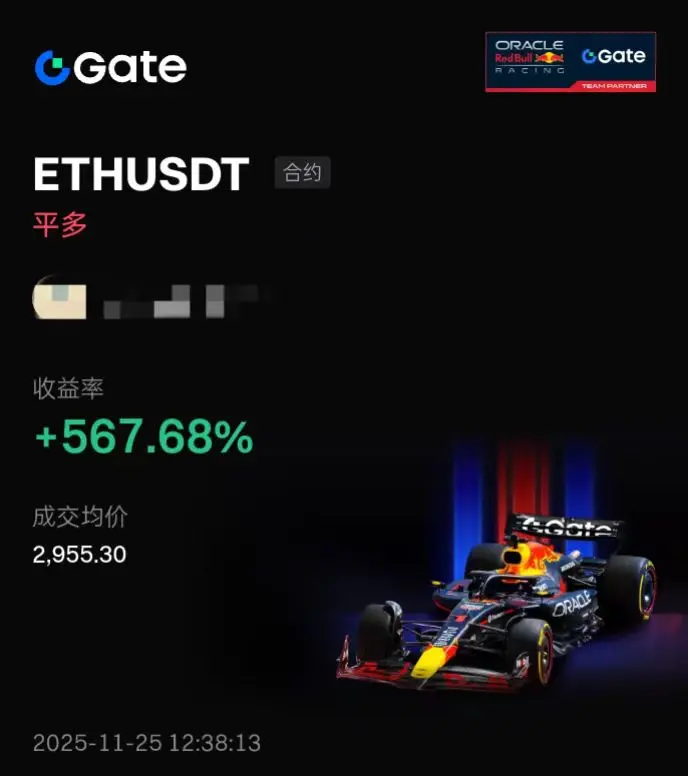

ETH current price 3020-25 long stop loss 2970 take profit 3080 (break even)-3140 nearby

WildTraderGuzi

I am Guzi, and by the end of October this year, I will have been in the industry for seven years and four months.

These seven years have passed in the blink of an eye, it feels just like yesterday when I first entered the industry. The time when I just started is still vivid in my memory, and thinking back on it now is quite painful.

There is a saying from a big shot, who is now free and has done many meaningful things, donating several hundred million. This big shot was born in 1992, one year younger than me. Back in 2012 or so, he was working while trading. When he was close to a margin call

View OriginalThese seven years have passed in the blink of an eye, it feels just like yesterday when I first entered the industry. The time when I just started is still vivid in my memory, and thinking back on it now is quite painful.

There is a saying from a big shot, who is now free and has done many meaningful things, donating several hundred million. This big shot was born in 1992, one year younger than me. Back in 2012 or so, he was working while trading. When he was close to a margin call