Bitcoin Price Prediction Stalled At 100000 Psychological Level

Market Overview

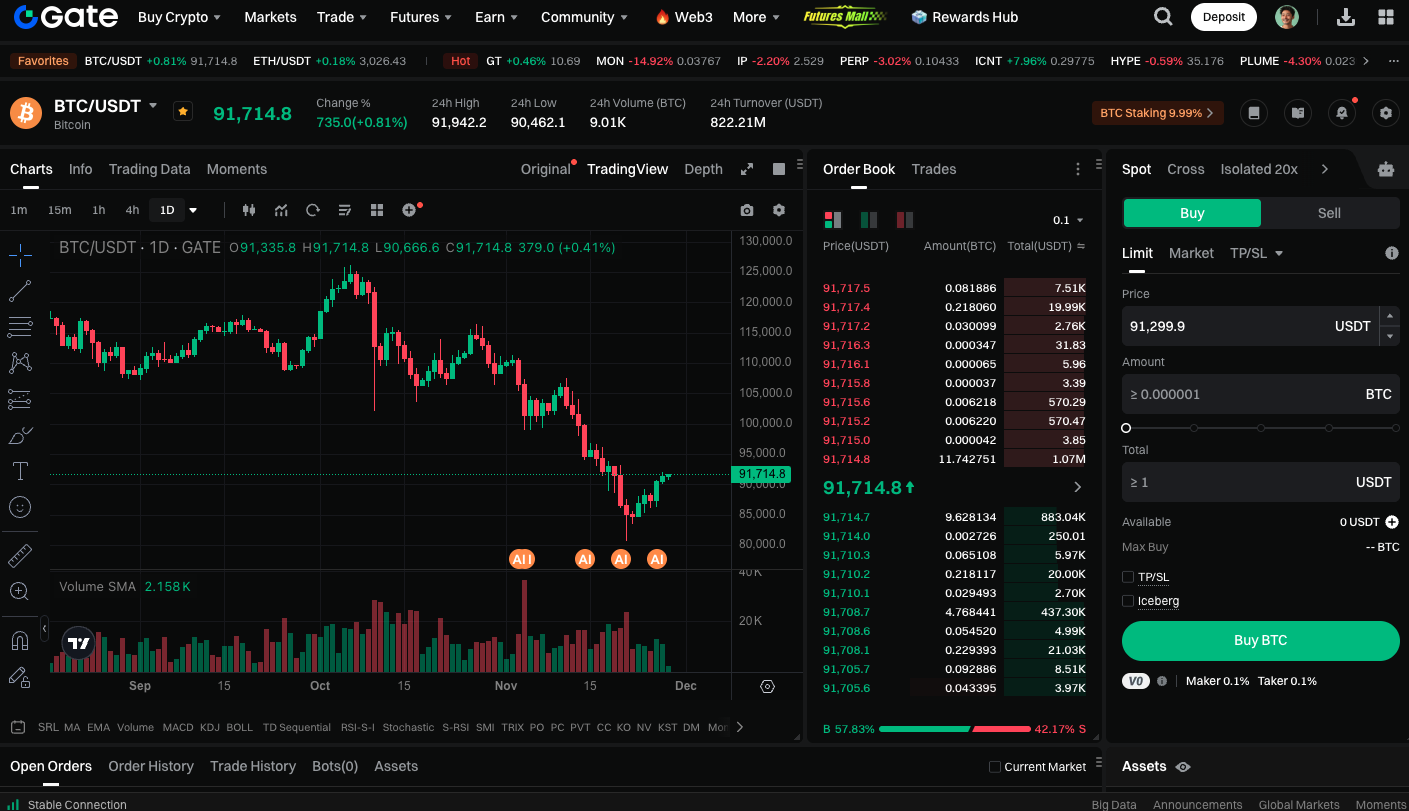

Bitcoin has recently traded below $100,000, signaling a period of short-term stagnation. Traders are uncertain, analysts are divided, and investors are caught between hope and anxiety. According to Bitwise Chief Investment Officer Matt Hougan, this brief slowdown does not mean the bull market is over. In fact, it may represent a historic inflection point for Bitcoin.

Impact of Government Factors

The recent stall partly resulted from the temporary U.S. government shutdown, which delayed ETF approvals and document reviews. While ETFs for XRP, Litecoin, Solana, and Hedera have received technical approval, there’s been no progress on new filings. With government operations back on track, Hougan anticipates a wave of ETF approvals, new product launches, and increased institutional participation—all of which could drive significant momentum for the crypto market.

$100,000 Psychological Threshold

Despite a steady flow of positive news, Bitcoin repeatedly retreats after approaching $100,000. Hougan points out that this price level has become a psychological barrier. Many long-term holders are taking partial profits. Most of this selling pressure is being managed through options strategies rather than direct spot market selling. As a result, this trend has also tempered the market’s upward momentum.

Investor Sentiment and Market Cycles

Investors remain cautious following past market crashes—from FTX’s collapse to the downfall of meme coins—which has made them more prudent and determined to avoid another multi-year bear market. The lack of a clear altcoin bull run has further dampened market activity and trading enthusiasm.

Long-Term Outlook Remains Bullish

Although short-term momentum is limited, Hougan stays optimistic. He believes Bitcoin has not yet reached its peak, and the traditional four-year cycle model is losing relevance. The market is starting to respond to new fundamentals, such as increased institutional capital, clearer regulations, asset tokenization, and global access to ETFs.

For long-term investors, this period may present a significant opportunity. With market fundamentals still strong, once remaining selling pressure subsides and institutional demand emerges, Bitcoin could quickly enter a new phase of growth.

Start trading BTC spot now: https://www.gate.com/trade/BTC_USDT

Conclusion

Bitcoin’s short-term performance remains constrained by the $100,000 psychological threshold, but its long-term potential is strong. As ETF approvals accelerate and institutional inflows increase, the market is positioned for substantial growth. Investors are advised to remain patient, monitor key catalysts and the easing of selling pressure, and prepare for the next bull run.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution