From NVIDIA to Binance, “Selling Shovels” Remains the Most Powerful Business Model

In 1849, the California Gold Rush drew countless fortune seekers to the American West.

Levi Strauss, a German immigrant, initially planned to join the gold rush himself. However, he quickly spotted a different opportunity: miners’ pants often tore, creating a strong demand for more durable workwear.

He crafted a batch of jeans from canvas, selling them specifically to gold miners. This decision gave birth to the Levi’s clothing empire, while the vast majority of those who actually chased gold lost everything.

On November 20, 2025, NVIDIA once again posted a stunning earnings report.

Third-quarter revenue reached a record $57 billion, up 62% year over year. Net profit soared 65% to $31.9 billion. The newest generation of GPUs are still in such short supply that even having the funds doesn’t guarantee access. The entire AI industry is effectively working for NVIDIA.

At the same time, a similar storyline is playing out on the digital frontier of crypto.

From the 2017 ICO bull run, to DeFi Summer in 2020, and the Bitcoin ETF and Meme coin waves of 2024, every narrative and get-rich-quick cycle has seen retail traders, project teams, and VCs rotate in and out. Yet only exchanges like Binance have consistently remained at the top of the food chain.

History doesn’t repeat, but it does rhyme.

From the gold rush of 1849 to today’s crypto and AI booms, the biggest winners are rarely the “miners” themselves. Instead, it’s those who sell the “shovels.” Selling shovels is the most resilient business model for surviving cycles and capturing upside amid uncertainty.

The AI Gold Rush: NVIDIA Strikes It Rich

To most, the face of this AI wave is ChatGPT and other large models—AI agents writing, drawing, and coding.

But from a business and profit perspective, this AI surge isn’t truly about an “application boom.” It’s a revolution in computing power unlike anything before.

Just as in the 19th-century California Gold Rush, tech giants like Meta, Google, and Alibaba are the miners, kicking off an AI gold rush of their own.

Meta recently announced it would invest up to $72 billion in AI infrastructure this year and expects to spend even more next year. CEO Mark Zuckerberg said he’d rather risk “missing out on hundreds of billions of dollars” than fall behind in superintelligence research.

Amazon, Google, Microsoft, and OpenAI have all committed record capital expenditures to AI.

Tech giants are racing ahead, and Jensen Huang is all smiles—he’s the Levi Strauss of the AI age.

Every company building large models must buy huge numbers of GPUs or rent GPU cloud services. Each new model iteration consumes massive training and inference resources.

If a model can’t beat its rivals or an app lacks a clear business model, it can be scrapped and rebuilt. But the GPUs already bought and the compute contracts already signed have been paid for—cash out the door.

In short, while everyone is still exploring whether “AI can change the world” or “AI applications can be profitable in the long term,” anyone wanting to play must first pay an “entry tax” to the computing power providers.

NVIDIA stands firmly atop this computing power food chain.

It has nearly monopolized the high-performance training chip market. The H100, H200, and B100 have become the “golden shovels” that AI companies scramble to secure. NVIDIA has integrated its GPU hardware with a robust software ecosystem (CUDA), development tools, and framework support, building dual moats in technology and ecosystem.

NVIDIA doesn’t need to bet on which large model will win. It just needs the whole industry to keep betting—betting that AI can deliver new futures, support higher valuations, and justify bigger budgets.

In the traditional internet sector, Amazon AWS played a similar role. Whether startups survived or failed, they still had to pay for cloud resources up front.

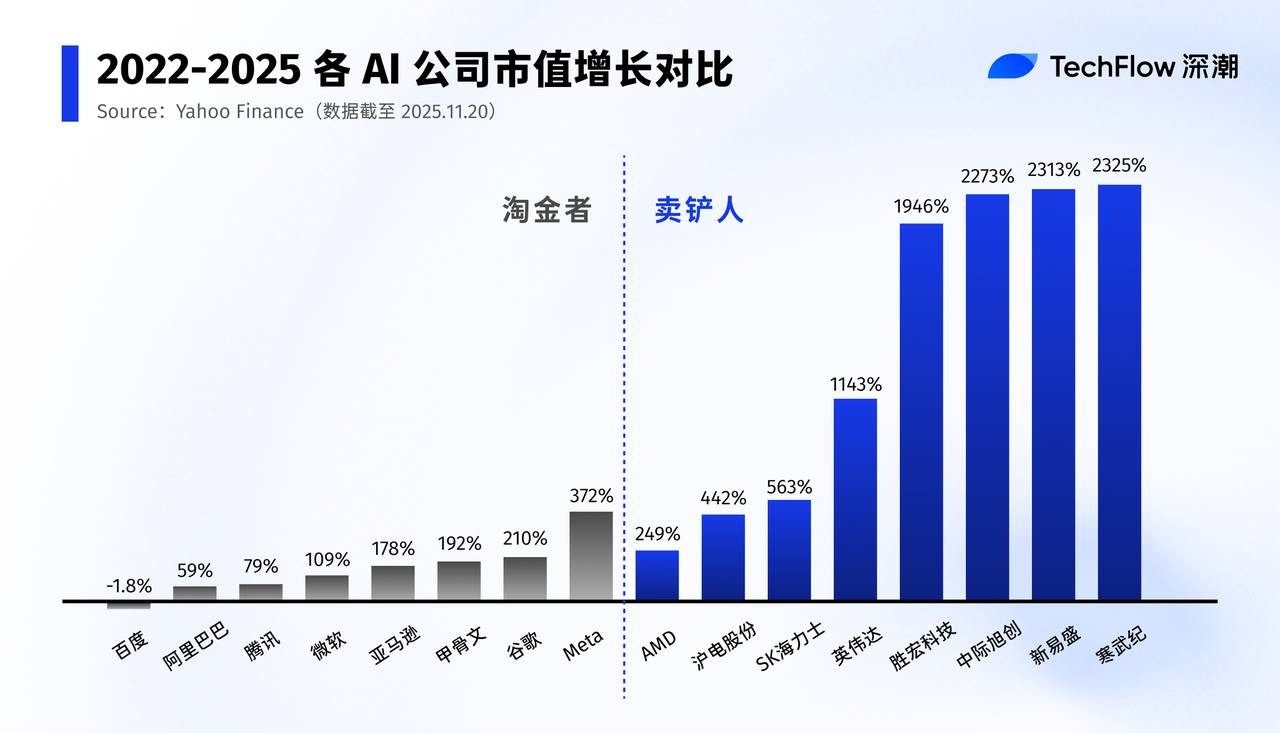

Of course, NVIDIA doesn’t stand alone. Behind it lies an entire “shovel seller supply chain” that is also quietly reaping huge rewards from the AI boom.

GPUs require high-speed interconnects and optical modules. In China’s A-share market, companies like Innolight, Accelink, and TFC Communication have become indispensable parts of the “shovel,” with share prices surging severalfold this year alone.

Data center upgrades demand vast numbers of cabinets, power systems, and cooling solutions. From liquid cooling and power distribution to data center construction, new opportunities keep emerging. Storage, PCBs, connectors, packaging, and testing—every component supplier linked to “AI servers” has seen valuations and profits soar in this cycle.

This is the power of the shovel-seller model:

Gold miners can lose money, and mining may fail, but as long as people keep digging, the shovel sellers never lose.

Large models are still searching for ways to “make money,” but the compute and hardware value chain is already raking in stable profits.

Shovel Sellers in Crypto

If NVIDIA is the shovel seller in AI, who fills that role in crypto?

The answer is clear: exchanges.

The industry keeps evolving, but exchanges remain the constant—they keep printing money.

2017 marked the first truly global bull market in crypto history.

It was easy to launch a token—just a whitepaper and a few slides could get you listed and funded. Investors chased “10x and 100x coins,” countless tokens launched and collapsed, and most projects were frozen or delisted within a year or two, with founding teams disappearing without a trace.

But projects still paid listing fees, traders paid transaction fees, and futures contracts incurred position-based fees.

Token prices could crash repeatedly, but exchanges only needed trading volume to profit. The more frequent the trading and the greater the volatility, the more they earned.

In 2020’s DeFi Summer, Uniswap’s AMM model challenged traditional order books. Yield farming, lending, and liquidity pools made it feel as if “centralized exchanges were no longer needed.”

Yet in practice, huge sums moved from CEXs to on-chain mining, only to flow back to CEXs for risk management, cash-out, and hedging during peaks and crashes.

DeFi may be the future in theory, but in reality, CEXs are still the main entry and exit points for fiat, hedging, and perpetual trading.

By 2024–2025, Bitcoin ETFs, the Solana ecosystem, and Meme 2.0 have once again pushed crypto to new highs.

This cycle, regardless of whether the narrative is “institutional adoption” or “on-chain paradise,” one thing hasn’t changed: huge amounts of leveraged capital still flow to centralized exchanges. Leverage, futures, options, perpetuals, and structured products form exchanges’ “profit moat.”

Additionally, CEXs and DEXs are merging at the product level, making on-chain asset trading within CEXs routine.

Token prices can rise or fall, projects and sectors can rotate, regulations can tighten, but as long as trading and volatility persist, exchanges remain the most stable “shovel sellers” in the game.

Beyond exchanges, crypto has many other “shovel sellers:”

For example, mining rig makers like Bitmain profit from selling hardware rather than mining themselves, staying profitable through multiple market cycles.

API service providers like Infura and Alchemy benefit as blockchain applications grow.

Stablecoin issuers like Tether and Circle earn digital dollar seigniorage through interest spreads and asset allocation.

Asset issuance platforms like Pump.Fun keep collecting fees through mass meme asset launches…

These players don’t need to bet on which chain will win or which meme will explode. As long as speculation and liquidity remain, their money machines keep running.

Why Is “Shovel Selling” the Ultimate Business Model?

The real world of business is far more ruthless than most realize. Innovation is usually a near-impossible gamble. Success takes not only personal effort, but the luck of timing and history.

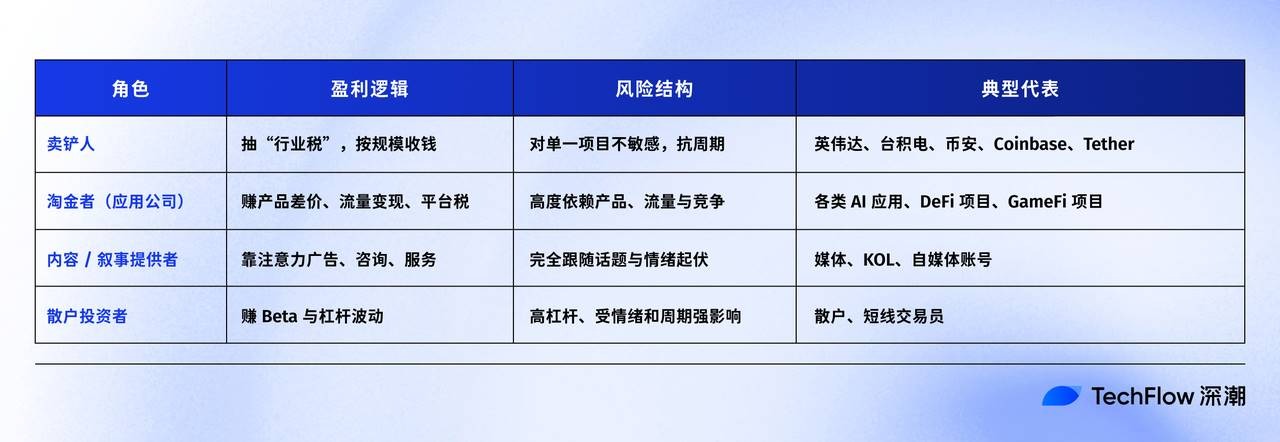

For any cyclical industry, the outcomes typically look like this:

Building applications—the equivalent of gold mining—is a hunt for alpha (excess returns). You must bet on direction, timing, and outcompeting rivals. Odds of success are low, payoffs high, and a single misstep can wipe you out.

Building foundational infrastructure—the upstream shovel seller—delivers beta. As long as the industry grows and user numbers keep rising, you profit from scale and network effects. Shovel sellers bet on probability, not luck.

NVIDIA doesn’t need to pick the winning AI model, nor does Binance need to know which narrative will last longest.

They just need one thing: “people keep playing the game.”

Once you’re committed to NVIDIA’s CUDA ecosystem, switching costs are sky-high. Once your assets are on a major exchange and you’re used to its depth and liquidity, moving to a smaller venue is nearly impossible.

The endgame for shovel selling is often monopoly. Once that’s achieved, the sellers control pricing—just look at NVIDIA’s 73% gross margin.

To put it bluntly:

Shovel-selling companies collect an “industry existence tax,” while gold miners chase “time window premiums.” The latter must seize user mindshare in a fleeting window or be forgotten. Content and narrative creators profit from “attention volatility” and vanish when the spotlight shifts.

Put even more simply:

Selling shovels bets “this era will move in this direction.”

Building applications bets “everyone will pick me.”

The first is a macro bet; the second is a brutal elimination race. Statistically, the odds for shovel sellers are an order of magnitude higher.

For retail investors and founders alike, the lesson is clear: if you don’t know who the final winner will be or which asset will multiply, invest in those supplying water, selling shovels—or even just selling jeans to all the miners.

One last stat: Ctrip’s Q3 net profit reached 19.919 billion yuan, surpassing Moutai (19.2 billion) and Xiaomi (11.3 billion).

Don’t just focus on who’s the brightest star in any single story,

Think about who keeps earning in every story.

In times of frenzy, serve the frenzy—but stay calm. That’s the highest wisdom in business.

Disclaimer:

- This article is republished from [TechFlow], with copyright belonging to the original author [Liam, TechFlow]. If you have any concerns about this republication, please contact the Gate Learn team for prompt handling.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Do not copy, distribute, or plagiarize translated articles without noting Gate as the source.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?