Peter Schiff and Michael Syler's feud escalates: Bitcoin's only strategy is labeled as a "fraud," with a public debate imminent.

On November 16, 2025, the famous gold advocate and economist Peter Schiff publicly criticized Michael Saylor's Strategy company for its Bitcoin-only strategy as a "fraud" and predicted that the company would "ultimately go bankrupt."

Schiff has issued a public debate challenge to Saylor, proposing a live showdown during the Dubai Blockchain Week in December. Meanwhile, Strategy's stock price has dropped nearly 30% this month, and the Bitcoin price has fallen below the critical support level of 95,000 dollars, raising ongoing concerns in the market about companies with high-leverage Bitcoin positions.

BTC-1.06%

MarketWhisper·Just Now

XRP News: XRP Whales Dump 200 Million Coins -Crash Incoming?

The sale of 200 million XRP by major holders raised concerns about the market's stability, prompting traders to reevaluate their positions. Current indicators show a mixed outlook, with uncertainty surrounding potential price movements of XRP.

XRP-0.57%

LiveBTCNews·1m ago

Shiba Inu Market Update: Key Metric Surges 137%, Price Potential Grows

Shibarium comeback: Total value locked jumped 137%, signaling growing adoption and network activity.

Exchange outflows: Tokens leaving exchanges suggest strong holding behavior and increased investor interest.

Technical outlook:

SHIB-2.31%

CryptoNewsLand·2m ago

U.S. stock futures and Bitcoin rebound in sync, with Nvidia's earnings report and Fed policy becoming the market focus.

According to Bloomberg, on November 17, 2025, U.S. stock index futures rose in tandem with Asian tech stocks, with S&P 500 futures up 0.4% and Nasdaq 100 futures climbing 0.6%. Investors are closely following the upcoming earnings report from Nvidia and U.S. economic data.

The sentiment in the cryptocurrency market has also improved, with Bitcoin rising by 2%, after previously erasing its gains for the year. Meanwhile, Japan's economy contracted for the first time in six quarters, and the tensions between China and the United States have put pressure on the Asian market. As the U.S. government ends the shutdown and key economic data is released, the market is reassessing the Federal Reserve's interest rate cut probability for December, which has now dropped below 50%.

MarketWhisper·2m ago

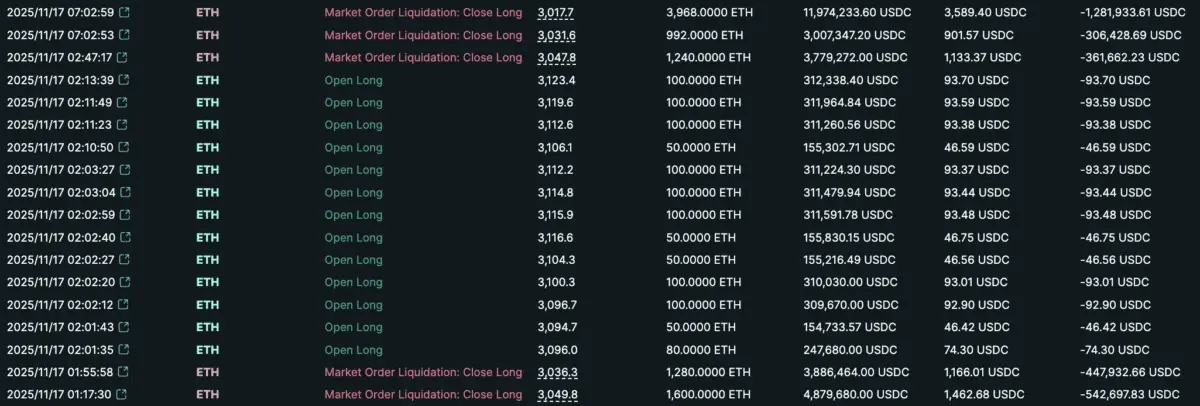

Brother Magi is not giving up! After a loss of 4.4 million, the liquidation price of the 7,700 ETH long order is revealed.

According to on-chain data, although Brother Ma Ji, Huang Li Cheng, stopped loss on some Ethereum long orders over the weekend, he was again subjected to forced liquidation during the fall on November 16. His account was liquidated a total of 9,080 ETH on the 17th, resulting in a loss of 2.94 million USD. Including the positions he actively cut loss beforehand, Brother Ma Ji has incurred a total loss of 3.578 million USD in this wave of Ethereum long order trading, with the total loss over the past week expanding to approximately 4.4 million USD.

ETH-0.85%

MarketWhisper·4m ago

How does Trump's Secretary of Commerce family earn 2.5 billion dollars a year by seizing encryption bonuses?

Written by: Todd Gillespie

Compiled by: Luffy, Foresight News

Cantor Fitzgerald LP's year-end expenditure list may include a special item this year.

"As soon as I left the office, I joked with someone that I would be happy to buy him a foldable bed because he has to come to work on Sunday and won't be able to leave until Friday," said Sage Kelly, 53, co-CEO of Cantor Fitzgerald, during an interview at the New York office.

This private boutique financial institution headquartered in New York is steadily climbing the ranks on Wall Street, seizing the opportunity presented by the cryptocurrency boom, and reviving its SPAC-driven trading business, experiencing its busiest and most successful year ever.

Currently, Cantor is

BTC-1.06%

DeepFlowTech·10m ago

Deconstructing the DeFi journey of JPYC and the institutional path of the joint stablecoin

Author: Kevin, Movemaker researcher; Source: X, @MovemakerCN

Introduction: The "bifurcation" pattern of Japanese stablecoins

Japan's stablecoin market is showing a "dual-track" or "bifurcated" development pattern. This pattern is not a coincidence of market evolution but rather the result of a "top-level design" shaped by Japan's unique regulatory framework, deep-seated industrial demands, and distinctly different technological implementation paths.

The first track is a bottom-up development path. Its typical representative is JPYC. This track operates within the "fence" of the law and mainly serves the global, permissionless DeFi ecosystem.

The second track is a top-down path dominated by traditional financial giants. Its core representatives are the three major Japanese banks (Mitsubishi UFJ, Sumitomo Mitsui, Mizuho) that recently announced they would jointly promote and rely on P.

DEFI6.44%

金色财经_·11m ago

The privacy sector is booming, a detailed explanation of a16z's consecutive lead investment in two rounds of the privacy Blockchain Seismic.

The recent rise in the price of Privacy Coins has attracted market attention. The privacy Blockchain project Seismic has completed a $10 million financing round, bringing its total financing to $17 million, primarily for technology research and development. Seismic is EVM-based and designed for fintech, using TEE technology to ensure data privacy, and has launched the native execution client Seismic Reth. The project team is experienced and has launched its first application, Brookwell, which aims to protect user privacy while connecting Decentralized Finance and TradFi.

PANews·11m ago

Can XRP Reach $100? Here’s What the Math Says

The article discusses the feasibility of XRP reaching $100, examining supply and market cap implications. Currently valued under $3, achieving a $100 price would require an unprecedented $6 trillion market cap.

XRP-0.57%

TheCryptoBasic·17m ago

PENGU Revisits Its First Entry Level and Builds a Base Near 0.013

PENGU drops into the same demand zone that produced the first 3X rally and traders now watch the reaction

The price forms a clean downtrend while the RSI makes a steady lower line that may soon break in sync

The structure shows clear compression at support and this setup often forms before a

CryptoNewsLand·40m ago

PENGU Sentiment Shifts: Bulls and Bears Battle for Control

PENGU faces key support amid weak momentum and bearish pressure, with traders awaiting signals for a potential trend shift. Current trading ranges and crucial levels suggest cautious sentiment and the possibility of sharp price swings.

PENGU-3.49%

CryptoNewsLand·51m ago

Starknet breaks out after surpassing the 7-month accumulation zone

Starknet (STRK) saw a significant 40% growth in 24 hours, despite a negative funding rate indicating short positions. Strong buyer demand in the spot market suggests a potential short squeeze. After seven months of accumulation, STRK may have broken out, with critical resistance turning into support. Future price targets are set at $0.279 and $0.293.

STRK-10.68%

TapChiBitcoin·54m ago

ETF crypto: Bitcoin and Ethereum are experiencing heavy withdrawals, while Solana is going against the trend and increasing capital.

Từ ngày 10 đến 14 tháng 11, các quỹ ETF tiền điện tử giao ngay của Mỹ đã trải qua những xu hướng trái ngược. Các quỹ ETF Bitcoin ghi nhận dòng vốn rút ra ròng 1,11 tỷ USD, đánh dấu tuần rút vốn thứ ba liên tiếp. Các quỹ ETF Ethereum cũng chịu áp lực, với $729 triệu USD bị rút ra. Ngược lại, các quỹ ETF Solana thu hút 46,34 triệu USD dòng vốn vào, cho thấy sự chuyển dịch trong khẩu vị thị trường sang các tài sản thay thế.

TapChiBitcoin·54m ago

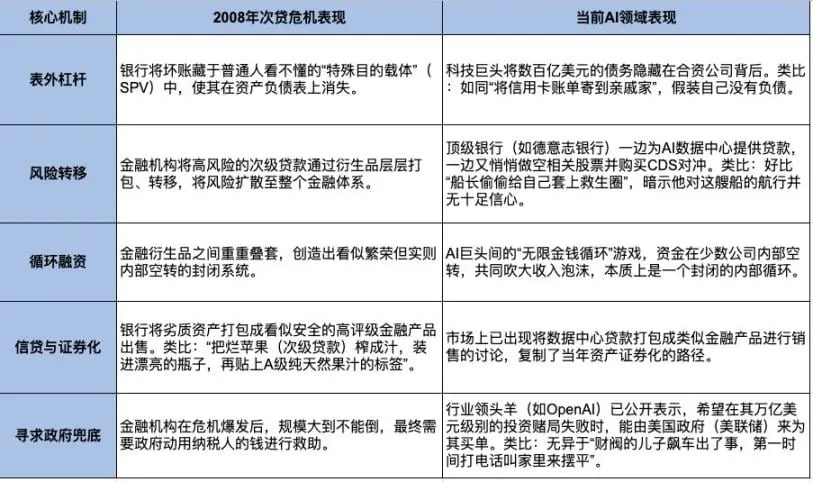

Is the AI bubble about to burst? How tech giants are replaying the 2008 subprime mortgage crisis

Author: Bruce

Introduction: The Hidden Shadows Under the AI Boom

We are in an exciting era, where the AI revolution is permeating every corner of life at an astonishing speed, promising a more efficient and intelligent future. However, recently, a concerning signal has emerged: the world's most watched AI company, OpenAI, publicly requested federal loan guarantees from the U.S. government to support its massive infrastructure expansion, which could cost over one trillion dollars. This is not just an astronomical figure, but a stark warning. If the financial blueprint supporting this AI boom has a striking resemblance to the structure of the 2008 financial crisis that nearly destroyed the global economy over a decade ago, how should we view this?

Despite the exciting prospects of the AI industry and the potential of technological revolution, recent market trends have revealed unsettling signals of financial pressure.

PANews·1h ago

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreDeFi Day Del Sur in Buenos Aires

Aave reports that the fourth edition of DeFi Day del Sur will be held in Buenos Aires on November 19th.

2025-11-18

DevConnect in Buenos Aires

COTI will participate in DevConnect in Buenos Aires on November 17th-22nd.

2025-11-21

Tokens Unlock

Hyperliquid will unlock 9,920,000 HYPE tokens on November 29th, constituting approximately 2.97% of the currently circulating supply.

2025-11-28

Abu Dhabi Meetup

Helium will host the Helium House networking event on December 10 in Abu Dhabi, positioned as a prelude to the Solana Breakpoint conference scheduled for December 11–13. The one-day gathering will focus on professional networking, idea exchange and community discussions within the Helium ecosystem.

2025-12-09

Hayabusa Upgrade

VeChain has unveiled plans for the Hayabusa upgrade, scheduled for December. This upgrade aims to significantly enhance both protocol performance and tokenomics, marking what the team calls the most utility-focused version of VeChain to date.

2025-12-27