2025 XTPrice Prediction: Analyzing Key Factors That Will Shape XT Token's Future Value

Introduction: XT's Market Position and Investment Value

XT Smart Chain (XT), as a public blockchain infrastructure focused on high-performance and low-cost services, has achieved significant milestones since its inception in 2018. As of 2025, XT's market capitalization has reached $41,685,811, with a circulating supply of approximately 6,045,803 tokens, and a price hovering around $6.895. This asset, known as the "Layer 2 innovator," is playing an increasingly crucial role in delivering efficient blockchain services.

This article will comprehensively analyze XT's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide professional price predictions and practical investment strategies for investors.

I. XT Price History Review and Current Market Status

XT Historical Price Evolution Trajectory

- 2022: Launch of XT Smart Chain, price started at $0.35

- 2024: Reached all-time high of $7.813 on December 27

- 2025: Experienced a market correction, price dropped to $3.645 on April 7

XT Current Market Situation

As of October 1, 2025, XT is trading at $6.895, with a 24-hour trading volume of $144,215.86. The token has seen a slight decline of 0.82% in the past 24 hours. However, it has shown strong performance over longer time frames, with a 4.82% increase over the past 30 days and an impressive 38.28% gain over the past year.

XT currently ranks 765th in the cryptocurrency market with a market capitalization of $41,685,811.68. The circulating supply stands at 6,045,803 XT tokens, which represents 0.6% of the total supply of 1 billion tokens. The fully diluted market cap is $6,895,000,000.

The token's price is currently closer to its all-time high than its all-time low, indicating overall positive market sentiment. The 24-hour price range shows a low of $6.784 and a high of $6.953, suggesting relatively stable trading within a narrow band.

Click to view the current XT market price

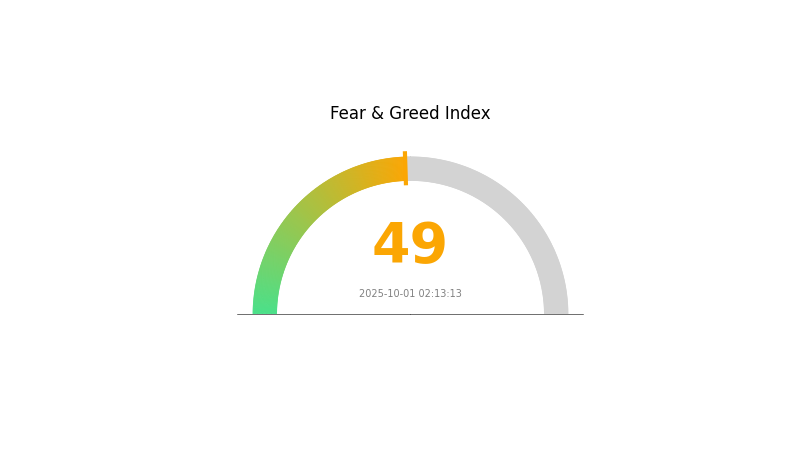

XT Market Sentiment Indicator

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains balanced as we enter October 2025, with the Fear and Greed Index hovering at 49, indicating a neutral stance. This equilibrium suggests investors are neither overly pessimistic nor excessively optimistic about the market's direction. While caution persists, there's also a sense of opportunity. Traders on Gate.com are closely monitoring market trends, preparing for potential shifts in either direction. As always, it's crucial to conduct thorough research and manage risk wisely in this dynamic crypto landscape.

XT Holdings Distribution

The address holdings distribution data for XT is currently unavailable, which limits our ability to conduct a comprehensive analysis of its concentration characteristics. This lack of data could be due to various factors, such as the token being relatively new, having low on-chain activity, or issues with data collection and reporting.

Without specific address holdings information, it's challenging to assess the degree of centralization or decentralization in XT's distribution. This data gap also makes it difficult to evaluate potential impacts on market structure, price volatility, or the risk of market manipulation. The absence of this crucial information highlights the need for improved transparency and data availability in the cryptocurrency market.

Investors and analysts should exercise caution when evaluating XT's market dynamics and seek additional sources of information to gain a more complete understanding of its on-chain characteristics and overall market health.

Click to view the current XT holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting XT's Future Price

Supply Mechanism

- Halving Event: The 2024 halving event will reduce block rewards from 6.25 BTC to 3.125 BTC, significantly decreasing new supply and increasing market scarcity.

- Historical Pattern: Historically, Bitcoin's price tends to reach new highs in the year following each halving event.

- Current Impact: The 2024 halving is expected to drive prices upward in 2025 due to reduced supply and increased scarcity.

Institutional and Whale Dynamics

- Institutional Holdings: The adoption rate of Bitcoin by institutions is rising, partly due to the introduction of Bitcoin ETFs and continuous investments from companies like MicroStrategy.

- Corporate Adoption: Bitcoin ETFs have lowered entry barriers, allowing more traditional investors to access Bitcoin and enhancing its status as a mainstream financial asset.

- Government Policies: Regulatory uncertainties and evolving policies continue to be core factors influencing the market.

Macroeconomic Environment

- Monetary Policy Impact: Macroeconomic pressures and uncertainties in global economic conditions remain significant influences on Bitcoin's price.

- Inflation Hedge Properties: Bitcoin's fixed supply of 21 million coins positions it as a unique asset for hedging against inflation, especially as market demand grows.

- Geopolitical Factors: Global investor confidence and economic environments play crucial roles in shaping Bitcoin's price trends.

Technical Development and Ecosystem Building

- ETF Influence: The introduction of Bitcoin ETFs has made it easier for retail and institutional investors to enter the market, driving demand growth.

- Adoption Rate Model: The increasing number of Bitcoin wallets serves as an important indicator of rising adoption rates, providing strong support for price appreciation.

III. XT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $6.06 - $6.88

- Neutral prediction: $6.88 - $7.37

- Optimistic prediction: $7.37 - $7.85 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $5.64 - $8.75

- 2028: $8.04 - $9.06

- Key catalysts: Increasing adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $8.76 - $9.16 (assuming steady market growth)

- Optimistic scenario: $9.16 - $9.56 (assuming strong market performance)

- Transformative scenario: $9.56 - $9.80 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: XT $9.79 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 7.85232 | 6.888 | 6.06144 | 0 |

| 2026 | 8.9916 | 7.37016 | 5.23281 | 6 |

| 2027 | 8.75354 | 8.18088 | 5.64481 | 18 |

| 2028 | 9.05991 | 8.46721 | 8.04385 | 22 |

| 2029 | 9.55228 | 8.76356 | 6.83558 | 27 |

| 2030 | 9.79898 | 9.15792 | 7.0516 | 32 |

IV. XT Professional Investment Strategies and Risk Management

XT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate XT tokens during market dips

- Set price targets and rebalance portfolio regularly

- Store tokens in secure hardware wallets or reputable custodial services

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price levels

XT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Store majority of holdings offline

- Security precautions: Enable two-factor authentication, use strong passwords

V. XT Potential Risks and Challenges

XT Market Risks

- Volatility: High price fluctuations common in crypto markets

- Liquidity: Potential issues during extreme market conditions

- Competition: Emergence of rival blockchain platforms

XT Regulatory Risks

- Regulatory uncertainty: Evolving global regulatory landscape

- Compliance requirements: Potential changes in legal status

- Cross-border restrictions: Varying regulations across jurisdictions

XT Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: Scalability challenges during high demand

- Technological obsolescence: Rapid advancements in blockchain technology

VI. Conclusion and Action Recommendations

XT Investment Value Assessment

XT Smart Chain shows promise as a high-performance blockchain infrastructure, but faces significant competition and regulatory uncertainties. Long-term potential exists, but short-term volatility and risks should be carefully considered.

XT Investment Recommendations

✅ Beginners: Start with small, affordable investments to learn about the technology ✅ Experienced investors: Consider allocating a portion of crypto portfolio based on risk tolerance ✅ Institutional investors: Conduct thorough due diligence and consider XT as part of a diversified blockchain investment strategy

XT Trading Participation Methods

- Spot trading: Buy and sell XT tokens on Gate.com

- Staking: Participate in network validation for potential rewards

- DApp ecosystem: Explore decentralized applications built on XT Smart Chain

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is XT a good investment?

Yes, XT is a promising investment. It offers low downside risk and diversification with over 200 holdings, making it attractive for equity exposure. Current market trends suggest potential for growth.

What is the price prediction for XTZ in 2025?

Based on current forecasts, the price of XTZ in 2025 is predicted to be in the range of $0.85 to $1.42 on average.

What crypto has the highest price prediction?

As of 2025, Bitcoin is predicted to have the highest price, followed by Ethereum. These two cryptocurrencies are expected to maintain their leading positions in terms of value and market dominance.

What is the price prediction for Tezos in 2030?

Based on current market trends, Tezos is predicted to reach $1.08 by 2030, representing a 60.76% increase from current prices.

Share

Content