Greenyeth

用户暂无简介

今天做出决定,明天你会为之感到高兴。

查看原文- 赞赏

- 点赞

- 评论

- 转发

- 分享

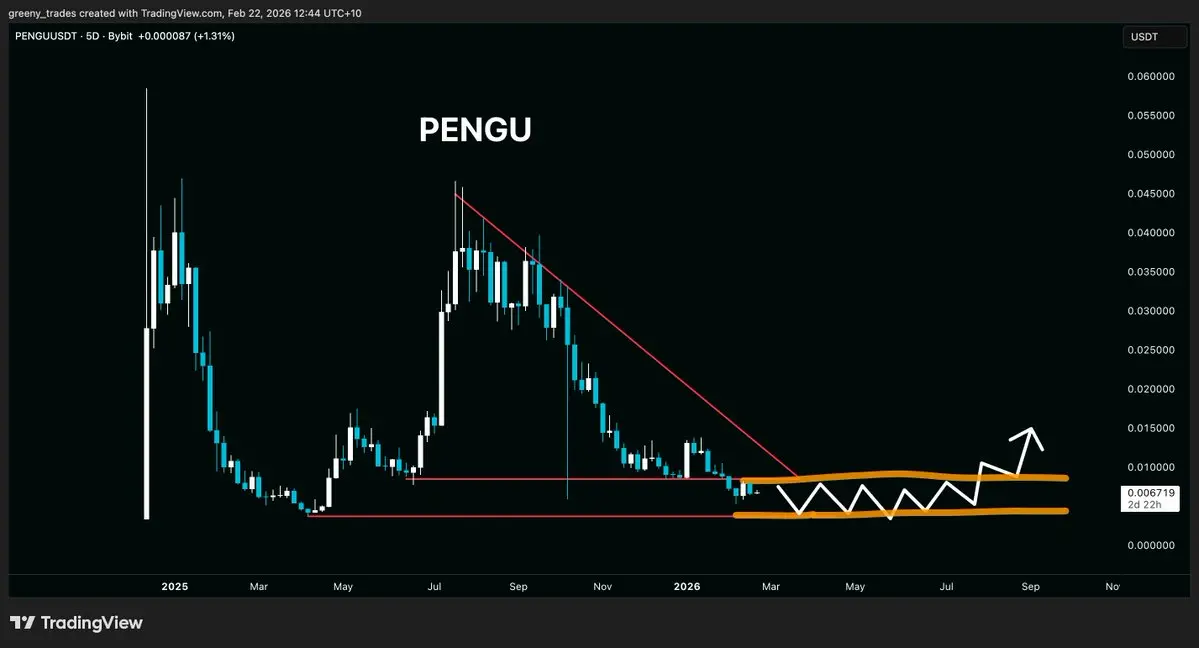

阻止任何分享这个误导性图表的人……它们并不相同。一个是在熊市之后,另一个是在牛市之后 🤦♂️

查看原文

- 赞赏

- 点赞

- 评论

- 转发

- 分享

关于流媒体产品的荒谬通货膨胀,特别是Kayo,简直是 WTF 他们在想什么。

查看原文- 赞赏

- 点赞

- 评论

- 转发

- 分享

痛苦!!!但重新走出去感觉不错 🏃♂️

查看原文

- 赞赏

- 点赞

- 评论

- 转发

- 分享

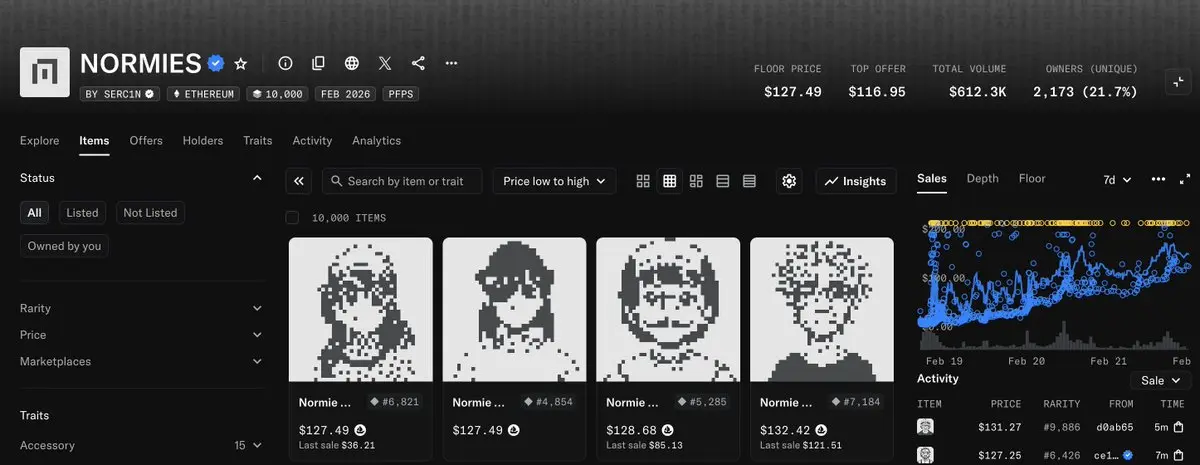

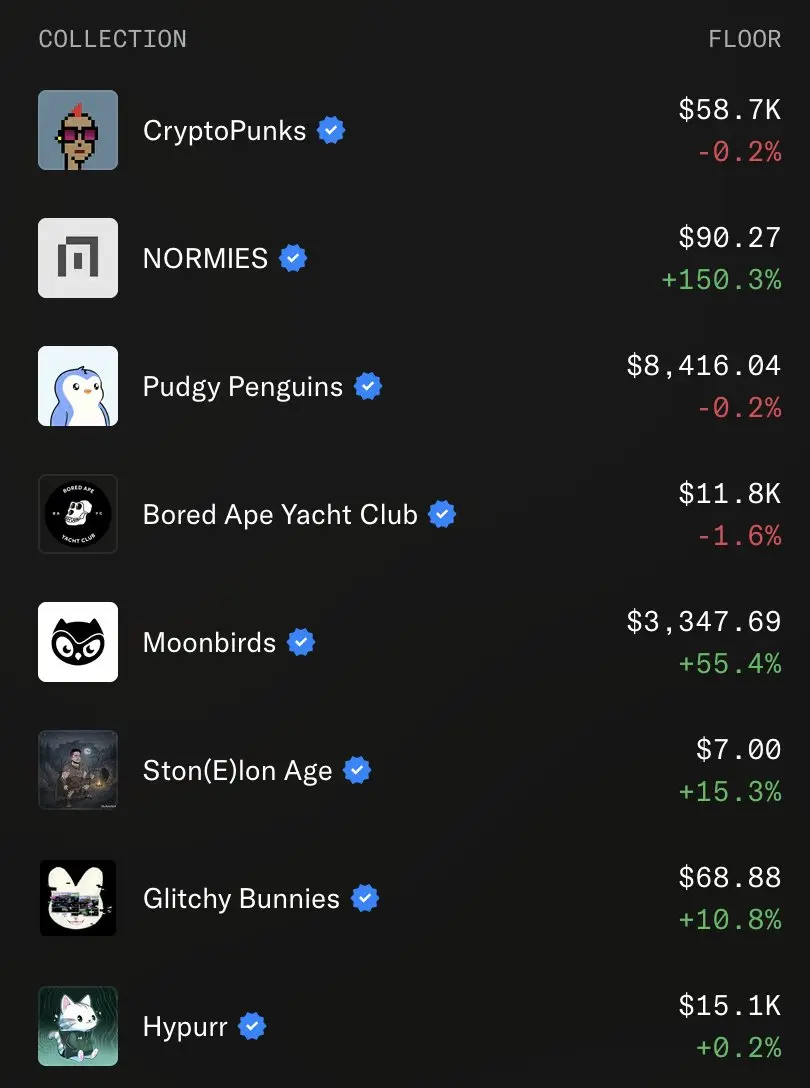

以美元查看NFT价格是正确的方式。

查看原文

- 赞赏

- 点赞

- 评论

- 转发

- 分享

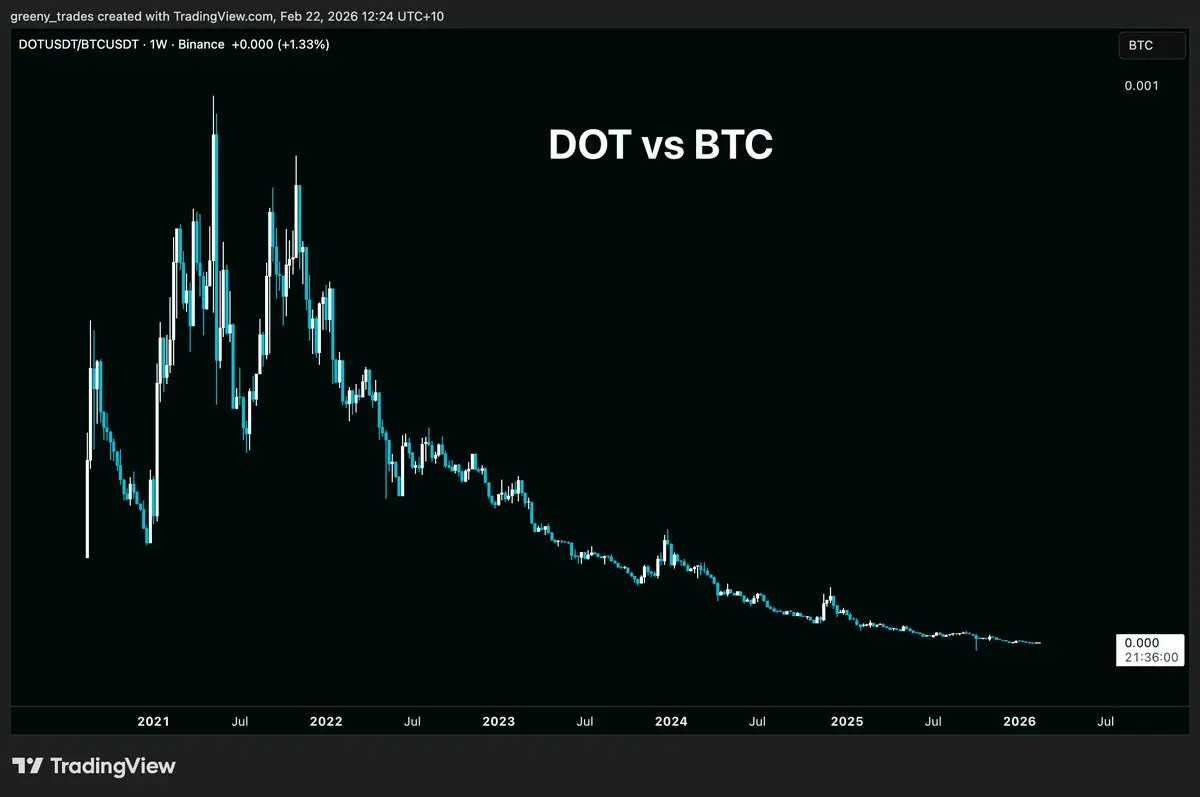

当你看到一些年轻人在CT上持有他们的资产下跌90%还期待这些代币“反弹”时,真的挺令人难过的。

抱歉,传奇,但不幸的是,你将不得不通过艰难的方式了解加密货币的残酷现实……你应该始终获利了结/设置止损。

查看原文抱歉,传奇,但不幸的是,你将不得不通过艰难的方式了解加密货币的残酷现实……你应该始终获利了结/设置止损。

- 赞赏

- 1

- 评论

- 转发

- 分享

我快乐的地方 ☀️

查看原文

- 赞赏

- 点赞

- 评论

- 转发

- 分享

热门话题

查看更多32.01万 热度

10.63万 热度

42.08万 热度

5827 热度

12.05万 热度

热门 Gate Fun

查看更多- 市值:$2549.89持有人数:20.13%

- 市值:$2547.52持有人数:20.13%

- 市值:$0.1持有人数:10.00%

- 市值:$2496.55持有人数:10.00%

- 市值:$2694.79持有人数:20.00%

置顶

福利加码,Gate 广场明星带单交易员二期招募开启!

入驻发帖 · 瓜分 $20,000 月度奖池 & 千万级流量扶持!

如何参与:

1️⃣ 报名成为跟单交易员:https://www.gate.com/copytrading/lead-trader-registration/futures

2️⃣ 报名活动:https://www.gate.com/questionnaire/7355

3️⃣ 入驻 Gate 广场,持续发布交易相关原创内容

丰厚奖励等你拿:

首帖福利:首发优质内容即得 $30 跟单体验金

双周内容激励:每双周瓜分 $500U 内容奖池

排行榜奖励:Top 10 交易员额外瓜分 $20,000 登榜奖池

流量扶持:精选帖推流、首页推荐、周度明星交易员曝光

活动时间:2026 年 2 月 12 日 18:00 – 2 月 24 日 24:00(UTC+8)

详情:https://www.gate.com/announcements/article/49849Gate 广场内容挖矿奖励继续升级!无论您是创作者还是用户,挖矿新人还是头部作者都能赢取好礼获得大奖。现在就进入广场探索吧!

创作者享受最高60%创作返佣

创作者奖励加码1500USDT:更多新人作者能瓜分奖池!

观众点击交易组件交易赢大礼!最高50GT等新春壕礼等你拿!

详情:https://www.gate.com/announcements/article/49802🏮 新年快乐,马上发财!Gate 广场 $50,000 红包雨狂降!

发帖即领,手慢无 👉 https://www.gate.com/campaigns/4044

🧨 三重惊喜,陪您红火过新年:

1️⃣ $50,000 红包雨:发帖即领,新用户 100% 中奖,单帖最高 28 GT

2️⃣ 马年锦鲤:带 #我在Gate广场过新年 发帖,抽 1 人送 50 GT + 新春礼盒

3️⃣ 创作者榜单赛:赢国米球衣、Red Bull 联名夹克、VIP 露营套装等豪礼

📅 2/9 17:00 – 2/23 24:00(UTC+8)

请将 App 更新至 8.8.0+ 版本参与

详情:https://www.gate.com/announcements/article/49773Gate 广场“新星计划”正式上线!

开启加密创作之旅,瓜分月度 $10,000 奖励!

参与资格:从未在 Gate 广场发帖,或连续 7 天未发帖的创作者

立即报名:https://www.gate.com/questionnaire/7396

您将获得:

💰 1,000 USDT 月度创作奖池 + 首帖 $50 仓位体验券

🔥 半月度「爆款王」:Gate 50U 精美周边

⭐ 月度前 10「新星英雄榜」+ 粉丝达标榜单 + 精选帖曝光扶持

加入 Gate 广场,赢奖励 ,拿流量,建立个人影响力!

详情:https://www.gate.com/announcements/article/49672