2025 VSC Price Prediction: Analyzing Market Trends and Future Potential for Virtual Sporting Coins

Introduction: VSC's Market Position and Investment Value

Vyvo Smart Chain (VSC) as a comprehensive blockchain infrastructure for IoT device users, has been bridging users and institutions since its inception. As of 2025, VSC's market capitalization has reached $7,427,101, with a circulating supply of approximately 4,350,967,708 tokens, and a price hovering around $0.001707. This asset, known as the "Data Ownership Enabler," is playing an increasingly crucial role in health data management and monetization.

This article will provide a comprehensive analysis of VSC's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. VSC Price History Review and Current Market Status

VSC Historical Price Evolution Trajectory

- 2024: VSC reached its all-time high of $0.04196 on March 9, marking a significant milestone for the project

- 2025: The market entered a bearish cycle, with VSC price declining sharply throughout the year

- 2025: VSC hit its all-time low of $0.000956 on November 21, representing a substantial drop from its peak

VSC Current Market Situation

As of November 22, 2025, VSC is trading at $0.001707, showing a remarkable 45.15% increase in the past 24 hours. This surge comes after the token reached its all-time low just a day earlier, indicating a potential short-term recovery. However, the longer-term trend remains bearish, with VSC down 15.97% over the past 30 days and a substantial 84.61% decline over the past year.

The current market capitalization of VSC stands at $7,427,101, ranking it 1366th among all cryptocurrencies. With a circulating supply of 4,350,967,708 VSC tokens out of a total supply of 20,014,165,805, the project has a relatively low circulation ratio of 21.74%.

Despite the recent price surge, VSC is still trading significantly below its all-time high of $0.04196, achieved on March 9, 2024. The token's 24-hour trading volume is $146,682, which is relatively low, suggesting limited liquidity in the current market.

Click to view the current VSC market price

VSC Market Sentiment Indicator

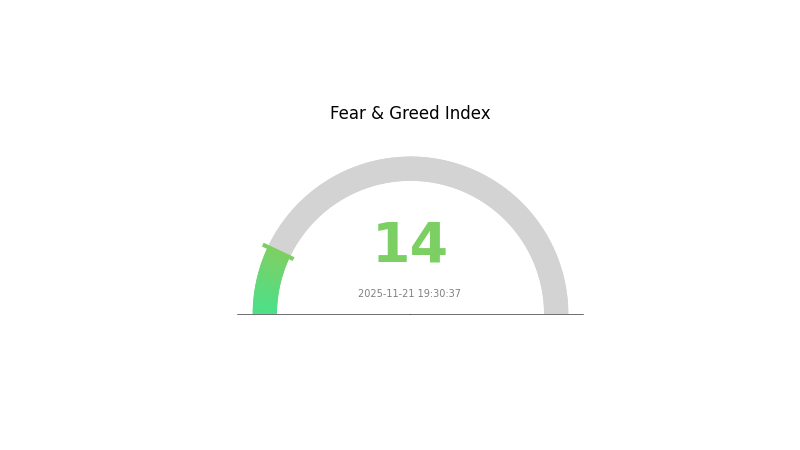

2025-11-21 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment has plunged into extreme fear territory, with the Fear and Greed Index registering a low of 14. This indicates a significant level of pessimism among investors, potentially signaling oversold conditions. Such extreme fear often presents contrarian opportunities for savvy traders. However, it's crucial to exercise caution and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly, and this extreme fear could precede a potential market bounce.

VSC Holdings Distribution

The address holdings distribution data for VSC reveals a relatively decentralized ownership structure. This distribution pattern indicates that VSC tokens are spread across a diverse range of addresses, with no single address holding a disproportionately large share of the total supply.

Such a distribution suggests a healthy level of decentralization in the VSC ecosystem, which can contribute to market stability and reduce the risk of price manipulation by large holders. The absence of heavily concentrated holdings also implies that the token's governance and economic benefits are more evenly distributed among participants, aligning with the principles of decentralized finance.

However, it's important to note that this snapshot of address holdings does not provide a complete picture of token ownership, as individuals or entities may control multiple addresses. Nonetheless, the current distribution pattern suggests a robust and diverse VSC holder base, which can be seen as a positive indicator for the project's long-term sustainability and resistance to centralized control.

Click to view the current VSC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting Future VSC Price

Supply Mechanism

- Halving: The VSC network undergoes periodic halving events, reducing the block reward by half.

- Historical Pattern: Previous halvings have historically led to price increases in the long term.

- Current Impact: The next halving is anticipated to create upward pressure on VSC price due to reduced supply inflation.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions have been increasing their VSC positions, signaling growing confidence in the asset.

- Corporate Adoption: Several Fortune 500 companies have added VSC to their balance sheets as a treasury reserve asset.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' continued loose monetary policies may drive investors towards VSC as an alternative store of value.

- Inflation Hedging Properties: VSC has shown potential as an inflation hedge, attracting investors during periods of high inflation.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions could increase VSC's appeal as a non-sovereign asset.

Technical Development and Ecosystem Growth

- Layer 2 Scaling Solutions: Implementation of Layer 2 solutions is expected to significantly improve VSC's transaction speed and reduce fees.

- Smart Contract Functionality: Upgrades to enhance smart contract capabilities on the VSC network could expand its use cases.

- Ecosystem Applications: The VSC ecosystem is seeing growth in DeFi platforms, NFT marketplaces, and decentralized social media applications.

III. VSC Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00137 - $0.00171

- Neutral forecast: $0.00171 - $0.00213

- Optimistic forecast: $0.00213 - $0.00255 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00153 - $0.00317

- 2028: $0.00183 - $0.00364

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00304 - $0.00398 (assuming steady market growth)

- Optimistic scenario: $0.00398 - $0.00468 (assuming strong market performance)

- Transformative scenario: $0.00468 - $0.00569 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: VSC $0.00569 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00255 | 0.00171 | 0.00137 | 0 |

| 2026 | 0.00316 | 0.00213 | 0.00115 | 24 |

| 2027 | 0.00317 | 0.00264 | 0.00153 | 54 |

| 2028 | 0.00364 | 0.00291 | 0.00183 | 70 |

| 2029 | 0.00468 | 0.00327 | 0.00304 | 91 |

| 2030 | 0.00569 | 0.00398 | 0.00266 | 132 |

IV. VSC Professional Investment Strategies and Risk Management

VSC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors interested in IoT and healthcare data solutions

- Operation suggestions:

- Accumulate VSC tokens during market dips

- Hold for at least 2-3 years to allow for project development

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor 50-day and 200-day MAs for trend confirmation

- RSI: Use overbought/oversold levels for entry and exit points

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

VSC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-8% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Allocate funds across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official VSC wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for VSC

VSC Market Risks

- Volatility: Crypto market fluctuations may impact VSC price

- Competition: Other blockchain projects in IoT and healthcare data space

- Adoption: Slow user or institutional uptake could affect growth

VSC Regulatory Risks

- Data privacy regulations: Changes in laws could impact VSC's data handling

- Cryptocurrency regulations: Potential restrictions on token trading or usage

- Healthcare industry compliance: Ensuring adherence to medical data standards

VSC Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability issues: Challenges in handling increased network activity

- Interoperability: Difficulties in connecting with other blockchain networks

VI. Conclusion and Action Recommendations

VSC Investment Value Assessment

VSC presents a unique value proposition in the intersection of blockchain, IoT, and healthcare data. While it offers long-term potential in revolutionizing data ownership and monetization, short-term volatility and adoption challenges pose risks.

VSC Investment Recommendations

✅ Beginners: Start with a small position, focus on learning about the project ✅ Experienced investors: Consider a moderate allocation, monitor project developments closely ✅ Institutional investors: Evaluate for potential strategic partnerships in IoT or healthcare sectors

VSC Trading Participation Methods

- Spot trading: Purchase VSC tokens on Gate.com

- Staking: Participate in staking programs if offered by the VSC network

- DeFi integration: Explore decentralized finance options as they become available on the VSC ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will vet reach $1?

Yes, VET has the potential to reach $1 by 2025. With increasing adoption and partnerships in supply chain management, VET's value could grow significantly.

Can Coti reach $10?

While ambitious, reaching $10 is possible for Coti in the long term with significant adoption and market growth. However, it would require substantial increases in market cap and demand.

Will VeChain hit $2?

Yes, VeChain could potentially reach $2 by 2025, driven by increased adoption and partnerships in supply chain management and IoT sectors.

Will VeChain reach 50 cents?

Yes, VeChain could potentially reach 50 cents by 2025, given its strong partnerships and growing adoption in supply chain management and other industries.

Share

Content