2025 AVA Price Prediction: Analyzing Market Trends, Ecosystem Growth and Potential ROI for Investors

Introduction: AVA's Market Position and Investment Value

Travala.com (AVA), as a leading cryptocurrency-friendly travel booking platform, has made significant strides since its inception in 2017. By 2025, AVA's market capitalization has reached $36,128,932, with a circulating supply of approximately 69,949,531 tokens, and a price hovering around $0.5165. This asset, often referred to as the "travel industry's crypto pioneer," is playing an increasingly crucial role in revolutionizing the online travel booking sector.

This article will provide a comprehensive analysis of AVA's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to offer professional price predictions and practical investment strategies for investors.

I. AVA Price History Review and Current Market Status

AVA Historical Price Evolution Trajectory

- 2019: Initial launch, price reached an all-time low of $0.01218947 on February 27

- 2021: Bull market peak, price hit an all-time high of $6.45 on April 14

- 2025: Market stabilization, price fluctuating around $0.5165

AVA Current Market Situation

As of October 2, 2025, AVA is trading at $0.5165, with a 24-hour trading volume of $131,116.57. The token has shown a positive 6.01% price change in the last 24 hours, indicating short-term bullish momentum. AVA's market capitalization stands at $36,128,932.76, ranking it 833rd in the global cryptocurrency market.

The current price is significantly below its all-time high of $6.45, but well above its all-time low of $0.01218947. Over the past year, AVA has demonstrated resilience with a 10.66% price increase, suggesting a gradual recovery and growing investor confidence.

With a circulating supply of 69,949,531 AVA tokens out of a maximum supply of 100,000,000, the token has a circulation ratio of 69.95%. This indicates a relatively high proportion of tokens in circulation, which could contribute to price stability.

Click to view the current AVA market price

AVA Market Sentiment Indicator

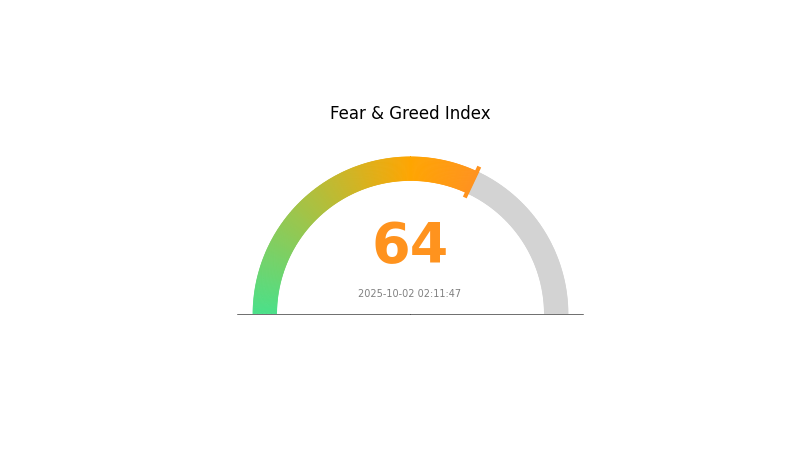

2025-10-02 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently exhibiting signs of greed, with the Fear and Greed Index at 64. This suggests that investors are becoming increasingly optimistic, potentially driving prices higher. However, caution is advised as extreme greed can lead to market corrections. Traders should consider diversifying their portfolios and setting stop-loss orders to protect gains. Remember, market sentiment can shift rapidly, so stay informed and adjust your strategy accordingly.

AVA Holdings Distribution

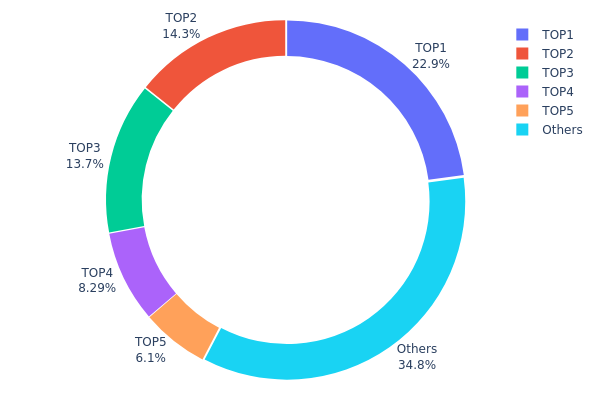

The address holdings distribution data for AVA reveals a relatively concentrated ownership structure. The top five addresses collectively hold 65.2% of the total supply, with the largest holder possessing 22.87% of all tokens. This concentration level indicates a potentially influential group of major stakeholders in the AVA ecosystem.

Such a distribution pattern raises concerns about market stability and decentralization. With significant holdings concentrated among a few addresses, there's an increased risk of price volatility should these major holders decide to trade large volumes. Additionally, this concentration could potentially impact governance decisions if AVA implements a token-based voting system.

However, it's worth noting that 34.8% of tokens are distributed among other addresses, suggesting some level of broader participation. While not ideal for full decentralization, this distribution indicates a balance between major stakeholders and a wider community of smaller holders, which could contribute to a more stable market structure in the long term.

Click to view the current AVA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5a52...70efcb | 16000.00K | 22.87% |

| 2 | 0xf977...41acec | 10000.00K | 14.29% |

| 3 | 0x259a...2de7d4 | 9563.97K | 13.67% |

| 4 | 0x20bc...d3da16 | 5796.13K | 8.28% |

| 5 | 0xd948...315a52 | 4266.23K | 6.09% |

| - | Others | 24323.20K | 34.8% |

II. Key Factors Influencing AVA's Future Price

Supply Mechanism

- Token Burn: Periodic token burns may reduce the circulating supply, potentially impacting the price.

- Historical Pattern: Previous supply changes have shown correlation with price movements.

- Current Impact: The upcoming supply changes are expected to create upward pressure on the price.

Institutional and Whale Movements

- Institutional Holdings: Major financial institutions are increasingly adding AVA to their portfolios.

- Corporate Adoption: Several prominent companies are exploring AVA integration for various applications.

- Government Policies: Regulatory clarity in key markets is shaping the institutional approach to AVA.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly interest rates, affect AVA's attractiveness as an investment.

- Inflation Hedge Properties: AVA is being evaluated as a potential hedge against inflation in uncertain economic times.

- Geopolitical Factors: Global political events and tensions influence AVA's perceived value as a decentralized asset.

Technological Development and Ecosystem Growth

- Scalability Upgrades: Ongoing improvements to transaction speed and network capacity are enhancing AVA's utility.

- Interoperability Enhancements: Development of cross-chain functionalities is expanding AVA's use cases.

- Ecosystem Applications: The growth of DApps, DeFi protocols, and NFT platforms on AVA is driving adoption and demand.

III. AVA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.3557 - $0.5155

- Neutral prediction: $0.5155 - $0.55416

- Optimistic prediction: $0.55416 - $0.59283 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.5566 - $0.90018

- 2028: $0.60319 - $1.03971

- Key catalysts: Market expansion, technological advancements, and broader crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.86169 - $1.1367 (assuming steady growth and adoption)

- Optimistic scenario: $1.1367 - $1.3567 (assuming strong market performance and increased utility)

- Transformative scenario: $1.3567 - $1.46634 (assuming breakthrough developments and mainstream acceptance)

- 2030-12-31: AVA $1.46634 (potential peak price based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.59283 | 0.5155 | 0.3557 | 0 |

| 2026 | 0.82016 | 0.55416 | 0.36021 | 7 |

| 2027 | 0.90018 | 0.68716 | 0.5566 | 33 |

| 2028 | 1.03971 | 0.79367 | 0.60319 | 53 |

| 2029 | 1.3567 | 0.91669 | 0.86169 | 77 |

| 2030 | 1.46634 | 1.1367 | 1.04576 | 120 |

IV. Professional Investment Strategies and Risk Management for AVA

AVA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with a belief in the travel industry's future

- Operation suggestions:

- Accumulate AVA during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store in a secure hardware wallet or reputable custody solution

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor travel industry news and Travala.com's partnerships

- Set stop-loss orders to manage downside risk

AVA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Plans

- Diversification: Spread investments across different cryptocurrencies and traditional assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Paper wallet for long-term holding

- Security precautions: Use two-factor authentication, store private keys offline

V. Potential Risks and Challenges for AVA

AVA Market Risks

- Volatility: Cryptocurrency market's inherent price fluctuations

- Competition: Other travel-focused cryptocurrencies may emerge

- Adoption: Slow uptake of crypto payments in the travel industry

AVA Regulatory Risks

- Cryptocurrency regulations: Changing legal landscape in different jurisdictions

- Travel industry compliance: Potential conflicts with existing travel regulations

- Tax implications: Unclear or evolving tax treatment of crypto assets

AVA Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the token's code

- Blockchain scalability: Limitations of the underlying blockchain technology

- Interoperability issues: Challenges in integrating with traditional travel booking systems

VI. Conclusion and Action Recommendations

AVA Investment Value Assessment

AVA presents a unique value proposition in the travel industry, with potential for long-term growth. However, short-term volatility and regulatory uncertainties pose significant risks.

AVA Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the travel crypto sector ✅ Experienced investors: Consider a balanced approach, mixing long-term holding with strategic trading ✅ Institutional investors: Conduct thorough due diligence, potentially engage in OTC trades for large positions

AVA Trading Participation Methods

- Spot trading: Buy and sell AVA on Gate.com's spot market

- Staking: Participate in AVA staking programs if available

- DeFi: Explore decentralized finance options involving AVA tokens

Cryptocurrency investment carries extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Ava coin good?

Yes, AVA coin shows promise. Currently at $0.53, it's projected to reach $5, indicating strong growth potential. Its performance is tied to market trends and investor sentiment.

What is Cardano's price prediction in 2025?

Based on market analysis, Cardano (ADA) is predicted to trade between $0.66 and $1.88 in 2025, with a potential bullish target of $2.36.

What will be the price of Ava coin?

Based on market analysis, Ava coin is projected to trade between $0.49 and $0.77 by 2026, with an average price of $0.61.

Why has Ava crypto gone up?

Ava crypto has risen due to new AI-driven travel booking features, increased token utility, and higher token lock-in. The upcoming Web3 loyalty expansion also boosts its future potential.

Share

Content