Bitcoin Price Prediction: Potential To Test 95500 Resistance

Bitcoin Price Overview

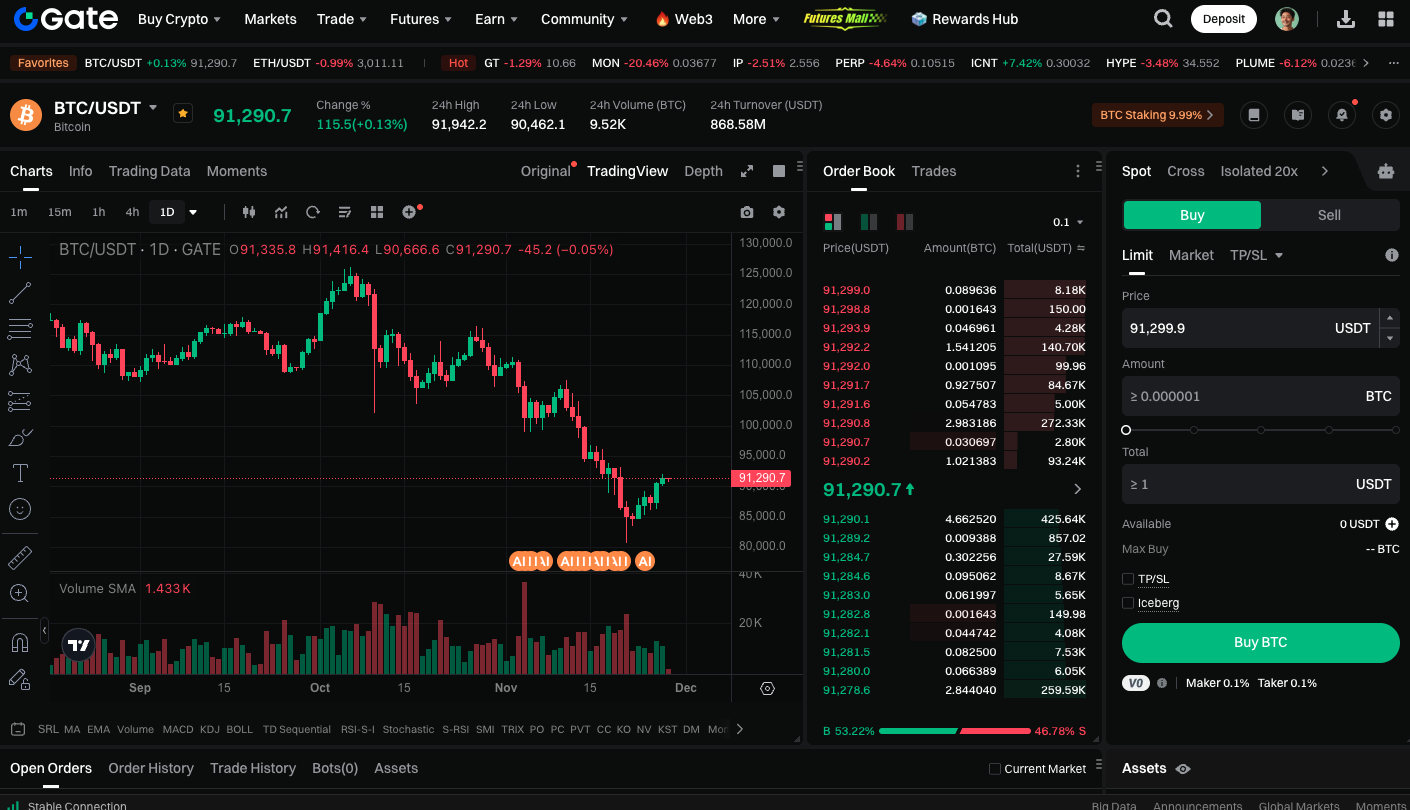

Bitcoin has recently stayed above $85,000, establishing a short-term support base before rebounding toward the $90,000 resistance area. BTC broke through $91,000, with highs reaching around $92,000. As of this report, the price is retracing part of its gains.

Support and Pullback

Bitcoin is approaching a short-term pullback within its current uptrend. If bullish momentum remains strong, the price may attempt another move higher.

Resistance Level Analysis

Immediate resistance stands near $91,200, with the first major barrier at $92,000. The next potential target is $92,500. A decisive close above $92,500 could open the way to $93,750, and possibly to the $94,500 or $95,500 resistance zones.

Potential Downside Risks

If Bitcoin fails to break above the $92,000 resistance area, a further decline is possible. Immediate support levels are at $90,500 and $88,450. If these supports are breached, the price could quickly test $87,500. The next major support lies at $86,300, and a break below this level may accelerate the downside move.

Technical Indicators

On the technical front, the hourly MACD shows weakening bullish momentum, while the RSI has dropped below 50. Investors should remain alert to risks and market volatility.

Start trading BTC spot now: https://www.gate.com/trade/BTC_USDT

Summary

Bitcoin maintains a bullish outlook but faces several short-term resistance levels. If bulls break above $92,500, BTC could challenge the $95,500 high. On the other hand, a drop below the $88,450 support may lead to further correction. Investors should closely watch key support and resistance levels, as well as short-term technical indicators, to inform their trading strategies.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution