Gate Ventures Weekly Crypto Recap (November 10, 2025)

TL;DR

- Liquidity pressure intensified and the dollar tightened, the Fed announced halting QT and could restart balance sheet expansion next year.

- This week’s incoming data includes the US inflation data, initial jobless claims, monthly budget statement, PPI, retail sales and business inventories.

- BTC and ETH dropped 5.26% and 8.29% respectively, each posting their third-largest ETF outflows on record ($1.22B and $507.83M). The ETH/BTC ratio slid to 0.0342, while the BTC Fear & Greed Index fell to 29 (Fear).

- Total market cap declined 5.26%, though altcoins were more resilient, down just 1.05% outside the top 10. Privacy coins led gains, with ZEC’s trading volume surpassing BTC and ETH, and NEAR Intent gaining traction as a multi-chain protocol.

- ICP surged 80.9% to lead the top 30, followed by ZEC (+68.7%) and XMR, supported by strong fundamentals and growing privacy demand.

- 0xIntuition launched its token backed by ConsenSys and Polygon Ventures, listed on major exchanges, peaking at $0.58 and now trading near $0.20.

- S&P’s first on-chain Digital Markets 50 Index to debut via Chainlink and Dinari.

- Marathon Digital reports record $123M profit as it pivots from bitcoin mining to AI and energy.

- Ethereum staking queue surges with 1.5M ETH awaiting activation amid growing institutional confidence.

Macro Overview

Liquidity pressure intensified and the dollar tightened, the Fed announced halting QT and could restart balance sheet expansion next year.

Since October, US financial institutions have faced rising funding pressures, dollar liquidity has tightened, and the dollar has staged a cyclical rebound. At the FOMC meeting on October 29, the Fed announced it plans to end quantitative tightening (QT) on December 1st. This QT halt is similar to 2019, to stop reducing Treasury holdings, and to continue to run off MBS with a monthly cap of $35 billion, and reinvest MBS principal paydowns into Treasury bills. Since June 2022, the Fed has shrunk by about $2.3 trillion, which is over 25% of the total balance sheet, with Treasuries and MBS reduced by roughly $1.6 trillion and $600 billion. Since July, borrowing via the discount window has risen and liquidity pressures intensified after regional bank frauds; borrowing via the Fed’s Standing Repo Facility exceeded $5 billion and surpassed $10 billion on October 29.

This move not only supports dollar liquidity in aggregate, but also releases liquidity in a targeted way to the Treasury market, aiming to ease recent funding stress in short-term funding markets to avoid systemic liquidity risks. It also signals a blurring line between monetary and fiscal policy. It could be possible that the Fed is expected to restart balance sheet expansion as early as Q1 and no later than Q3 next year. If key spreads in the secured overnight funding markets, such as SOFR-ONRRP or SOFR-IORB, remain at post-pandemic highs, the Fed may even resume balance sheet expansion within this year.

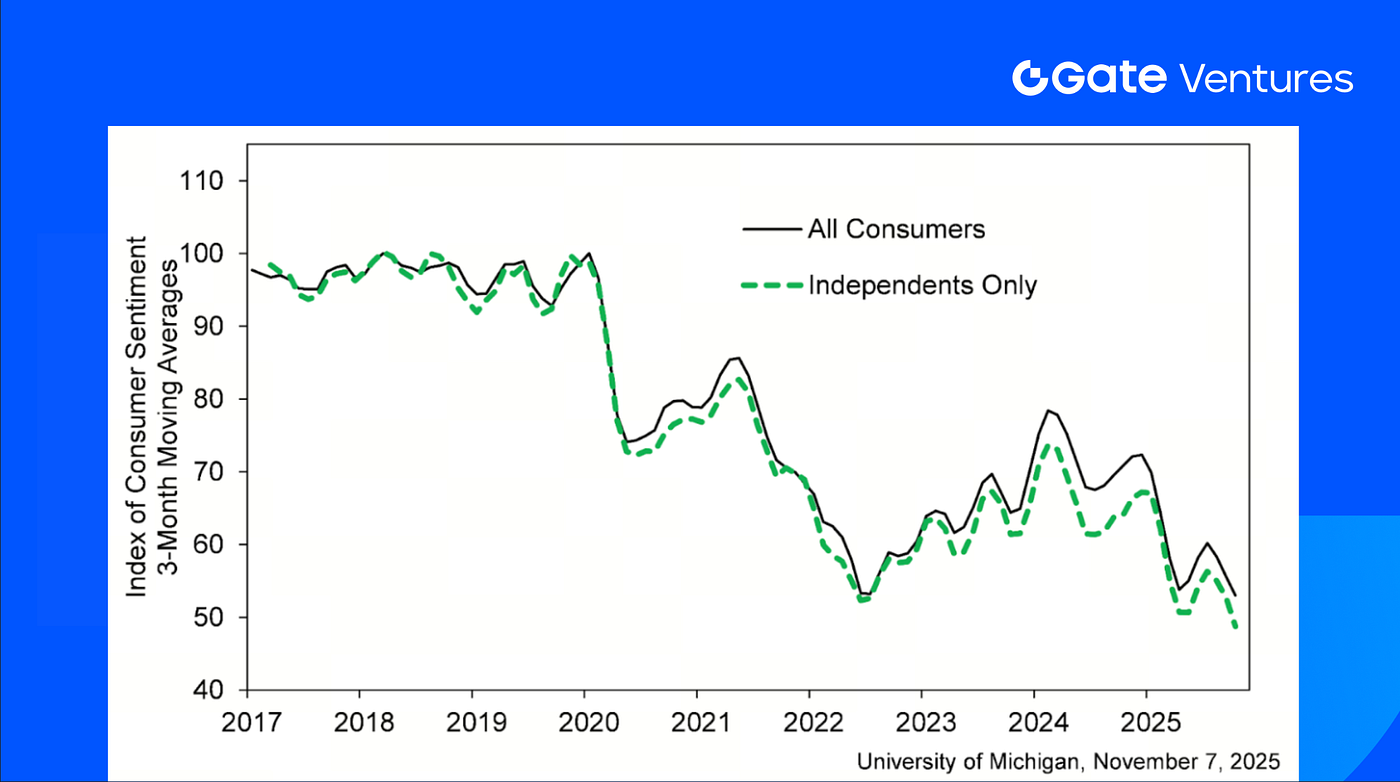

This week’s incoming data includes the US inflation data, initial jobless claims, monthly budget statement, PPI, retail sales and business inventories. While the US government shutdown continues and the official data release will still likely be postponed, the private sector data is telling the market anxiety on the economic outlook is accumulating. Last week University of Michigan’s survey showed that consumer sentiment was at its lowest in more than three years, with future expectations down significantly as well. (1, 2)

University of Michigan US National Sentiment

DXY

The US dollar had seen a slight soften trend last week, dropping from over $100 to current level of $99.654, as other major currencies rose and investors sought to balance the Fed’s hawkish stands and uncertainties on US economy.(3)

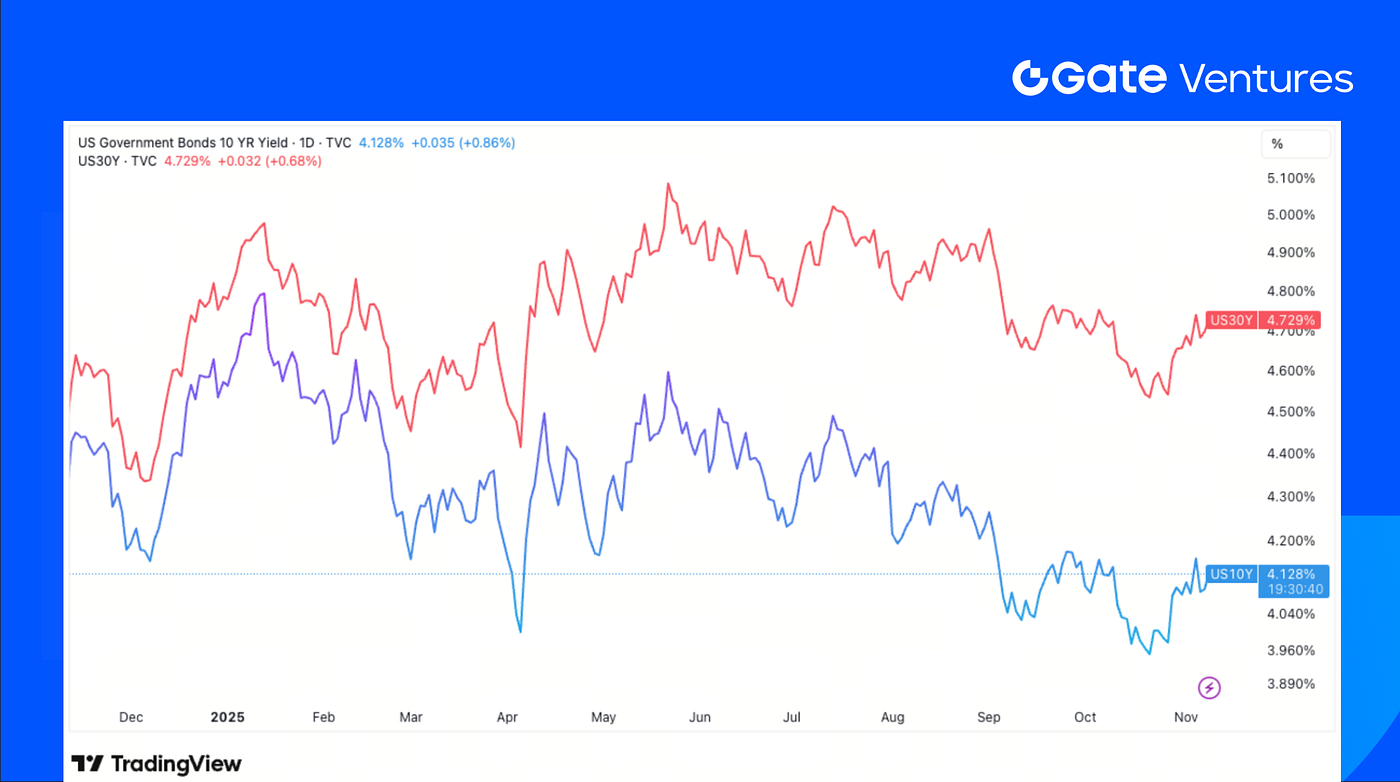

US 10-Year and 30-Year Bond Yields

The US short and long term bond yields rose last week due to the economic data blackout and ongoing US government shutdown. Investors are hoping the shutdown might soon end after Senate Minority Leader proposed a new plan.(4)

Gold

Gold prices rose last week as the dollar softened, and uncertainty around the US government shutdown added to safe-haven demand and the stock market set for weekly declines. (5)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

BTC fell 5.26% last week while ETH declined 8.29%. Bitcoin ETFs recorded $1.22B in net outflows, the third largest in history. Ethereum ETFs also saw $507.83M in outflows, the third highest on record. (6)

The ETH/BTC ratio dropped another 3.17% to 0.0342, continuing its steady downtrend. The BTC Fear and Greed Index dipped to 29, returning to the Fear zone. (7)

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The total crypto market cap fell 5.26% last week, while the market excluding BTC and ETH declined 3.88%. BTC and ETH led the downturn, as the broader altcoin market (excluding top 10 dominance) saw only a mild pullback of 1.05%.

The privacy coin sector continued to perform well, led by Zcash (ZEC), whose short-term shield transaction count reached an all-time high. Another standout was NEAR Intent, a multi-chain transaction protocol that functions as an underlying infrastructure layer and has already integrated DEXs such as SwapKit, Zashi, and KyberSwap. Protocol fees generated also reached an all-time high to around $300K per day.

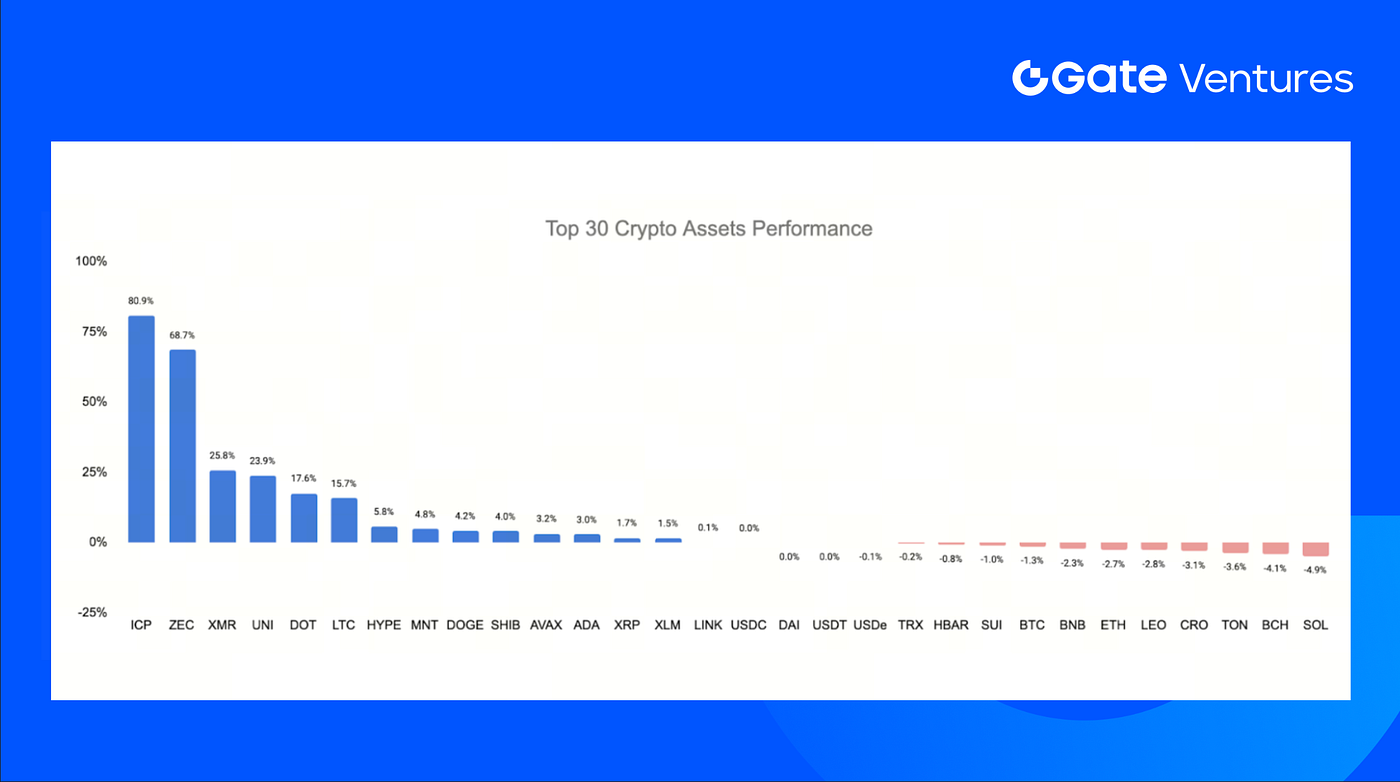

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Nov 10th 2025

The altcoin market maintained strong momentum, led by ICP (Internet Computer), ZEC (Zcash), and XMR (Monero). ICP topped the list with an impressive 80.9% price gain. Fundamentally, ICP now boasts the highest real-time throughput in the market at 1,145 tx/s, surpassing even Solana’s 819 tx/s. (8)

ZEC followed with a 68.7% price increase, continuing its strong performance. Its weekly transaction count reached a one-year high of 190k, while shielded assets remained elevated at 4.8 million ZEC, accounting for roughly 26% of total supply. Shielded transactions rose to 22%, marking a 46.7% increase from 15% last year, reflecting a growing user preference for anonymous transaction methods. (9)

4. New Token Launched

Intuition is building a next-generation infrastructure layer for the “semantic web” of Web3, a system where reputation, trust, identity, and human-centric knowledge become on-chain assets that can be monetized, composed, and utilized by applications. Backed by prominent partners including ConsenSys and Polygon Ventures, the project aims to bridge the gap between AI, data ownership, and decentralized knowledge networks.

Following its token generation event, the 0xIntuition token was listed on major exchanges such as Gate, Upbit, Bithumb, and Coinbase. The token peaked at $0.58 on its first trading day and is currently hovering around $0.20.

The Key Crypto Highlights

1. S&P’s first onchain Digital Markets 50 Index to debut via Chainlink and Dinari

Chainlink and Dinari are partnering to launch the S&P Digital Markets 50 Index onchain, tracking 35 U.S. blockchain-adopting firms and 15 major digital assets. Developed with S&P Dow Jones Indices, the benchmark will use Chainlink oracles to deliver real-time verified pricing and transparency across TradFi and crypto. The move follows Chainlink’s partnership with FTSE Russell and reinforces Dinari’s role in tokenizing equities via its dShares platform, which already provides access to 200+ tokenized U.S. assets. (10)

2. Marathon Digital reports record $123M profit as it pivots from bitcoin mining to AI and energy

MARA Holdings (NASDAQ: MARA) posted a record $123M Q3 profit, up 92% YoY to $252M revenue, driven by higher BTC prices, improved efficiency, and a 64% hashrate increase. The firm now holds 53,250 BTC (~$5.6B) and plans a 1.5GW gas-fired power and data center project in Texas with MPLX LP, extending its pivot toward AI and energy infrastructure. With $6.8B in combined cash and BTC, MARA targets 75 EH/s hashrate by year-end despite lagging stock performance.(11)

3. Ethereum staking queue surges with 1.5M ETH awaiting activation amid growing institutional confidence

Ethereum’s validator entry queue has grown to 1.5M ETH, while 2.45M ETH awaits exit, reflecting intensifying network participation. The rate-limiting queue prevents volatility by pacing validator activations and withdrawals. The rise highlights institutional confidence and a shift toward native staking, as long-term participants forgo liquidity to secure direct control and stable yields. Despite the 32 ETH threshold and exit delays, staking growth reinforces Ethereum’s role as the core settlement layer for global DeFi and stablecoin activity. (12)

Key Ventures Deals

1. Brevan Howard’s BH Digital and Galaxy Digital back Canaan with $72M equity deal to boost mining infrastructure

Canaan Inc., the Nasdaq-listed bitcoin miner, raised $72M through an equity deal involving BH Digital (Brevan Howard), Galaxy Digital, and Weiss Asset Management. The round includes the issuance of 63.7M ADSs at $1.131 each, with no warrants or derivatives. Proceeds will enhance Canaan’s balance sheet, fund energy infrastructure, and reduce reliance on future capital raises. The deal underscores renewed institutional confidence in Canaan’s technology and its strategic shift toward utility-grade computing projects. (13)

2. Harmonic raises $6M in Seed round to to optimize Solana performance

Harmonic, a Solana infrastructure startup, raised $6M in a seed round led by Paradigm with support from key Solana ecosystem angels. The firm is developing Solana’s first open block-building system, enabling validators to source blocks from multiple competing builders in real time — removing single-leader bottlenecks and improving performance. Harmonic’s open aggregation model brings “exchange-grade” execution to Solana, positioning it closer to Nasdaq-level reliability and throughput as network upgrades continue.(14)

3. Liquid raises $7.6M Seed to to bring institutional-grade infrastructure to onchain perps

Liquid, a decentralized perpetuals aggregator combining trading, yield, and risk management in one app, raised $7.6M in seed funding led by Paradigm with participation from General Catalyst and angels including Ashwin Ramachandran (Nova Fund | BH Digital), Eric Wu (Opendoor), and Vlad Novakovski (Lighter). The platform connects perps venues like Hyperliquid, Lighter, and Ostium, offering unified access and analytics. Liquid has already processed $500M+ in volume, targeting institutional-grade usability for retail traders.(15)

Ventures Market Metrics

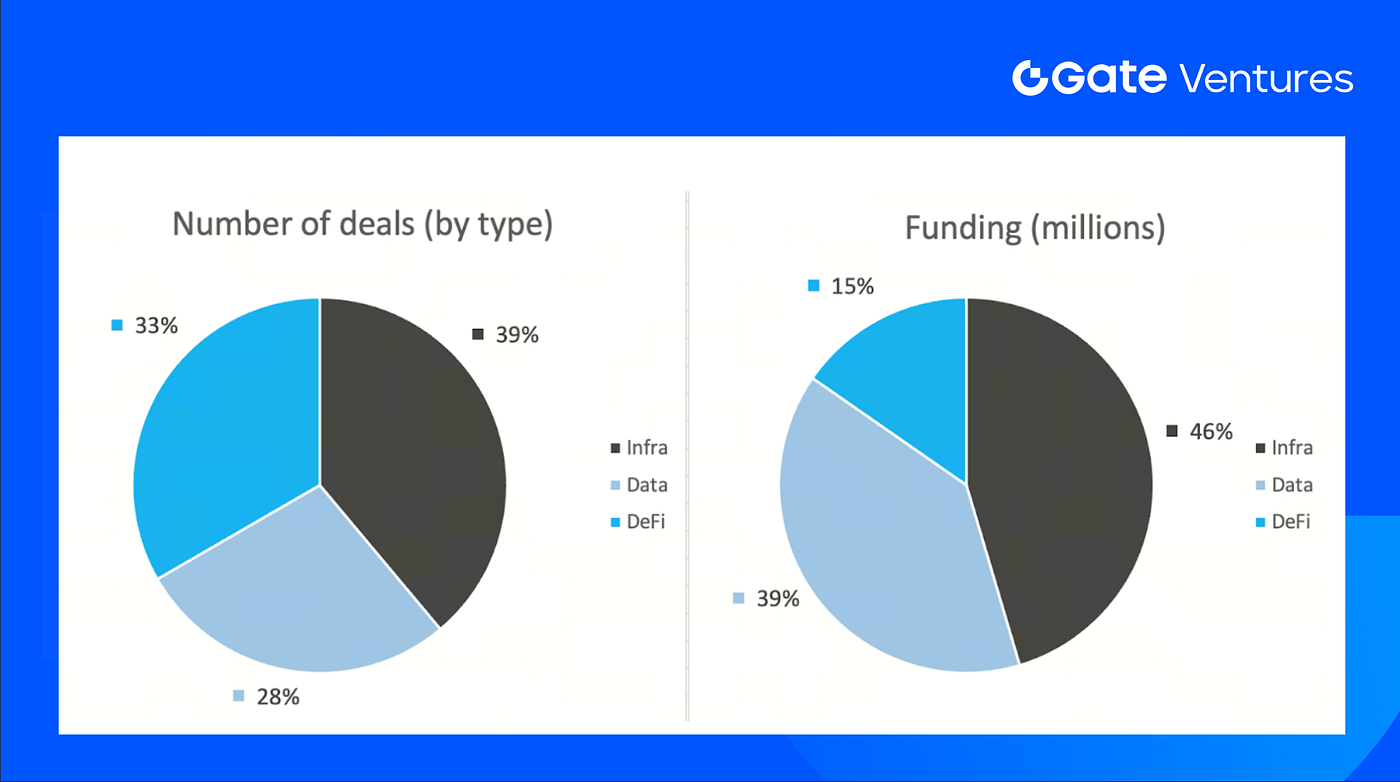

The number of deals closed in the previous week was 18, with Infra having 7 deals, representing 39% for each sector of the total number of deals. Meanwhile, Data had 5 (28%) and DeFi had 6 (33%) deals.

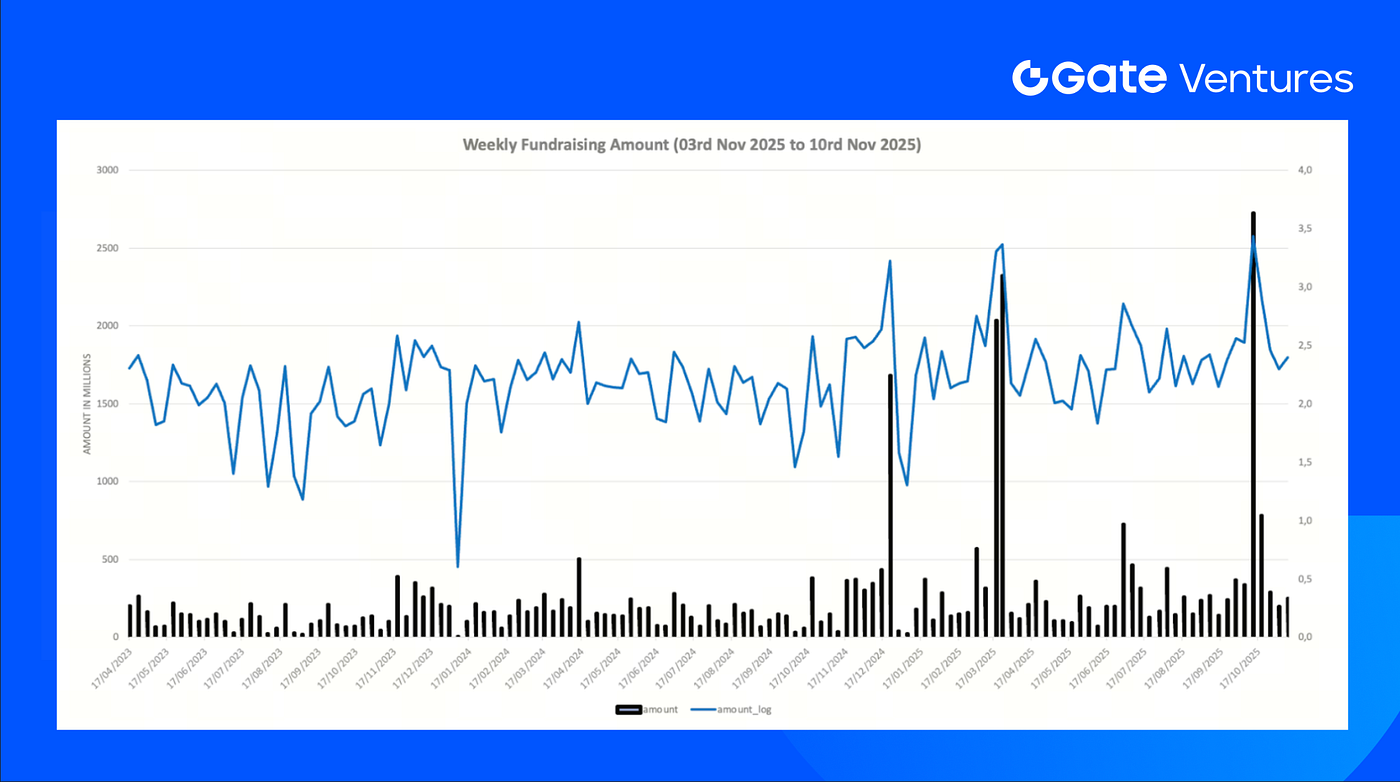

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 10th Nov 2025

The total amount of disclosed funding raised in the previous week was $250M, 11% deals (2/18) in previous week didn’t public the raised amount. The top funding came from Infra sector with $137M. Most funded deals: Canaan $72M, Future $35M.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 10th Nov 2025

Total weekly fundraising rose to $250M for the 1st week of Nov-2025, an increase of +26% compared to the week prior. Weekly fundraising in the previous week was up +616% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website | Twitter | Medium | LinkedIn

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Reference:

- S&P Global Weekly Ahead Economic Data, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-10-november-2025.html

- University of Michigan: Consumer Sentiment, https://www.sca.isr.umich.edu/

- DXY Index, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- US 10 Year Bond Yield, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AUS10Y

- Gold Price, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC Greed and Fear Index, https://alternative.me/crypto/fear-and-greed-index/

- ICP real-time tps, https://chainspect.app/dashboard

- ZCash performance, https://zechub.wiki/dashboard

- S&P’s first onchain Digital Markets 50 Index to debut via Chainlink and Dinari,https://www.theblock.co/post/377812/chainlink-and-dinari-bringing-sp-crypto-stock-index-onchain

- Marathon Digital reports record $123M profit as it pivots from bitcoin mining to AI and energy,https://cointelegraph.com/news/mara-hut-8-profits-q3-bitcoin-reserves-grow

- Ethereum staking queue surges with 1.5M ETH awaiting activation amid growing institutional confidence,https://www.theblock.co/post/377317/ethereum-validator-queue-grows-with-1-5-million-eth-waiting-to-start-staking

- Brevan Howard’s BH Digital and Galaxy Digital back Canaan with $72M equity deal to boost mining infrastructure,https://investor.canaan-creative.com/news-releases/news-release-details/canaan-inc-announces-strategic-investment-brevan-howard-galaxy

- Harmonic raises $6M in Seed round to to optimize Solana performance,https://www.theblock.co/post/377791/paradigm-harmonic-funding-solana-nasdaq-speed

- Liquid raises $7.6M Seed to to bring institutional-grade infrastructure to on-chain perps,https://www.theblock.co/post/377341/paradigm-leads-funding-perp-dex-aggregator-liquid

Related Articles

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)

Gate Ventures Weekly Crypto Recap (September 22, 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)

How On-Chain TCGs Could Unlock the Next $2 Billion Market: Landscape Overview and Valuation Outlook