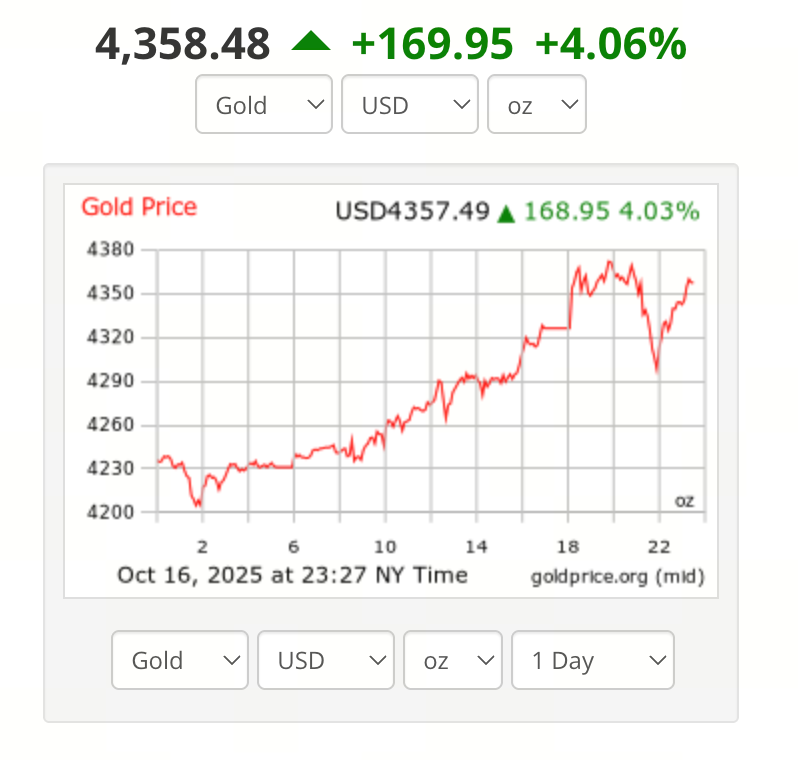

Gold Hits New All-Time High: Price Surpasses $4,300 per Ounce, Market Cap Tops $30 Trillion for the First Time

Gold Price Surpasses $4,300: Sets New All-Time High

Source: https://goldprice.org/

In October 2025, spot gold climbed past the historic $4,300 per ounce mark, reaching a peak of $4,325. This rally signals a new phase for the gold market. Over just a few weeks, gold prices have gained several percent, capturing the attention of investors worldwide.

Gold’s Market Cap Exceeds $30 Trillion for the First Time: What’s the Impact?

Beyond the price record, gold’s total market capitalization has crossed the critical $30 trillion threshold. This surge reflects the market’s renewed confidence in gold’s long-term value.

Implications include:

- Gold is now among the first asset classes to exceed $30 trillion in market cap, strengthening its role as a global reserve asset.

- Gold’s stability stands out compared to technology stocks and digital assets.

- This milestone also signals a sharp increase in global risk-aversion sentiment.

Key Drivers: Safe-Haven Demand, Easing Expectations, and Geopolitical Tensions

Gold’s price surge is the result of multiple factors:

- Safe-haven demand is rising: Weak global economic recovery, ongoing regional conflicts, and trade uncertainty are steering investors back to gold.

- Anticipated monetary easing: Broad expectations for Federal Reserve rate cuts are lowering dollar yields and increasing gold’s attractiveness.

- Dollar weakness and inflation concerns: Falling dollar index and mounting inflation make gold a prime hedge against currency depreciation.

- Central banks are increasing gold reserves: Several emerging market central banks are ramping up gold purchases, boosting demand.

What Does This Mean for Investors? Opportunities and Risks

While record gold prices are encouraging, individual investors should remain prudent:

Opportunities:

- Portfolio diversification: Gold helps stabilize assets in volatile markets.

- Inflation protection: Gold is a proven hedge against inflation.

- Long-term value: In an era of abundant liquidity, gold serves as a reliable store of value.

Risks:

- Overvaluation: Buying at high levels risks potential corrections.

- Policy risks: Interest rate hikes or a dollar rebound could pressure gold prices.

- Cost considerations: Physical gold requires storage, insurance, and may face liquidity challenges.

New investors should focus on small allocations and long-term holding strategies, avoiding impulsive buying at peaks.

Summary and Recommendations

Gold’s breakout above $4,300 per ounce and its market cap exceeding $30 trillion mark historic milestones. However, every asset rally carries risk. Investors should:

- Manage allocations and enter positions gradually.

- Monitor macro policies and U.S. dollar trends.

- Prioritize highly liquid instruments such as gold ETFs.

Gold will likely remain a cornerstone in global capital markets, but disciplined strategies are the key to long-term success.

Click to trade PAXG—a token pegged to gold’s price: https://www.gate.com/trade/PAXG_USDT

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Understand Baby doge coin in one article