2025 TAI Price Prediction: Navigating Volatility and Growth in the AI-Driven Token Market

Introduction: TAI's Market Position and Investment Value

Tars AI (TAI), as an AI-driven Web3 infrastructure platform, has been making strides in the blockchain industry since its inception. As of 2025, TAI's market capitalization has reached $20,183,373.99, with a circulating supply of approximately 691,685,195 tokens, and a price hovering around $0.02918. This asset, often referred to as a "Web3 AI solution," is playing an increasingly crucial role in empowering projects with cutting-edge artificial intelligence and blockchain-as-a-service offerings.

This article will comprehensively analyze TAI's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. TAI Price History Review and Current Market Status

TAI Historical Price Evolution

- 2024: Initial launch at $0.01, price surged to all-time high of $0.495

- 2025: Market correction, price declined to current level around $0.02918

TAI Current Market Situation

TAI is currently trading at $0.02918, with a 24-hour trading volume of $635,759.98. The token has experienced a slight decrease of 0.03% in the past 24 hours. TAI's market capitalization stands at $20,183,373.99, ranking it 910th in the overall cryptocurrency market. The circulating supply is 691,685,195 TAI, which represents 69.17% of the total supply of 1,000,000,000 tokens.

Recent price trends show TAI has faced significant downward pressure:

- 1 hour: -1.09%

- 7 days: -22.03%

- 30 days: -32.67%

- 1 year: -80.33%

This indicates a bearish sentiment in both short-term and long-term timeframes. The token is currently trading at about 94% below its all-time high of $0.495, reached on December 13, 2024.

Click to view the current TAI market price

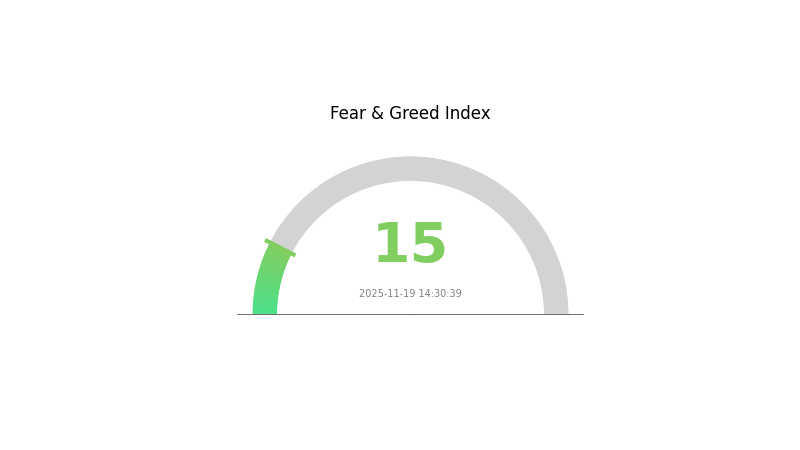

TAI Market Sentiment Indicator

2025-11-19 Fear and Greed Index: 15 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of extreme fear, with the Fear and Greed Index registering a low score of 15. This indicates a high level of uncertainty and pessimism among investors. During such times, it's crucial to remain calm and avoid making impulsive decisions. Remember, market sentiment can shift rapidly, and periods of extreme fear often present potential buying opportunities for long-term investors. However, always conduct thorough research and consider your risk tolerance before making any investment decisions.

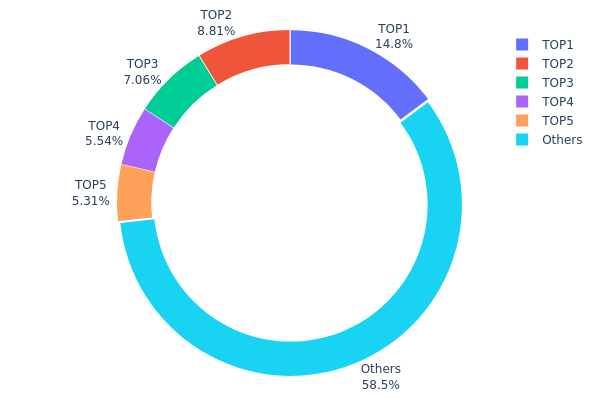

TAI Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of TAI tokens. The top 5 addresses collectively hold 41.49% of the total supply, with the largest holder possessing 14.80%. This distribution pattern indicates a moderate level of concentration, as the majority (58.51%) is held by addresses outside the top 5.

While there is some centralization among top holders, it's not excessive. The distribution suggests a balance between larger stakeholders and a broader base of smaller holders. This structure may contribute to market stability, as no single entity has overwhelming control. However, it's worth noting that significant price movements could occur if top holders decide to liquidate their positions.

The current distribution reflects a moderate level of decentralization for TAI. The presence of multiple large holders, combined with a substantial portion held by smaller addresses, suggests a diverse ecosystem. This structure may enhance the token's resilience to manipulation and promote a more robust on-chain governance system.

Click to view the current TAI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5z7gxL...X7efg2 | 132078.14K | 14.80% |

| 2 | 5LZkAT...mtboT2 | 78558.07K | 8.80% |

| 3 | BizJFk...FgoYkE | 63000.08K | 7.06% |

| 4 | 2h8JJq...A94QY2 | 49417.17K | 5.53% |

| 5 | 5PAhQi...cnPRj5 | 47331.26K | 5.30% |

| - | Others | 521791.65K | 58.51% |

II. Key Factors Affecting TAI's Future Price

Supply Mechanism

- Mining Rewards: As TAI's mining rewards decrease over time, the reduced supply growth may support price appreciation.

- Historical Pattern: Previous halving events have typically led to price increases in the medium term.

- Current Impact: The upcoming halving in 2026 is expected to tighten supply and potentially drive prices higher.

Institutional and Whale Activity

- Institutional Holdings: Major technology and financial firms have been increasing their TAI holdings, providing price support.

- Corporate Adoption: Companies like Tesla and MicroStrategy have added TAI to their balance sheets, boosting legitimacy and demand.

- Government Policies: Regulatory clarity in some jurisdictions has encouraged institutional participation, while uncertainty remains in others.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly those of the Federal Reserve, influence TAI's appeal as an inflation hedge.

- Inflation Hedging Properties: TAI has shown some correlation with inflation expectations, potentially attracting investors during high inflation periods.

- Geopolitical Factors: Global tensions and economic uncertainties can increase TAI's attractiveness as a non-sovereign store of value.

Technological Development and Ecosystem Building

- Layer 2 Solutions: Ongoing development of scaling solutions aims to improve transaction speeds and reduce fees, potentially driving adoption.

- Smart Contract Upgrades: Enhancements to TAI's smart contract capabilities could expand its utility in decentralized finance and other applications.

- Ecosystem Applications: The growth of decentralized finance (DeFi) protocols and non-fungible token (NFT) platforms on TAI's network may increase demand for the native token.

III. TAI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.02058 - $0.02500

- Neutral prediction: $0.02500 - $0.03000

- Optimistic prediction: $0.03000 - $0.03363 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.03126 - $0.04363

- 2028: $0.03162 - $0.03924

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.03500 - $0.04500 (assuming steady market growth)

- Optimistic scenario: $0.04500 - $0.05500 (assuming strong market performance)

- Transformative scenario: $0.05500 - $0.06048 (assuming exceptional market conditions)

- 2030-12-31: TAI $0.04447 (average prediction)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03363 | 0.02899 | 0.02058 | 0 |

| 2026 | 0.03381 | 0.03131 | 0.02066 | 7 |

| 2027 | 0.04363 | 0.03256 | 0.03126 | 11 |

| 2028 | 0.03924 | 0.0381 | 0.03162 | 30 |

| 2029 | 0.05027 | 0.03867 | 0.02784 | 32 |

| 2030 | 0.06048 | 0.04447 | 0.02757 | 52 |

IV. Professional Investment Strategies and Risk Management for TAI

TAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Value investors and believers in AI-driven blockchain technology

- Operation suggestions:

- Accumulate TAI during market dips

- Set price targets for partial profit-taking

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Identify support and resistance levels

- Use stop-loss orders to manage risk

TAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Allocate across different blockchain sectors

- Options: Consider using put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for TAI

TAI Market Risks

- Volatility: Significant price fluctuations common in the crypto market

- Liquidity: Limited trading volume may impact ease of entry/exit

- Competition: Emerging AI blockchain projects may affect market share

TAI Regulatory Risks

- Unclear regulations: Potential impact from future cryptocurrency laws

- Cross-border restrictions: Varying legal status in different jurisdictions

- Tax implications: Evolving tax treatment of crypto assets

TAI Technical Risks

- Smart contract vulnerabilities: Potential for code exploits

- Scalability challenges: Future growth may strain network capacity

- Integration issues: Compatibility problems with existing blockchain systems

VI. Conclusion and Action Recommendations

TAI Investment Value Assessment

TAI presents a high-risk, high-potential opportunity in the AI-driven blockchain space. Long-term value lies in its innovative approach, but short-term volatility and regulatory uncertainties pose significant risks.

TAI Investment Recommendations

✅ Beginners: Start with small positions, focus on education ✅ Experienced investors: Implement dollar-cost averaging strategy ✅ Institutional investors: Consider as part of a diversified crypto portfolio

TAI Trading Participation Methods

- Spot trading: Direct purchase and holding of TAI tokens

- Staking: Participate in network validation for potential rewards

- DeFi integration: Explore liquidity provision or yield farming opportunities

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance, and it is recommended to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is tai coin a good investment?

Based on current projections, TAI coin is unlikely to be a good investment. Predictions suggest limited growth potential, with a maximum price of $0.03 expected by the end of 2025.

What crypto will 1000x prediction?

LivLive's $LIVE token shows potential for 1000x growth due to its real-world action utility and tokenized value system. Its presale offers a compelling early-stage opportunity.

Is tars AI a good investment?

Based on current projections, TARS AI may not be a promising investment. Forecasts suggest minimal growth potential, with predictions indicating limited value increase by 2028.

Can TRX reach $10?

TRX reaching $10 is possible but challenging. It would require significant market growth, widespread adoption, and favorable conditions. While not impossible, it's a substantial increase from current levels.

Share

Content