Solana’s New Slogan Sparks Talk of a Financial Revolution

In the second half of 2025, Solana updated its official slogan from “Web3 Infrastructure for Everyone” to “Global Financial Infrastructure for Everyone.” This change signals Solana’s growing focus on its financial role, elevating financial infrastructure to center stage while putting blockchain technology in a supporting role.

This shift is deeply significant—Solana is intentionally repositioning “blockchain technology” as foundational infrastructure, with its financial capabilities and institutional adoption highlighted. The financialization of Solana is now backed by major players like Visa, Stripe, PayPal, Apollo, and BlackRock, with institutional involvement moving from mere technical pilots to active, large-scale product deployment.

Solana is increasingly becoming the go-to platform for asset issuance, stablecoins, RWA management, and financial innovation in both traditional and emerging finance. Rather than simply investing in SOL’s price, the new era is about “building finance with Solana,” turning on-chain infrastructure into the backbone of global capital and financial markets. This upgrade in Solana’s role is propelling it from a Web3 base layer to a global internet capital network, driving deep institutional value integration and compliant applications.

Strategic Shift: From Infrastructure to Specialized Financial Platform

With meme coin hype fading in 2025, the market is reevaluating Solana’s long-term outlook: Beyond memes, what’s Solana’s true value?

As attention grows, Solana has made a decisive transition in the past two years, evolving from a technical prototype and basic ecosystem into a robust application-driven platform.

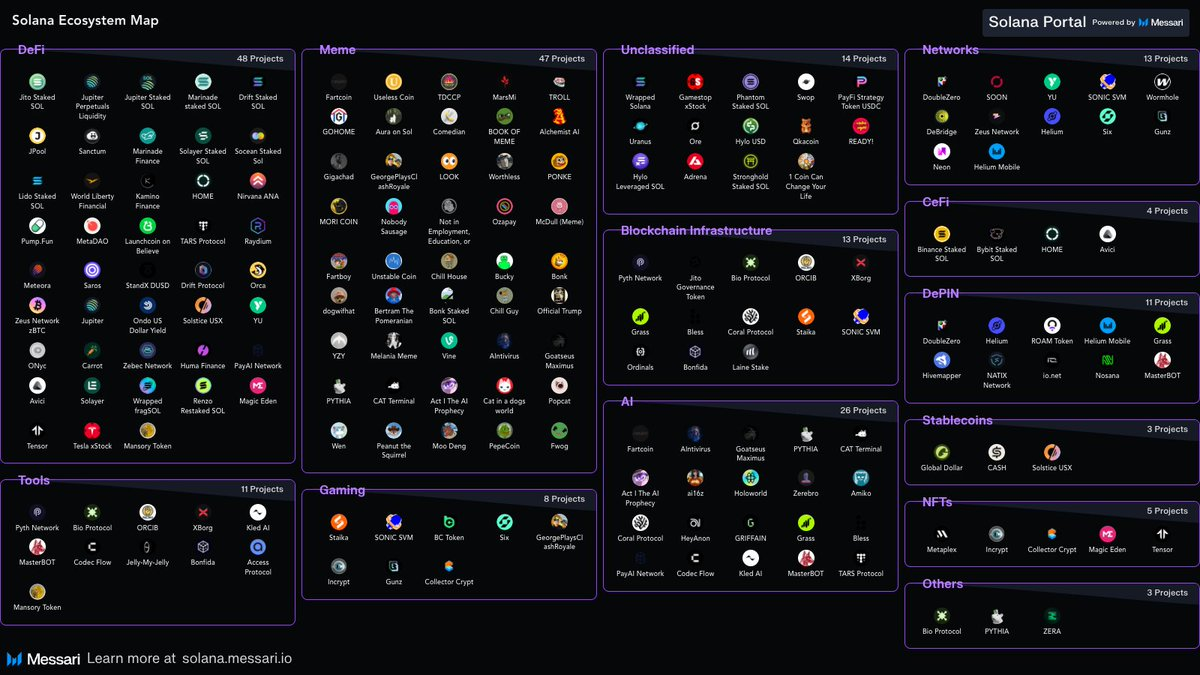

Previously, the spotlight was on traffic, viral innovations, and “killer apps.” But a deeper look at Solana’s ecosystem reveals the powerful momentum building in financial infrastructure—sectors like DeFi, assets, stablecoins, RWA, AI, and NFTs are now driving mainstream growth.

Source: https://solana.messari.io/landscape

As the ecosystem’s infrastructure and components mature, Solana has found its strategic path as a financial infrastructure leader.

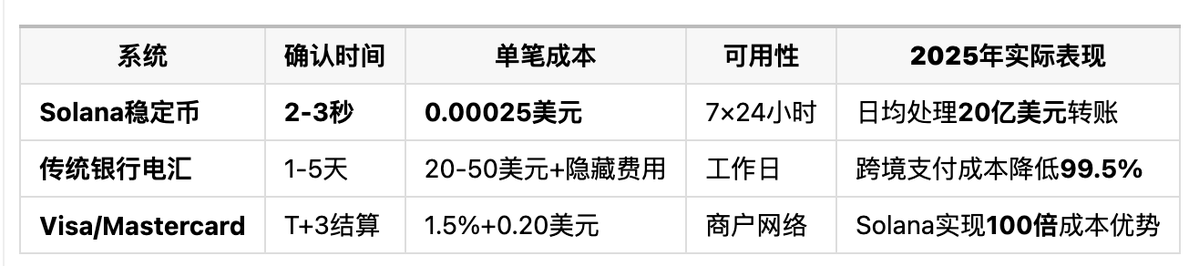

Technical metrics reinforce this direction:

- Operating hours: Traditional systems run 9–5, Solana is 24/7, nonstop

- Speed: Traditional transfers take 1–5 days, Solana confirms in 2–3 seconds

- Cost: Traditional international transfers cost $15–$50, Solana costs $0.0005

- Throughput: Average 869 TPS (transactions per second, hourly), with peaks at 5,289 TPS

Stablecoins, on-chain treasuries (DAT), RWA assets, institutional custody, and integrated payments have emerged as the ecosystem’s key growth engines, attracting global financial institutions and capital. Solana’s evolution has moved beyond “blockchain tools,” entering a new era as a global financial infrastructure.

Solana’s Financial Breakthroughs in 2025

Solana’s Financial Trajectory

On October 23, 2025 (UTC), at the 11th Wanxiang Global Blockchain Summit, Solana Foundation Chair Lily Liu (@ calilyliu) delivered a keynote titled “Building New Finance,” formally outlining Solana’s financial vision.

“Solana’s impact on finance is like Netflix’s on entertainment or Amazon’s on shopping—an internet-scale disruptor, growing at breakneck speed, and redefining the future of modern finance.”

The key takeaway: This new platform doesn’t just change products—it transforms how users access financial services.

- Netflix made entertainment on-demand, everywhere—no longer limited to TV or theaters.

- Amazon turned shopping into a one-click, online experience—instant and borderless.

- Solana is streamlining, automating, and simplifying on-chain finance, improving on the limited, process-heavy services of banks and exchanges.

Solana’s Financial Breakout

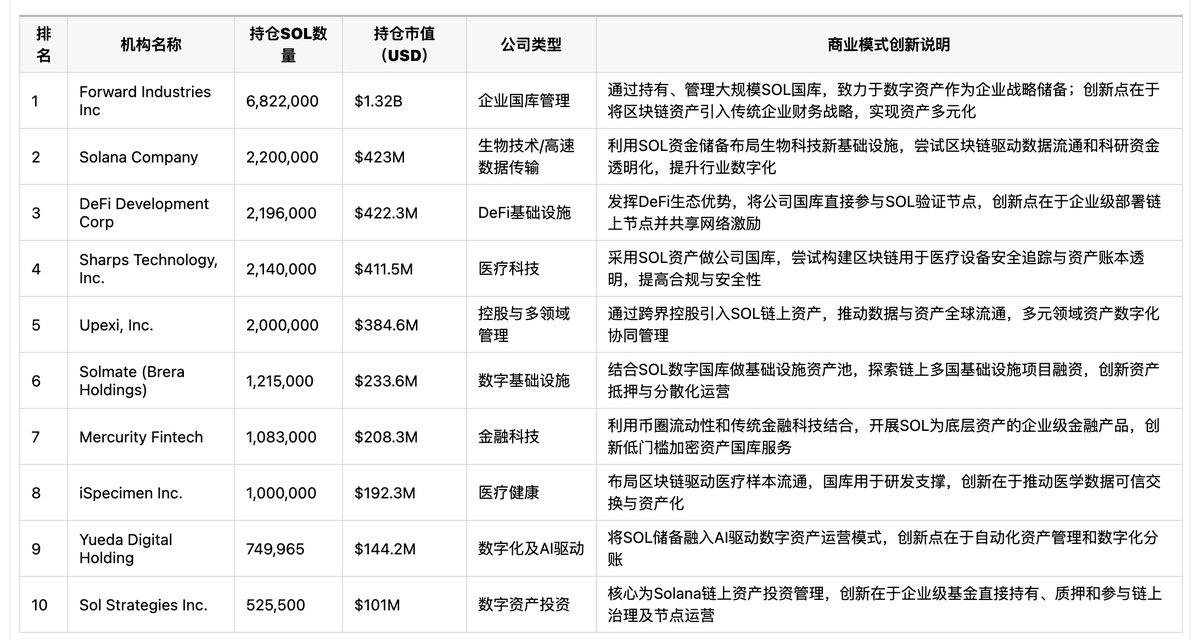

1. Digital Asset Treasury (DAT): Institutional Capital on Solana

Market Scale

- CoinGecko data: 19 public companies hold 15.4 million SOL (about $3 billion), 2.5% of circulating supply

- Committed investment exceeds $4.3 billion, including PIPE financing, ATM programs, and convertibles

- Annual growth over 100%; holdings may double by 2026

Top Company Performance

Here’s how leading DAT companies are performing.

Source: rwa.xyz

DAT Analysis

1. SOL offers higher real on-chain yields vs. BTC and ETH:

Multicoin Capital notes that SOL provides unique yields compared to BTC and ETH. On average, SOL stakers earn about 8% annualized—6.19% from inflation, 1.86% from real on-chain activity and MEV. These transaction- and MEV-driven cash flows make SOL highly attractive as a long-term capital and DAT base asset.

2. DAT companies achieve superior capital efficiency:

DeFi allows direct lending via blockchain and smart contracts, bypassing banks and other intermediaries, which dramatically reduces operating and matching costs.

By arbitraging yield spreads between traditional bank financing and DeFi lending, companies can profit from DeFi’s lower costs, higher transparency, and native digital financing. Unlike centralized, high-cost, tightly regulated banks, DeFi arbitrage offers high profit potential and diverse yield models through multiple counterparties.

2. Stablecoin Ecosystem: Core Payment Infrastructure

Explosive Supply Growth

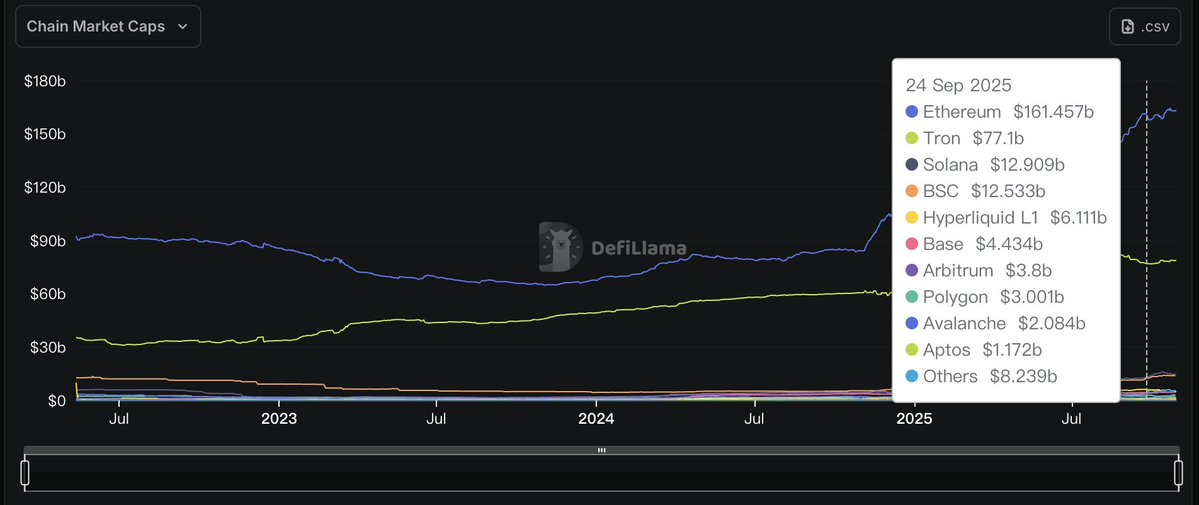

- Solana stablecoin supply rocketed from $5.2 billion at the end of 2024 to $16 billion

- 170% YoY growth, now third largest after Ethereum and Tron

- USDC dominates ($10.6 billion); USDT climbing fast ($4.5 billion). Early 2025’s stablecoin surge coincided with the launch of Donald Trump’s meme coin $TRUMP, sparking a wave of capital inflows. Trump meme coin’s viral spread united politics, finance, and entertainment, breaking traditional crypto boundaries and energizing Solana and the industry. Meanwhile, new U.S. laws such as the GENIUS Act brought compliance tailwinds, driving a spike in compliant stablecoin issuance and usage on Solana.

Source: https://defillama.com/

Source: https://defillama.com/

3. Payment Infrastructure: From Pilots to Full Production

Payment Infrastructure: From Pilots to Full Production

In 2025, Visa announced Solana’s integration into its stablecoin settlement platform, marking Solana’s move from experimental phase to mainstream financial production. This milestone places Solana alongside Ethereum, Stellar, and Avalanche, supporting real-time card settlement for major stablecoins like USDC and EURC.

Visa’s multi-chain, multi-currency architecture boosts Solana’s liquidity and payment efficiency, delivering faster, cheaper payments to banks, fintechs, and merchants.

Rapid Payment Scale Growth

Solana’s monthly on-chain stablecoin transactions now exceed $50 billion, with 3–4 million daily active users—an impressive base and capital flow.

Merchant adoption is surging: Over 6,000 merchants use Solana Pay for crypto payments, with transaction fees dropping to about 1%, driving widespread usage and real-world adoption.

Real-World Business Cases

- Mastercard and MoonPay linked 3.5 billion Mastercard cards to Solana wallets, enabling seamless credit card integration for daily digital asset use.

- E-commerce platform Helio partnered with Shopify for instant crypto checkout, eliminating chargeback risks and offering safer, more convenient payments for retailers and consumers.

- Western Union will launch the USDPT stablecoin on Solana in the first half of 2026, providing its 100 million customers with fast, cost-effective international remittances.

Here’s a quick comparison:

In summary, stablecoin settlement integration is driving Solana’s payment infrastructure from pilot to mass commercial deployment. Growing on-chain volumes and robust ecosystem partnerships cement Solana’s role as a next-generation global payment network.

4. Traditional Finance Integration: Bridging Trillion-Dollar Assets

R3 Corda Bridge: Deployed Solutions

On September 4, 2025 (UTC), R3 Labs launched, natively bridging $17 billion in RWA assets from Corda to Solana:

- Instant availability: Bonds, funds, and more trade 24/7 on Solana

- Trustless: Native cross-chain, no third-party custody

- Scale: Connects institutions like DTCC and Nasdaq

Enterprise Custody Solutions

- Helius: Manages 1.3 billion SOL staked, serving The Solana Company and other enterprises

- Anchorage Digital: Federally chartered SOL custody, integrated with Jupiter DEX for DeFi access anchorage

- BitGo: Added Solana support for institutional ETFs and corporate treasuries

5. ETF Developments

1. Global Solana ETF Regulatory Overview

In 2025, Solana spot ETFs entered mainstream global capital markets, becoming the first major Layer 1 after Bitcoin and Ethereum to offer both “spot + staking” innovation. Applications and launches in the US, Hong Kong, Canada, and Singapore are driving compliant institutional and retail participation in Solana’s financial evolution.

- US: SEC fast-tracked SOL ETF approvals. Leading firms like Bitwise (BSOL) and Grayscale (GSOL) offer spot and staking ETFs, letting investors hold SOL and automatically earn staking yields—annual returns baked into ETF NAV.

- Hong Kong: China Asset Management listed Asia’s first Solana spot ETF, holding only spot SOL (no staking), with low entry barriers and high compliance standards.

- Canada/Singapore: Multiple asset managers are exploring spot + staking funds, with financing and custody models aligning with North American trends.

2. Spot ETF vs. Staking ETF: Institutional Logic

- Spot ETF: Directly holds SOL, tradable on traditional brokerage accounts. Investors gain price exposure, ideal for those valuing liquidity and accessibility.

- Staking ETF: Fund stakes SOL on-chain, earning ~7% annual yield, automatically credited to ETF NAV. US/Canada markets lead in automated yield distribution, boosting product appeal and capital efficiency.

3. Investment Impact & Industry Significance

Solana ETFs are lowering the technical barrier to blockchain investing and promoting regulatory transparency. Staking ETFs demonstrate that digital assets can generate real cash flows and capital efficiency, serving as vital vehicles for DeFi, corporate treasuries, and RWA management. Solana ETFs are the bridge for traditional finance entering crypto.

Solana’s Financial Ecosystem: Summary

Solana is building a new, global financial infrastructure, closing the loop between traditional and digital assets through “capital entry” and “on-chain fund flows.”

ETF & DAT—Lower barriers for institutional and retail capital inflows. ETFs (exchange-traded funds) and DAT (digital asset treasury) open Solana’s ecosystem to fiat/capital, making SOL a compliant mainstream asset and enabling on-chain management for treasuries and listed companies. This drives billions in inflows.

Together, these mechanisms secure Solana’s institutionalized capital supply and global financial foundation.

On-chain stocks & RWA—Digitizing assets and reshaping capital markets. Corporate digital treasuries, RWA, and on-chain stocks enable issuance, custody, and trading of funds and bonds on Solana, bringing transparency and liquidity to asset management.

Major enterprises are driving real industry and blockchain finance integration, moving global capital from “on-chain management” to active on-chain use.

Stablecoins & Payments—Booming fund usage, vibrant on-chain economy. Stablecoins (USDC, USDT) are the backbone of Solana’s payment and circulation, with supply and transaction volume surging, streamlining merchant settlement, user transfers, and enterprise flows at scale and low cost.

Stablecoin payments are making Solana the backbone for global giants like Visa and Mastercard, processing billions daily—faster and cheaper than traditional finance.

In sum, Solana completes a closed financial ecosystem: “capital entry → on-chain circulation → expanded application,” attracting mainstream funding, enabling actual circulation, and driving deep enterprise and asset adoption. This marks the leap from base infrastructure to institutionalized application, making Solana a leader in financial digitization.

Solana’s Eastern Momentum

I. Compliance ETF Innovation: China Asset Management ETF & Solana in the East

1. Hong Kong Launches First Solana Spot ETF

On October 27, 2025 (UTC), China Asset Management (Hong Kong) launched the first Solana spot ETF on the HKEX, making Asia’s capital markets the first to connect with the Solana ecosystem. Unlike US/Canada’s “spot + staking” model, Hong Kong’s ETF holds native SOL only—no staking rewards—reflecting a strict compliance and custody regime. Multi-currency settlement (HKD, USD, RMB) lowers the entry barrier for Eastern investors.

2. Korea, Singapore & Other Eastern ETF Updates

Korea and Southeast Asia have not yet approved Solana spot ETFs, but institutional interest is high. Singapore and Australia have seen attempts at SOL derivatives and fund products, with some Singaporean public funds seeking compliance channels aligned with North America. Korea’s Upbit exchange allows Solana asset on-chain circulation, driving compliance innovation.

3. Compliance & Staking Innovation Breakthroughs

Most Asian ETFs are pure spot products, without staking rewards, due to regulators’ strict custody standards. As security solutions mature and regulation eases, staking ETFs may soon launch in Asia, making “hold SOL + earn yield” mainstream and connecting the region to the global on-chain economy.

II. Enterprise Applications: Solana Partnerships with Local Leaders

1. CMB International & On-chain RWA Innovation

In August 2025 (UTC), CMB International partnered with DigiFT, OnChain Singapore, and Hong Kong-Singapore public funds to launch USD money market funds as RWA assets, using Solana’s multi-chain ecosystem for custody and distribution. This enables “on-chain subscriptions” and strengthens links between financial institutions and blockchain infrastructure, boosting RWA digitization and expanding compliant asset custody.

2. Huawei Cloud and Solana

Huawei Cloud is actively building Web3 infrastructure and enterprise multi-chain services. Solana’s high performance and vibrant developer community have strong appeal in Asia-Pacific and enterprise applications. By meeting cloud providers’ needs for high-frequency trading, data storage, and node hosting, Huawei Cloud can deliver stable, compliant, efficient support for Solana projects and enable direct integration of on-chain data with enterprise cloud systems.

At Token2049 this year, @ Solana_zh appeared alongside Huawei.

III. Asia-Pacific Power: Solana’s Ecosystem in Japan, Korea, Southeast Asia

1. Korea & Japan Ecosystem Activation

Korea’s pro-blockchain stance spurs Solana’s rapid ecosystem growth; exchanges like Upbit support Solana asset on-chain circulation. Korean companies are exploring Solana DePIN for data, IoT payments, and Web3. Japanese firms invest in Solana NFT and DeFi, fueling innovation and local partnerships.

2. Southeast Asia’s Web3 Hotspot

Vietnam, Thailand, and Singapore are now Solana’s biggest Asia-Pacific user bases and innovation hubs. The annual APAC Solana Summit draws thousands of builders, driving new projects in stablecoins, cross-chain RWA protocols, and on-chain data custody. Solana’s high TPS, low latency, and low costs perfectly suit Southeast Asian mobile and cross-border finance needs.

3. DePIN & Hardware Industry Collaboration

Asia-Pacific manufacturing dominates Solana DePIN hardware, with China, Vietnam, and Malaysia supplying mining and mobile nodes for distributed computing. The region’s vast population and mobile internet penetration accelerate Solana’s real-world applications in payments, gaming, media, and digital identity.

4. Community-Driven Innovation

East and Southeast Asia’s large, digitally native user bases and vibrant communities make Solana one of Web3’s most energetic public chains, driving global liquidity and innovation from the East and fostering collaboration between Eastern and Western capital, projects, and users.

Summary

Solana’s Eastern momentum leads the world in ETF compliance innovation and, through partnerships with local giants like CMB International and Huawei Cloud, extends blockchain’s reach to real industry, data custody, and finance. The thriving markets and communities in Japan, Korea, and Southeast Asia, plus hardware and user growth, are forging Solana’s new landscape in the East and creating a fresh model for integrating Web3, capital markets, and the real economy globally.

Conclusion

With Solana’s strategic leap in 2025 from Web3 infrastructure to global financial standard, the ecosystem is reshaping fintech, capital markets, and institutional innovation. Solana isn’t just improving financial service efficiency and models—it’s opening new doors for asset management, payments, investment, and compliance. Looking ahead, Solana is set to be the core platform and benchmark for global financial digital transformation.

Key areas to watch:

- Growth of DAT-based corporate treasuries and real economy integration

- Expansion of stablecoin and on-chain payment use cases, plus compliance

- Large-scale RWA digitization and cross-border custody

- Diversified ETF and financial product innovation, with more institutional capital

- Performance upgrades and native compliance tools driving traditional finance integration

By 2026, with US ETF approval, broader bank integration, and corporate treasury adoption, Solana could truly become “the Netflix of finance”—making programmable finance as simple, instant, and accessible as streaming video.

Statement:

- This article is reposted from [TechFlame_News], copyright belongs to the original author [@ zhouKelvinZzzz]. For concerns about reposting, please contact the Gate Learn team for prompt resolution per procedure.

- Disclaimer: The views and opinions expressed are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team and may not be copied, distributed, or plagiarized without referencing Gate as the source.

Related Articles

How To Claim The Jupiter Airdrop: A Step-By-Step Guide

Solana Staking Simplified: A Complete Guide to SOL Staking

Introduction to Raydium

Complete Guide to Buying Meme Coins on the Solana Blockchain

Solana, Sui, Aptos: Potential Ethereum Killers - A Review of their Performance in 2024