Bitcoin Price Prediction: BTC Could Surpass $120,000 with BlackRock’s Yield-Generating ETF

Preface

Global asset management leader BlackRock has once again captured market attention by registering a trust company in Delaware, setting the stage for the launch of its Bitcoin Premium Income ETF. This strategic move is widely seen as a further extension of BlackRock’s Bitcoin product offerings and may act as a novel catalyst for driving Bitcoin’s price above $120,000.

BlackRock’s Bitcoin Income Strategy

Distinct from traditional spot Bitcoin ETFs—such as BlackRock’s iShares Bitcoin ETF (IBIT)—this new product adopts a covered call strategy. By selling Bitcoin futures call options and collecting premiums, the fund delivers regular income to investors. Although this approach limits some upside potential, it provides a steadier cash flow. For those seeking to hold Bitcoin while earning yield, this structure presents an appealing opportunity. As Bloomberg ETF analyst Eric Balchunas notes, this product effectively adds an income component to Bitcoin and represents an upgrade on IBIT.

Rising Regulatory Openness in the U.S.

BlackRock’s timing aligns with a pivotal shift in regulatory attitudes. The U.S. Securities and Exchange Commission (SEC) has recently eased its approval standards for crypto asset ETFs, enabling more products to launch swiftly under unified listing criteria and minimizing the need for individual reviews. This streamlined process signals faster growth for the Bitcoin ETF market and suggests the U.S. is rapidly positioning itself as a global center for crypto investment—reflecting President Donald Trump’s vision to establish the country as the world’s crypto capital.

Bitcoin Income Products Are Advancing

Historically, traditional finance has underestimated Bitcoin chiefly due to its lack of inherent yield. In recent years, new solutions—such as Strategy’s STRK convertible preferred shares, backed by more than 630,000 Bitcoins—have provided stable cash flow for investors. If BlackRock’s Premium Income ETF receives approval, it will join the short list of mainstream Bitcoin yield products in the U.S., likely drawing more institutional capital and propelling Bitcoin to new price highs.

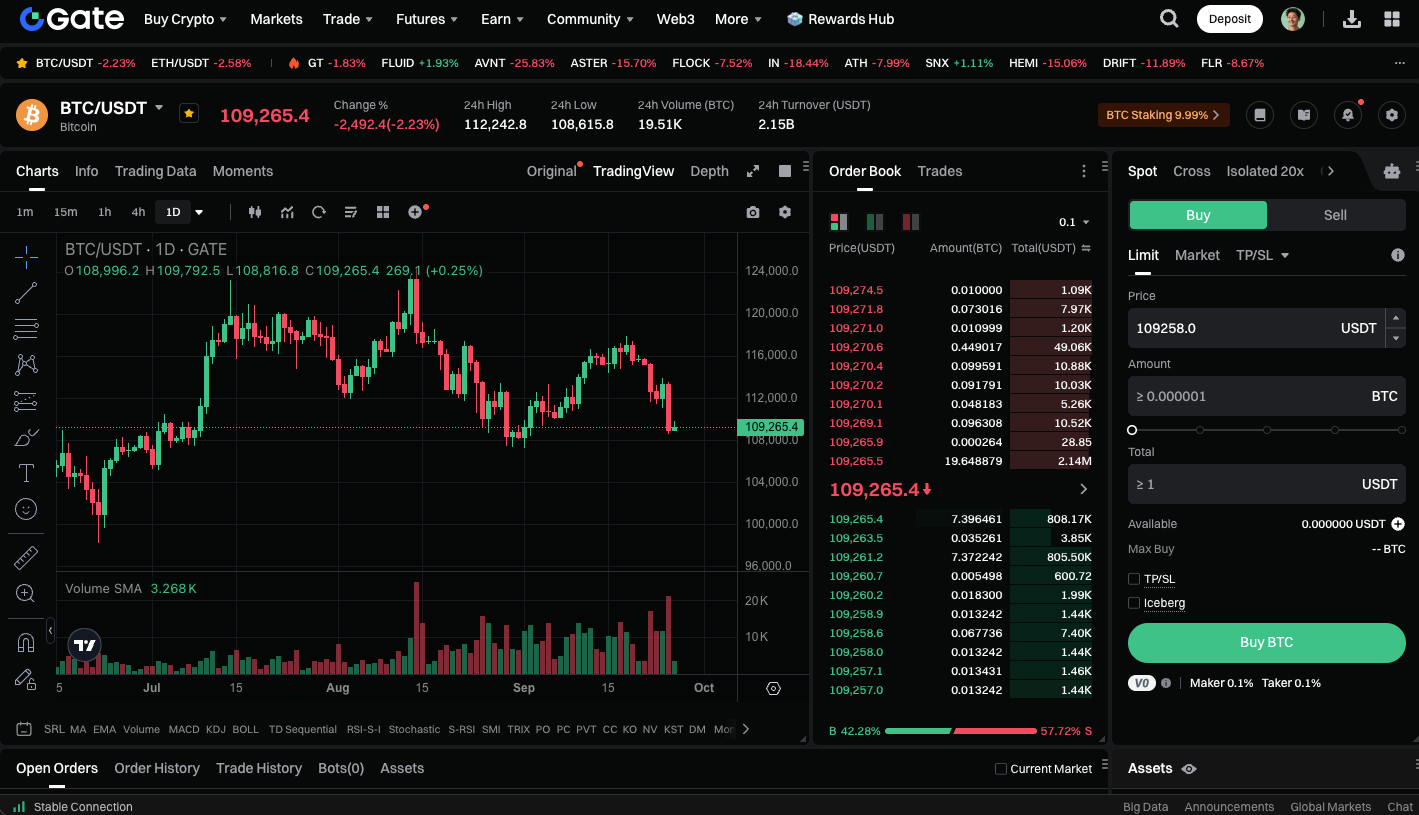

Trade BTC spot instantly: https://www.gate.com/trade/BTC_USDT

Conclusion

BlackRock is redefining Bitcoin investment with its income-focused strategy. Through the rollout of the Premium Income ETF, the firm is expanding traditional finance’s role in the crypto industry and may well become the driving force behind Bitcoin’s surge beyond $120,000.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article