The Seer's Practical Notes

Preface

In today’s information-saturated world, we face an unprecedented form of visual deception. Much like the filtered beauty on Xiaohongshu that often turns out to be a landfill in reality, social media traffic no longer represents what is real, and reality itself often lacks the spotlight. When truth becomes scarce amid the haze of algorithms, how do we cut through the fog to make informed decisions?

Imagine a world where every international turning point or tech mogul feud could be quantified into real odds and openly traded. Would this make the world clearer—or even more chaotic? In a recent in-depth Day1Global discussion, guests revealed a harsh yet fascinating reality: prediction markets are far more than simple gambling tools—they fundamentally overturn the logic of how information is distributed and traded:

👉 Probability Tavern: Prediction Market Episode 1

👥 Guests: @chessxyz @ZixiStablestock @starzq @Rubywang

The following are five investment principles about truth distilled from this conversation.

Don’t Be Fooled by a 90% Win Rate—Odds Are the Heart of Asymmetric Opportunity

For most investors, chasing projects with an 80–90% win rate feels like a natural way to avoid risk. Yet for seasoned professionals, this is often the prime territory for “IQ tax” traps.

Prediction markets rarely follow a perfect normal distribution. Instead, they operate on power-law or long-tail dynamics. Many people rush to sweep up bets with a 90% win rate, convinced it’s a money-making strategy. But Zixi sounded a crucial warning: the real focus isn’t on win rates—it’s on the odds.

Those seemingly certain bets can be wiped out by a single black swan event—like a sudden geopolitical upheaval—erasing all your previous nine wins overnight. True professionals hunt for asymmetric opportunities: for example, Chess once saw Manchester City play away against an obscure Norwegian team in the Champions League, bought in at extremely low odds, and turned $100 into $700. This approach mirrors the logic of primary market VC investing: pursue high-odds opportunities, not marginal spreads.

The Power of Binary Options: Prediction Markets as Asset Hedges

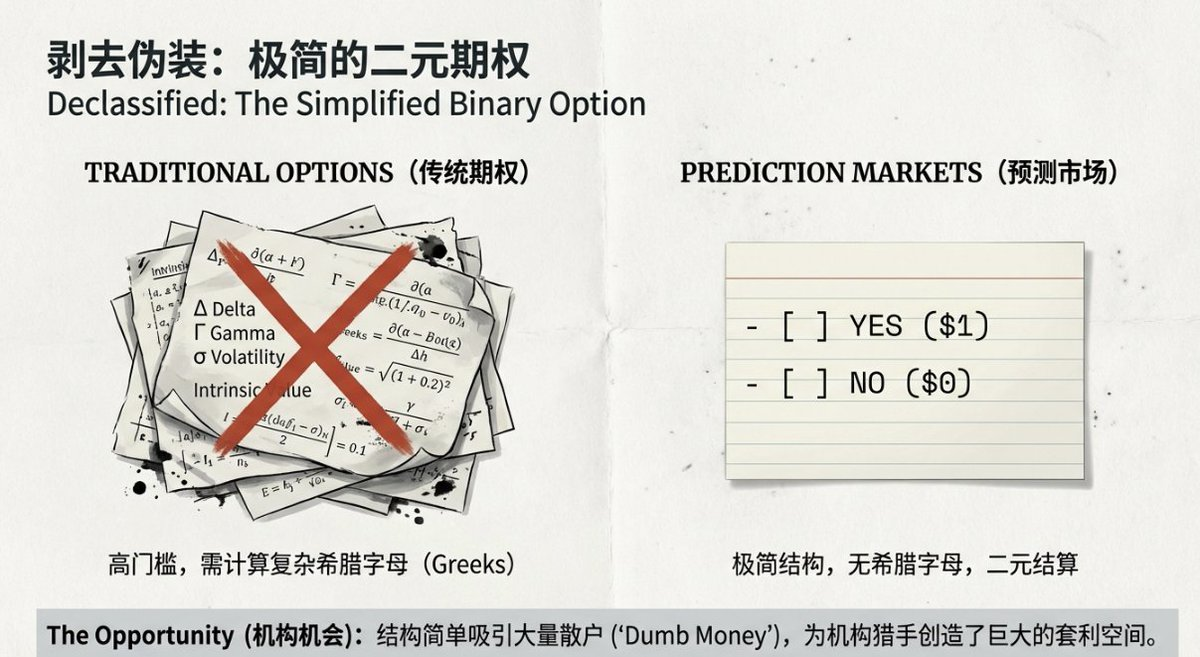

In practical finance, prediction markets essentially serve as a more intuitive and responsive form of binary options compared to traditional derivatives.

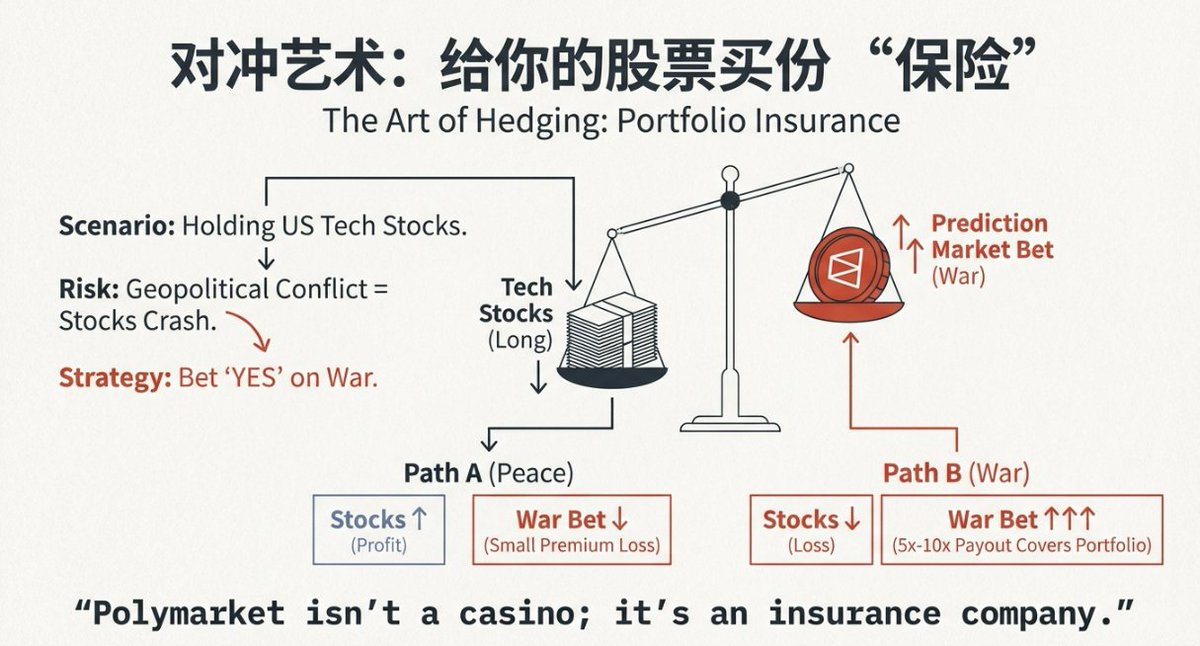

For investors holding large positions in US stocks or digital assets, geopolitical turmoil brings significant drawdown risk. Zixi shared a real case: during heightened tensions in Iran, he placed a $3,200 bet on whether the US would take action. This move wasn’t just about making money—it was a hedge:

- If conflict broke out: stock portfolio losses would be offset by doubled winnings in the prediction market, achieving breakeven.

- If nothing happened: the small amount wagered in the prediction market (the premium) would be lost, but the main assets in equities would continue to appreciate.

This win-win logic helps investors stay composed in turbulent markets. Unlike traditional options that require calculating implied volatility (Greeks), prediction markets reduce complex financial models to simple binary outcomes, dramatically lowering the barrier for everyday participants in risk management.

When Radar Becomes an Oracle: Physical Data Outpaces News Releases

The core competition in prediction markets is an arms race for information asymmetry. While the world refreshes social media and waits for official news, professionals search for the truth through physical evidence.

Zixi described how he profited from the Iran situation: experts ignored diplomatic statements and instead monitored FlightRadar24 in real time. When all commercial flights vanished over Iran, or an unusual Russian military plane flew directly from Israel to Russia, the truth became clear.

Exit signals are even more valuable: when Zixi saw commercial flights reappear over Iran, he recognized the conflict risk had eased, closed his position, and ultimately turned a $3,200 bet into $8,000 (netting $4,875 in profit), for a 150–250% return. In prediction markets, physical data—satellite imagery, flight paths, weather—may serve as the true oracle, since it can’t be faked.

The JJ Lin App and the Cost of Belief: More than Gambling—An Emotional Outlet

Why have prediction markets become a cultural phenomenon? Because they provide adults with a social outlet and a way to affirm their beliefs.

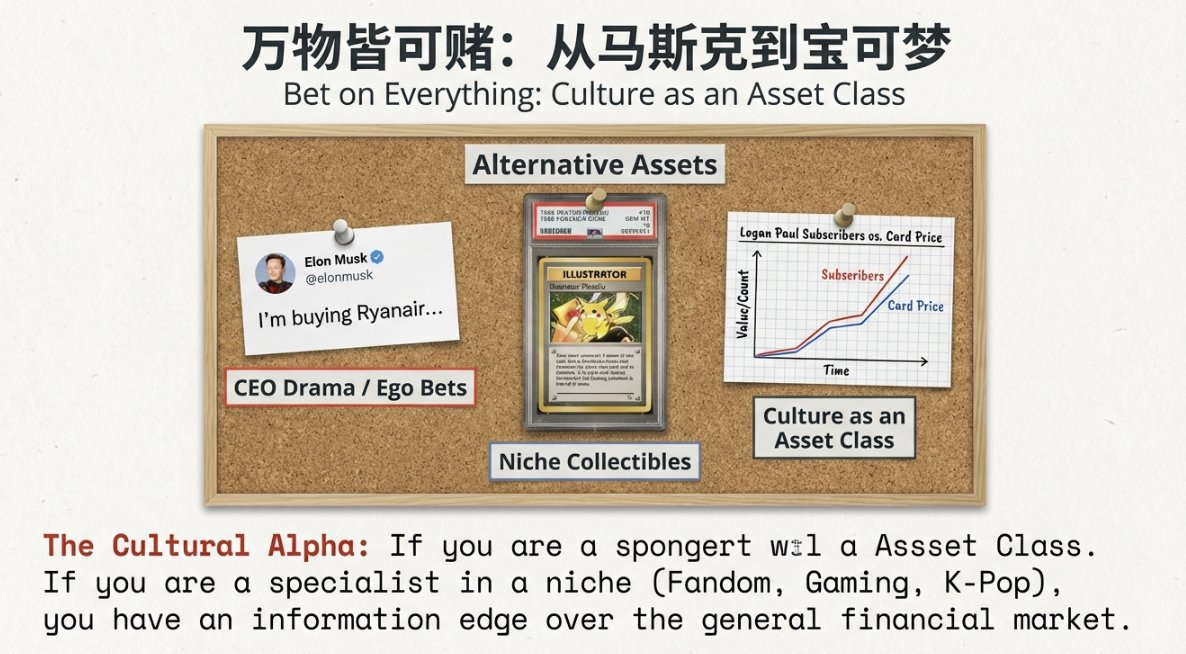

Star drew an interesting comparison: JJ Lin’s fan app “Neighbor Distance” charges a 300 RMB entry fee, proving people are willing to pay for belief and emotion. Prediction markets transform this motivation into a tool for information discovery.

Whether it’s Taylor Swift’s chart rankings, Elon Musk’s rumored Ryanair acquisition, or the outcome of the Oscars, prediction markets offer a low-cost way to participate in major narratives or entertainment gossip. They let fans back their opinions with real money. If you win, your judgment is validated; if you lose, it’s an inexpensive emotional release. This healthy outlet is becoming a new social currency for people under modern pressures.

Beware the Definition Black Hole: Don’t Chase the Tail at 99% Win Rates

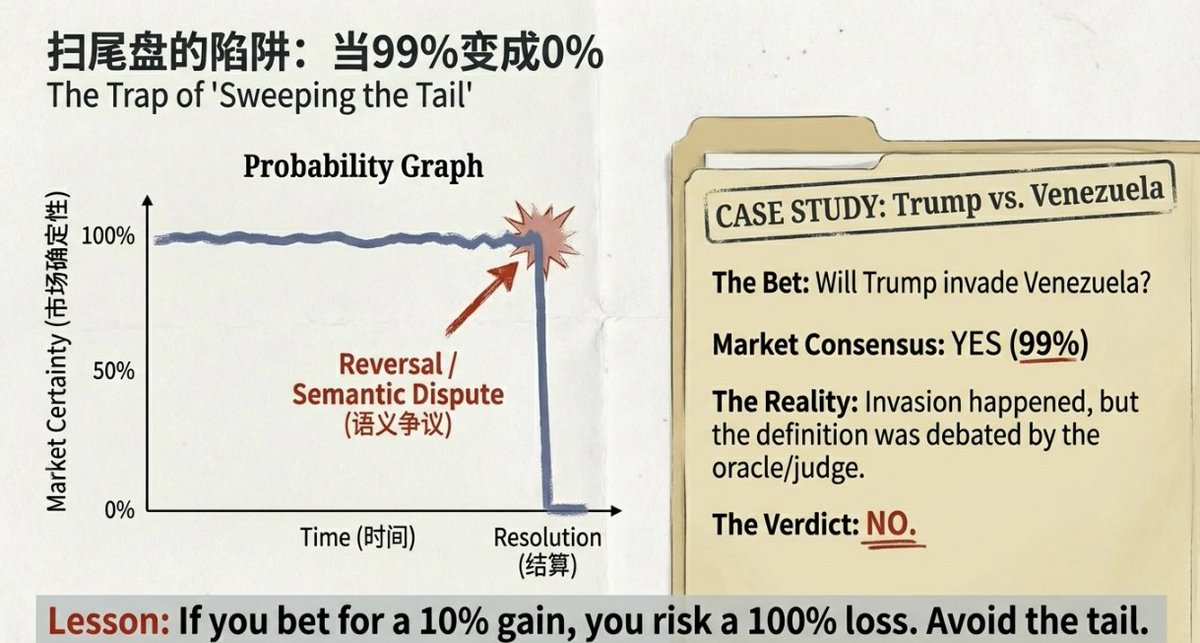

In prediction markets, your most hidden risk isn’t a logical misstep—it’s the risk of definition, or the “Power of Definition.”

Professional institutions are already involved. Global options giant SIG (Susquehanna International Group) is now deeply active on platforms like Polymarket. These well-equipped players even buy high-resolution satellite imagery to monitor oil production and dominate order books.

Even more dangerous is the subjectivity of outcome determination. Zixi cited an example from the Trump era: in a market on whether the US would invade Venezuela, even if the military moved, if the adjudicator defined it as a “special military operation” instead of an invasion, a 99% sure bet could instantly become worthless. Remember: the house not only wins—they define what “winning” means. Never blindly buy in at the end of an event; you never know how that final 1% of subjectivity could wipe out your position.

The World Will Ultimately Become One Big Prediction Game

Prediction markets are transforming how we interact with reality. They require every participant to move from idle opinions to staking real capital on their beliefs.

In traditional AMM (Automated Market Maker) models, we assume liquidity follows a normal distribution. In prediction markets, however, we must contend with long-tail extremes. If every opinion you express in the future requires a wager, would you still trust every news story you see?

In a world where probability and superstition coexist, prediction markets may be the only shortcut to truth—because they recognize that, compared to hype, money is a far better motivator for honesty.

Statement:

- This article is reprinted from [BruceBlue]. Copyright belongs to the original author [BruceBlue]. If you have any concerns about this reprint, please contact the Gate Learn team, and we will address it promptly according to our procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Do not copy, distribute, or plagiarize the translated article without referencing Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?