2025 BEEFI Price Prediction: Bullish Outlook as DeFi Adoption Surges

Introduction: BEEFI's Market Position and Investment Value

Beefy.Finance (BEEFI), as a "set and forget" platform for yield farming, has been quietly and efficiently operating in the background since its inception. As of 2025, BEEFI's market capitalization has reached $9,496,000, with a circulating supply of approximately 80,000 tokens, and a price hovering around $118.7. This asset, known as the "yield farming autopilot," is playing an increasingly crucial role in the field of decentralized finance (DeFi).

This article will comprehensively analyze BEEFI's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. BEEFI Price History Review and Current Market Status

BEEFI Historical Price Evolution Trajectory

- 2020: Project launch, price reached an all-time low of $3.28 on October 14

- 2021: Bull market peak, price hit an all-time high of $4,116.95 on March 16

- 2025: Market correction, price declined to $118.7 as of November 21

BEEFI Current Market Situation

As of November 21, 2025, BEEFI is trading at $118.7, experiencing a 2.69% decrease in the past 24 hours. The token's market capitalization stands at $9,496,000, ranking it 1245th in the overall cryptocurrency market. BEEFI's trading volume in the last 24 hours is $9,442.0524, indicating moderate market activity. The circulating supply matches the total and maximum supply at 80,000 tokens, suggesting no further inflation. Year-to-date, BEEFI has seen a significant decline of 57.85%, reflecting the broader market downturn. The token is currently trading 97.12% below its all-time high and 3,519.51% above its all-time low, showcasing the volatile nature of the cryptocurrency market.

Click to view the current BEEFI market price

BEEFI Market Sentiment Indicator

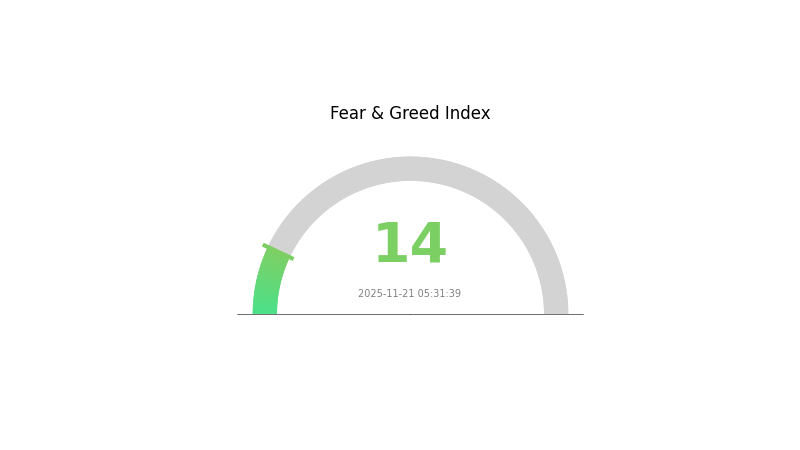

2025-11-21 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the BEEFI sentiment index plummeting to 14. This stark reading suggests investors are in panic mode, potentially creating oversold conditions. While such extreme fear often precedes market bottoms, caution is advised. Savvy traders might view this as an opportunity to "be greedy when others are fearful," but thorough research and risk management remain crucial. Keep a close eye on market developments and adjust strategies accordingly.

BEEFI Holdings Distribution

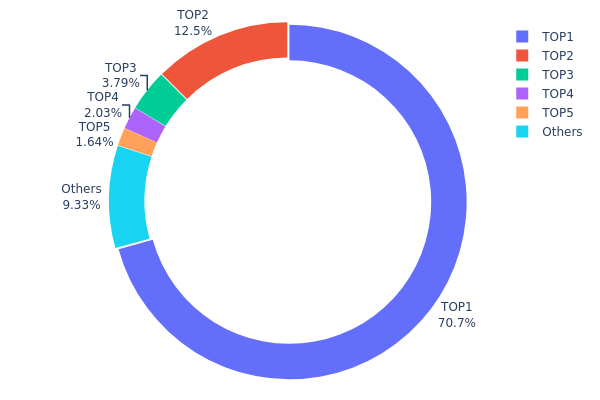

The address holdings distribution data reveals a highly concentrated ownership structure for BEEFI tokens. The top address holds a staggering 70.71% of the total supply, with 56.57K tokens. This level of concentration raises significant concerns about centralization and potential market manipulation.

The second-largest holder possesses 12.50% of the supply, while the remaining top 5 addresses collectively account for 7.44%. This leaves only 9.35% distributed among all other holders. Such a top-heavy distribution suggests that BEEFI's market is susceptible to high volatility and price swings, as actions taken by the largest holders could have outsized impacts on the token's value and liquidity.

This concentration of holdings may undermine BEEFI's decentralization efforts and could pose risks to its on-chain stability. Potential investors should be aware that this distribution pattern may lead to reduced market efficiency and increased vulnerability to large-scale sell-offs or accumulation events initiated by the dominant addresses.

Click to view the current BEEFI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb1f1...b0e087 | 56.57K | 70.71% |

| 2 | 0xf977...41acec | 10.00K | 12.50% |

| 3 | 0x28c6...f21d60 | 3.03K | 3.78% |

| 4 | 0xfba2...462d83 | 1.63K | 2.03% |

| 5 | 0xc9c6...ab6041 | 1.31K | 1.63% |

| - | Others | 7.46K | 9.35% |

II. Key Factors Affecting BEEFI's Future Price

Supply Mechanism

- Tokenomics: BEEFI employs a deflationary model with token burning mechanisms.

- Historical Pattern: Previous supply reductions have generally led to price increases.

- Current Impact: The ongoing token burning is expected to create upward pressure on BEEFI's price.

Technical Development and Ecosystem Building

- Ecosystem Expansion: BEEFI is actively developing its DeFi ecosystem, including yield farming and lending protocols.

- Cross-chain Integration: Plans for integration with multiple blockchain networks to increase accessibility and utility.

- Ecosystem Applications: Growing number of DApps built on the BEEFI network, enhancing its value proposition.

III. BEEFI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $98.52 - $108.70

- Neutral prediction: $108.70 - $128.70

- Optimistic prediction: $128.70 - $138.88 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $107.15 - $183.50

- 2028: $82.53 - $165.07

- Key catalysts: Broader crypto market trends, BEEFI ecosystem developments

2029-2030 Long-term Outlook

- Base scenario: $161.89 - $185.37 (assuming steady market growth)

- Optimistic scenario: $185.37 - $208.84 (assuming strong BEEFI adoption)

- Transformative scenario: $208.84 - $226.15 (assuming exceptional market conditions and BEEFI breakthroughs)

- 2030-12-31: BEEFI $185.37 (potential year-end average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 138.88 | 118.7 | 98.521 | 0 |

| 2026 | 139.09 | 128.79 | 96.59213 | 8 |

| 2027 | 183.5 | 133.94 | 107.15 | 12 |

| 2028 | 165.07 | 158.72 | 82.53449 | 33 |

| 2029 | 208.84 | 161.89 | 113.33 | 36 |

| 2030 | 226.15 | 185.37 | 174.25 | 56 |

IV. Professional Investment Strategies and Risk Management for BEEFI

BEEFI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking passive income from yield farming

- Operation suggestions:

- Allocate a portion of portfolio to BEEFI for long-term yield farming

- Regularly reinvest earned rewards to compound returns

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage downside risk

BEEFI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple yield farming strategies

- Regular profit-taking: Periodically convert a portion of BEEFI rewards to stablecoins

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for BEEFI

BEEFI Market Risks

- Volatility: BEEFI price can experience significant fluctuations

- Liquidity risk: Limited trading volume may impact ability to exit positions

- Competition: Emergence of new yield farming platforms could affect BEEFI's market share

BEEFI Regulatory Risks

- Uncertain regulatory landscape: Potential for increased scrutiny of DeFi platforms

- Compliance challenges: Future regulations may impact BEEFI's operations

- Tax implications: Evolving tax laws may affect yield farming returns

BEEFI Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Oracle failures: Inaccurate price feeds could disrupt yield farming strategies

- Network congestion: High gas fees on Ethereum may impact profitability

VI. Conclusion and Action Recommendations

BEEFI Investment Value Assessment

BEEFI offers potential for high yields through automated yield farming strategies, but carries significant risks due to market volatility and the evolving DeFi landscape. Long-term value depends on the platform's ability to adapt and maintain competitive yields.

BEEFI Investment Recommendations

✅ Beginners: Start with a small allocation to understand yield farming mechanics ✅ Experienced investors: Consider BEEFI as part of a diversified DeFi portfolio ✅ Institutional investors: Evaluate BEEFI's risk-adjusted returns against other yield-generating assets

Ways to Participate in BEEFI Trading

- Spot trading: Buy and hold BEEFI tokens on Gate.com

- Yield farming: Stake BEEFI tokens directly on the Beefy.Finance platform

- Liquidity provision: Contribute to BEEFI liquidity pools for additional rewards

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Are beef prices expected to go up?

Yes, beef prices are expected to rise due to increasing global demand and limited supply growth in major producing countries.

Are beef prices going up in Canada?

Yes, beef prices in Canada are expected to rise in 2025 due to increased production costs and growing global demand for Canadian beef.

Will cattle prices go down in 2025 in Canada?

Based on current market trends and expert forecasts, cattle prices in Canada are expected to remain stable or slightly increase in 2025 due to steady demand and limited supply growth.

Will beef prices come down in 2025?

Based on current market trends and projections, beef prices are expected to stabilize or slightly decrease in 2025 due to improved supply chain efficiency and increased production.

Share

Content