ForkMonger

Is there a new signal of big institutions increasing their holdings? Check out this founder's tactics

Senior executives of well-known companies have once again expressed bullish sentiment on Bitcoin, indicating the industry's firm stance on long-term allocation. Market patterns show that after related opinions are published, institutions often increase their Bitcoin holdings, providing a reference for investors.

BTC-0.39%

- Reward

- 13

- 7

- Repost

- Share

SleepTrader :

:

Is this the same trick again? Saying one thing but doing another, just waiting for retail investors to follow suit. ---

Such obvious tricks, and people still believe. I think next time he speaks, I’ll do the opposite.

---

The "signal" from institutions, to put it plainly, is just a rhythm chart for harvesting retail investors.

---

Wait, is this logic reversed? Do institutions increase their holdings after he speaks, or does he speak after they increase their holdings?

---

Always like this, bullish sentiment is pumped up, and then? They run away.

---

Catching the signal ≠ making money; the key is that you’re one step behind them, brother.

---

"Long-term allocation" means long-term locking, but we’re just short-term trapped.

---

Laughs, no matter how obvious the signal, it’s just a menu for the big players.

---

Instead of waiting for signals, why not just go all-in? Anyway, it’s all gambling.

---

Institutions are deep in tricks; I want to go back to the countryside.

View More

Sometimes looking back, opportunities are right in front of you but you always miss them. The story of this ancient whale is a classic example.

Let's go back to November 2013, when BTC was hovering around $332. This holder accumulated 5,000 coins in one go, which at the time cost less than $2 million. And he held on to them for a full 12 years.

By November 2024, this whale finally started to realize profits. Just 9 hours ago, he sold another 500 BTC, totaling $47.77 million. Based on the current pace of operations, this whale has already transferred 2,500 BTC to a major exchange, with a total

Let's go back to November 2013, when BTC was hovering around $332. This holder accumulated 5,000 coins in one go, which at the time cost less than $2 million. And he held on to them for a full 12 years.

By November 2024, this whale finally started to realize profits. Just 9 hours ago, he sold another 500 BTC, totaling $47.77 million. Based on the current pace of operations, this whale has already transferred 2,500 BTC to a major exchange, with a total

BTC-0.39%

- Reward

- 4

- 5

- Repost

- Share

MetaverseLandlord :

:

It's really like holding a gold mine and not knowing it. The leek farmers from 2013 have now become major players.View More

#数字资产市场动态 has been trading for 8 years, now 37 years old, with assets in the eight figures. When staying in hotels on business trips, I never look at the prices—this is not showing off, just the reality. Among friends of the same age, those working in factories or doing e-commerce are not living as comfortably.

To be honest, relying on a fixed salary to turn things around is too difficult. I realized this about ten years ago, so I decided to go all-in on trading. Having stepped on enough pits, I can now speak about it confidently.

Having seen enough of the market—experienced both bull and bea

View OriginalTo be honest, relying on a fixed salary to turn things around is too difficult. I realized this about ten years ago, so I decided to go all-in on trading. Having stepped on enough pits, I can now speak about it confidently.

Having seen enough of the market—experienced both bull and bea

- Reward

- 13

- 7

- Repost

- Share

GateUser-e19e9c10 :

:

That's right, you just need to know when to stay quiet and lay low, and not chase after every trend blindly.View More

There's a particularly painful phenomenon: knowing you should cut your losses, but your finger just won't press the sell button.

Many people think it's a lack of technical skill, but actually, they started off wrong — stop-loss isn't a technical issue at all; it's purely human nature messing around.

**The First Hurdle: The Cost of Dignity**

When not cutting losses, it's not because you can't see the market has turned bad, but because you’re holding onto a pride, insisting on waiting for a reversal to prove you were right from the start. You're not protecting your money; you're defending that s

View OriginalMany people think it's a lack of technical skill, but actually, they started off wrong — stop-loss isn't a technical issue at all; it's purely human nature messing around.

**The First Hurdle: The Cost of Dignity**

When not cutting losses, it's not because you can't see the market has turned bad, but because you’re holding onto a pride, insisting on waiting for a reversal to prove you were right from the start. You're not protecting your money; you're defending that s

- Reward

- 7

- 4

- Repost

- Share

OneBlockAtATime :

:

Ah... I feel like I'm looking in a mirror, so realistic it hurts.View More

There have been quite a few movements in the crypto space these days. Keep an eye on the calendar so you don't miss out.

**Upcoming Token Events**

LayerZero's ZRO token is about to undergo a major unlock. On January 20th at 7:00 PM Beijing time, approximately 25.71 million ZRO will be unlocked, accounting for 6.36% of the circulating supply, with a market cap close to $44.5 million. Will this impact the market? Stay tuned.

Next, on January 21st at 8:00 AM, Plume's PLUME token will experience a larger unlock — 1.37 billion tokens, which is significant, representing 39.75% of the circulating sup

View Original**Upcoming Token Events**

LayerZero's ZRO token is about to undergo a major unlock. On January 20th at 7:00 PM Beijing time, approximately 25.71 million ZRO will be unlocked, accounting for 6.36% of the circulating supply, with a market cap close to $44.5 million. Will this impact the market? Stay tuned.

Next, on January 21st at 8:00 AM, Plume's PLUME token will experience a larger unlock — 1.37 billion tokens, which is significant, representing 39.75% of the circulating sup

- Reward

- 5

- 4

- Repost

- Share

GasSavingMaster :

:

Plume's 39.75% unlock really dares to do it, directly smashing the market in advance.View More

Many beginners in the crypto space face the biggest problem of not knowing how to start with small amounts. Today, let's discuss a relatively steady progressive strategy—if your initial capital is 1000U, you can follow this approach.

**Stage 1: Survival Stage (1000U to 5000U)**

The goal at this stage is very clear: stay alive. Divide 1000U into 5 parts, each with 200U for trading. It sounds conservative, but this is the key—controlling the risk per trade to give yourself room for mistakes.

What exactly should you do? Set stop-loss and take-profit points before each trade. Don’t chase rallies,

View Original**Stage 1: Survival Stage (1000U to 5000U)**

The goal at this stage is very clear: stay alive. Divide 1000U into 5 parts, each with 200U for trading. It sounds conservative, but this is the key—controlling the risk per trade to give yourself room for mistakes.

What exactly should you do? Set stop-loss and take-profit points before each trade. Don’t chase rallies,

- Reward

- 6

- 5

- Repost

- Share

rugged_again :

:

Well said, but I still think most people can't reach the first stage and already blow up. At the beginning, when it seems like there's no profit, they get itchy and must leverage to try.

View More

I recently revisited the Plasma project and felt that its approach is quite unique — it’s not rushing to jump on hot topics, but instead focusing on practical applications. Specifically, its design in terms of scalability and efficiency is indeed impressive. High-frequency interactions and complex contracts run at much lower costs on Plasma, which is quite attractive to developers and users.

The infrastructure is also gradually maturing, and the ecosystem activity is on the rise. The moment when the network truly starts to play a role seems to be getting closer. From an investment perspective,

View OriginalThe infrastructure is also gradually maturing, and the ecosystem activity is on the rise. The moment when the network truly starts to play a role seems to be getting closer. From an investment perspective,

- Reward

- 10

- 4

- Repost

- Share

NotFinancialAdvice :

:

Plasma is really the type of quiet achiever who makes big gains without much noise, unlike other projects that shout every day. Honestly, with the cost advantage there, developers will definitely come.

In the long run, it's definitely worth paying attention to, but in the short term, there's not much hype to ride on.

View More

Currently, many cryptocurrencies are facing significant depth adjustments. Especially at this price level, the number of traders following the trend to add positions is too high, which often indicates that market sentiment has reached a dangerous level. This is true even for some popular coins.

I have personally suffered losses in this regard. There are always voices in the group saying "It’s about to rise," and I believed them, adding to my positions several times, only to be repeatedly forced to cut losses. Listening to those who say it will go up—such talk is not unusual in any market condi

I have personally suffered losses in this regard. There are always voices in the group saying "It’s about to rise," and I believed them, adding to my positions several times, only to be repeatedly forced to cut losses. Listening to those who say it will go up—such talk is not unusual in any market condi

FIL-2.43%

- Reward

- 1

- 4

- Repost

- Share

bridgeOops :

:

The 11 files are calling the bottom now at 1.5, this is ridiculous, I really can't stand the people in the group.View More

On-chain data monitoring has detected an interesting phenomenon: a whale that once sold 255 BTC has recently engaged in leveraged trading on DASH and DOGE—short 5x on DASH and long 10x on DOGE. Interestingly, this major holder's main positions are actually quite conservative: long positions in BTC, ETH, and SOL totaling $457 million, with an unrealized loss of $3.3 million.

This contrast is quite thought-provoking. On one hand, holding nearly $500 million in mainstream cryptocurrencies long positions, while on the other hand, testing the market with leverage on smaller coins—Is this a risk hed

View OriginalThis contrast is quite thought-provoking. On one hand, holding nearly $500 million in mainstream cryptocurrencies long positions, while on the other hand, testing the market with leverage on smaller coins—Is this a risk hed

- Reward

- 3

- 5

- Repost

- Share

MentalWealthHarvester :

:

What is this whale betting on? 457 million isn't enough for it to mess around with?View More

The GWEI airdrop registration phase is about to end. Hurry up and complete your wallet registration. According to the project team, this airdrop is expected to be one of the most attention-grabbing events in the crypto community this year.

Users interested in GWEI should stay updated with the project's official announcements, especially regarding the specific timeline for exchange listings. The team will continue to release the latest progress, so don't miss out.

View OriginalUsers interested in GWEI should stay updated with the project's official announcements, especially regarding the specific timeline for exchange listings. The team will continue to release the latest progress, so don't miss out.

- Reward

- 7

- 4

- Repost

- Share

FlashLoanKing :

:

Oh my god, another airdrop, my wallet is almost full.View More

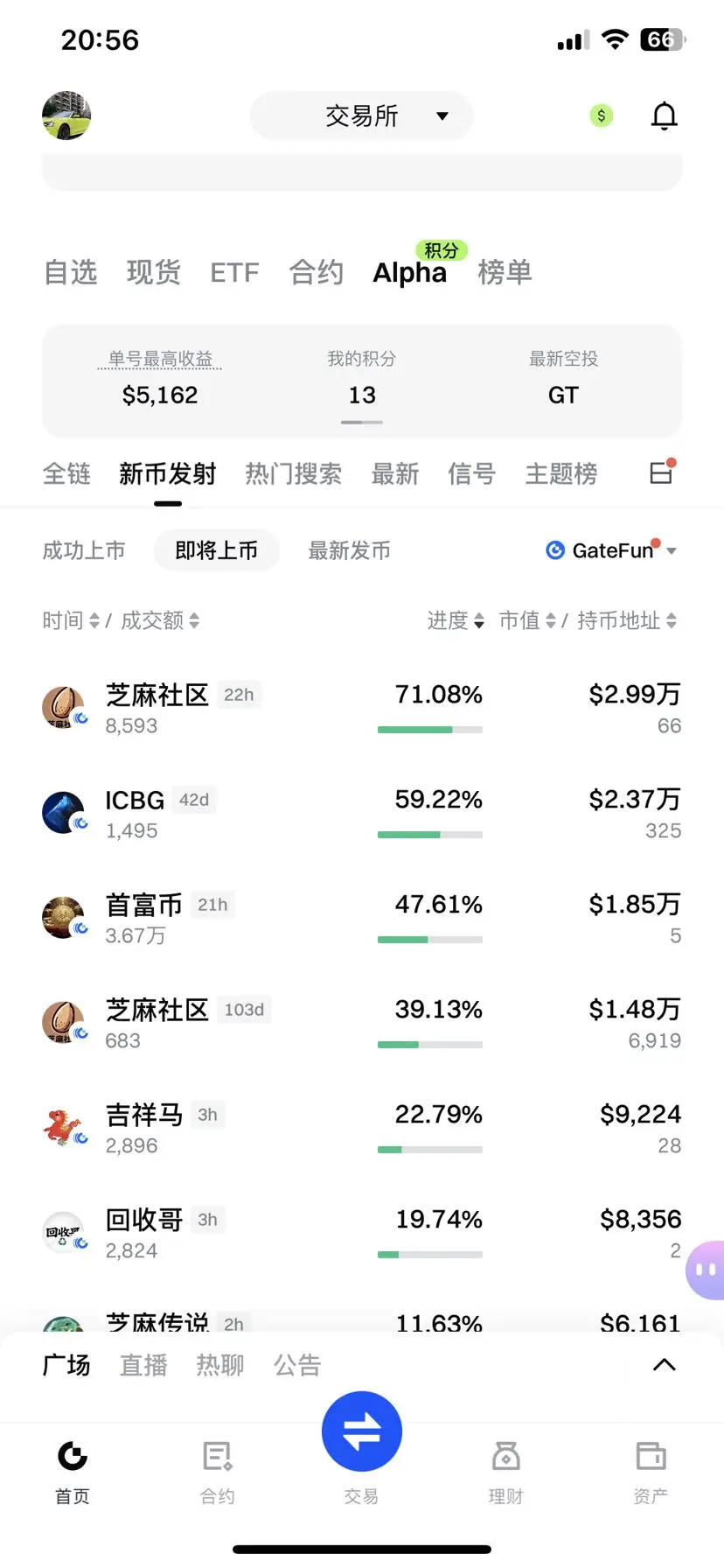

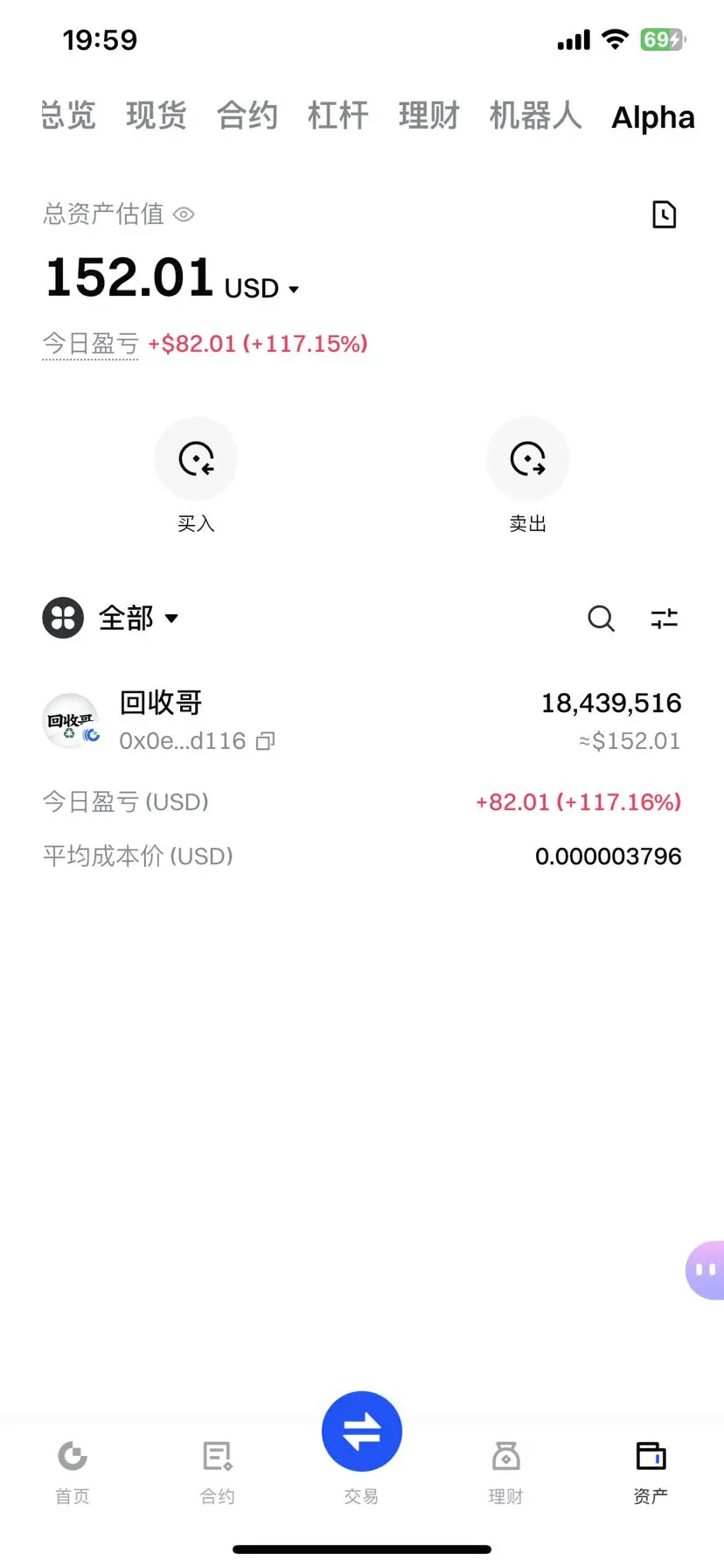

#回收哥 The first and only token I personally created, now in the listing stage. The platform will go live once 100% of the funding goal is reached.

Hope everyone shows more support, let's take off together 🛫

View OriginalHope everyone shows more support, let's take off together 🛫

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 4

- 6

- Repost

- Share

DORO :

:

66666View More

When your principal is less than 1500U, forget about the "doubling" dream. The only goal at this stage is one — to survive. Living is more important than how much you earn.

Want to stand firm in the crypto world? These three methods can be used immediately:

**First: Diversify your funds, never all in**

Suppose you have 1200U. Don't put it all in at once; doing so is equivalent to self-destruct. Divide it into three parts: 400U for intraday trading, doing just one or two trades a day, taking profits and exiting; another 400U for swing trading, waiting for clear signals before acting; and the la

View OriginalWant to stand firm in the crypto world? These three methods can be used immediately:

**First: Diversify your funds, never all in**

Suppose you have 1200U. Don't put it all in at once; doing so is equivalent to self-destruct. Divide it into three parts: 400U for intraday trading, doing just one or two trades a day, taking profits and exiting; another 400U for swing trading, waiting for clear signals before acting; and the la

- Reward

- 8

- 4

- Repost

- Share

BrokeBeans :

:

Really, going all in is like gambling your life. I've seen too many people lose everything with a single all-in move. Dividing your positions has definitely saved me several times. You can't be greedy.

That hits too close to home. If you don't understand, don't just make random moves. The worst times I lost the most were when I was trading impulsively.

Stop-loss really depends on discipline. Otherwise, you'll always think it will bounce back, and that's the end.

Being alive is the real victory. What's the point of doubling your money? Small accounts just have to hang in there.

View More

#数字资产市场动态 $TNSR's recent rally was quite significant, but unfortunately I didn't buy more at the low point. I watched it drop from 0.08 to 0.0086 and didn't dare to act, and now that it has rebounded, I regret it—missed out on the opportunity to earn more. This is the norm in the crypto world, isn't it? When the market moves, some people miss out, some jump in, and others follow halfway. Market fluctuations are easy to see clearly in hindsight, but when it comes to your own account, your hands go weak. The lesson this time: next time, I need to have some psychological preparation for the lows.

TNSR14.95%

- Reward

- 9

- 5

- Repost

- Share

ser_we_are_early :

:

Seeing 0.0086, that wave really crushed my mentality. I was scared back then, and now I regret it to the point of feeling sick.View More

Daily trading, does wishing work? Actually, it does. Look at this guy, labeled as a "noob player," who managed to turn into a millionaire in just one day. How big is the contrast? Dreams sometimes become reality in such an absurd way. The crypto world is like that—yesterday's newbie might be tomorrow's legend. Although the probability is slim, someone always manages to turn the impossible into possible. Isn't this when wishing is most useful?

View Original- Reward

- 7

- 6

- Repost

- Share

GasFeeCrier :

:

Bro, this story is a bit unbelievable, but the crypto world really is this crazy.View More

TRUMP team makes a big move: 381,000 tokens transferred to exchanges, worth $2 million

【Blockchain Rhythm】 Interestingly, the TRUMP project team has recently taken action again. According to on-chain data monitoring, the TRUMP team wallet has just transferred 381,000 TRUMP tokens to a major exchange, equivalent to approximately $2 million at the current price. Such large fund inflows into exchanges usually indicate that the project team is adjusting their strategy. Whether they aim to increase liquidity or have other plans, the market is watching.

TRUMP-2.73%

- Reward

- 13

- 4

- Repost

- Share

RadioShackKnight :

:

381,000 coins dumped on the exchange? So it's another round of cutting leeks, huh? How many times has this script been played out?View More

Marge is an emerging token project currently trading at a 17k market cap. The project leverages an AI-powered recursive context system, representing an interesting approach to intelligent protocol design. For those exploring early-stage Web3 innovations, this particular approach to integrating AI mechanisms into token economics could warrant attention in the current landscape of experimental blockchain projects.

- Reward

- 3

- 3

- Repost

- Share

TokenomicsShaman :

:

17k market cap... This is playing with fire. Recursive context systems sound like too much fuss.View More

BERA has pulled back from the high of 1.0366. This wave of decline indeed scared many people. But upon closer inspection of the market, the trading volume has significantly shrunk, what does this indicate? The main funds have not actually exited in large scale.

Low-level oscillations are often like this — seemingly fierce declines are actually washing out those retail investors with unstable mindsets. The unwilling profit-taking has been cleared out, which precisely indicates that the main forces are recovering chips. Currently, around the 0.899 level, from a volume perspective, there is indee

Low-level oscillations are often like this — seemingly fierce declines are actually washing out those retail investors with unstable mindsets. The unwilling profit-taking has been cleared out, which precisely indicates that the main forces are recovering chips. Currently, around the 0.899 level, from a volume perspective, there is indee

BERA-8.03%

- Reward

- 2

- 3

- Repost

- Share

GateUser-3339b780 :

:

No panic, no cutting losses, buy more when you have moneyView More

If you're keeping things straightforward, just acquire a solid amount of tokens directly on the blockchain. No need to overthink it—go onchain and make it happen with real volume.

- Reward

- 2

- 3

- Repost

- Share

RugpullTherapist :

:

Just buy directly on the chain, don't overthink it... Really, just go ahead and invest with confidence.View More

Airdrop profit-taking has been realized, and the selling pressure from newly issued tokens is gradually diminishing. Early believers have already jumped on board, and the momentum for short sellers to close their positions is also waning. Now, the true construction phase has arrived.

I am very optimistic about this starting point. After cleansing and oscillation, the structure of market participants has been fully adjusted—those remaining are genuine builders and long-term participants. Starting to accumulate from the bottom now is more meaningful than ever. When all speculative forces are exh

View OriginalI am very optimistic about this starting point. After cleansing and oscillation, the structure of market participants has been fully adjusted—those remaining are genuine builders and long-term participants. Starting to accumulate from the bottom now is more meaningful than ever. When all speculative forces are exh

- Reward

- 6

- 4

- Repost

- Share

P2ENotWorking :

:

Sounds great, but I feel like it's just hype to pump up retail investors again.View More

This week's trading report is out—21 consecutive wins, the main market has accumulated 15,482 points, corresponding to a capital gain of 95,838; small caps gained 634 points, with a capital gain of 65,275.

Here's a daily breakdown: Monday's main market gained 4,464 points (capital gain of 28,162), small caps gained 154 points (capital gain of 15,496); Tuesday's main market gained 3,028 points (capital gain of 21,137), small caps gained 51 points (capital gain of 5,653); Wednesday's main market gained 3,282 points (capital gain of 18,231), small caps gained 243 points (capital gain of 24,143);

View OriginalHere's a daily breakdown: Monday's main market gained 4,464 points (capital gain of 28,162), small caps gained 154 points (capital gain of 15,496); Tuesday's main market gained 3,028 points (capital gain of 21,137), small caps gained 51 points (capital gain of 5,653); Wednesday's main market gained 3,282 points (capital gain of 18,231), small caps gained 243 points (capital gain of 24,143);

- Reward

- 8

- 4

- Repost

- Share

TrustlessMaximalist :

:

A 21-game winning streak earned through hard work, not just hype.View More

Load More

Trending Topics

View More23.41K Popularity

18.71K Popularity

29.22K Popularity

10.23K Popularity

9.17K Popularity

Hot Gate Fun

View More- MC:$3.55KHolders:10.00%

- MC:$3.55KHolders:10.00%

- MC:$3.59KHolders:20.05%

- MC:$3.55KHolders:10.00%

- MC:$3.54KHolders:10.00%

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889Gate 2025 Year-End Gala Square TOP50 List Announced!

The final ranking phase is now live.

Earn Votes by watching live streams and posting.

30 Votes = 1 chance — support your favorite creators now!

👉 https://www.gate.com/activities/community-vote-2025

iPhone 17 Pro Max, JD gift cards, Mi Band, Gate merch await you!

Creators are welcome to rally fans to climb the rankings and win rewards!

Voting ends: Jan 20, 02:00 UTC

Details: https://www.gate.com/announcements/article/48693