币莹莹C

I will wait for you at the highest place on the entire site...

币莹莹C

01:45 AM on Saturday, September 6, 2025

Bitcoin's posture remains smooth, with another bearish candle on the hourly chart overshadowing two small bullish candles, indicating a possible further investigation. Currently, we are in the weekend phase, and as always, a low long position is being initiated.

Big Pie: Connect at the range of 10.91-10.96

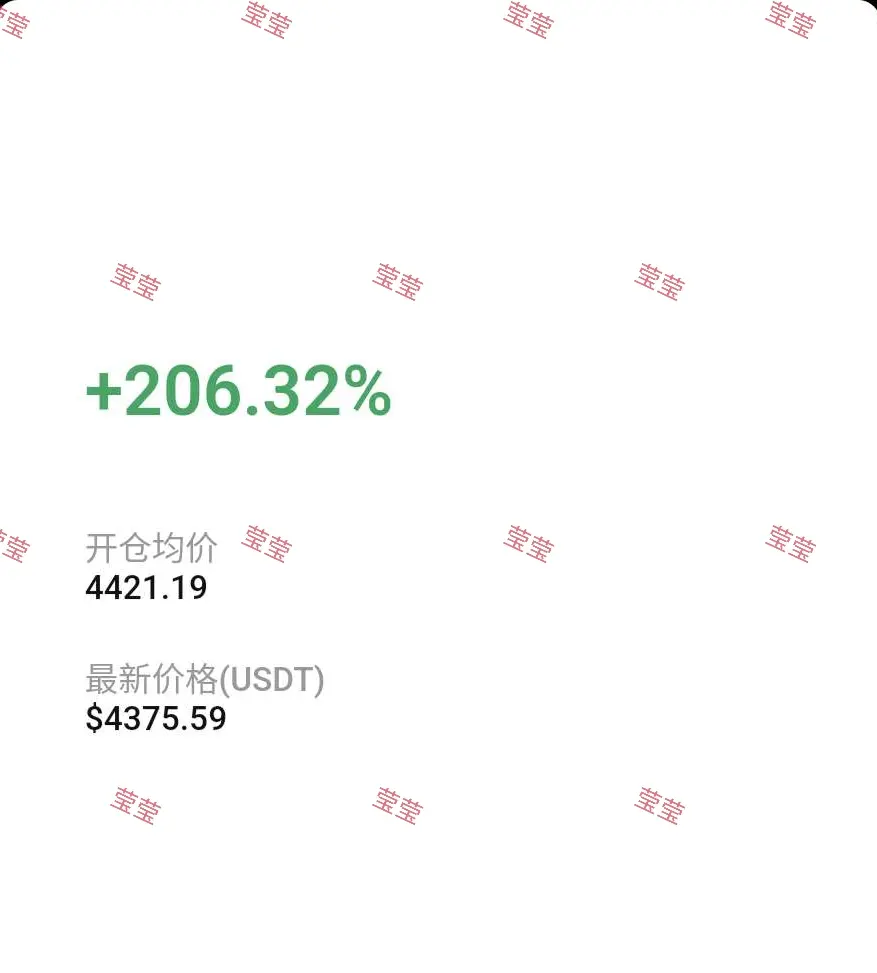

Posture: 4210-4240 area connects to #BTC#

Bitcoin's posture remains smooth, with another bearish candle on the hourly chart overshadowing two small bullish candles, indicating a possible further investigation. Currently, we are in the weekend phase, and as always, a low long position is being initiated.

Big Pie: Connect at the range of 10.91-10.96

Posture: 4210-4240 area connects to #BTC#

BTC0.3%

- Reward

- like

- 2

- Repost

- Share

TigerLord :

:

Quick, enter a position! 🚗View More

Great Kong Jun, Black Friday, we will achieve great results again...

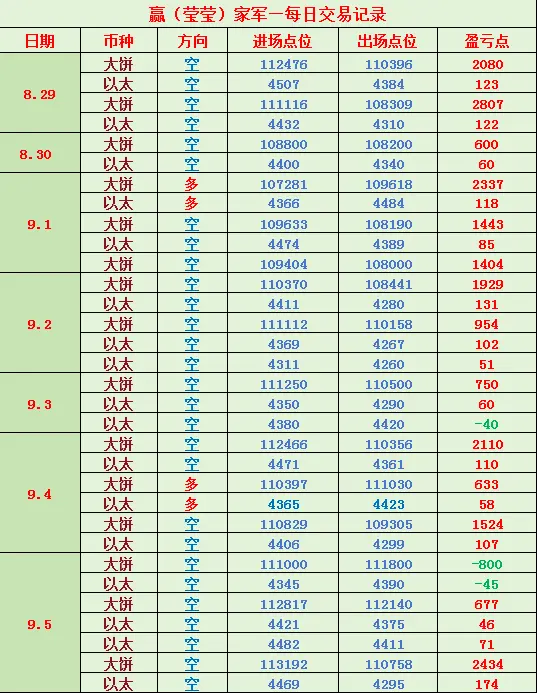

Looking at the patterns is a belief, doing the patterns is the purpose, and being able to hold onto them is called having a vision.

Looking at this week's performance, it's all about the same pattern, only giving two small wins, with two orders from the young shoots, overall quite impressive, congratulations...

The most impressive data trends this week were on Thursday and Friday, where the grasp was quite accurate, basically top-notch, just enjoying to the fullest.

Golden September and Silver October, plenty of oppor

Looking at the patterns is a belief, doing the patterns is the purpose, and being able to hold onto them is called having a vision.

Looking at this week's performance, it's all about the same pattern, only giving two small wins, with two orders from the young shoots, overall quite impressive, congratulations...

The most impressive data trends this week were on Thursday and Friday, where the grasp was quite accurate, basically top-notch, just enjoying to the fullest.

Golden September and Silver October, plenty of oppor

BTC0.3%

- Reward

- 1

- 2

- Repost

- Share

GateUser-df23889b :

:

Is there a prediction order?View More

The non-farm shooting star and inverted hammer have settled, next we look at the US stock index guidance, there are many opportunities, don't be afraid...

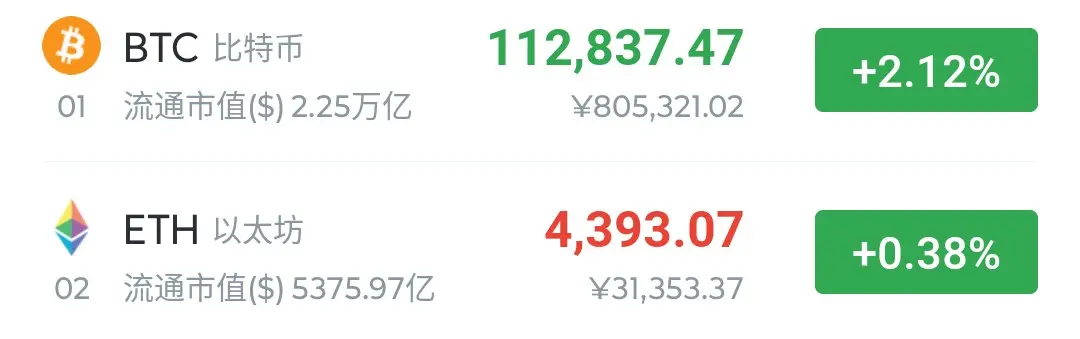

Bitcoin is around 113,200; cautious investors can continue to wait until above 113,500.

The demeanor can wait until it goes above 4500 to continue.

Bitcoin is around 113,200; cautious investors can continue to wait until above 113,500.

The demeanor can wait until it goes above 4500 to continue.

BTC0.3%

- Reward

- 3

- 8

- Repost

- Share

GateUser-7bb86fb5 :

:

Hold on tight, we're about to To da moon 🛫View More

On Friday, September 5th, the big non-farm payroll report is coming. Will Bitcoin continue to face pressure at the 113,000 level or will it break through?

First of all, the small non-farm and initial jobless claims data are positive, but the data is not significantly different, while the market is declining.

Secondly, from a technical perspective, Bitcoin and Ethereum are once again facing resistance at the 11.3 and 4500 levels.

Third, the probability of the Federal Reserve cutting interest rates in September reaches 99.4%.

Overall, it's a mixed bag of joy and sorrow; now we just have to w

View OriginalFirst of all, the small non-farm and initial jobless claims data are positive, but the data is not significantly different, while the market is declining.

Secondly, from a technical perspective, Bitcoin and Ethereum are once again facing resistance at the 11.3 and 4500 levels.

Third, the probability of the Federal Reserve cutting interest rates in September reaches 99.4%.

Overall, it's a mixed bag of joy and sorrow; now we just have to w

- Reward

- 1

- 2

- Repost

- Share

QiangshengTradingCompany :

:

Charge!View More

Reverse pump, must consolidate at resistance level, overall Bitcoin is relatively strong, but the posture remains weak and lagging.

Bitcoin posture has currently secured a 650+/46 point space.

Sell all at low positions, and you can reduce holdings at high positions before the non-farm report goes out #BTC#

Bitcoin posture has currently secured a 650+/46 point space.

Sell all at low positions, and you can reduce holdings at high positions before the non-farm report goes out #BTC#

BTC0.3%

- Reward

- like

- Comment

- Repost

- Share

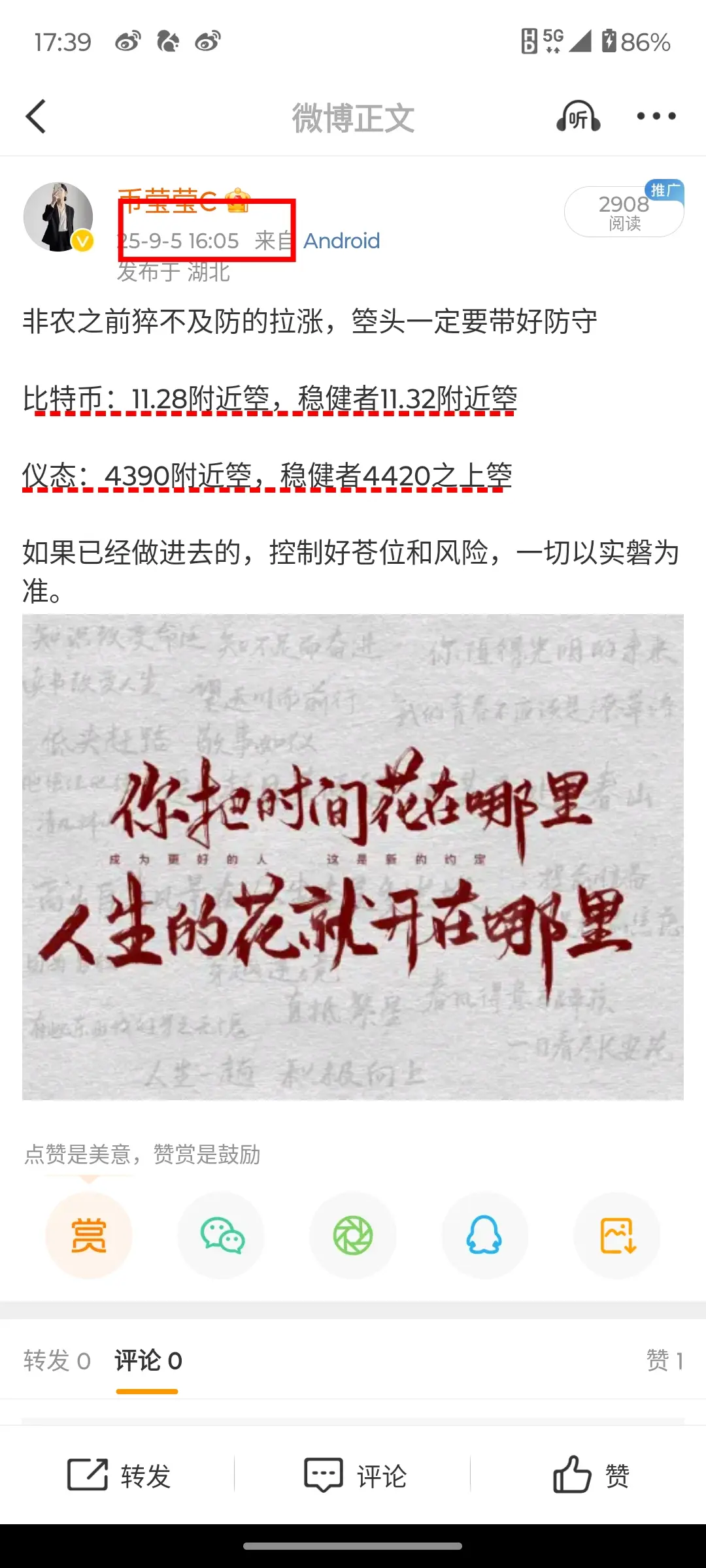

The sudden pump before the non-farm payrolls, make sure to have good defense with the cone head.

Bitcoin: around 11.28箜, for the cautious around 11.32箜

Attitude: Around 4390, a rise, for the steady above 4420.

If you have already invested, control the position and risk, and take everything based on the actual situation. #BTC#

Bitcoin: around 11.28箜, for the cautious around 11.32箜

Attitude: Around 4390, a rise, for the steady above 4420.

If you have already invested, control the position and risk, and take everything based on the actual situation. #BTC#

BTC0.3%

- Reward

- 3

- 4

- Repost

- Share

GateUser-180398de :

:

How to add you on WeChat?View More

The reversal came too quickly, with multiple rounds of wash trading. This morning, the major coin's performance was relatively normal with some losses, and the current price around 11.28 is a good point to re-enter with a light position. Those who prefer a more cautious approach can wait until around 11.32...

The posture, 4345 Keng was originally making over 50 points without exiting, the current price is 4390, looking for opportunities to break even with an average price around 4367. Observers can short lightly around the current price of 4390, while those who are more cautious should wai

The posture, 4345 Keng was originally making over 50 points without exiting, the current price is 4390, looking for opportunities to break even with an average price around 4367. Observers can short lightly around the current price of 4390, while those who are more cautious should wai

BTC0.3%

- Reward

- like

- Comment

- Repost

- Share

September welcomes a key point - Non-Farm Payrolls

Time is money, and opportunity is like picking up money, but many friends are still deeply trapped in fire and water.

Although Bitcoin is currently consolidating at a low level this week, many friends are still holding long positions above 114,000/4,450. The frightening thing is that they are still resisting above 120,000/4,700.

At the same time, another portion still holds short positions below 10.8/4000. If it were you, how would you resolve it?

解套要趁早,那都是与时间/机会在奔跑,日内给出3个名额,优先解套...... #BTC#

Time is money, and opportunity is like picking up money, but many friends are still deeply trapped in fire and water.

Although Bitcoin is currently consolidating at a low level this week, many friends are still holding long positions above 114,000/4,450. The frightening thing is that they are still resisting above 120,000/4,700.

At the same time, another portion still holds short positions below 10.8/4000. If it were you, how would you resolve it?

解套要趁早,那都是与时间/机会在奔跑,日内给出3个名额,优先解套...... #BTC#

BTC0.3%

- Reward

- 2

- Comment

- Repost

- Share

It was said that there would be no rebound, only a second dip. Bitcoin continues to maintain a weak consolidation, with its posture continuing to fall and dip, and SOL is also testing the 200 mark.

Mainstream and altcoins collectively fall, our high position in the market is heading down, making it completely comfortable. From the current trend, the overall downward momentum has not stopped and may continue or directly break down, perhaps this is the anticipated market condition ahead of the major non-farm payroll report.

There may be a fall between 5-8 AM in the early session, and we can exit

View OriginalMainstream and altcoins collectively fall, our high position in the market is heading down, making it completely comfortable. From the current trend, the overall downward momentum has not stopped and may continue or directly break down, perhaps this is the anticipated market condition ahead of the major non-farm payroll report.

There may be a fall between 5-8 AM in the early session, and we can exit

- Reward

- 5

- 15

- Repost

- Share

GateUser-fed2d74e :

:

It has been fluctuating, I need to observe for a while.View More

News: The non-farm payroll, initial jobless claims data is Favourable Information, the US stock market has a slight rise but it is still difficult to boost the performance of Bitcoin, and institutional selling is making things worse.

Technical Analysis: The hourly chart has broken down, and the four-hour chart has further dropped below the BOLL middle line, indicating a continuous increase in bearish volume.

Dare to imagine, today is Thursday and it is also possible to anticipate the large non-farm payroll movement in advance—breaking down. Also, there is a 97% chance of a rate cut in Septembe

Technical Analysis: The hourly chart has broken down, and the four-hour chart has further dropped below the BOLL middle line, indicating a continuous increase in bearish volume.

Dare to imagine, today is Thursday and it is also possible to anticipate the large non-farm payroll movement in advance—breaking down. Also, there is a 97% chance of a rate cut in Septembe

BTC0.3%

- Reward

- 5

- 3

- Repost

- Share

SimpleGetRich :

:

News: Non-farm payroll, initial job data is favourable, and US stocks are slightly up, but it's hard to boost Bitcoin's rising momentum, and institutional dumping adds to the woes. Technical analysis: The hourly chart has broken down, and the four-hour chart has also fallen below the BOLL middle band, with short positions continuing to increase.

Daring to imagine, today is Thursday and it is possible to preemptively digest the big non-farm trend—breaking downwards. Also, there is a 97% chance of a rate cut in September, but it has not led to a substantial big pump; in the short term, it is under pressure to break down, buying the expectation and selling the facts...

BTC situation: 11.08/4406 short order can reduce position and hold...

In the early morning phase, the position near 10.85, in the 4220-4250 area, allows for fluctuations up and down... #BTC#

View More

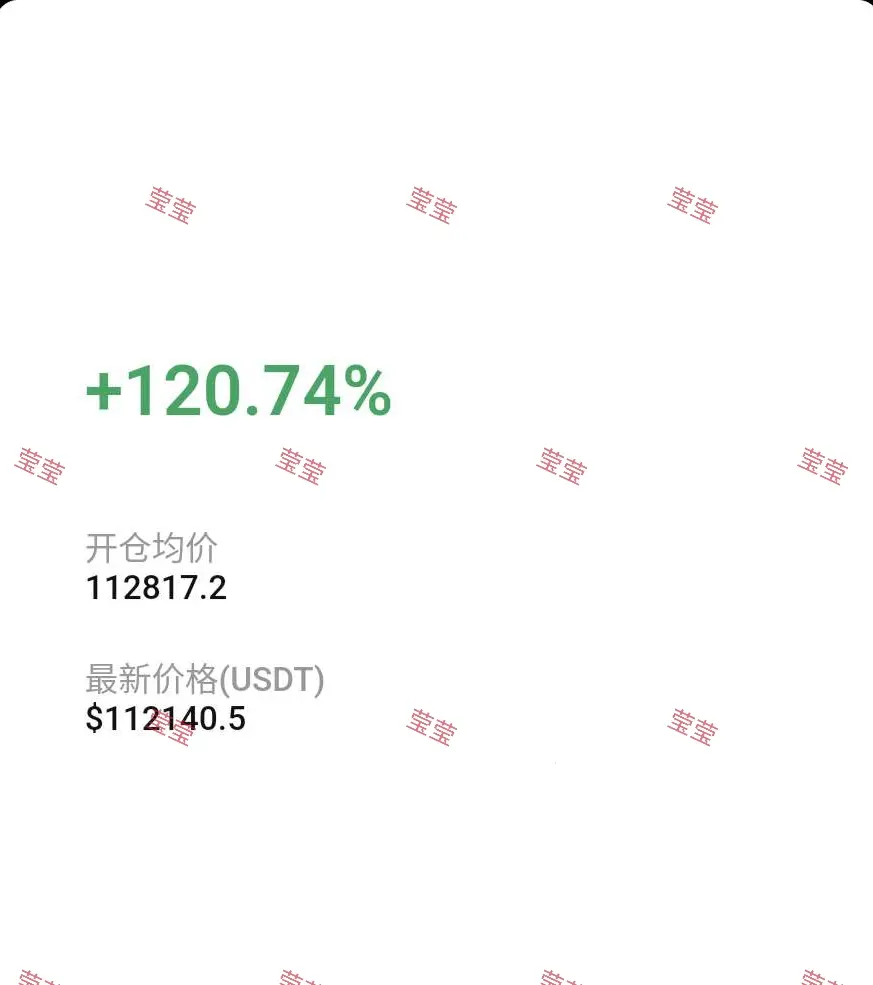

Carry on with the trend, Bitcoin's hourly chart shows three large bearish candles, and on the four-hour chart, it directly fell below the middle band of BOLL. As promised for the second test, here it comes...

The pancake posture stage has taken down 1500/107, 6000 oil, reducing the position held...

Be brave, be bold, the rebound continues to look for opportunities... #BTC#

The pancake posture stage has taken down 1500/107, 6000 oil, reducing the position held...

Be brave, be bold, the rebound continues to look for opportunities... #BTC#

BTC0.3%

- Reward

- like

- Comment

- Repost

- Share

The small non-farm payroll/initial jobless claims are both bullish, U.S. stocks opened slightly higher, and Bitcoin remains under pressure...

A wave of sharp decline in the morning came as expected, indicating that the selling pressure at resistance levels was severe. The rebound in Europe and the United States is weak, and the transition between strong and weak is still very weak.

Although the evening data is favorable, the difference is not significant, making it difficult to boost the current bearish trend, so the short-term trend is turning downward...

The key resistance level for Bitcoin

A wave of sharp decline in the morning came as expected, indicating that the selling pressure at resistance levels was severe. The rebound in Europe and the United States is weak, and the transition between strong and weak is still very weak.

Although the evening data is favorable, the difference is not significant, making it difficult to boost the current bearish trend, so the short-term trend is turning downward...

The key resistance level for Bitcoin

BTC0.3%

- Reward

- like

- 2

- Repost

- Share

GateUser-fa41e1db :

:

good vives are waiting View More

This week's appetizer - the small non-farm payroll and the initial clear sky, are you ready?

It is expected that the small non-farm payrolls will usher in a wave of market activity, with initial fluctuations not being very large.

Previous value of the ADP Nonfarm Employment Change: 104,000, forecast value: 65,000

If the announced value is greater than 65,000, it is a bearish signal. If it is greater than 104,000, it is a significant bearish signal. (Between 65,000 and 104,000, it means it will rise first and then fall.)

However, based on recent overall data, the probability of a利箜 remains

It is expected that the small non-farm payrolls will usher in a wave of market activity, with initial fluctuations not being very large.

Previous value of the ADP Nonfarm Employment Change: 104,000, forecast value: 65,000

If the announced value is greater than 65,000, it is a bearish signal. If it is greater than 104,000, it is a significant bearish signal. (Between 65,000 and 104,000, it means it will rise first and then fall.)

However, based on recent overall data, the probability of a利箜 remains

BTC0.3%

- Reward

- 6

- 7

- Repost

- Share

Elegant :

:

Just charge forward!💪 Just charge forward!💪 Just charge forward!💪 Just charge forward!💪View More