13:55

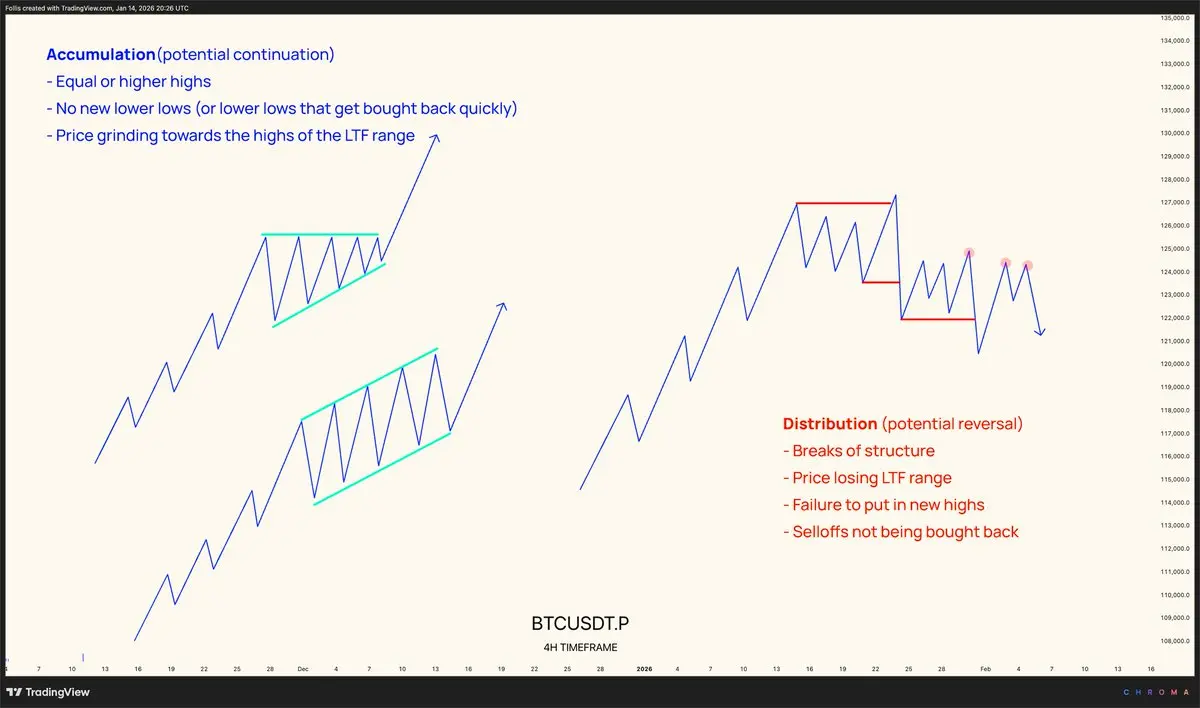

This market pattern is mostly profitable for those with a flexible mindset; those with rigid patterns and emotional overconfidence are usually losing money.

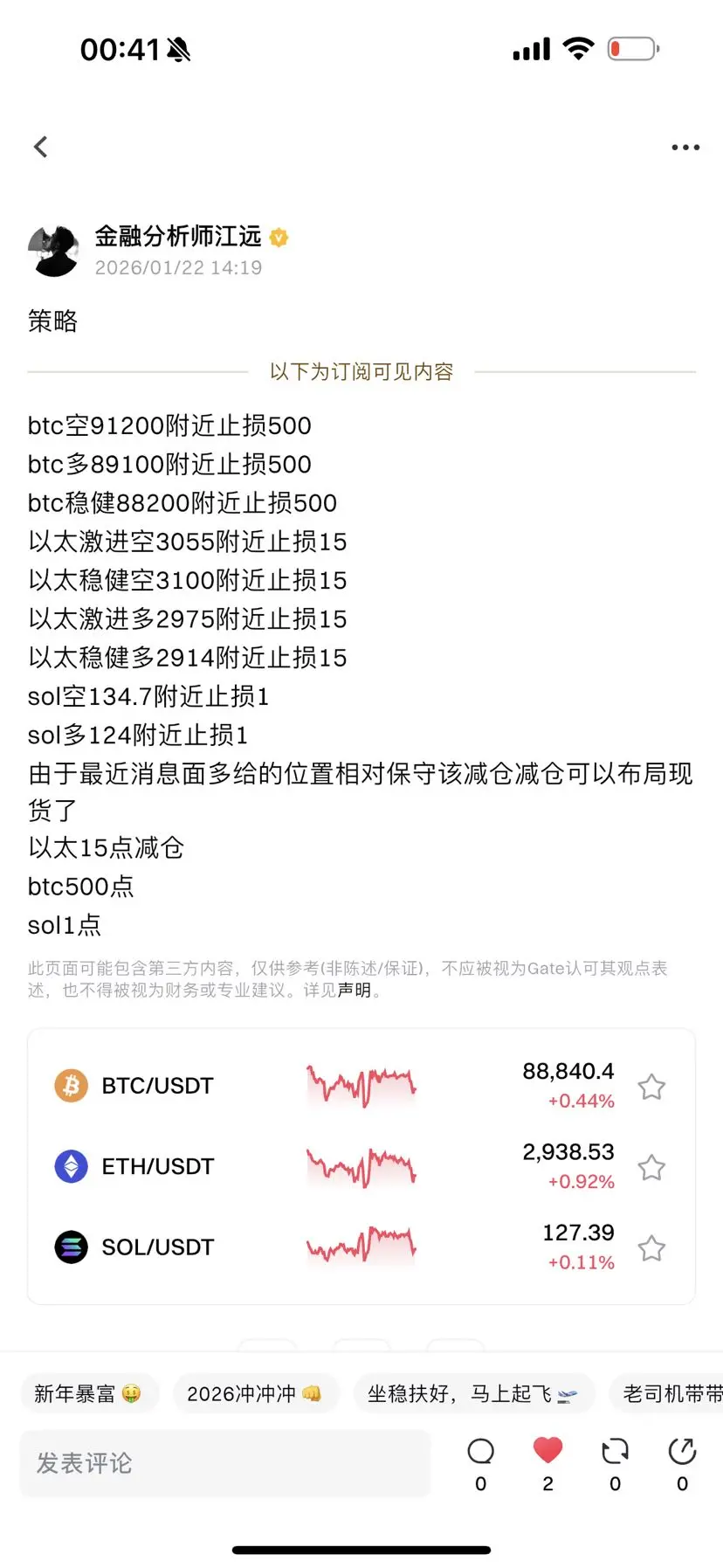

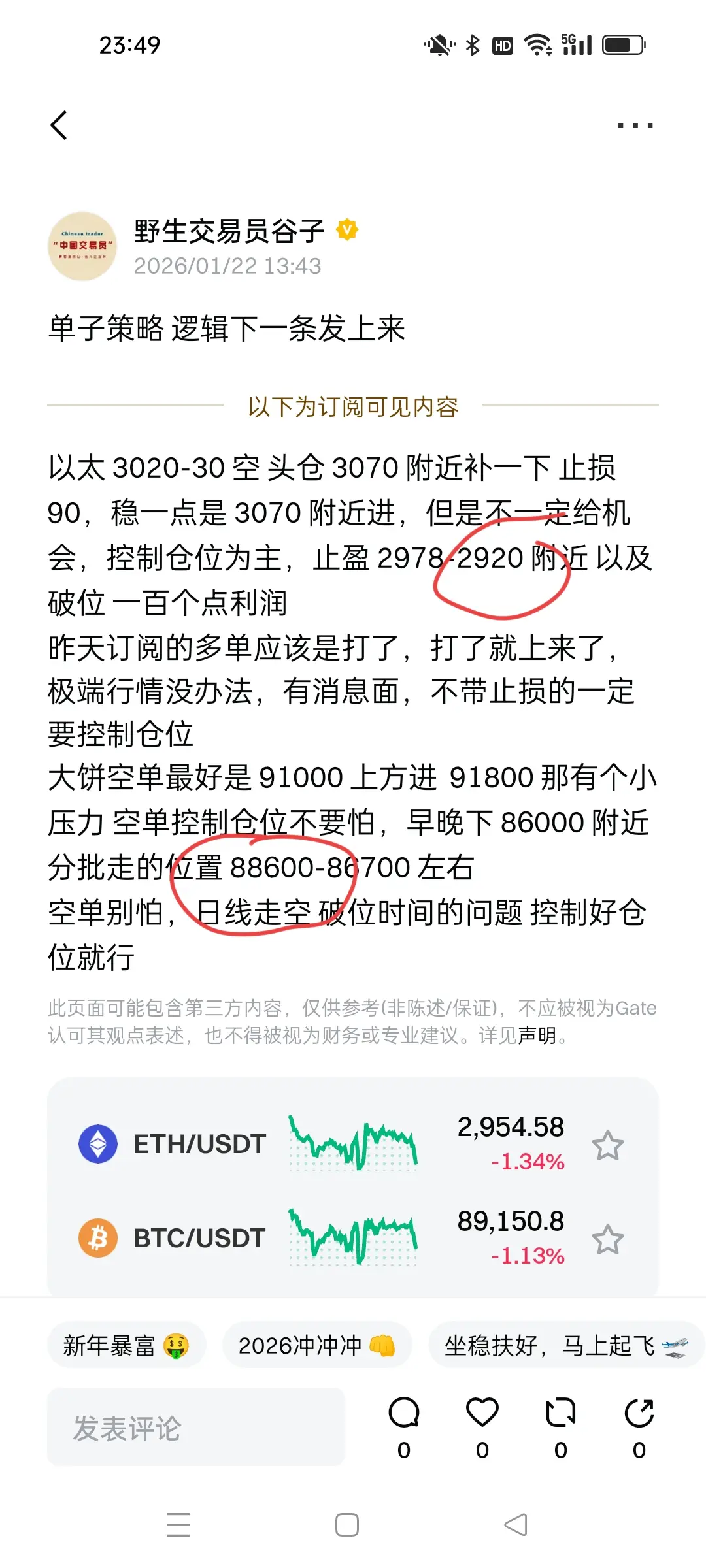

The current market also confirms what I said yesterday about Ethereum needing to reach around 3070. I gave a long strategy order, but it was stopped out. Yesterday was influenced by news factors, extreme market conditions, and a crash following the US session, which made the mood quite complicated. At the same time, I also placed a short order around 3070, with the first take profit at 2990. The highest reached was 3067.86. Trading requires flexibility.

The subscription orders generally have a high risk-reward ratio. The overall judgment and trend take time to develop. Short-term trades can only be executed in real-time during live sessions, and stop-losses are not large. Currently, the first target around 3070 has been reached, so the usual approach is to look for high-altitude short opportunities. As long as 3070 does not stabilize and break through, the subsequent trend will continue the daily-level bearish trend. Focus on short positions; control your position size and don’t be afraid. A breakdown below 2800 is inevitable; Bitcoin at 86,600 and below will also happen sooner or later.

If you're really worried about losing control, adjust leverage to 5X. Don’t add positions or set stop-losses; just hold. When the price comes back and hits your target, your position might be gone. Many people have experienced this—I've been there too. When holding large positions, you don’t cherish them; when holding small positions, trading feels exhausting.

The major trend is to watch for a breakout above 3070-80, which could push the price to around 3170. That is a critical short position, and stop-losses should also be short. Sometimes, controlling your position size means not sweating over a few points or insisting on perfect entries and exits—that can be deadly. This is a big directional judgment; real-time market conditions are the priority. When extreme conditions hit the expected levels, you must control your position size to enter. Otherwise, if it drops, you won’t dare to buy more; if it rises, you won’t dare to short. It’s truly risky. Position control is always the core because losses are limited, but gains can be substantial. Trading is a form of cultivation—human nature, psychological battles, desire, ambition, and pressure make every day feel like a trial. Whether ultra-short or mid-term, emotional control is crucial. Don’t panic over unrealized profits or losses. Stay calm with floating profits, but remember, it’s all real money, which shows we are still far from success.

This market pattern is mostly profitable for those with a flexible mindset; those with rigid patterns and emotional overconfidence are usually losing money.

The current market also confirms what I said yesterday about Ethereum needing to reach around 3070. I gave a long strategy order, but it was stopped out. Yesterday was influenced by news factors, extreme market conditions, and a crash following the US session, which made the mood quite complicated. At the same time, I also placed a short order around 3070, with the first take profit at 2990. The highest reached was 3067.86. Trading requires flexibility.

The subscription orders generally have a high risk-reward ratio. The overall judgment and trend take time to develop. Short-term trades can only be executed in real-time during live sessions, and stop-losses are not large. Currently, the first target around 3070 has been reached, so the usual approach is to look for high-altitude short opportunities. As long as 3070 does not stabilize and break through, the subsequent trend will continue the daily-level bearish trend. Focus on short positions; control your position size and don’t be afraid. A breakdown below 2800 is inevitable; Bitcoin at 86,600 and below will also happen sooner or later.

If you're really worried about losing control, adjust leverage to 5X. Don’t add positions or set stop-losses; just hold. When the price comes back and hits your target, your position might be gone. Many people have experienced this—I've been there too. When holding large positions, you don’t cherish them; when holding small positions, trading feels exhausting.

The major trend is to watch for a breakout above 3070-80, which could push the price to around 3170. That is a critical short position, and stop-losses should also be short. Sometimes, controlling your position size means not sweating over a few points or insisting on perfect entries and exits—that can be deadly. This is a big directional judgment; real-time market conditions are the priority. When extreme conditions hit the expected levels, you must control your position size to enter. Otherwise, if it drops, you won’t dare to buy more; if it rises, you won’t dare to short. It’s truly risky. Position control is always the core because losses are limited, but gains can be substantial. Trading is a form of cultivation—human nature, psychological battles, desire, ambition, and pressure make every day feel like a trial. Whether ultra-short or mid-term, emotional control is crucial. Don’t panic over unrealized profits or losses. Stay calm with floating profits, but remember, it’s all real money, which shows we are still far from success.