Interesting Stories about Ethereum Nodes

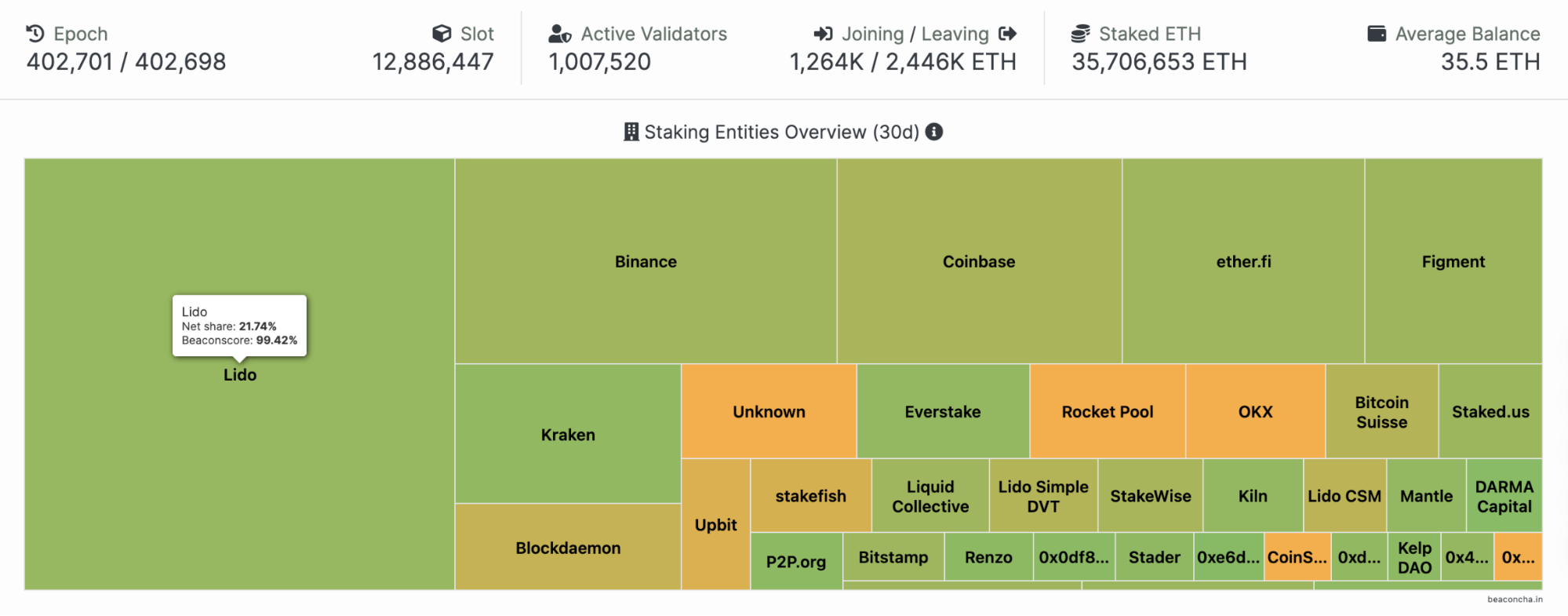

Ethereum’s total staked ETH has increased to around 35 million tokens (numbers may slightly differ depending on the data source). The jump from 15 million to 25 million staked ETH took roughly one year, but the increase from 25 million to 35 million took twice as long. Looking ahead, it’s likely that staking volume will eventually hit an upper limit, after which staked and unstaked ETH will reach a dynamic equilibrium.

The chart above comes from beaconcha.in, the open-source explorer developed by BitFly, known for building EtherMine—the largest Ethereum PoW mining pool in its time. BitFly, based in Austria, has developed several blockchain explorers, including ethernodes.org, which tracks execution and consensus layer node data for Ethereum. This site was previously referenced for statistics on the large number of Ethereum nodes hosted on AWS.

Two years ago, AWS accounted for over 60% of hosted Ethereum nodes. Since then, both the geographic distribution and choice of cloud providers have shifted significantly. (All data below reflects the time of writing and excludes unsynchronized nodes.)

Which Clients Power Ethereum Nodes?

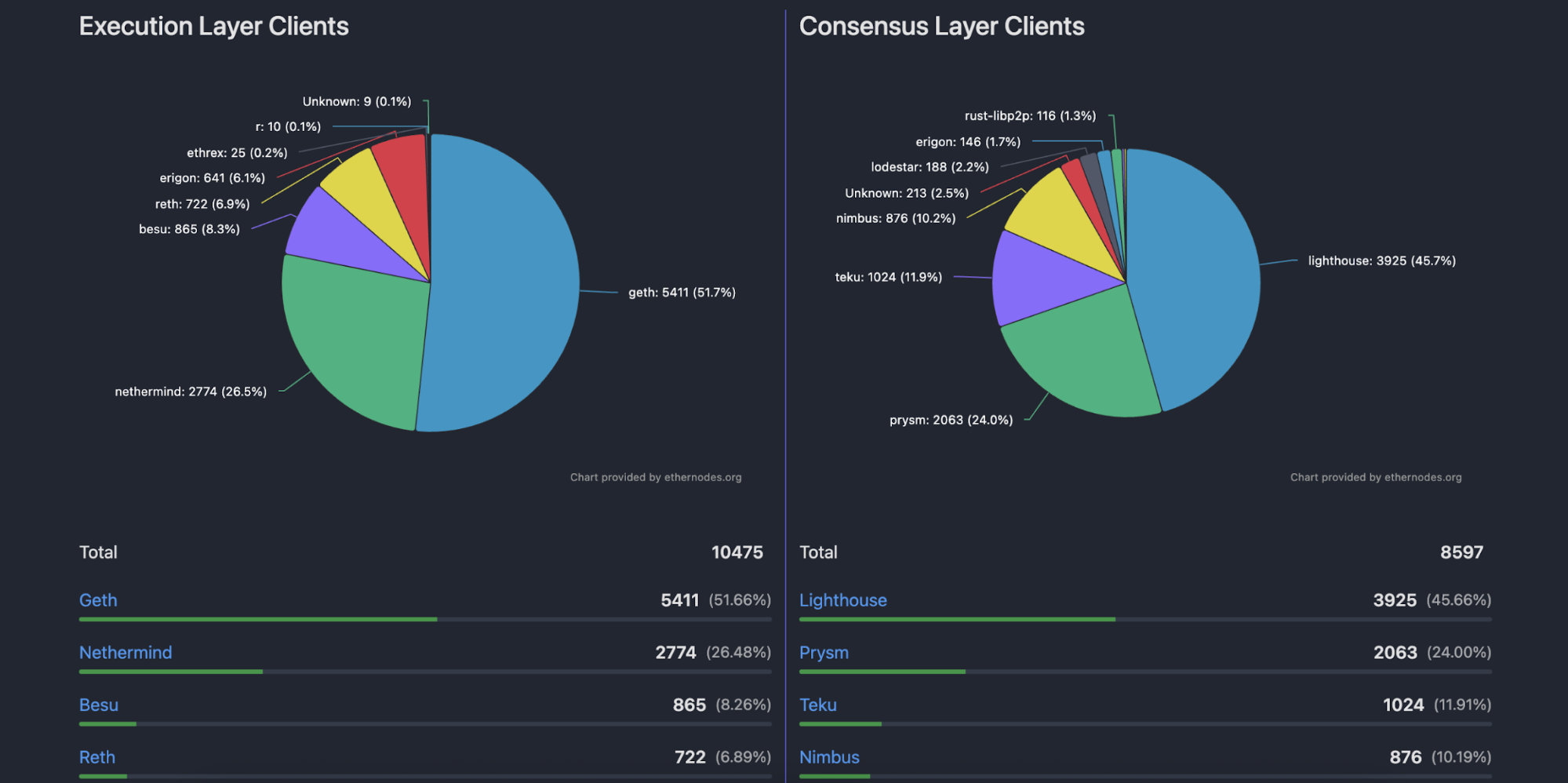

Out of the 10,475 execution layer nodes surveyed, Geth leads with a 51.66% share—still an outsized portion. Nethermind, championed by Ethereum Foundation Executive Director Tomasz Stańczak, follows at 26.48%. Besu, originally by ConsenSys and migrated to Hyperledger Foundation’s GitHub repo in 2019, holds 8.26%. Erigon (formerly Turbo-Geth, led by UK developer Alexey Akhunov and renamed in May 2021), once counted among the four major execution layer clients, now stands at 6.1%, having been overtaken by Paradigm’s Reth at 6.89%.

Reth remains controversial in the Ethereum community. Yearn core developer Banteg has argued that Reth heavily borrows from Akula (a Rust-based client) and copies Erigon’s architecture, yet Paradigm offered no support to those developers. Paradigm CTO Georgios Konstantopoulos responded that Reth “stands on the shoulders of giants,” but many in the community view this as venture-style resource extraction. Akula’s developers, unable to compete with Paradigm, have since abandoned their project.

Recently, Ethereum core developer Federico Carrone warned on X that Paradigm’s expansion—as a for-profit company hiring key researchers, funding open-source libraries, and leading EIPs and Reth—poses a threat to Ethereum’s decentralization. Carrone’s own Ethrex client accounts for just 0.2% of execution layer nodes.

On the consensus layer, Lighthouse—created and maintained by Australian security firm Sigma Prime—is the most widely used client, powering 45.66% of the 8,597 consensus layer nodes counted. Prysm, with about 24%, was originally developed by Prysmatic Labs, which Offchain Labs acquired in 2022. Teku, at 11.91%, shares its development team with Besu. Nimbus, representing 10.19%, is sustained by grants from the Ethereum Foundation and similar organizations; it’s engineered for resource efficiency so node operators can run Ethereum clients on devices with limited hardware like phones and laptops.

The top four clients represent 93.29% of execution layer nodes and 91.76% of consensus layer nodes, signaling strong client concentration. That said, these shares have dropped compared to two to three years ago, showing that the Ethereum Foundation’s diversification efforts are bearing fruit.

Where Are Ethereum Nodes Located?

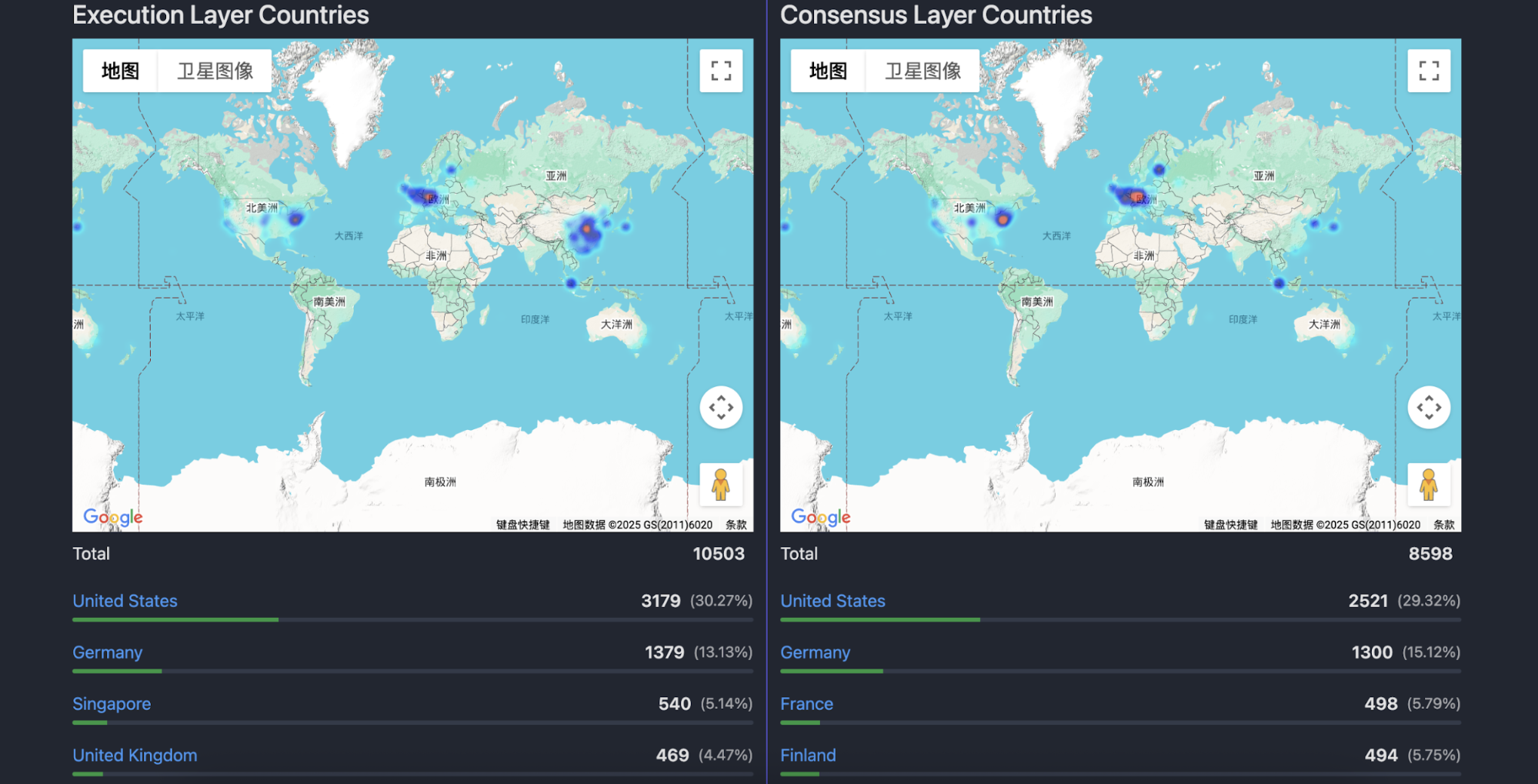

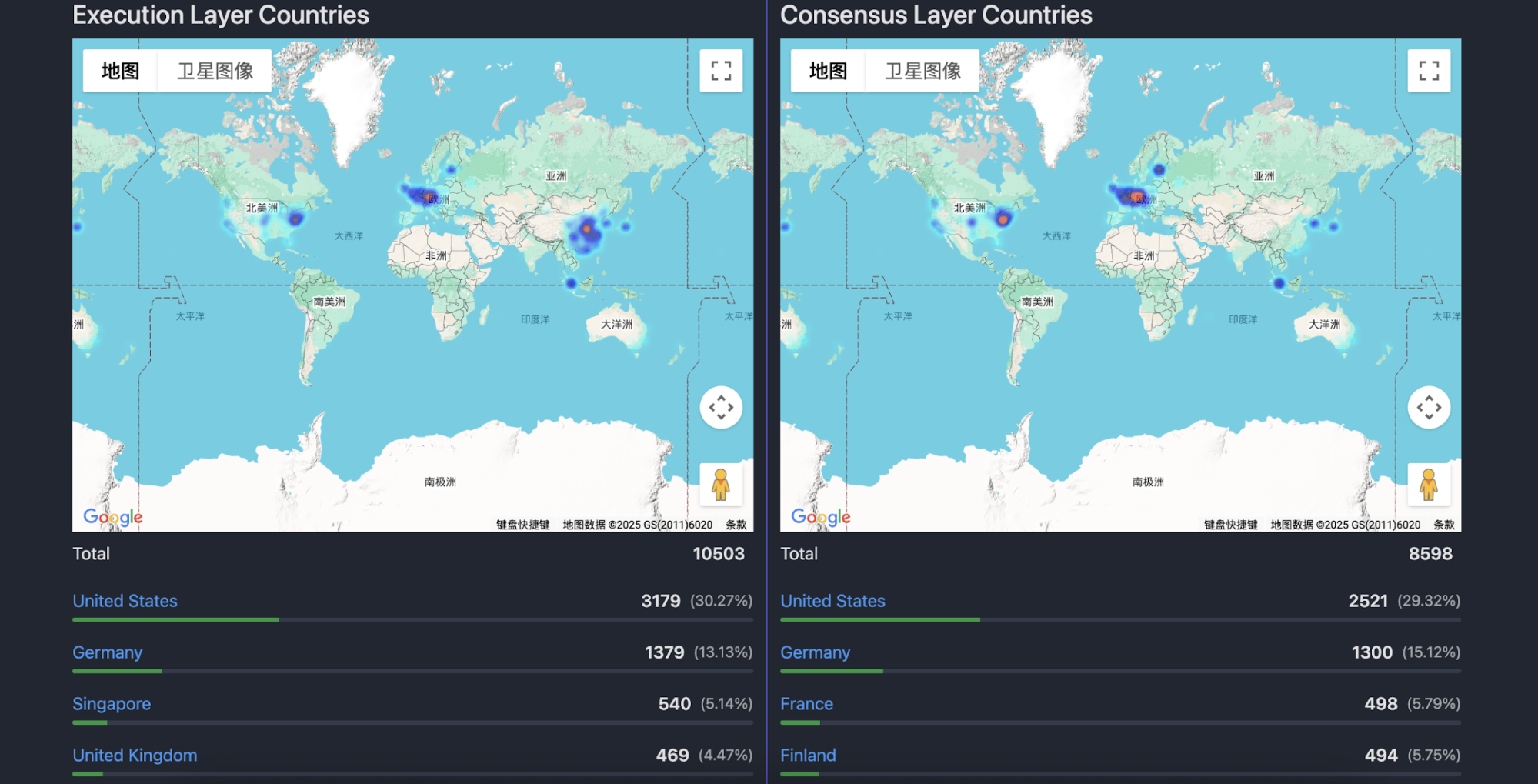

Determining the exact physical location of Ethereum nodes is challenging; most sites estimate positions based on IP analysis, which can be imprecise. Still, the data provides a general picture of node distribution.

More than 30% of execution layer nodes have IPs in the United States, with the highest density near Washington, D.C. Other clusters appear in San Francisco, Los Angeles, and New York, with additional nodes scattered across Kansas, Iowa, Texas, Florida, Massachusetts, and other states.

In Europe, nodes are mostly concentrated in Germany (13.13%), the UK (4.47%), France (4.28%), and Finland (3.78%). The map shows these nodes clustered in major cities like Dublin, Paris, Frankfurt, and Helsinki.

Nodes with IPs in China account for less than 4% but are distributed widely—from Changchun (Jilin) in the north, to Hainan in the south, Xining (Qinghai) in the west, and coastal Shanghai and Taiwan in the east. According to IP data, there are 103 nodes in Hong Kong, 97 in Taiwan, with only 204 nodes in the remainder of China. The densest concentration is in Zhengzhou, Henan, as indicated by the darkest spot on the map below.

Consensus layer client nodes in North America and Europe follow similar distribution patterns as execution layer nodes. In China, although dozens of consensus nodes are counted, their presence is not clearly marked on the map. Overall, the US and Germany rank first and second for both execution and consensus layer nodes, but Ethereum nodes are found worldwide—from Guatemala, Kuwait, and Montenegro to Iceland in the far north.

Which Cloud Services Are Nodes Using?

The statement “half of Ethereum nodes run on AWS” is a common saying in the industry. While cloud-hosted nodes were once common, the landscape has shifted significantly.

Of execution layer nodes, 49.1% are hosted on cloud services and 45% are self-hosted on private infrastructure. For consensus layer nodes, the need for stability (to avoid slashing penalties) drives 58.5% to be hosted, with 37.5% self-hosted. The detailed breakdown reveals additional insights.

Among self-hosted execution layer nodes, China Unicom and China Telecom together supply 51.52% of internet service. Other providers include China Unicom Industrial Internet Backbone, China Mobile, China Education and Research Network Center, China Unicom (Shenzhen), China Telecom Yunnan IDC1, China Telecom Group, and Beijing Baidu Netcom.

This points to more than 20% of execution layer nodes operating within China, possibly using overseas IPs, while very few use domestic network providers. Because running execution layer nodes doesn’t guarantee stable income, these nodes likely serve RPC endpoints, development, high-frequency trading, or algorithmic strategies needing rapid transaction broadcasting—indicating that China continues to play an important role in the on-chain market.

Hosted node cloud service distributions closely align with geographic patterns.

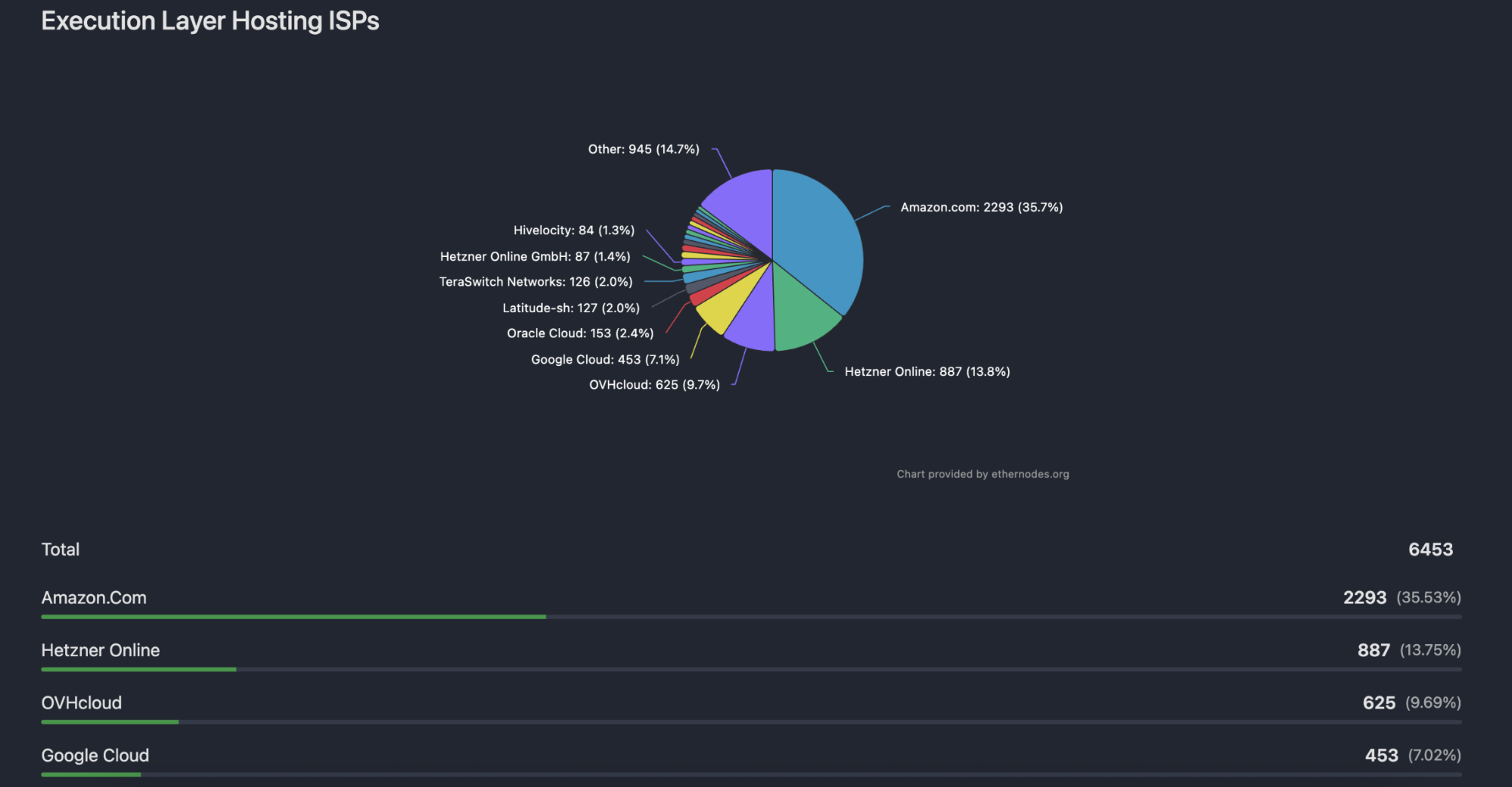

Of hosted execution layer nodes, 35.53% are on AWS, 13.75% on Hetzner Online (Germany), and 9.69% on OVHcloud (France). Google Cloud (7.02%) and Oracle Cloud (2.37%) round out the top five, reflecting the geographic concentration of nodes in the US and Europe. Consensus layer nodes show similar rankings, with Alibaba Cloud, Tencent Cloud, and Huawei Cloud present but with minimal shares.

Overall, AWS hosts about 20% of all Ethereum nodes—a reasonable proportion by industry standards.

In summary, among over 10,000 execution layer and nearly 9,000 consensus layer nodes, there’s no single dominant network or cloud provider in terms of region or infrastructure. Only client choice shows concentrated risk, but that too is gradually decreasing as the Ethereum Foundation advances decentralization and the goal of a decentralized ‘world computer.’

Statement:

- This article is republished from [Foresight News]. Copyright remains with the original author [Eric, Foresight News]. For republication objections, please contact the Gate Learn team, who will respond promptly in accordance with established procedures.

- Disclaimer: The views and opinions in this article are those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless explicitly attributed to Gate, translated articles may not be copied, distributed, or plagiarized.

Related Articles

What Is Ethereum 2.0? Understanding The Merge

Reflections on Ethereum Governance Following the 3074 Saga

Our Across Thesis

What is Neiro? All You Need to Know About NEIROETH in 2025

An Introduction to ERC-20 Tokens