#BTC and

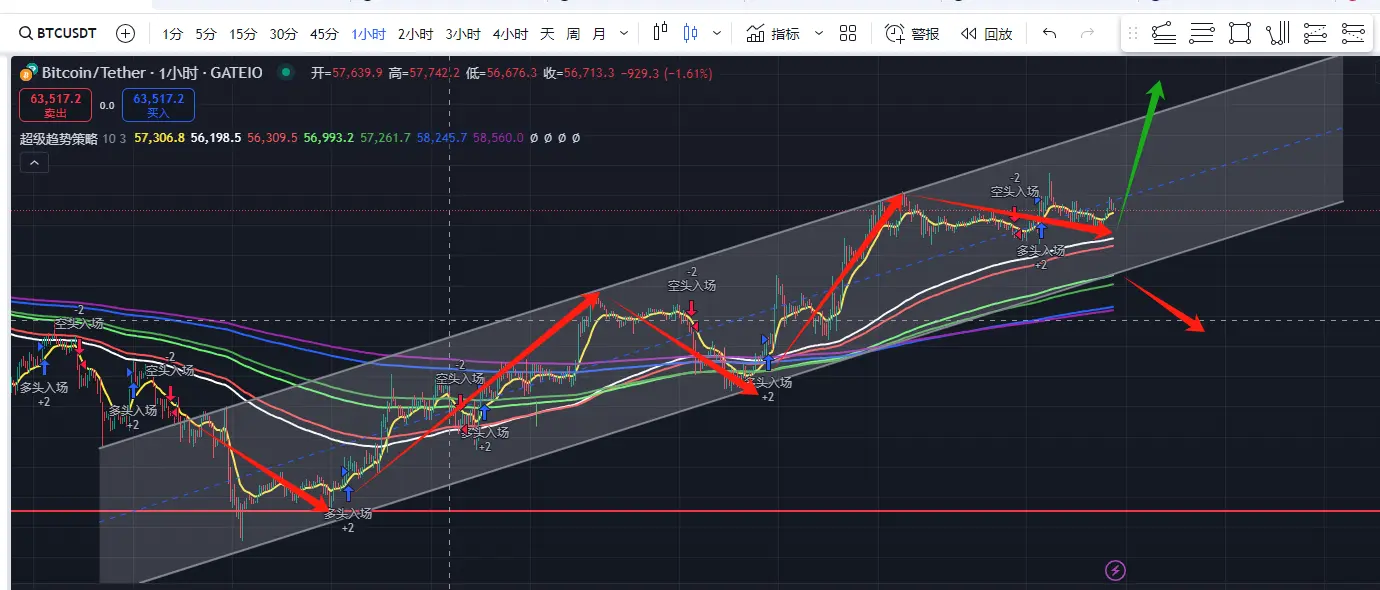

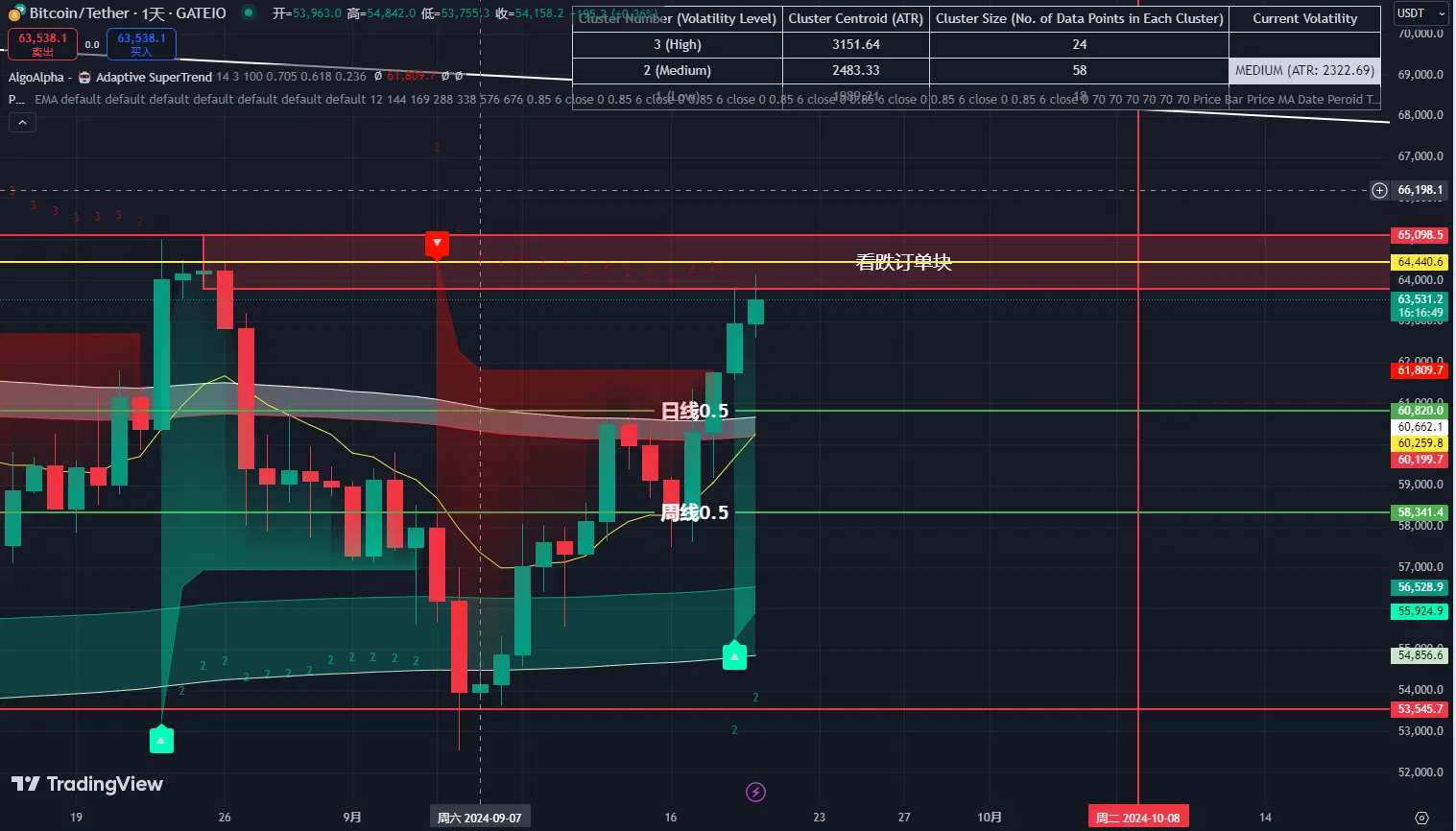

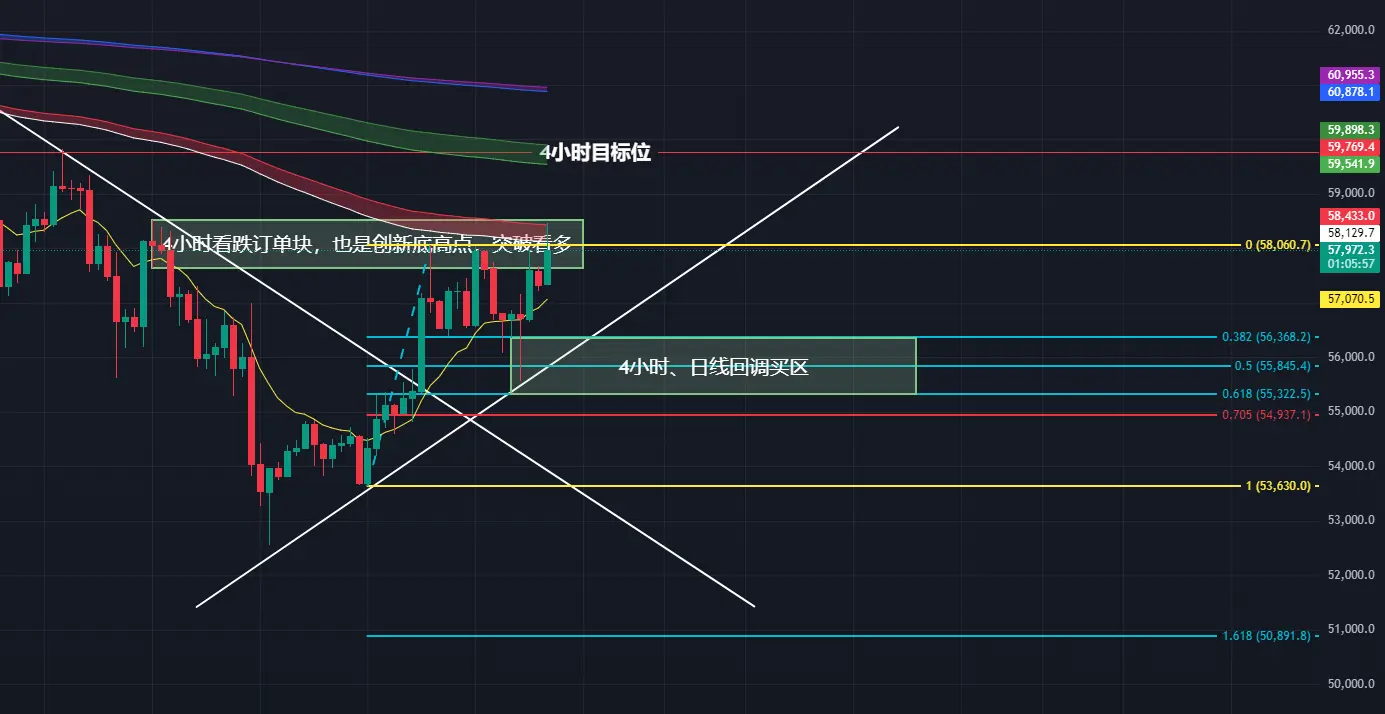

#ETH take a look at the previous strategy for supplementary updates. Recently, the strategy points are based on the new supplementary strategy chart.

What you need to do is think about it:

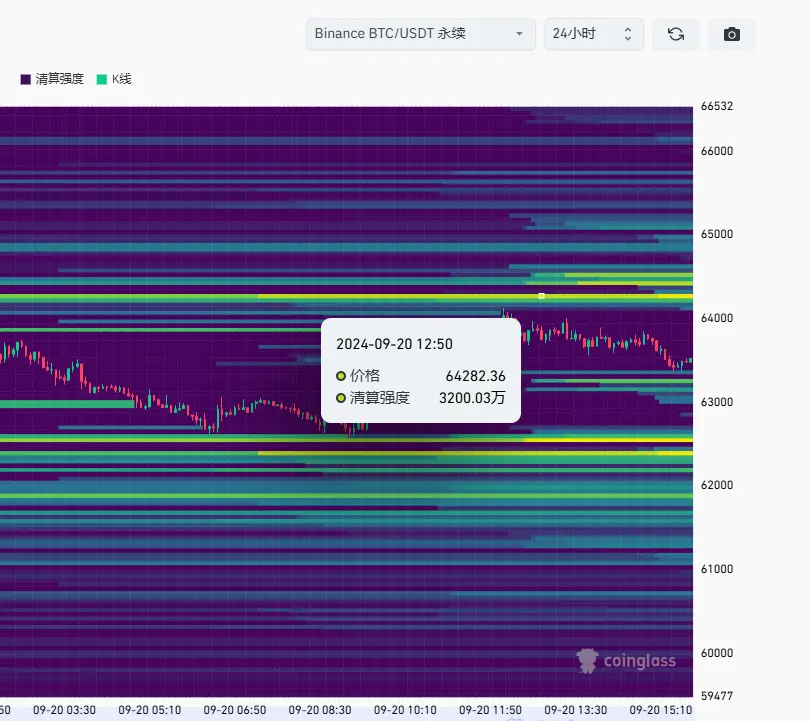

1. Are people seeing the same thing through different indicators?

2. Who is everyone? Large Investors, retail investor, institution?

3. Since everyone can see it, who made the money?

4. But all the indicators seem to make so much sense?

5. I'm also thinking about it. Let's think together. Feel free to leave me a message for interaction.

Don't panic when it falls, look for a higher Rebound, whether