Why Does Bitcoin Keep Falling?

Bitcoin, which many expected to break above $100,000, has abruptly fallen back to the low $80,000s.

What’s even more frustrating for the crypto community is that, outside the digital asset space, other markets are thriving. Gold and silver have both hit new highs, with gold surpassing $5,000. The Russell 2000 Index has outperformed the S&P 500 for 11 consecutive days, and China’s STAR 50 Index posted a monthly gain of over 15%.

The so-called “ABC investment strategy” (Anything But Crypto) remains a reality. Why is every market except crypto rallying? And with the Trump administration back, why does the crypto market remain stuck in a persistent downturn?

From macro to micro, external to internal factors, the market appears to be brewing a much larger storm: the White House faces another potential shutdown, Japan continues monetary tightening, Trump’s policies add uncertainty, and within the crypto market, capital is fleeing while meme coins siphon off liquidity.

Three Major Macro Hurdles

Another Looming White House Shutdown

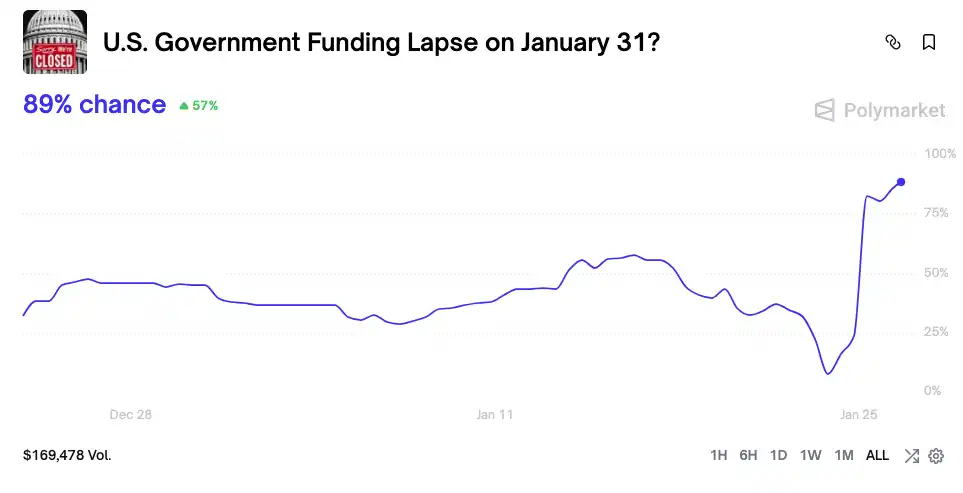

The US government is once again on the verge of a shutdown. After another fatal shooting by federal law enforcement in Minnesota, Senate Democrats collectively opposed a funding bill that included the Department of Homeland Security, sending Polymarket’s January 30 shutdown risk soaring to 80%.

A government shutdown means fiscal spending freezes, with hundreds of billions of dollars locked in the Treasury General Account (TGA) and unable to enter the market. The TGA essentially becomes a one-way financial black hole, draining liquidity from the system. In October 2025, over $200 billion was withdrawn from the market in just 20 days—comparable to several rounds of rate hikes.

As the TGA absorbs massive reserves from the banking system, funding costs spike. The crypto market, highly sensitive to liquidity, is always the first to feel the impact.

Looking back at the 43-day shutdown in October 2025, Bitcoin’s price action was dramatic:

• Early shutdown (October 1–10): Bitcoin hit a record high of $126,500 on October 6. The market widely believed the shutdown would highlight the value of decentralized currencies.

• Mid-shutdown (October 11–November 4): The shutdown lasted longer than expected, and during the policy vacuum when many thought the worst was over, the crypto market was hit by the “1011 liquidity black swan,” plunging to $102,000—a drop of more than 20% from the high.

• Late shutdown (November 5–12): Prices hovered around $110,000, with no immediate rebound as the shutdown neared its end.

Once burned, twice shy—the market now reacts to shutdown risks more swiftly and directly. Within 24 hours of the latest spike in shutdown risk, Bitcoin fell from $92,000 to below $88,000. The market seems to have learned its lesson, no longer viewing government shutdowns as bullish, but instead pricing them as a direct liquidity negative.

Japan’s Butterfly Effect

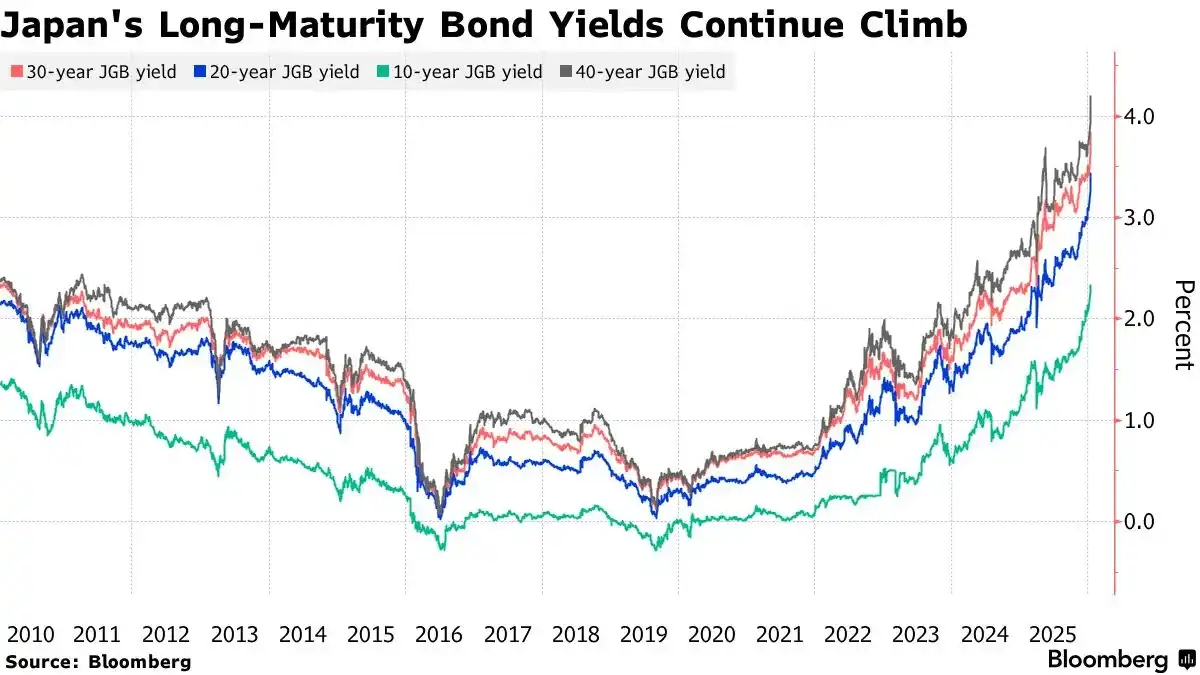

Another major shock comes from Tokyo. On January 19–20, 2026, Japan’s 10-year government bond yield surged to 2.33%, a 27-year high.

Expectations of Bank of Japan rate hikes and fiscal expansion pushed government bond yields to their highest level since 1999.

This marks a reversal in the yen carry trade. Previously, investors borrowed low-yielding yen to buy higher-yielding assets like US Treasuries and Bitcoin.

Now, the Bank of Japan has started raising rates (to 0.75% in December 2025), and new Prime Minister Sanae Takaichi has announced an end to fiscal austerity, pledging large-scale investment and tax cuts. This has triggered serious concerns about Japan’s fiscal health, leading to a sell-off in government bonds and a spike in yields.

More importantly, Japan’s economic fundamentals now support a prolonged period of higher rates. According to the Ministry of Internal Affairs and Communications, Japan’s unemployment rate held steady at 2.6% in November 2025, marking 59 consecutive months of full employment. The strong labor market gives the Bank of Japan confidence to continue hiking rates. This Friday (January 31), Japan will release December’s unemployment rate, and the market widely expects it to remain low, reinforcing expectations for further rate hikes.

Soaring JGB yields are pushing up global borrowing costs and further narrowing the yen carry trade spread. Carry traders are being forced to unwind positions, selling dollar assets and buying back yen, which is tightening global market liquidity—and this trend is likely to persist.

Risk-Off Before Key Data Releases

This Thursday at 3:00 a.m. (Beijing time), the US Federal Reserve FOMC will announce its rate decision, followed by a monetary policy press conference with Chair Jerome Powell. On Friday, Japan will release December’s unemployment rate, and the US will publish December PPI data.

During weeks of critical data releases, major investors usually enter a “quiet period,” reducing risk exposure and waiting for uncertainty to clear. This risk-off sentiment further intensifies selling pressure.

Historical data show that in the 5–7 days before FOMC decisions, Bitcoin often weakens, displaying a “pre-meeting dip” pattern. For example, ahead of the December 2025 FOMC meeting, Bitcoin fell from a $94,000 high to around $90,000. Similarly, before the October 2025 meeting, Bitcoin dropped from $116,000 to below $112,000.

This pattern reflects large institutional investors’ risk management strategies. Before Fed policy becomes clear, they tend to reduce exposure to risk assets to prepare for potential surprises.

Liquidity’s Seesaw

Without new macro liquidity, both global markets and the crypto sector are locked in a zero-sum battle for existing liquidity. The crypto market’s liquidity is being siphoned off by other asset classes, while major coins like BTC are losing liquidity to meme coins.

Bitcoin ETF vs. Gold ETF

While macro factors are a long-term concern, capital flows are an immediate risk.

The approval of spot Bitcoin ETFs in early 2025 was once seen as the bull market’s engine. However, since mid-January, ETF inflows have slowed sharply, with five consecutive days of net outflows totaling $1.7 billion.

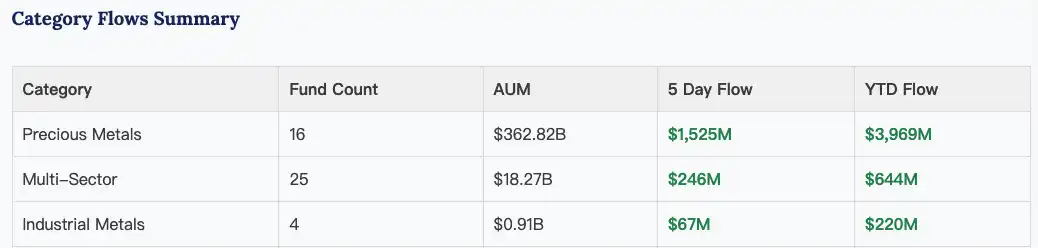

Meanwhile, gold and silver ETFs continue to attract capital. In 2025, gold ETFs saw their strongest inflows since 2020, with total holdings rising by more than 220 tons.

This trend has continued into 2026, with precious metals ETFs posting $4 billion in net inflows in just the first three weeks of January.

Precious metals ETFs have seen about $4 billion in total inflows since January | Source: ETF Action

This sharp contrast highlights a fundamental shift in market risk appetite. Amid growing macro uncertainty, capital is rotating out of high-risk Bitcoin and into traditional safe-haven assets like gold and silver.

Meme Coins Siphon Liquidity

Against a macro backdrop of tightening liquidity, the crypto market is split between extremes: Bitcoin continues to slide, while meme coins are surging.

One example is the Solana meme coin “Nietzschean Penguin” ($PENGUIN), which soared 100x in two days to a market cap of $170 million after the White House’s official X account posted an AI-generated image of Trump with a penguin.

This reflects deeply suppressed market sentiment.

When macro narratives break down, value investing loses appeal, ETF inflows slow, and the post-1011 crypto market loses its wealth effect, existing capital rushes into meme coins seeking short-term windfalls.

This is a “last hurrah” and “break-even” mentality: if value coins won’t rally, investors turn to speculative bets.

But these “chase-the-pump” and “break-even” emotions are easily exploited by orchestrators. “Nietzschean Penguin” was repeatedly amplified over two days by A16Z, Solana’s official account, the White House, and Elon Musk, showing clear signs of coordinated promotion.

The White House’s official X account posted three “penguin”-related tweets in two days

Looking back, every time the market heated up—$Trump, “Binance Life,” and other rapid pumps with strong backing—it was quickly followed by a major market crash. This kind of sentiment further drains liquidity from major coins, creating a vicious cycle.

Currently, crypto market liquidity is much weaker than in December 2024 and October 2025. So even with amplification from the White House and major X accounts, “Nietzschean Penguin’s” ceiling remains below $200 million.

Will the Storm Continue?

Although debate over Bitcoin’s “four-year cycle” is intensifying, since Bitcoin broke below $110,000 on October 11, 2025, the market appears to have entered a bear phase, with liquidity thinning over three months of consolidation.

This time, however, the situation is even more complex. Short-term market direction will depend on political maneuvering in Washington, Fed policy signals, and the earnings reports of tech giants.

In the longer term, the global economy appears increasingly anxious due to geopolitics and is stuck in a debt-liquidity-bubble cycle.

Meanwhile, Trump remains an unpredictable “wild card.”

On January 17, the Trump administration threatened to impose a 10% import tariff on eight European countries—Denmark, Norway, Sweden, France, Germany, and others—to force concessions on the Greenland issue. Although Trump dropped the tariff threat after meeting with the NATO Secretary General on January 21, “the art of the deal” remains fraught with uncertainty.

On January 24, Trump threatened to impose a 100% tariff on all Canadian exports to the US in order to block a trade deal with China.

No one can predict what “crazy” move he might make next to secure re-election in the midterms.

For investors, this may not be the time to chase rallies in other assets. In this “January siege,” patience and caution—waiting for the macro fog to clear—may be the only viable strategy.

Disclaimer:

- This article is republished from [BlockBeats]. Copyright belongs to the original author [EeeVee]. For any concerns regarding republication, please contact the Gate Learn team, who will address the issue promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Without explicit mention of Gate, do not copy, distribute, or plagiarize the translated article.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?