Majors must lead as crypto selloff reflects macro repricing, not fundamental break

Last week’s selloff was driven by rate-cut repricing, not a structural break. Positioning is now cleaner and global easing continues. BTC needs to reclaim its range before broader sentiment can improve.

Macro update

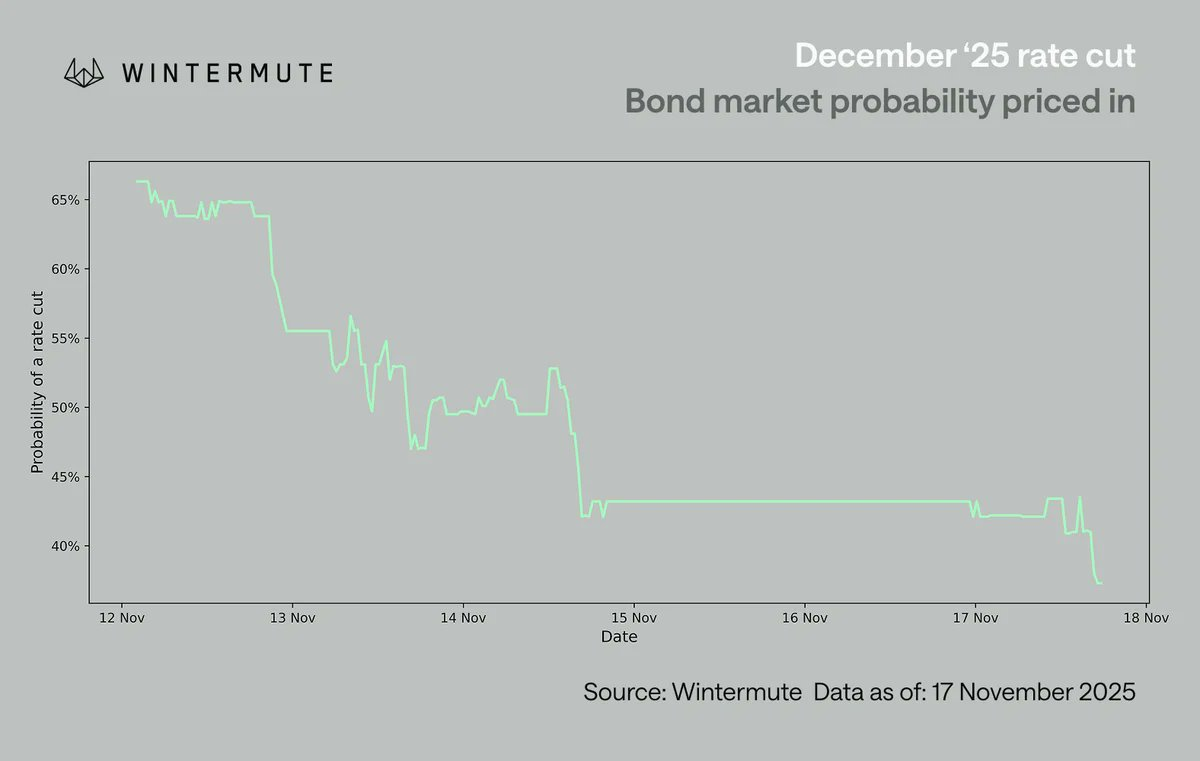

Last week was about digesting the abrupt repricing of December’s rate-cut expectations. The probability of a cut fell from roughly 70% to 42% in just about a week, amplified by the absence of other macro data points. Powell walking back the almost certain December cut forced investors to examine individual FOMC member preferences, revealing the cut was far from consensus. The response was immediate: U.S. risk assets softened and crypto, the most sentiment-sensitive risk asset, got hit hardest.

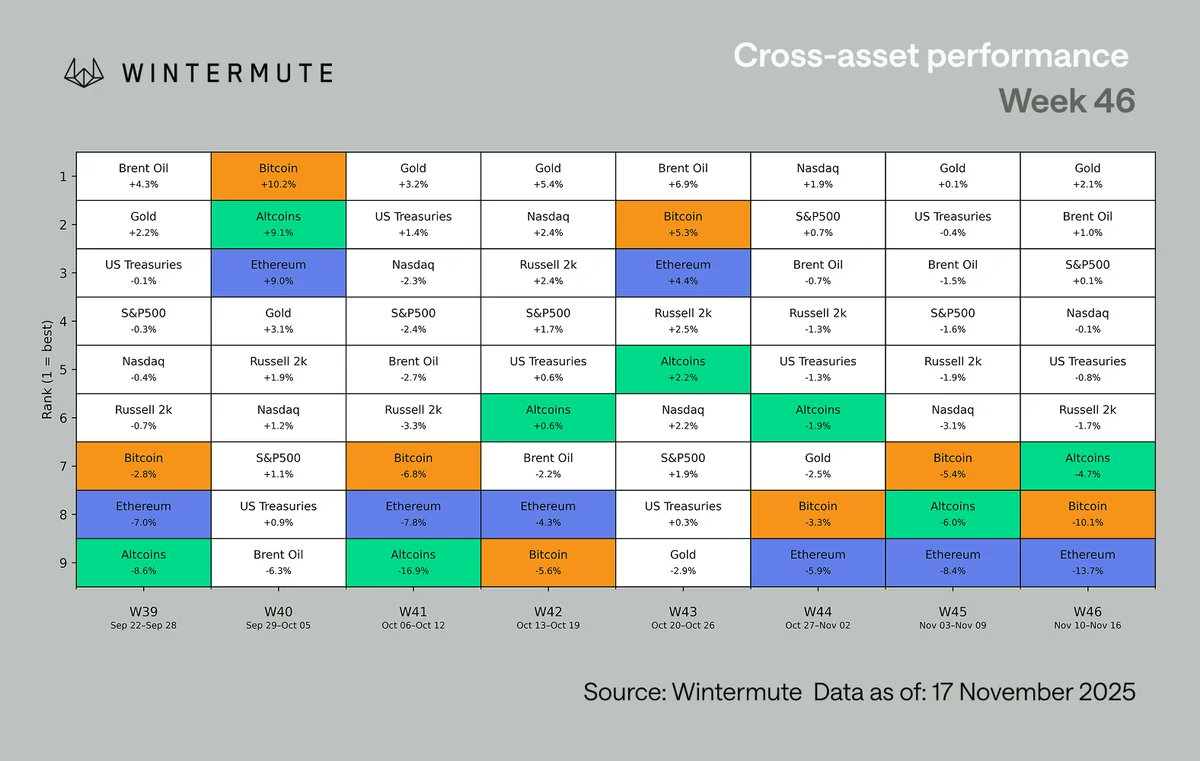

Across asset classes, digital assets remain at the bottom of the performance quilt. The underperformance isn’t new; crypto has been lagging equities since early summer, partly due to continued negative skew versus equities. BTC and ETH actually underperformed the aggregate of alts, which rarely happens in a down-tape. Two factors explain this:

- Alts have been bleeding already for a while

- Narrow pockets like privacy and fee switches continue to show isolated strength

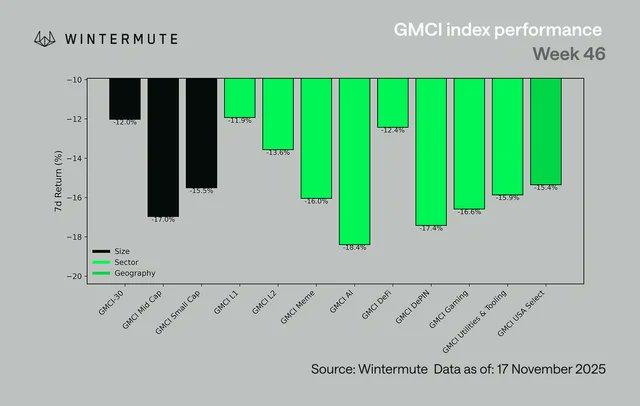

On a sector level, performance was uniformly negative. The @ gmci_ GMCI-30 fell 12% and most sectors dropped between 14-18%, led by AI, DePIN, Gaming and Memes. Even typically more resilient categories like L1s, L2s and DeFi saw broad weakness. The move was indiscriminate and reflects a full risk-off shift rather than sector rotation.

The exhibit above rolls Monday-Monday, hence discrepancy vs first exhibit

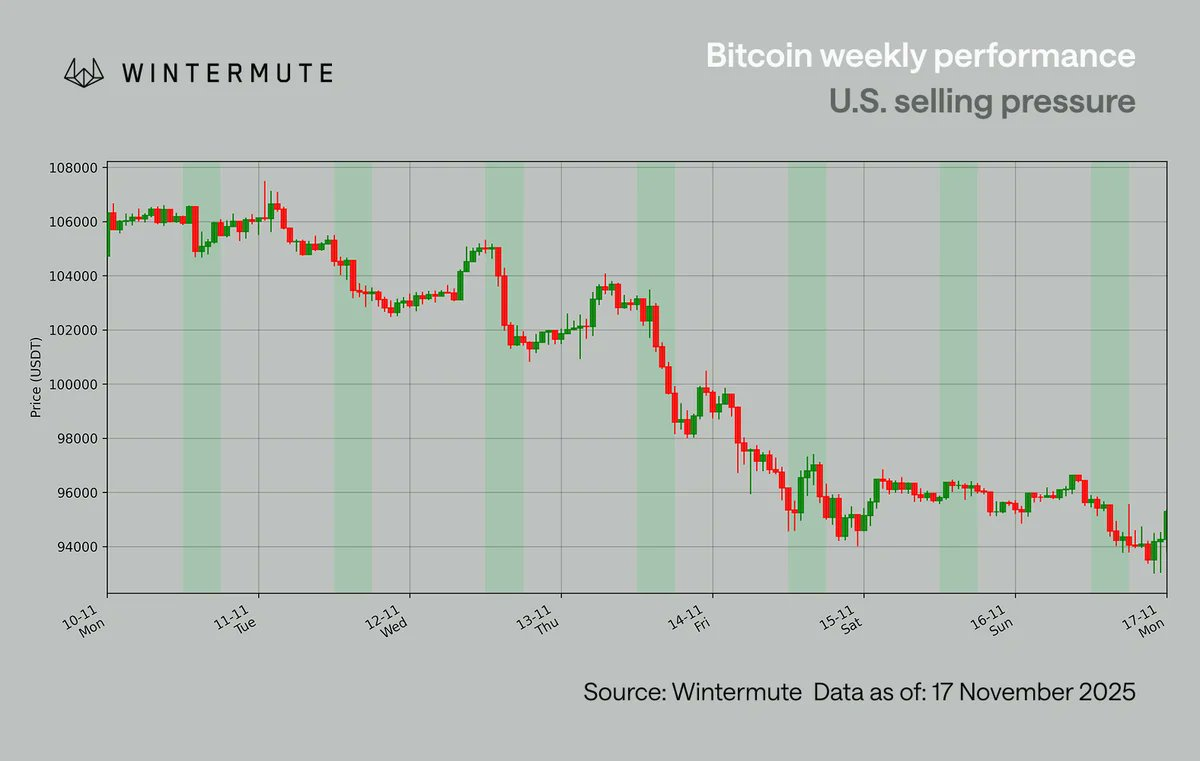

BTC is trading sub-$100k again, which hadn’t happened since May. BTC defended the $100k level twice (Nov 4 and 7) before last week and even experienced a relief rally back to $110k early last week. However, the recovery faded aggressively, mainly during U.S. hours, with hourly candles showing a clear pattern of selling as soon as the U.S. came online until we finally rejected $100k after two previous tests.

Some pressure came from whales trimming exposure. Q4 to Q1 selling is usually seasonal, but this year it has been pulled forward, partly because many traders expect the four-year cycle to imply a softer year ahead. This belief becomes self-fulfilling as participants derisking earlier amplifies the move. Importantly, there was no real fundamental break; the pressure was U.S.-led and macro-driven.

The rate-cut repricing was the more plausible driver. After Powell walked back the December cut idea, U.S. traders began drilling into individual FOMC member views. U.S. desks started shading December cut odds lower, moving from roughly 70% toward the low 60s before the broader global market caught on. This explains why the heaviest pressure showed up during U.S. hours on Nov 10-12, even while headline probabilities were still in the mid 60s.

While rate cuts dictate short-term sentiment, the broader macro environment has not deteriorated. We remain in a global easing cycle:

- Japan is preparing a $110bn stimulus package

- China continues to print

- U.S. QT program ends next month

- Fiscal channels such as the proposed $2k stimulus remain active

The shift is more about timing than direction, how quickly liquidity comes through and how long before it feeds into speculative risk. For now, crypto is trading almost entirely on macro, and without fresh data to anchor rate expectations, the market remains reactive rather than constructive.

Our take

Macro remains supportive and the reset in positioning leaves the market cleaner, but for sentiment to stabilize majors need to perform

The selloff looked more like a macro-driven flush than a structural break. Positioning has been cleared out, the U.S.-led pressure is now well understood, and cycle dynamics around whales and year-end flow explain much of the move.

The broader backdrop remains constructive with global easing continuing, U.S. QT ending next month, stimulus channels still active and liquidity likely improving into Q1. What is missing is confirmation from majors. Until BTC moves back toward the top of its range, market breadth is likely to stay narrow and narratives will remain short-lived. This macro setup does not resemble a prolonged bear environment. With macro driving the market, the next catalyst is more likely to come from policy and rate expectations rather than crypto-native flows, and once majors regain momentum the market should be positioned to recover more broadly.

Disclaimer:

- This article is reprinted from [wintermute_t]. All copyrights belong to the original author [wintermute_t]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

NFTs and Memecoins in Last vs Current Bull Markets

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market