Breaking Down DragonFly’s 2025 Airdrop Report: The Crypto Airdrop Market and America’s Unclaimed Share

It’s now 2025—have you ever made a fortune from airdrops?

If not, don’t be discouraged, because some people don’t even have the right to participate in airdrops—such as our American friends across the ocean.

One fact that’s hard to believe is that the professionalized airdrop farming industry has flourished in the Chinese-speaking community, while in the U.S., due to regulatory restrictions, most crypto projects deliberately avoid U.S. users when designing airdrop policies to sidestep compliance risks.

Now, with the U.S. government introducing various pro-crypto policies, the president actively engaging in crypto-related actions, and more American companies accumulating Bitcoin, the U.S. has never had such a strong influence in the crypto market as it does today.

Changes in U.S. policy are reshaping the landscape of the airdrop market while also providing a reference for innovation in other countries.

Against this backdrop, the well-known VC firm Dragonfly has released the 2025 Airdrop Status Report, attempting to quantify the impact of U.S. policies on airdrops and the crypto economy through data and analysis.

TechFlow has distilled and interpreted the core insights of this report, summarized as follows.

Key Findings: The U.S. Users and Government Have Not Benefited from Airdrops

- U.S. Users Are Restricted by Geoblocking

- Affected Users: In 2024, approximately 920,000 to 5.2 million active U.S. users (5%-10% of all U.S. crypto holders) were unable to participate in airdrops or access certain projects due to geoblocking policies.

- U.S. Users’ Share of Global Crypto Addresses: In 2024, 22%-24% of all active crypto addresses worldwide belonged to U.S. users.

- Economic Value of Airdrops

- Total Airdrop Value: Among 11 sampled projects, the total value of airdrops amounted to approximately $7.16 billion, with around 1.9 million users worldwide participating. The median claim per address was about $4,600.

- Lost Income for U.S. Users:

- In 11 geoblocked airdrop projects, the estimated income loss for U.S. users ranged between $1.84 billion and $2.64 billion (2020-2024).

- According to CoinGecko’s analysis of 21 geoblocked airdrop projects, the potential income loss for U.S. users could be as high as $3.49 billion to $5.02 billion (2020-2024).

- Tax Revenue Loss

- Personal Tax Losses:

- Federal Tax Revenue Loss: Approximately $418 million to $1.1 billion (2020-2024).

- State Tax Revenue Loss: Approximately $107 million to $284 million.

- Total Personal Tax Revenue Loss: Approximately $525 million to $1.38 billion, excluding additional capital gains tax revenue from token sales.

- Corporate Tax Losses:

- Due to the relocation of crypto companies, the U.S. has missed out on substantial corporate tax revenues. For instance, Tether (the issuer of USDT) made a profit of $6.2 billion in 2024. If fully subject to U.S. taxation, it could have contributed approximately $1.3 billion in federal taxes and $316 million in state taxes.

- Personal Tax Losses:

- Impact of Crypto Companies Relocating Abroad

- Regulatory pressures have driven crypto companies to register and operate overseas, further exacerbating U.S. tax losses.

- Tether is just one example, illustrating the broader negative impact of industry migration on the U.S. economy.

Why Are Airdrops Restricted in the U.S.?

The restrictions on airdrops in the United States stem from regulatory uncertainty and the high cost of compliance. The key reasons are as follows:

1. Ambiguous Regulatory Framework

U.S. regulators such as the SEC and CFTC tend to establish rules through enforcement actions rather than providing clear legal guidelines. This “enforcement-first” approach makes it difficult for crypto projects to predict what is legally permissible, particularly for emerging models like airdrops.

2. Airdrops May Be Classified as Securities

Under U.S. securities law, the SEC applies the Howey Test to determine whether an asset qualifies as a security. The test evaluates:

- Investment of Money: Whether users have spent money or resources to acquire the asset.

- Expectation of Profit: Whether users expect to earn from the asset’s appreciation or the efforts of the project team.

- Reliance on the Efforts of Others: Whether profits are primarily derived from the issuer’s or third-party efforts.

- Common Enterprise: Whether investors share profits and risks collectively.

Many airdropped tokens meet these criteria (e.g., users expect the tokens to appreciate in value), leading the SEC to classify them as securities. This means that project teams must comply with complex registration requirements, or risk hefty fines and even criminal charges. To avoid these legal risks, many projects choose to block U.S. users entirely.

3. Complex Tax Policies

Current U.S. tax laws require users to pay income tax on airdrops based on their market value at the time of receipt, even if the tokens haven’t been sold. This unrealized tax burden, combined with subsequent capital gains taxes, further discourages U.S. users from participating in airdrops.

4. Widespread Geoblocking

To avoid being accused of offering unregistered securities to U.S. users, many projects implement geoblocking for American participants. This strategy not only protects project teams from regulatory penalties but also highlights how U.S. regulations stifle innovation.

At the same time, the report provides a detailed timeline of how U.S. crypto regulations have evolved regarding airdrops, along with notable cases where major projects excluded U.S. users from airdrop distributions.

How Do Crypto Projects Block U.S. Users?

These measures are taken both to ensure compliance and to avoid penalties for unintentional violations. The most common methods include:

1. Geoblocking

Geoblocking works by setting virtual boundaries to restrict access to services or content from specific regions. Projects typically determine a user’s location through their IP address, DNS service country, payment information, and even language settings in online shopping. If a user is identified as being from the United States, they are denied access.

2. IP Address Blocking

IP blocking is a core technology of geoblocking. Every internet-connected device has a unique IP address, and when a user attempts to access a platform, the system filters out and blocks IP addresses identified as originating from the United States using a firewall.

3. VPN Blocking

A Virtual Private Network (VPN) can mask a user’s real IP address, providing privacy protection. However, crypto projects monitor traffic from VPN servers. If an IP address shows abnormally high traffic volume or varied user activity, the platform may block those IP addresses to prevent U.S. users from bypassing restrictions via VPN.

4. KYC (Know Your Customer) Verification

Many platforms require users to complete KYC procedures, submitting identity documents to confirm they are not U.S. residents. Some projects even require users to sign a statement via their crypto wallet declaring that they are not U.S. citizens. These measures are not only used to prevent illegal financing and money laundering but also serve as an additional layer of U.S. user restrictions.

5. Explicit Legal Disclaimers

Some projects clearly state in their airdrop or service terms that U.S. users are prohibited from participating. This “good faith effort” is meant to demonstrate that the project has taken reasonable steps to exclude U.S. users, potentially reducing its legal liability.

- Even though projects try to block U.S. users, U.S. regulators (such as the SEC and CFTC) do not provide clear compliance guidelines, leaving projects uncertain about what constitutes “sufficient blocking measures.”

- Blocking U.S. users also increases operational costs and compliance risks. For instance, relying on third-party geoblocking services (such as Vercel) could introduce data errors, leading to inadvertent violations—yet the ultimate responsibility still falls on the project team.

What Is the Economic Impact of the U.S. Missing Out on Crypto Airdrops?

How Much Economic Loss Has U.S. Policy Restrictions Caused?

To quantify the impact of geoblocking policies on U.S. residents in crypto airdrops and assess their broader economic consequences, the report estimates:

- The number of U.S. crypto holders

- Their participation in airdrops

- The potential economic and tax revenue losses caused by geoblocking restrictions

To conduct this analysis, the report examines 11 geoblocked airdrop projects and 1 non-geoblocked airdrop as a control group, performing an in-depth data analysis on user participation and economic value.

1. Crypto Participation Rate Among U.S. Users

Among an estimated 18.4 million to 52.3 million U.S. crypto holders, approximately 920,000 to 5.2 million active U.S. users per month in 2024 were directly affected by geoblocking policies, which limited their ability to claim airdrops and use certain crypto projects.

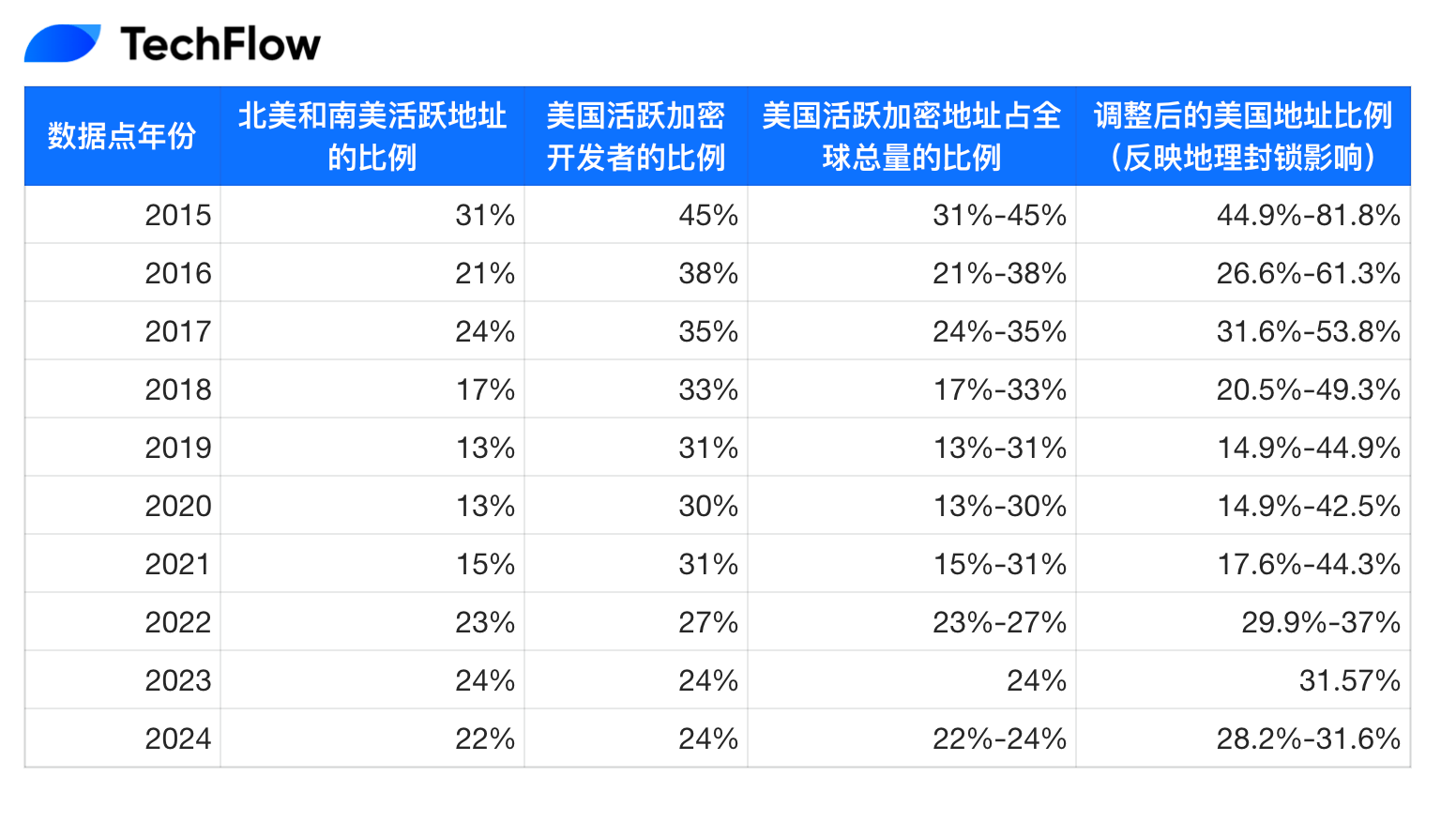

(Original image sourced from the report, translated and compiled by TechFlow.)

As of 2024, an estimated 22% to 24% of active crypto addresses worldwide belonged to U.S. residents.

From the 11 sampled projects, the total airdrop value was approximately $7.16 billion, with around 1.9 million users worldwide participating. The median claim per eligible address was around $4,600.

The following table breaks down the airdrop amounts by project name.

(Original image sourced from the report, translated and compiled by TechFlow.)

2. Losses from U.S. Users Not Participating in Airdrops

(Original image sourced from the report, translated and compiled by TechFlow.)

Based on the airdrop data in the table above, it is estimated that between 2020 and 2024, U.S. residents missed out on potential earnings of $1.84 billion to $2.64 billion from the sampled projects.

1.Tax Revenue Losses

Due to airdrop restrictions, the estimated tax revenue losses from 2020 to 2024 range from a lower bound of $1.9 billion (based on report samples) to an upper bound of $5.02 billion (based on additional research from CoinGecko).

Using individual tax rates, the corresponding federal tax revenue loss is estimated to be between $418 million and $1.1 billion. Additionally, the state tax revenue loss is estimated at $107 million to $284 million. In total, the U.S. has lost between $525 million and $1.38 billion in tax revenue over the past few years due to airdrop restrictions.

Offshore Tax Revenue Losses: In 2024, Tether reported $6.2 billion in profits, surpassing traditional financial giants like BlackRock. If Tether were headquartered in the U.S. and fully subject to U.S. taxes, it would be required to pay a 21% federal corporate tax, amounting to an estimated $1.3 billion in federal taxes. Additionally, considering the average state corporate tax rate of 5.1%, this would generate $316 million in state taxes. In total, Tether’s offshore status alone results in a potential annual U.S. tax revenue loss of approximately $1.6 billion.

2.Crypto Companies That Have Left the U.S.

Several crypto companies have completely exited the U.S. market due to regulatory challenges:

Bittrex: Shut down its U.S. operations, citing “regulatory uncertainty” and the increasing frequency of SEC enforcement actions, which made operating in the U.S. “unviable.”

Nexo: After 18 months of unsuccessful discussions with U.S. regulators, it phased out its U.S. products and services.

Revolut: The UK-based fintech company suspended crypto services for U.S. customers, citing regulatory changes and continued uncertainty in the U.S. crypto market.

Other companies are preparing for the worst (i.e., continued regulatory ambiguity and aggressive enforcement) by setting up offshore operations or shifting their focus to non-U.S. consumers. These include:

Coinbase: The largest U.S.-based crypto exchange, which launched operations in Bermuda to take advantage of a more favorable regulatory environment.

Ripple Labs: Engaged in a multi-year legal battle with the SEC. By September 2023, 85% of Ripple’s job openings were for non-U.S. positions, and by the end of 2023, the share of U.S. employees had dropped from 60% to 50%.

Beaxy: In March 2023, after the SEC charged the company and its founder, Artak Hamazaspyan, with operating an unregistered exchange and brokerage, Beaxy announced that it was shutting down due to regulatory uncertainty.

Recommendations

- Establish a “Safe Harbor” Mechanism for Non-Financing Crypto Airdrops:

- Issuers should be required to provide detailed information on token economics (e.g., total supply, distribution methods), governance structures, potential risks, and any usage restrictions.

- Insiders must comply with a minimum three-month lock-up period to prevent insider trading or early profiteering.

- Tokens should only be distributed through non-monetary contributions (such as network participation, service contributions, or prior holdings). If tokens are exchanged for direct monetary transactions, they should lose Safe Harbor eligibility.

- Expand the Scope of Rule 701 Under U.S. Securities Law: Extend Rule 701 to technology platform participants, especially those receiving tokens through airdrops or service-based compensation.

- Align Airdrop Taxation with Credit Card Rewards and Promotional Gift Cards:

- Airdropped tokens should not be considered taxable income upon receipt.

- Taxation should only occur when the tokens are sold or exchanged for another asset, as this is the point where tokens become liquid and have a quantifiable market value.

- The political transition period during election cycles presents a unique opportunity for regulatory innovation.

- The SEC should establish clear rules defining when digital assets are classified as securities and abandon the strategies of “regulation through enforcement” and “regulation through intimidation.” Instead, the SEC should shift toward formal rule-making, providing clear compliance guidelines to help crypto startups innovate with confidence.

Disclaimer:

- This article is reposted from [TechFlow]. The copyright belongs to the original author [TechFlow]. If there are any objections to this reposting, please contact the Gate Learn team, and the team will handle the request as soon as possible in accordance with the relevant procedures.

- Disclaimer: The views and opinions expressed in this article represent only the author’s personal views and do not constitute any investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless explicitly stated otherwise by Gate.io, any reproduction, distribution, or plagiarism of the translated content is strictly prohibited.

Related Articles

12 Best Sites to Hunt Crypto Airdrops in 2025

Reflections on Ethereum Governance Following the 3074 Saga

Top 20 Crypto Airdrops in 2025

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time