2025 ARG Price Prediction: Analyzing Potential Growth Factors and Market Trends for Argentina's Currency

Introduction: ARG's Market Position and Investment Value

Argentine Football Association Fan Token (ARG) as the official fan token of the Argentina Football Association Club, has been strengthening the relationship between fans and the club since its inception. As of 2025, ARG's market capitalization has reached $7,402,926, with a circulating supply of approximately 10,099,491 tokens, and a price hovering around $0.733. This asset, known as a "fan engagement tool," is playing an increasingly crucial role in sports fan participation and club decision-making processes.

This article will comprehensively analyze ARG's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. ARG Price History Review and Current Market Status

ARG Historical Price Evolution

- 2022: All-time high of $9.19 reached on November 18, coinciding with the FIFA World Cup

- 2022: All-time low of $0.424316 recorded on May 12, during a broader crypto market downturn

- 2025: Current price at $0.733, showing recovery but still below historical peak

ARG Current Market Situation

As of November 22, 2025, ARG is trading at $0.733, with a 24-hour trading volume of $21,706.91. The token has experienced a slight decline of 0.67% in the past 24 hours. ARG's market cap stands at $7,402,926.90, ranking it 1368th in the cryptocurrency market. The circulating supply is 10,099,491 ARG tokens, with a total supply of 20,000,000. Over the past week, ARG has shown a positive trend with a 2.18% increase, while experiencing a 4.01% decrease over the last 30 days. The token's performance over the past year indicates a 13.17% decline.

Click to view the current ARG market price

ARG Market Sentiment Indicator

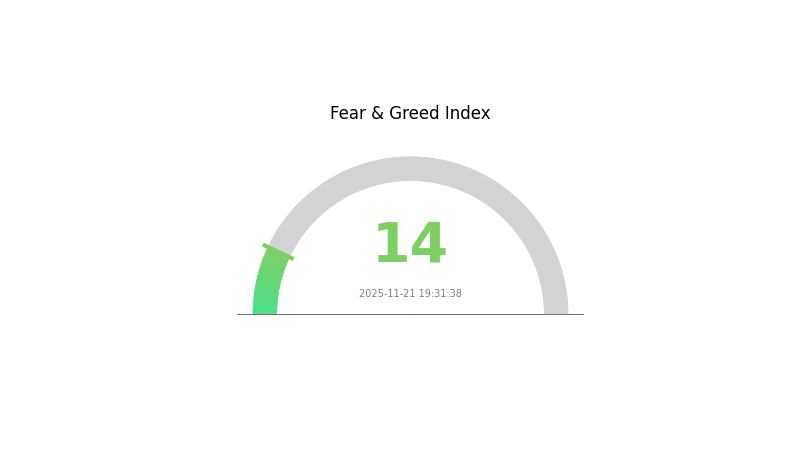

2025-11-21 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the Fear and Greed Index plummeting to 14. This indicates a high level of pessimism among investors, potentially signaling oversold conditions. While such extreme fear can present buying opportunities for contrarian investors, it's crucial to exercise caution and conduct thorough research. Market sentiment can shift rapidly, and the current fear could be a precursor to a market rebound or further decline. Stay informed and consider diversifying your portfolio to navigate these uncertain times.

ARG Holdings Distribution

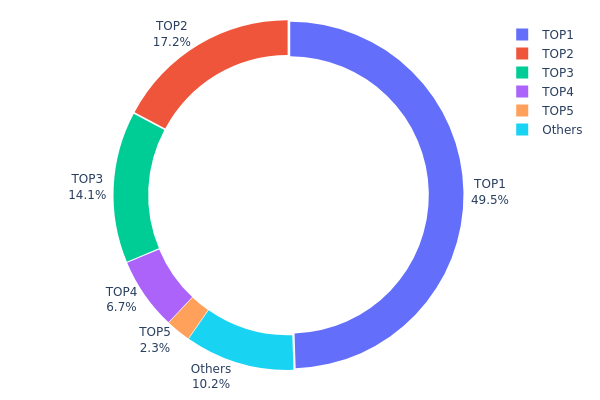

The address holdings distribution data for ARG reveals a highly concentrated ownership structure. The top address holds nearly half (49.50%) of the total supply, while the top 5 addresses collectively control 89.79% of all ARG tokens. This concentration is particularly noteworthy, with the largest holder possessing almost 10 million ARG tokens.

Such a concentrated distribution raises concerns about market stability and potential price manipulation. With a single entity controlling nearly half the supply, there's a risk of significant market impact should they decide to sell or move large quantities. The high concentration among the top holders also suggests a relatively low level of decentralization, which could affect ARG's resilience to market shocks and its overall ecosystem health.

This distribution pattern indicates that ARG's market structure may be vulnerable to volatility triggered by the actions of a few large holders. It also suggests that the token's on-chain governance, if implemented, could be heavily influenced by a small number of addresses. Potential investors and market participants should be aware of these concentration risks when considering ARG's market dynamics and long-term prospects.

Click to view the current ARG Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6F45...41a33D | 9900.51K | 49.50% |

| 2 | 0xc368...816880 | 3446.50K | 17.23% |

| 3 | 0x611f...dFB09d | 2812.94K | 14.06% |

| 4 | 0x0213...F3cF97 | 1340.19K | 6.70% |

| 5 | 0xc80A...e92416 | 459.84K | 2.30% |

| - | Others | 2040.02K | 10.21% |

II. Core Factors Affecting ARG's Future Price

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, ARG may potentially serve as a hedge against inflation, similar to other digital assets. However, its specific performance in inflationary environments would depend on various factors and market conditions.

Technical Development and Ecosystem Building

- Ecosystem Applications: While specific details are not provided, ARG, as a cryptocurrency, likely has or is developing various decentralized applications (DApps) and ecosystem projects to enhance its utility and value proposition within the blockchain space.

III. ARG Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.46141 - $0.60000

- Neutral forecast: $0.60000 - $0.75000

- Optimistic forecast: $0.75000 - $0.87888 (requires strong market recovery)

2027-2028 Outlook

- Market phase expectation: Potential bull market phase

- Price range prediction:

- 2027: $0.54304 - $1.10389

- 2028: $0.79765 - $1.38591

- Key catalysts: Increased adoption, technological advancements, and overall crypto market growth

2030 Long-term Outlook

- Base scenario: $0.99706 - $1.29276 (assuming steady market growth)

- Optimistic scenario: $1.29276 - $1.65474 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: Above $1.65474 (extreme positive market conditions and widespread ARG utility)

- 2030-12-31: ARG $1.29276 (76% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.87888 | 0.7324 | 0.46141 | 0 |

| 2026 | 0.97482 | 0.80564 | 0.572 | 10 |

| 2027 | 1.10389 | 0.89023 | 0.54304 | 21 |

| 2028 | 1.38591 | 0.99706 | 0.79765 | 36 |

| 2029 | 1.39404 | 1.19149 | 0.89362 | 62 |

| 2030 | 1.65474 | 1.29276 | 0.68516 | 76 |

IV. ARG Professional Investment Strategies and Risk Management

ARG Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and football enthusiasts

- Operation suggestions:

- Accumulate ARG tokens during market dips

- Stay informed about Argentina Football Association's developments

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor football-related news and events that may impact ARG price

- Set stop-loss orders to manage downside risk

ARG Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various fan tokens and crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ARG

ARG Market Risks

- High volatility: Fan token prices can fluctuate dramatically

- Limited liquidity: May face challenges in executing large trades

- Dependency on team performance: Token value tied to Argentina Football Association's success

ARG Regulatory Risks

- Uncertain regulatory landscape: Fan tokens may face scrutiny from financial regulators

- Potential classification changes: Risk of being categorized as securities

- Cross-border restrictions: Varying regulations across jurisdictions may impact trading

ARG Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token's underlying code

- Blockchain network issues: Congestion or outages on the Chiliz blockchain could affect transactions

- Wallet security: Risk of theft or loss if proper security measures are not implemented

VI. Conclusion and Action Recommendations

ARG Investment Value Assessment

ARG offers unique exposure to the sports fan token market, with potential for growth tied to the Argentina Football Association's popularity. However, investors should be aware of high volatility and regulatory uncertainties in this nascent market segment.

ARG Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about fan token dynamics ✅ Experienced investors: Consider ARG as part of a diversified crypto portfolio, with active management ✅ Institutional investors: Conduct thorough due diligence and consider ARG for thematic or sports-related investment strategies

ARG Trading Participation Methods

- Spot trading: Buy and sell ARG tokens on Gate.com

- Staking: Participate in staking programs if available to earn additional rewards

- Fan engagement: Utilize ARG tokens for voting and other fan-related activities on the Argentina Football Association platform

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does API3 have a future?

Yes, API3 has a promising future. Its decentralized API network and first-party oracles are likely to play a crucial role in Web3 development, potentially driving increased adoption and value in the coming years.

Is Argo Blockchain worth buying?

Yes, Argo Blockchain shows potential for growth in the crypto mining sector. Its strategic investments and expanding operations make it an attractive option for investors looking to gain exposure to the blockchain industry.

Is arx a good buy now?

Yes, ARX looks promising. Its innovative blockchain solutions and growing adoption suggest potential for significant price appreciation in the near future.

What is the price target for Argo?

Argo's price target for 2025 is projected to reach $0.50, based on market trends and potential growth in the Web3 sector.

Share

Content