2025 POLS Price Prediction: Analyzing Market Trends and Growth Potential for Polkastarter in the Evolving DeFi Landscape

Introduction: POLS's Market Position and Investment Value

Polkastarter (POLS), as a platform for launching and managing IDOs, has been playing a crucial role in the cryptocurrency ecosystem since its inception in 2020. As of 2025, POLS has a market capitalization of $16,766,427, with a circulating supply of approximately 99,209,631 tokens, and its price hovers around $0.169. This asset, often referred to as the "IDO launchpad pioneer," is playing an increasingly vital role in facilitating early-stage token sales and community building for blockchain projects.

This article will provide a comprehensive analysis of POLS's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to offer professional price predictions and practical investment strategies for investors.

I. POLS Price History Review and Current Market Status

POLS Historical Price Evolution

- 2020: Initial launch at $0.05, price reached all-time low of $0.116476 on October 30

- 2021: Bull market peak, POLS hit all-time high of $7.51 on February 17

- 2022-2025: Extended bear market, price gradually declined to current levels

POLS Current Market Situation

As of October 6, 2025, POLS is trading at $0.169, with a 24-hour trading volume of $21,203.55. The price has seen a 1.31% increase in the last 24 hours. POLS currently ranks #1187 by market capitalization, with a total market cap of $16,766,427.80. The circulating supply is 99,209,631.94 POLS tokens, which is 99.21% of the total supply of 100,000,000 POLS.

Over the past year, POLS has experienced a significant decline of 46.37%. However, in the short term, it has shown some stability with a 1.31% gain in the last 24 hours and a 0.24% increase in the past hour. The 7-day and 30-day trends remain negative at -2.81% and -15.27% respectively, indicating ongoing bearish sentiment in the medium term.

Click to view the current POLS market price

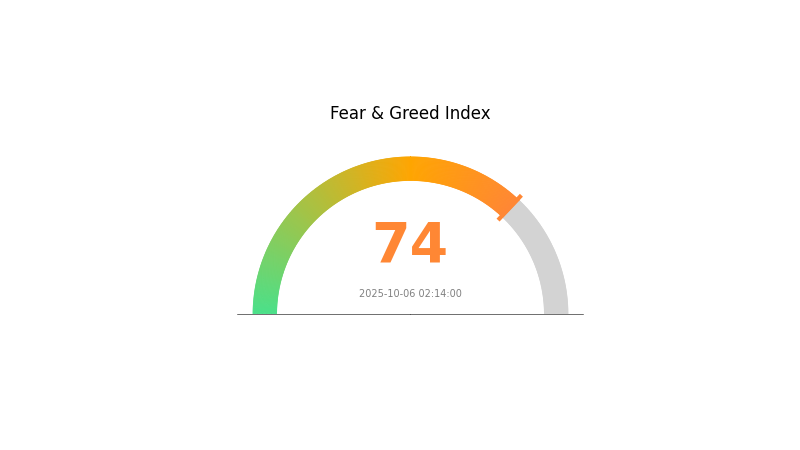

POLS Market Sentiment Indicator

2025-10-06 Fear and Greed Index: 74 (Greed)

Click to view the current Fear & Greed Index

The crypto market is buzzing with excitement as the Fear and Greed Index hits 74, indicating strong greed. This suggests investors are overly optimistic, potentially driving prices higher. However, seasoned traders know that extreme greed often precedes market corrections. It's crucial to remain cautious and avoid FOMO-driven decisions. Diversification and risk management are key in such market conditions. Keep an eye on fundamental factors and market trends to make informed investment choices. Remember, the crypto market is volatile, and sentiment can shift rapidly.

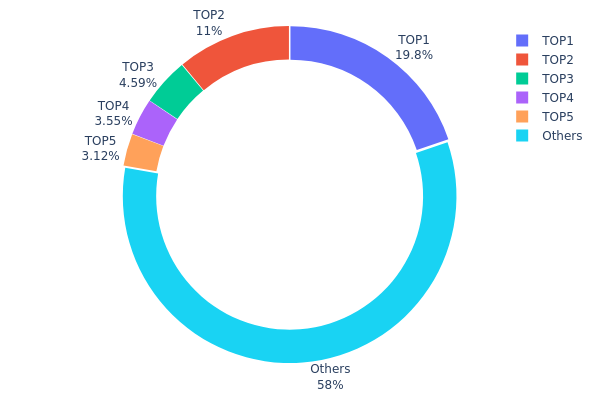

POLS Holdings Distribution

The address holdings distribution data for POLS reveals a significant concentration of tokens among a few top addresses. The top holder possesses 19.76% of the total supply, while the second-largest holder controls 11.01%. Together, the top five addresses account for approximately 42% of all POLS tokens, indicating a relatively centralized distribution.

This concentration of holdings raises concerns about potential market manipulation and price volatility. With such a large portion of tokens in few hands, coordinated actions by these major holders could significantly impact POLS's market dynamics. The high concentration also suggests that the token's on-chain structure may be less stable and more susceptible to sudden changes in liquidity or selling pressure.

Despite the concentration at the top, it's worth noting that nearly 58% of POLS tokens are distributed among other addresses, which provides some level of decentralization. However, the overall distribution pattern indicates that POLS's market structure leans towards centralization, potentially affecting its resistance to manipulation and long-term stability.

Click to view the current POLS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x533e...ff9648 | 19768.60K | 19.76% |

| 2 | 0xc24a...79d8d7 | 11013.72K | 11.01% |

| 3 | 0x39c1...02d7e1 | 4587.40K | 4.58% |

| 4 | 0x5d1c...e1b3f8 | 3552.56K | 3.55% |

| 5 | 0x4f70...fcd3cf | 3117.81K | 3.11% |

| - | Others | 57959.91K | 57.99% |

II. Key Factors Affecting POLS Future Price

Macroeconomic Environment

- Impact of Monetary Policy: Central bank policies and interest rate decisions are likely to influence POLS price movements.

- Inflation Hedging Properties: POLS may be evaluated for its potential as an inflation hedge in the current economic climate.

- Geopolitical Factors: International tensions and global economic uncertainties could affect POLS market sentiment.

Technological Development and Ecosystem Building

- Ecosystem Applications: The growth and adoption of major DApps and ecosystem projects built on POLS could significantly impact its value.

III. POLS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.10647 - $0.15

- Neutral prediction: $0.15 - $0.169

- Optimistic prediction: $0.169 - $0.1859 (requires favorable market conditions and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with some volatility

- Price range forecast:

- 2027: $0.09906 - $0.22154

- 2028: $0.15463 - $0.23296

- Key catalysts: Technological advancements, expanding use cases, and overall crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.21689 - $0.26569 (assuming steady market growth and adoption)

- Optimistic scenario: $0.31449 - $0.39588 (assuming accelerated adoption and favorable regulatory environment)

- Transformative scenario: $0.40 - $0.50 (assuming breakthrough applications and mainstream integration)

- 2030-12-31: POLS $0.39588 (potential peak price for the period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1859 | 0.169 | 0.10647 | 0 |

| 2026 | 0.18277 | 0.17745 | 0.17035 | 5 |

| 2027 | 0.22154 | 0.18011 | 0.09906 | 6 |

| 2028 | 0.23296 | 0.20082 | 0.15463 | 18 |

| 2029 | 0.31449 | 0.21689 | 0.18869 | 28 |

| 2030 | 0.39588 | 0.26569 | 0.18333 | 57 |

IV. Professional Investment Strategies and Risk Management for POLS

POLS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term believers in the Polkastarter ecosystem

- Operation suggestions:

- Accumulate POLS during market dips

- Stake POLS for governance participation and potential rewards

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving averages: Use to identify trends and support/resistance levels

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor Polkastarter IDO announcements for potential price catalysts

POLS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance POLS with other crypto assets and traditional investments

- Stop-loss orders: Use to limit potential losses in volatile market conditions

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, and regularly update software

V. Potential Risks and Challenges for POLS

POLS Market Risks

- High volatility: POLS price can experience significant swings

- IDO market sentiment: Changes in IDO popularity can affect POLS demand

- Competition: Emerging platforms may challenge Polkastarter's market position

POLS Regulatory Risks

- IDO regulations: Potential regulatory crackdowns on token sales

- Cross-chain compliance: Varying regulations across different blockchain networks

- Token classification: Risk of POLS being classified as a security

POLS Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the Polkastarter protocol

- Scalability issues: Challenges in handling increased transaction volume

- Interoperability failures: Risks associated with cross-chain operations

VI. Conclusion and Action Recommendations

POLS Investment Value Assessment

POLS offers exposure to the growing IDO market but faces significant competition and regulatory uncertainties. Long-term value depends on Polkastarter's ability to attract quality projects and maintain its market position.

POLS Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about IDOs and the Polkastarter ecosystem

✅ Experienced investors: Consider allocating a portion of your portfolio to POLS, actively participate in governance

✅ Institutional investors: Conduct thorough due diligence, consider POLS as part of a diversified DeFi portfolio

POLS Trading Participation Methods

- Spot trading: Buy and sell POLS on Gate.com

- Staking: Participate in POLS staking programs for potential rewards

- IDO participation: Use POLS to access IDOs on the Polkastarter platform

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Pols in 2030?

Based on current market trends, the price of Pols is predicted to reach $0.290893 by 2030.

How high can pol crypto go?

POL could potentially reach $10 in the near future. Long-term predictions suggest it may hit $100 by 2040, but exact future prices are uncertain and speculative.

How much is pol coin worth in 2025?

Based on market trends and expert analysis, Polygon (POL) coin is projected to be worth around $15 by 2025. However, actual value may fluctuate.

What is the future of Pol crypto?

Pol crypto's future looks promising, with potential for significant growth by 2030. Its adoption in decentralized apps and scalability solutions is expected to drive market interest and price increases.

Share

Content