz (CHZ) and Toncoin (TON) represent real-world use cases focused on sports and communities.

Social media is no longer just “like, share, forget.” Every interaction turns into a token, every share into ownership, and every community into DAOs. Users don't lose their data to platforms; they carry their own social identities on the blockchain. That's why SocialFi survives even when the market crashes; because it's no longer speculation, but a true “Ownership Economy.”

Since 2023, the sector's daily active wallets have increased by 518%. In 2026, with consolidation, we entered a healthier, more sustainable growth phase. Analysts predict that the SocialFi market could exceed $100 billion by 2033. And this growth will happen in communities like Gate Square, with real users like you.

My Gate Square friends, this story doesn't end here… This story is just beginning!

Tokenize your social interaction, own your own community, and take your place on this resilient ship, from Chiliz to TON, from ZORA to Lens. When the storm subsides, it's not the ones who survive but those who turn the storm into an opportunity who will win.

Like, Share, comment, write your own social story! 🔥