2025 ATM Price Prediction: Analyzing Trends and Forecasting the Future of Automated Banking

Introduction: ATM's Market Position and Investment Value

Atletico Madrid Fan Token (ATM) as a fan engagement token for Atletico Madrid Football Club, has made significant strides since its inception in 2020. As of 2025, ATM's market capitalization has reached $6,626,184, with a circulating supply of approximately 7,599,707 tokens, and a price hovering around $0.8719. This asset, often referred to as a "sports fan token," is playing an increasingly crucial role in the realm of fan participation and sports-related blockchain applications.

This article will provide a comprehensive analysis of ATM's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ATM Price History Review and Current Market Status

ATM Historical Price Evolution Trajectory

- 2020: ATM launched in December, initial price at $20.88

- 2021: Reached all-time high of $58.46 on May 16, marking a 180% increase

- 2025: Entered a bearish market, price dropped to all-time low of $0.871279 on November 21

ATM Current Market Situation

As of November 22, 2025, ATM is trading at $0.8719, showing a 4.08% decrease in the last 24 hours. The token has experienced significant downward pressure, with a 25.75% decline over the past 30 days and a 54.069% drop in the last year. The current price is 98.51% below its all-time high, indicating a prolonged bearish trend. ATM's market cap stands at $6,626,184, ranking it 1411th in the cryptocurrency market. With a circulating supply of 7,599,707 ATM tokens, representing 75.99% of the total supply, the token maintains a relatively high circulation ratio. The 24-hour trading volume of $31,254 suggests moderate market activity.

Click to view the current ATM market price

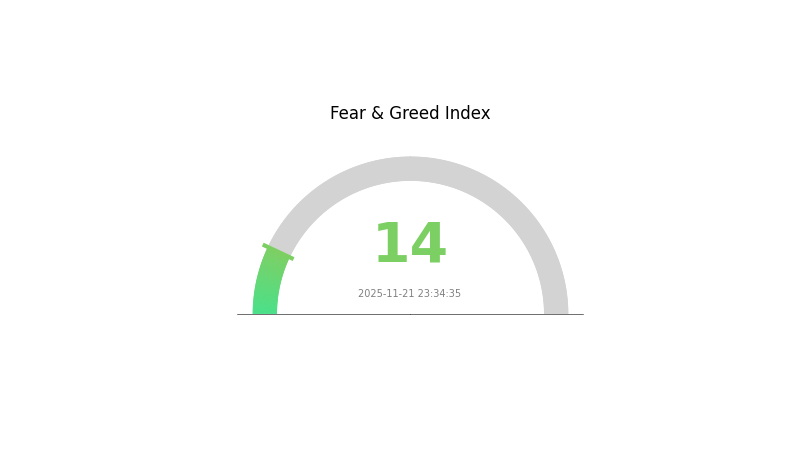

ATM Market Sentiment Index

2025-11-21 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 14. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. While fear can create discounts, it may also indicate underlying market issues. Savvy traders might consider dollar-cost averaging or waiting for clear reversal signals before making significant moves. Remember, market sentiment can shift rapidly in the volatile crypto space.

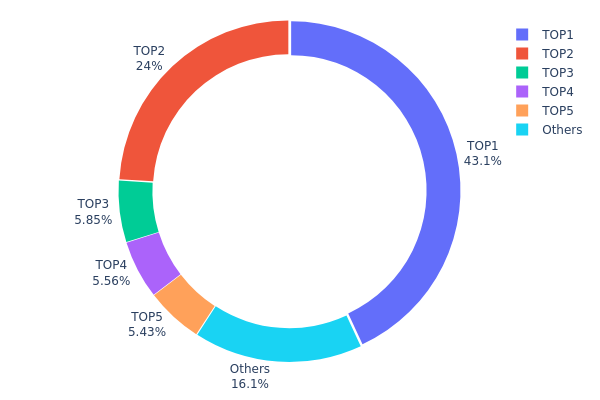

ATM Holdings Distribution

The address holdings distribution data reveals a significant concentration of ATM tokens among a few key addresses. The top holder possesses 43.08% of the total supply, while the second-largest address controls 24.00%. Together, these two addresses account for over two-thirds of all ATM tokens. The next three largest holders each own between 5% and 6% of the supply.

This high concentration of tokens in a small number of addresses raises concerns about the decentralization and potential market manipulation of ATM. With nearly 67% of tokens held by just two addresses, there is a risk of significant price volatility should these large holders decide to sell or transfer their holdings. Furthermore, this concentration could potentially allow for undue influence over governance decisions if ATM employs a token-based voting system.

The current distribution structure suggests a relatively low level of decentralization for ATM, which may impact its market stability and resistance to manipulation. Investors and market participants should be aware of this concentration when considering ATM's market dynamics and potential future developments.

Click to view the current ATM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xF977...41aceC | 4307.55K | 43.08% |

| 2 | 0x6F45...41a33D | 2400.29K | 24.00% |

| 3 | 0x76eC...78Fbd3 | 585.20K | 5.85% |

| 4 | 0xc80A...e92416 | 556.12K | 5.56% |

| 5 | 0x8791...988062 | 543.01K | 5.43% |

| - | Others | 1607.83K | 16.08% |

II. Key Factors Affecting ATM's Future Price

Supply Mechanism

- Fixed Supply: ATM has a fixed maximum supply, which can create scarcity and potentially drive up price as demand increases.

Institutional and Whale Dynamics

- Enterprise Adoption: Some businesses have begun exploring ATM for various applications, which could increase its utility and demand.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, ATM may be viewed as a potential hedge against inflation by some investors.

Technological Development and Ecosystem Building

- Ecosystem Applications: ATM is being integrated into various decentralized applications (DApps) and projects, expanding its use cases and potential value.

III. ATM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.55 - $0.70

- Neutral prediction: $0.80 - $0.95

- Optimistic prediction: $1.10 - $1.28 (requires positive market sentiment and increased adoption)

2027 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $0.83 - $1.48

- 2027: $0.77 - $1.52

- Key catalysts: Increased utility, wider adoption, and overall crypto market recovery

2030 Long-term Outlook

- Base scenario: $1.50 - $1.60 (assuming steady growth and adoption)

- Optimistic scenario: $1.60 - $1.75 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $1.80 - $2.00 (with breakthrough use cases and mainstream integration)

- 2030-12-31: ATM $1.62 (potential peak for the year)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.27925 | 0.8762 | 0.55201 | 0 |

| 2026 | 1.47648 | 1.07773 | 0.82985 | 23 |

| 2027 | 1.51976 | 1.27711 | 0.76626 | 46 |

| 2028 | 1.45437 | 1.39843 | 0.9789 | 60 |

| 2029 | 1.72594 | 1.4264 | 1.29802 | 63 |

| 2030 | 1.62346 | 1.57617 | 1.51312 | 80 |

IV. ATM Professional Investment Strategies and Risk Management

ATM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Fans of Atletico Madrid and long-term crypto investors

- Operation suggestions:

- Accumulate ATM tokens during market dips

- Participate in club decisions to maximize token utility

- Store tokens in a secure Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Track Atletico Madrid's performance and fan engagement

- Monitor overall crypto market sentiment

ATM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple fan tokens

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ATM

ATM Market Risks

- Volatility: Fan tokens can experience significant price swings

- Limited liquidity: May face challenges in large-scale trading

- Dependency on team performance: Token value may be affected by club results

ATM Regulatory Risks

- Uncertain regulatory landscape: Fan tokens may face scrutiny from financial authorities

- Potential restrictions: Governments may limit fan token usage or trading

- Compliance challenges: Evolving regulations may impact token utility

ATM Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token's code

- Blockchain scalability: Chiliz Chain may face congestion during high-demand periods

- Wallet security: Risk of hacks or user errors in token storage

VI. Conclusion and Action Recommendations

ATM Investment Value Assessment

ATM offers unique fan engagement opportunities but carries high volatility and regulatory uncertainties. Long-term value depends on Atletico Madrid's success and the broader adoption of fan tokens.

ATM Investment Recommendations

✅ Beginners: Start with small allocations, focus on learning about fan token ecosystems

✅ Experienced investors: Consider ATM as part of a diversified crypto portfolio

✅ Institutional investors: Conduct thorough due diligence on fan token market dynamics

ATM Trading Participation Methods

- Spot trading: Buy and sell ATM on Gate.com's spot market

- Staking: Explore staking options if available on the Socios platform

- Fan engagement: Actively participate in club decisions to maximize token utility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Would hamster kombat coin reach $1?

It's unlikely for hamster kombat coin to reach $1 in the near future, given its current market cap and circulation. However, with increased adoption and utility, it could potentially approach this target in the long term.

What will Atom be worth in 2025?

Based on market trends and expert predictions, Atom could potentially reach $50-$60 by 2025, driven by increased adoption and ecosystem growth.

Will ACH coin reach $1?

While it's difficult to predict exact prices, ACH has potential for growth. Reaching $1 depends on market conditions and project development. It's possible in the long term with increased adoption and favorable crypto trends.

What is the future prediction for Aptos 2025?

Aptos is expected to reach $50-$60 by 2025, driven by increased adoption and ecosystem growth.

Share

Content