2025 INIT Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Cryptocurrency

Introduction: INIT's Market Position and Investment Value

Initia (INIT), as an L1 blockchain uniting appchains, has been unlocking their full value through interwoven infrastructure and aligned economics since its inception. As of 2025, INIT's market capitalization has reached $17,031,875, with a circulating supply of approximately 148,750,000 tokens, and a price hovering around $0.1145. This asset, known for its innovative approach to blockchain interoperability, is playing an increasingly crucial role in the realm of decentralized applications and cross-chain connectivity.

This article will provide a comprehensive analysis of INIT's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. INIT Price History Review and Current Market Status

INIT Historical Price Evolution

- 2025 May: INIT reached its all-time high of $1.446, marking a significant milestone for the project

- 2025 October: The token experienced a sharp decline, hitting its all-time low of $0.0626

- 2025 November: INIT price has stabilized and shown signs of recovery, currently trading at $0.1145

INIT Current Market Situation

As of November 20, 2025, INIT is trading at $0.1145, with a market capitalization of $17,031,875. The token has experienced a 4.58% decrease in the last 24 hours, indicating short-term bearish sentiment. However, it's worth noting that INIT has shown a positive 1.15% increase in the past hour, suggesting potential short-term recovery.

The trading volume for INIT in the last 24 hours stands at $457,309.13, reflecting moderate market activity. With a circulating supply of 148,750,000 INIT tokens out of a total supply of 1,000,000,000, the current circulation ratio is 14.88%.

INIT's market performance over different time frames shows mixed results. While it has experienced significant losses over the past year (-82.46%) and month (-36.57%), the recent 7-day performance (-4.34%) indicates a potential slowdown in the downward trend.

The project's fully diluted valuation is $114,500,000, with INIT currently holding a market dominance of 0.0035%. This suggests that while INIT has a established presence in the cryptocurrency market, it still has room for growth and increased adoption.

Click to view the current INIT market price

INIT Market Sentiment Indicator

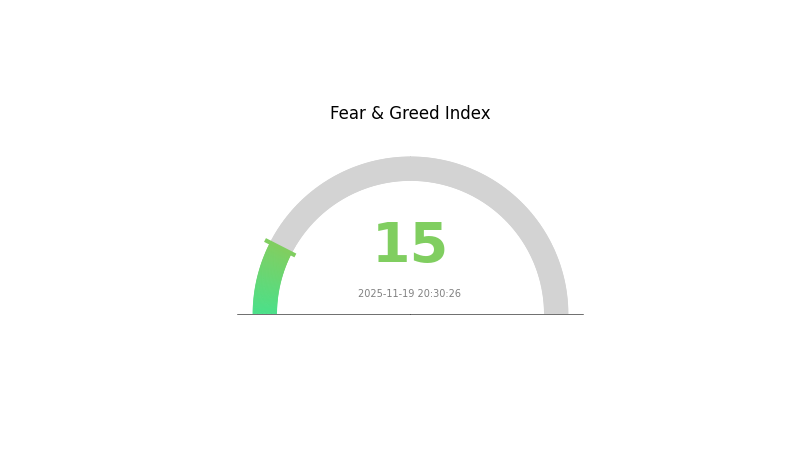

2025-11-19 Fear and Greed Index: 15 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the sentiment index plummeting to 15. This suggests investors are highly pessimistic, potentially creating oversold conditions. Historically, such extreme fear has often preceded market rebounds. However, caution is advised as underlying factors driving this sentiment remain unclear. Traders on Gate.com should consider this indicator alongside other market analyses before making investment decisions. Remember, extreme fear can present both risks and opportunities in the volatile crypto space.

INIT Holdings Distribution

The address holdings distribution data for INIT reveals a highly decentralized ownership structure. With no individual addresses holding a significant percentage of the total supply, the token distribution appears to be well-spread among a large number of holders.

This balanced distribution suggests a reduced risk of market manipulation by large individual holders, often referred to as "whales." The absence of concentrated holdings enhances market stability and potentially reduces the likelihood of sudden price swings caused by large sell-offs. Furthermore, this distribution pattern indicates a high level of decentralization, aligning with the core principles of blockchain technology and potentially fostering a more resilient and democratic ecosystem for INIT.

The current address distribution reflects positively on INIT's market structure, suggesting a mature and stable on-chain environment. This could contribute to more organic price discovery and potentially lower volatility in the long term, as the token's value is less likely to be influenced by the actions of a few large holders.

Click to view the current INIT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting INIT's Future Price

Supply Mechanism

- Token Distribution: 50% of INIT tokens are allocated for liquidity and early user incentives, with the remaining portion distributed for protocol sales, developer rewards, foundation operations, launch promotion activities, and airdrops.

Institutional and Whale Dynamics

- Exchange Listings: Gate.com plans to remove and cease trading of the INIT/BNB spot trading pair on November 07, 2025, at 11:00 (UTC+8).

Macroeconomic Environment

- Geopolitical Factors: The Chinese Ministry of Finance announced the suspension of additional tariffs on certain imported goods from the United States, effective November 10, 2025, at 13:01. This decision may impact global trade relations and market sentiment.

Technological Development and Ecosystem Building

- Ecosystem Applications: The project aims to establish itself as a new benchmark for multi-chain interoperability.

III. INIT Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.11107 - $0.1145

- Neutral forecast: $0.1145 - $0.14

- Optimistic forecast: $0.14 - $0.16832 (requires significant market recovery and adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range predictions:

- 2027: $0.11674 - $0.21427

- 2028: $0.13576 - $0.21541

- Key catalysts: Broader cryptocurrency market trends, INIT ecosystem developments

2030 Long-term Outlook

- Base scenario: $0.18 - $0.21011 (assuming steady market growth)

- Optimistic scenario: $0.21011 - $0.21641 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.22+ (with groundbreaking technological advancements or partnerships)

- 2030-12-31: INIT $0.21641 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.16832 | 0.1145 | 0.11107 | 0 |

| 2026 | 0.15413 | 0.14141 | 0.12302 | 24 |

| 2027 | 0.21427 | 0.14777 | 0.11674 | 29 |

| 2028 | 0.21541 | 0.18102 | 0.13576 | 59 |

| 2029 | 0.222 | 0.19822 | 0.16254 | 74 |

| 2030 | 0.21641 | 0.21011 | 0.13237 | 84 |

IV. INIT Professional Investment Strategies and Risk Management

INIT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate INIT tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use for trend identification

- Relative Strength Index (RSI): Identify overbought/oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news catalysts

- Set strict stop-loss and take-profit levels

INIT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Use two-factor authentication, avoid public Wi-Fi for transactions

V. Potential Risks and Challenges for INIT

INIT Market Risks

- High volatility: Sudden price fluctuations common in crypto markets

- Liquidity risk: Potential challenges in executing large trades

- Competition: Emerging L1 blockchains may impact INIT's market share

INIT Regulatory Risks

- Regulatory uncertainty: Changing global cryptocurrency regulations

- Compliance challenges: Potential issues with cross-border transactions

- Tax implications: Evolving tax laws for cryptocurrency holdings

INIT Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Possible network congestion during high demand

- Interoperability issues: Challenges in connecting with other blockchains

VI. Conclusion and Action Recommendations

INIT Investment Value Assessment

INIT presents a promising long-term value proposition as an L1 blockchain uniting appchains. However, short-term risks include market volatility and regulatory uncertainties.

INIT Investment Recommendations

✅ Beginners: Start with small, regular investments to understand market dynamics ✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading ✅ Institutional investors: Explore strategic partnerships and larger positions with proper risk management

INIT Trading Participation Methods

- Spot trading: Direct purchase and sale of INIT tokens on Gate.com

- Staking: Participate in network security and earn rewards

- DeFi integration: Explore decentralized finance opportunities within the Initia ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can Solana reach $1000 in 2025?

Based on current predictions, Solana is unlikely to reach $1000 in 2025. Forecasts suggest a maximum price of around $258.57 by the end of that year.

Does API3 have a future?

Yes, API3 has a promising future. Analysts predict its price could reach $8-$15 by 2025-2030, driven by increased adoption of decentralized APIs in the blockchain ecosystem.

Will Shiba hit $1 in 2040?

No, it's highly unlikely for Shiba Inu to reach $1 by 2040. While SHIB may see growth, reaching $1 would require an astronomical market cap, which is unrealistic given current market conditions and tokenomics.

What is the best token price prediction in 2025?

Based on current market trends and expert analysis, the BEST token is predicted to reach $0.10 by 2025, representing a 4x increase from its presale price of $0.025965.

Share

Content